- United States

- /

- Food

- /

- NasdaqGS:JJSF

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed performance amid renewed trade tensions with China and strong earnings reports from major banks, investors are paying close attention to strategies that can offer stability and income. In such an environment, dividend stocks can be appealing for their potential to provide consistent returns through regular payouts, making them a valuable consideration for those looking to balance growth with income in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 11.16% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.63% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.90% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.40% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.02% | ★★★★★★ |

| Ennis (EBF) | 5.77% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.91% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.60% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.76% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.56% | ★★★★★☆ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

J&J Snack Foods (JJSF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J&J Snack Foods Corp. manufactures, markets, and distributes nutritional snack foods and beverages to the food service and retail supermarket industries in the United States, Mexico, and Canada, with a market cap of approximately $1.83 billion.

Operations: J&J Snack Foods Corp.'s revenue segments include Food Service at $1.00 billion, Frozen Beverages at $377.13 million, and Retail Supermarket at $218.36 million.

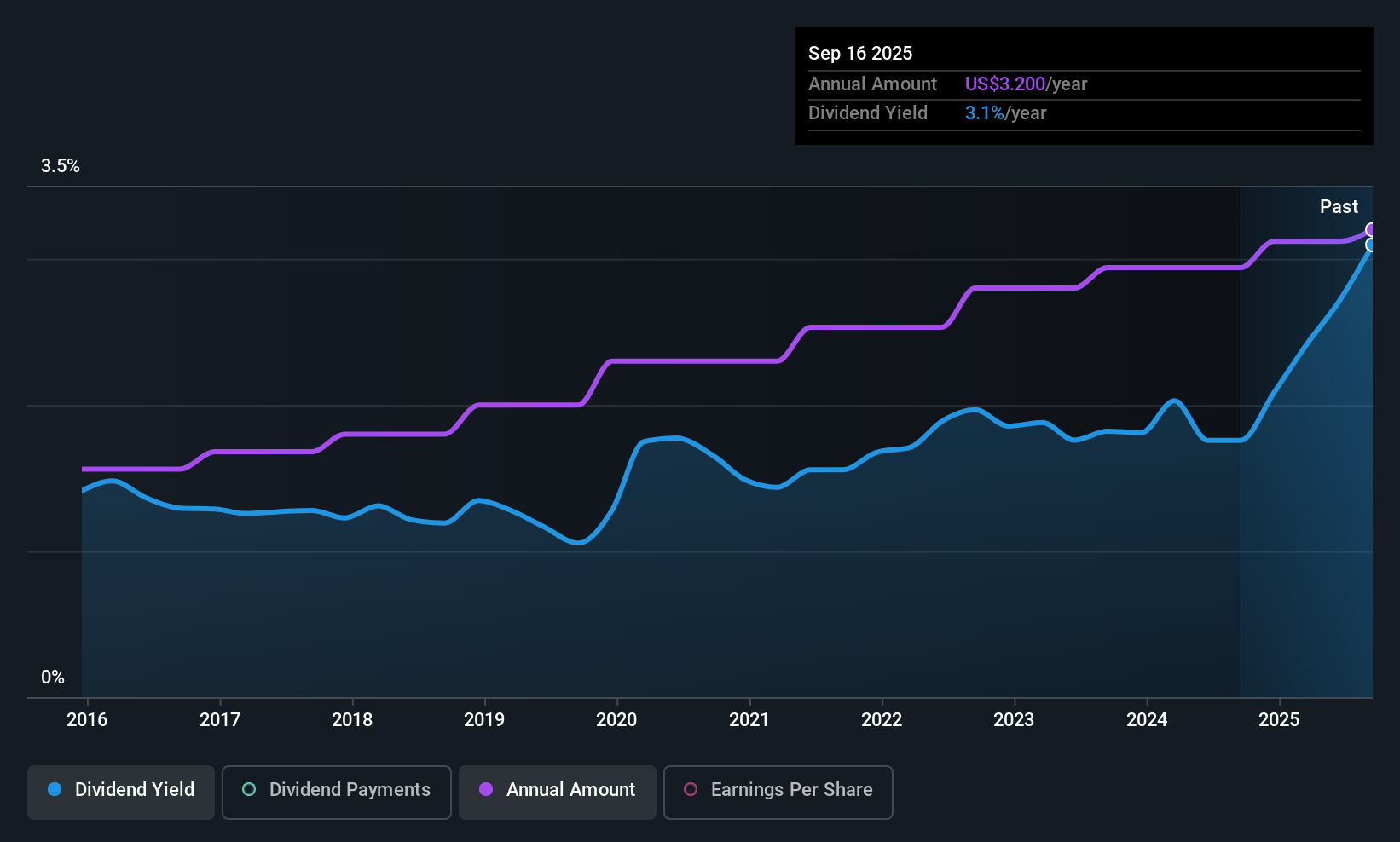

Dividend Yield: 3.5%

J&J Snack Foods has maintained stable and reliable dividends over the past decade, recently increasing its quarterly dividend to US$0.80 per share. However, with a high cash payout ratio of 93.6%, these payments are not well covered by cash flows, raising concerns about sustainability despite strong earnings coverage. Recent strategic moves include plant closures for cost optimization and a partnership with Urban Air Adventure Park to expand Dippin' Dots' reach, potentially enhancing future revenue streams.

- Click to explore a detailed breakdown of our findings in J&J Snack Foods' dividend report.

- In light of our recent valuation report, it seems possible that J&J Snack Foods is trading beyond its estimated value.

Univest Financial (UVSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Univest Financial Corporation serves as the bank holding company for Univest Bank and Trust Co., with a market cap of $822.10 million.

Operations: Univest Financial Corporation generates its revenue primarily through three segments: Banking ($253.93 million), Insurance ($22.17 million), and Wealth Management ($31.37 million).

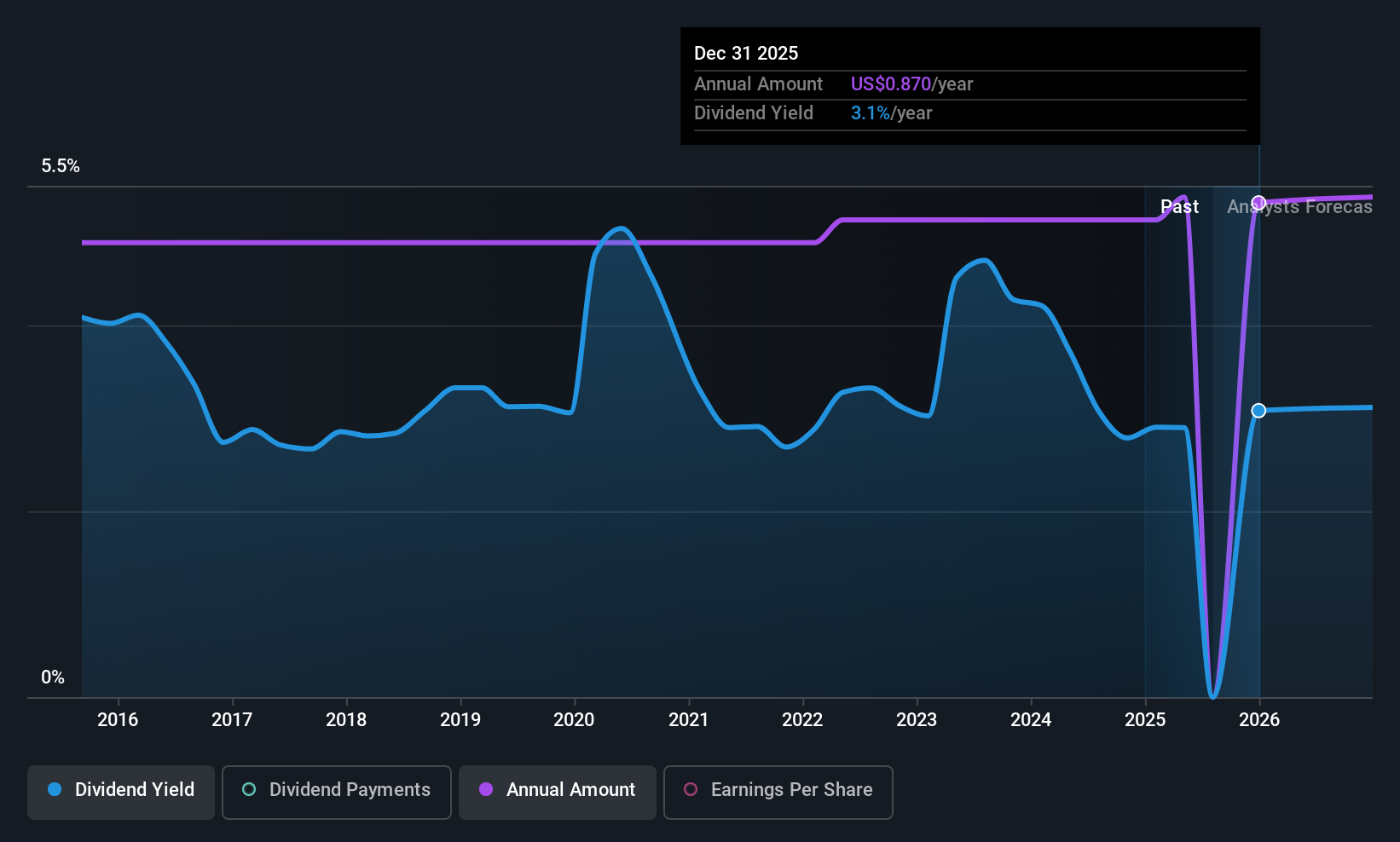

Dividend Yield: 3%

Univest Financial offers a stable dividend history with consistent growth over the past decade, supported by a low payout ratio of 31.2%, indicating strong earnings coverage. However, its dividend yield of 3.03% is below the top quartile in the US market. Recent financial results show increased net income and interest income, but significant insider selling and net charge-offs raise concerns about potential risks. The company continues to repurchase shares, enhancing shareholder value through buybacks.

- Delve into the full analysis dividend report here for a deeper understanding of Univest Financial.

- Our valuation report unveils the possibility Univest Financial's shares may be trading at a discount.

Regions Financial (RF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Regions Financial Corporation is a financial holding company offering a range of banking and related services to individual and corporate customers, with a market cap of approximately $21.56 billion.

Operations: Regions Financial Corporation generates revenue through three main segments: Consumer Bank ($3.68 billion), Corporate Bank ($2.41 billion), and Wealth Management ($686 million).

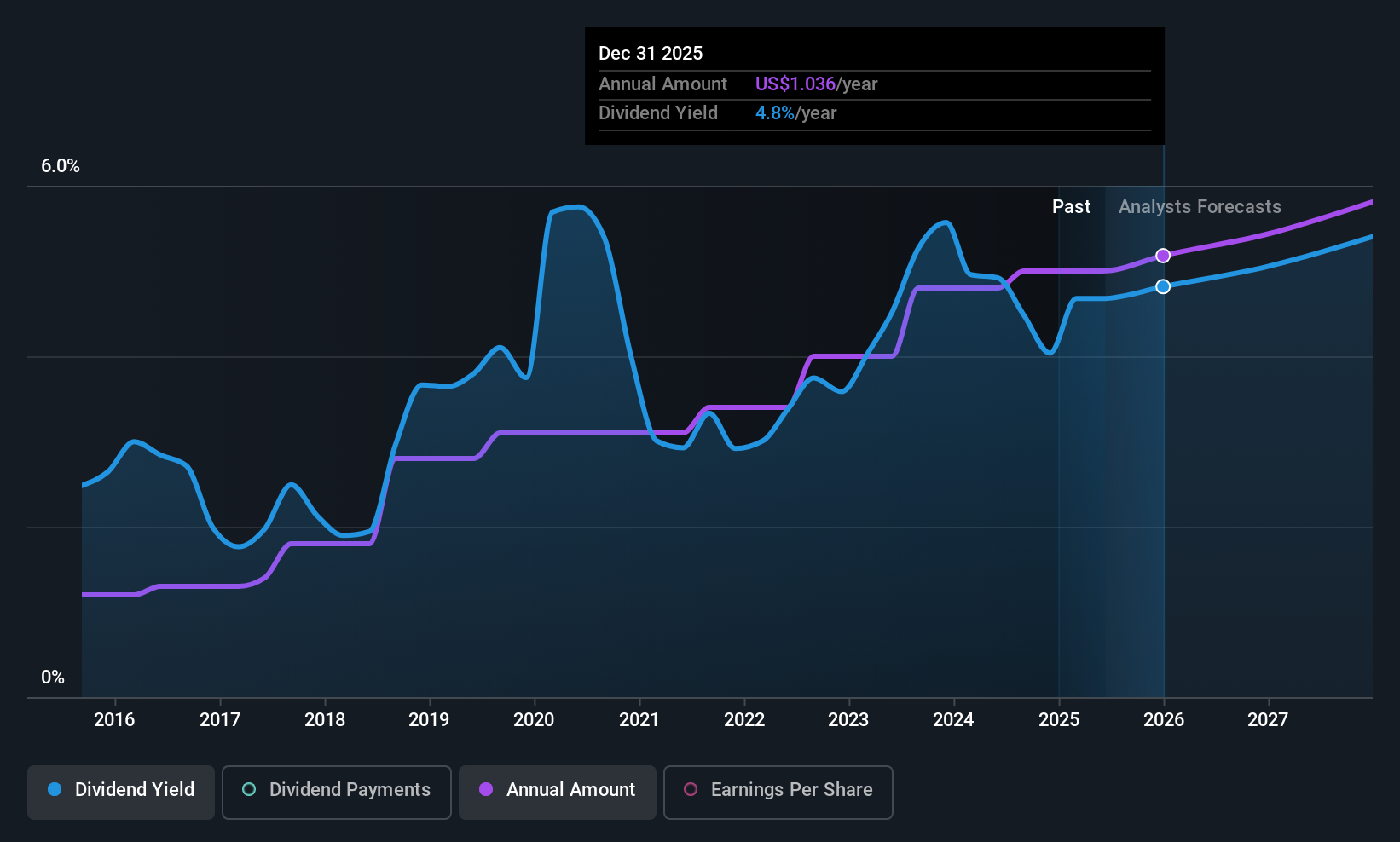

Dividend Yield: 4.3%

Regions Financial has a reliable dividend history, with payments increasing steadily over the past decade. Its current payout ratio of 46.5% suggests dividends are well covered by earnings, and this is expected to remain sustainable in the coming years. The recent 6% increase in quarterly dividends reflects confidence in its financial stability. Despite trading below estimated fair value, its dividend yield of 4.32% is slightly lower than top-tier US payers but remains attractive for income-focused investors.

- Unlock comprehensive insights into our analysis of Regions Financial stock in this dividend report.

- According our valuation report, there's an indication that Regions Financial's share price might be on the cheaper side.

Turning Ideas Into Actions

- Take a closer look at our Top US Dividend Stocks list of 136 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JJSF

J&J Snack Foods

Manufactures, markets, and distributes nutritional snack food and beverages to the food service and retail supermarket industries in the United States, Mexico, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives