As the U.S. stock market experiences mixed movements with major indices like the Dow Jones and S&P 500 showing slight gains, investors are closely monitoring earnings reports from key players such as Nvidia. In this dynamic environment, dividend stocks yielding around 3% can offer a stable income stream and potentially enhance portfolio resilience amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.65% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.80% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.50% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.01% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.63% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

Click here to see the full list of 138 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Artesian Resources (NasdaqGS:ARTN.A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Artesian Resources Corporation, with a market cap of $353.80 million, operates through its subsidiaries to provide water, wastewater, and other services in Delaware, Maryland, and Pennsylvania.

Operations: Artesian Resources Corporation generates revenue primarily from its Regulated Utility segment, which accounts for $98.93 million.

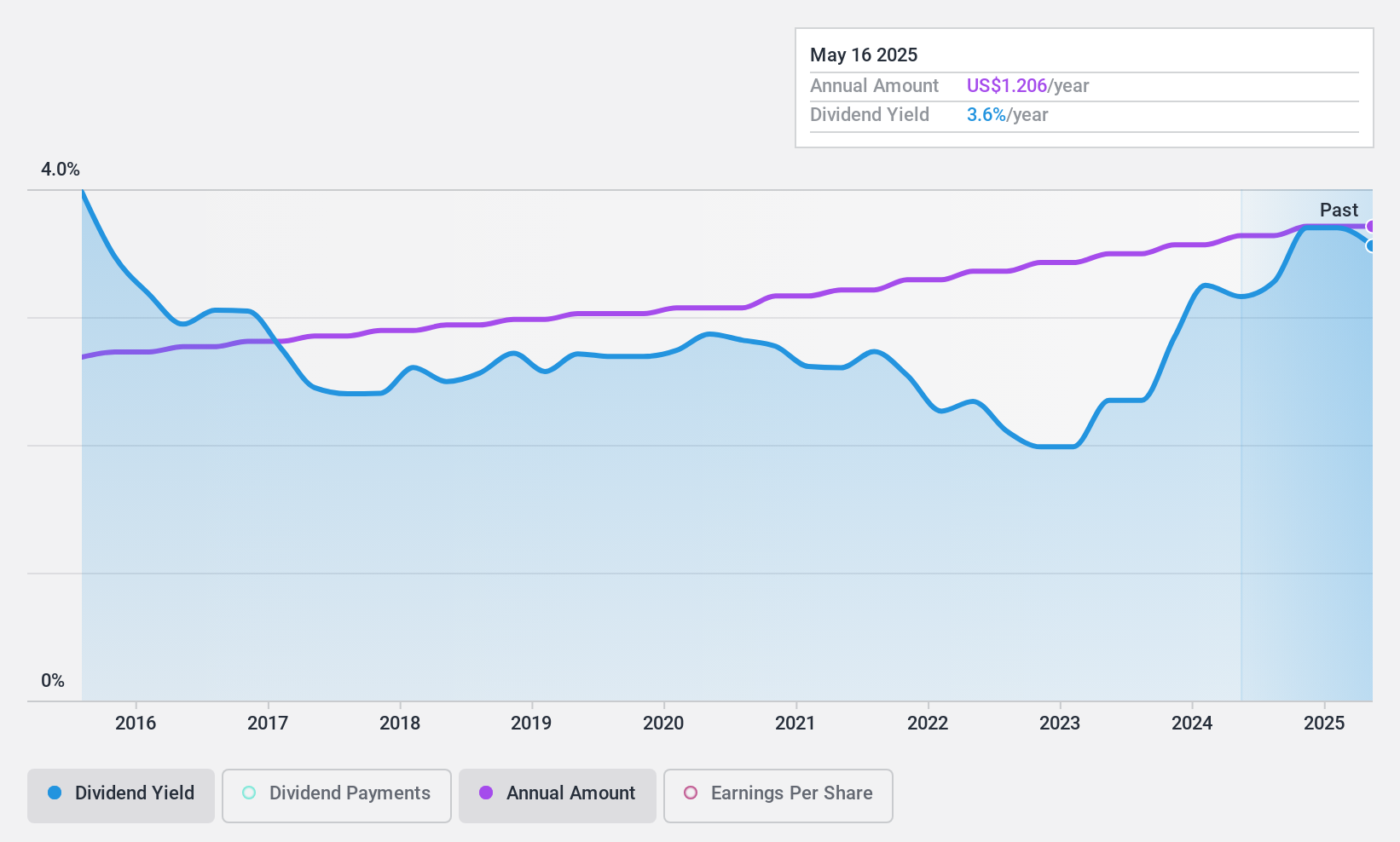

Dividend Yield: 3.5%

Artesian Resources recently announced a 2% increase in its quarterly dividend, raising the annualized rate to $1.2056 per share. The company's dividends have been stable over the past decade but are not well covered by free cash flow, though they are supported by earnings with a payout ratio of 60.1%. Despite a modest dividend yield compared to top-tier payers, Artesian's earnings grew significantly by 28.9% last year, enhancing its financial position despite high debt levels.

- Get an in-depth perspective on Artesian Resources' performance by reading our dividend report here.

- Our valuation report here indicates Artesian Resources may be undervalued.

Dillard's (NYSE:DDS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Dillard's, Inc. operates retail department stores across the southeastern, southwestern, and midwestern United States with a market cap of approximately $6.79 billion.

Operations: Dillard's generates revenue primarily through its retail operations, which accounted for approximately $6.45 billion.

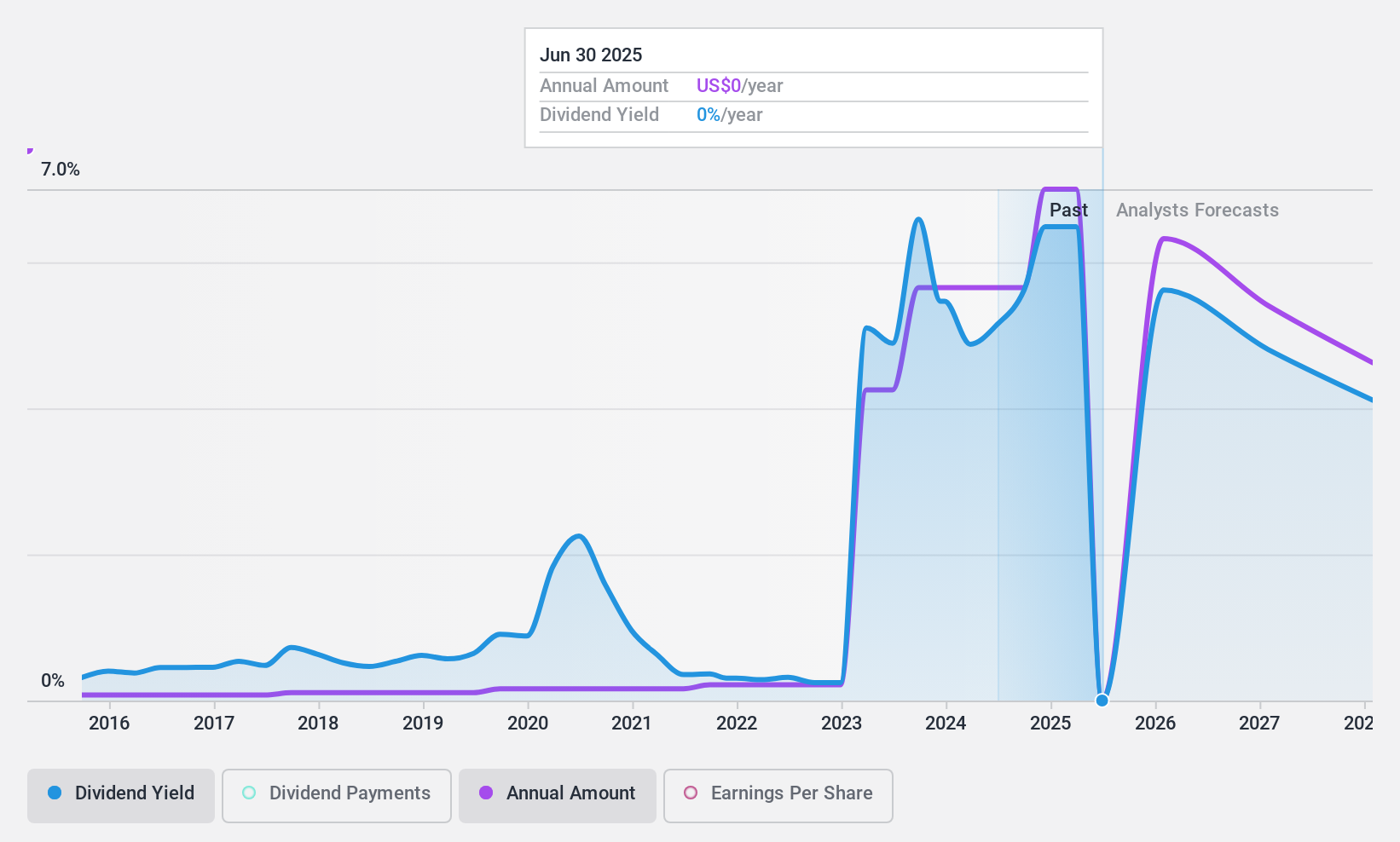

Dividend Yield: 5%

Dillard's dividends have been reliable and stable over the past decade, with a low payout ratio of 2.6%, ensuring strong coverage by earnings. The cash payout ratio stands at 49.9%, indicating dividends are well-supported by cash flows. Trading below its estimated fair value, Dillard’s offers an attractive dividend yield of 5.01%, placing it in the top quartile among US dividend payers despite recent declines in revenue and earnings per share compared to last year.

- Click here to discover the nuances of Dillard's with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Dillard's shares in the market.

Valero Energy (NYSE:VLO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valero Energy Corporation is involved in the manufacturing, marketing, and selling of petroleum-based and low-carbon liquid transportation fuels and petrochemical products across various regions including the United States, Canada, Europe, Latin America, and more; it has a market cap of approximately $44.96 billion.

Operations: Valero Energy's revenue is primarily derived from its Refining segment at $128.08 billion, followed by Renewable Diesel at $5.45 billion, and Ethanol at $4.70 billion.

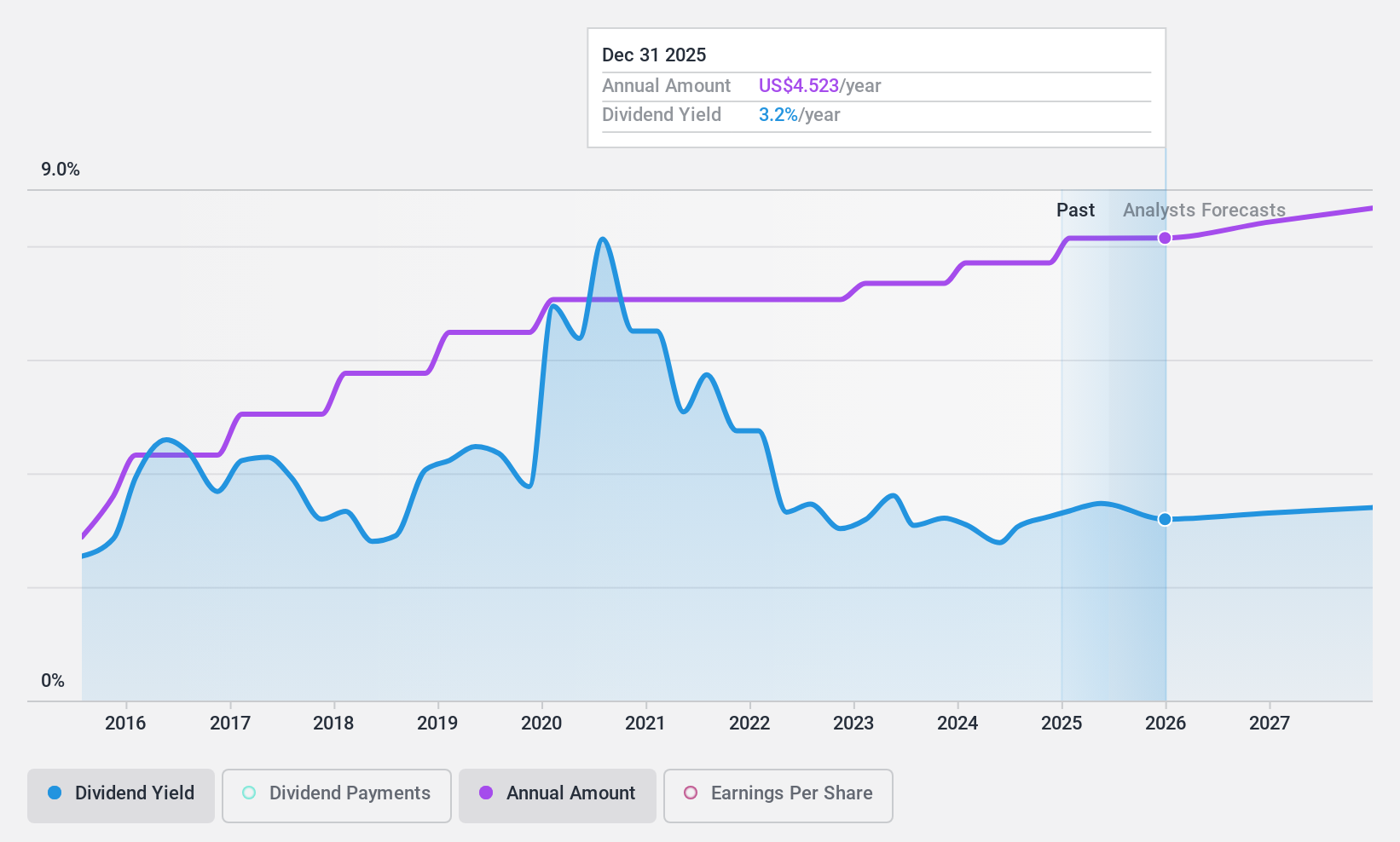

Dividend Yield: 3%

Valero Energy's dividend payments are well-covered, with a low payout ratio of 37.5% and a cash payout ratio of 22.6%. Despite recent declines in revenue and net income, the company maintains reliable and stable dividends over the past decade. The recent quarterly dividend of US$1.07 per share reflects this stability, although its yield of 3.03% is below top-tier US dividend payers. Recent leadership changes might impact future strategic directions but don't directly affect current dividends.

- Take a closer look at Valero Energy's potential here in our dividend report.

- Our valuation report unveils the possibility Valero Energy's shares may be trading at a discount.

Key Takeaways

- Access the full spectrum of 138 Top US Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDS

Dillard's

Operates retail department stores in the southeastern, southwestern, and midwestern areas of the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives