- United States

- /

- Professional Services

- /

- NYSE:WNS

Even With A 30% Surge, Cautious Investors Are Not Rewarding WNS (Holdings) Limited's (NYSE:WNS) Performance Completely

WNS (Holdings) Limited (NYSE:WNS) shareholders have had their patience rewarded with a 30% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

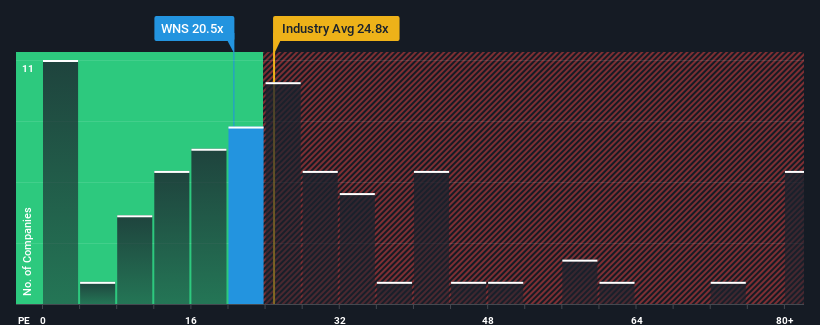

In spite of the firm bounce in price, it's still not a stretch to say that WNS (Holdings)'s price-to-earnings (or "P/E") ratio of 20.5x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 19x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

WNS (Holdings) could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for WNS (Holdings)

How Is WNS (Holdings)'s Growth Trending?

The only time you'd be comfortable seeing a P/E like WNS (Holdings)'s is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 18%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 20% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 18% over the next year. Meanwhile, the rest of the market is forecast to only expand by 15%, which is noticeably less attractive.

In light of this, it's curious that WNS (Holdings)'s P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

WNS (Holdings)'s stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of WNS (Holdings)'s analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for WNS (Holdings) with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than WNS (Holdings). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if WNS (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WNS

WNS (Holdings)

A business process management (BPM) company, provides data, voice, analytical, and business transformation services worldwide.

Excellent balance sheet and good value.