- United States

- /

- Energy Services

- /

- NYSE:ARIS

Insiders Hold These 3 Stocks With Earnings Growth Up To 59%

Reviewed by Simply Wall St

As the U.S. stock market grapples with volatility amid fresh concerns over tariffs and economic uncertainty, investors are keenly observing how these factors impact corporate earnings and growth trends. In such an environment, stocks with strong insider ownership often stand out, as they can signal confidence from those who understand the company best—its executives and directors—especially when coupled with robust earnings growth potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.9% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Kingstone Companies (NasdaqCM:KINS) | 17.9% | 24.2% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Ramaco Resources (NasdaqGS:METC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ramaco Resources, Inc. is involved in the development, operation, and sale of metallurgical coal with a market cap of $444.69 million.

Operations: The company's revenue segments are not specified in the provided text.

Insider Ownership: 11.1%

Earnings Growth Forecast: 54.8% p.a.

Ramaco Resources faces challenges with declining sales and net income, reporting US$666.3 million in sales and US$11.19 million in net income for 2024, down from the previous year. Despite this, earnings are forecast to grow significantly at 54.8% annually, outpacing the US market average of 13.8%. The stock trades at a substantial discount to fair value but has experienced high volatility recently. Dividends remain under pressure with recent reductions noted.

- Click here to discover the nuances of Ramaco Resources with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Ramaco Resources is trading beyond its estimated value.

Aris Water Solutions (NYSE:ARIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aris Water Solutions, Inc. is an environmental infrastructure company offering water handling and recycling solutions to oil and natural gas operators in the United States, with a market cap of approximately $1.64 billion.

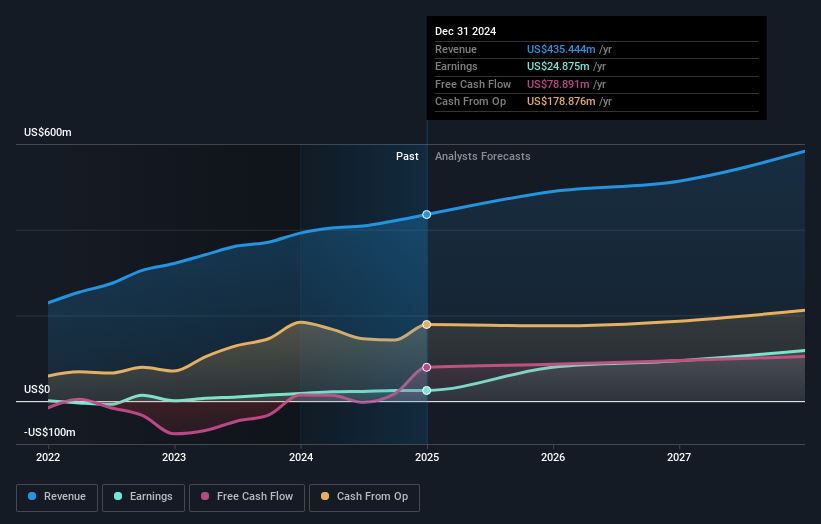

Operations: The company generates revenue primarily from its Utilities - Water segment, which accounts for $435.44 million.

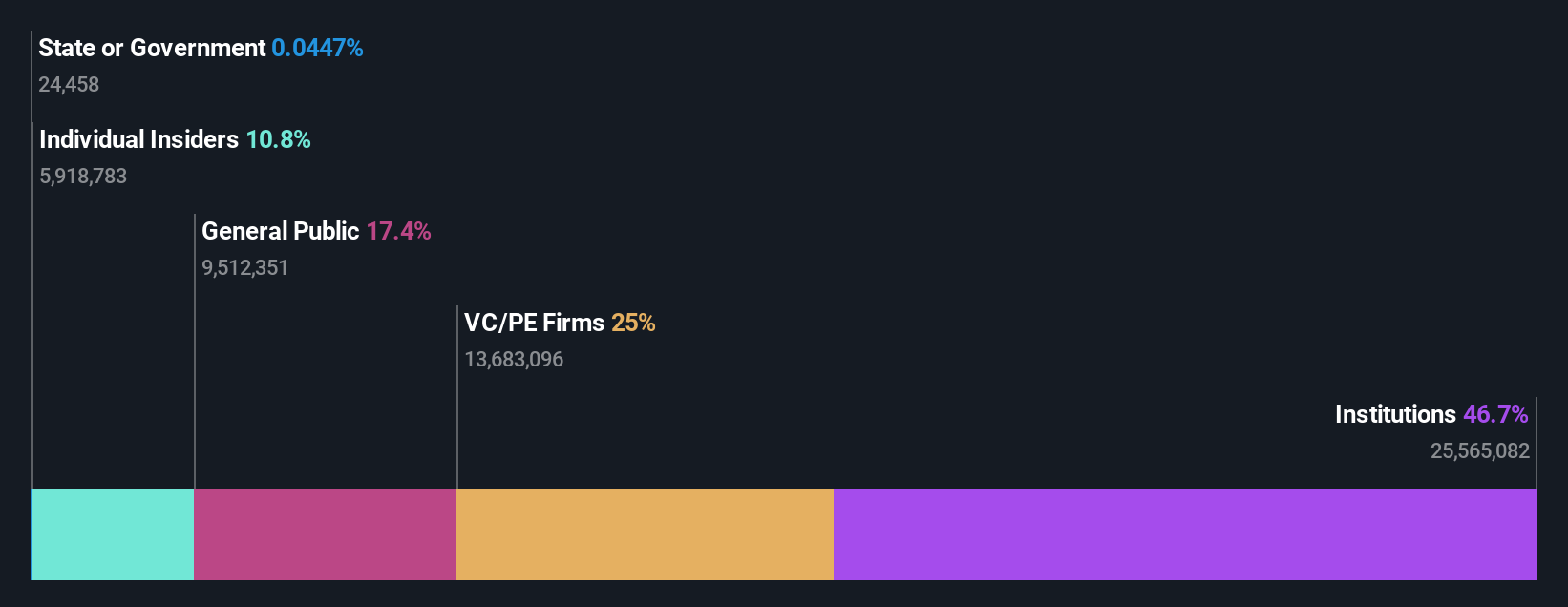

Insider Ownership: 10.8%

Earnings Growth Forecast: 40.4% p.a.

Aris Water Solutions, with substantial insider ownership, reported a revenue increase to US$118.61 million for Q4 2024. Earnings are forecast to grow significantly at 40.4% annually, outpacing the broader US market. Despite a low return on equity forecast and interest coverage concerns, the company increased its quarterly dividend by 33% to US$0.14 per share. Recent earnings growth of 40.2% underscores potential but is tempered by slower revenue growth expectations at 9% annually.

- Take a closer look at Aris Water Solutions' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Aris Water Solutions shares in the market.

XPeng (NYSE:XPEV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XPeng Inc. is a company that designs, develops, manufactures, and markets smart electric vehicles in China with a market cap of approximately $21.78 billion.

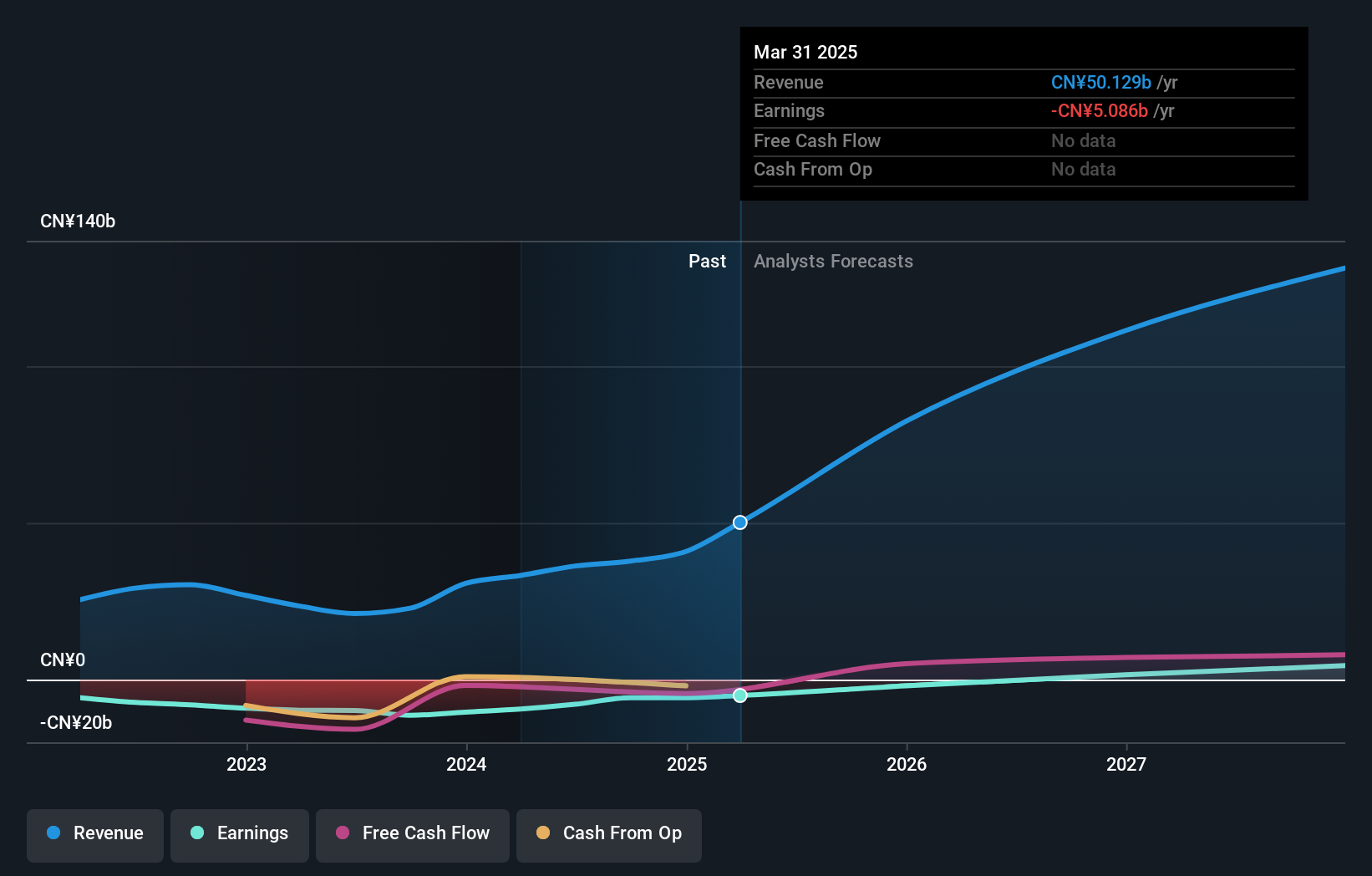

Operations: The company's revenue primarily comes from its Auto Manufacturers segment, generating CN¥37.81 billion.

Insider Ownership: 20.7%

Earnings Growth Forecast: 59.8% p.a.

XPeng's growth trajectory is underscored by its substantial insider ownership and rapid international expansion, particularly in Europe. The company forecasts a 59.85% annual earnings growth and expects revenue to grow at 27.5% annually, surpassing the US market average. Recent milestones include a significant increase in vehicle deliveries—30,453 Smart EVs in February 2025—and strategic partnerships to enhance its European presence, positioning XPeng as a dynamic force in the global EV market.

- Delve into the full analysis future growth report here for a deeper understanding of XPeng.

- According our valuation report, there's an indication that XPeng's share price might be on the expensive side.

Make It Happen

- Navigate through the entire inventory of 208 Fast Growing US Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Aris Water Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARIS

Aris Water Solutions

An environmental infrastructure and solutions company, provides water handling and recycling solutions to oil and natural gas operators in the United States.

Proven track record slight.

Similar Companies

Market Insights

Community Narratives