- United States

- /

- Food

- /

- NasdaqGM:LWAY

US Growth Companies With High Insider Ownership Growing Earnings At 53%

Reviewed by Simply Wall St

As the U.S. stock market flirts with record highs, driven by gains in major indices like the S&P 500 and Nasdaq Composite, investors are closely monitoring growth companies that show potential for robust earnings expansion. In this thriving environment, stocks with high insider ownership often draw attention as they can indicate strong confidence from those closest to the company's operations and strategy.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Astera Labs (NasdaqGS:ALAB) | 15.7% | 61.3% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 103.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.3% | 33.8% |

| Capital Bancorp (NasdaqGS:CBNK) | 31% | 30.2% |

We'll examine a selection from our screener results.

Lifeway Foods (NasdaqGM:LWAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lifeway Foods, Inc. is a company that produces and markets probiotic-based products both in the United States and internationally, with a market cap of $332.93 million.

Operations: The company's revenue primarily comes from its cultured dairy products segment, generating $181.98 million.

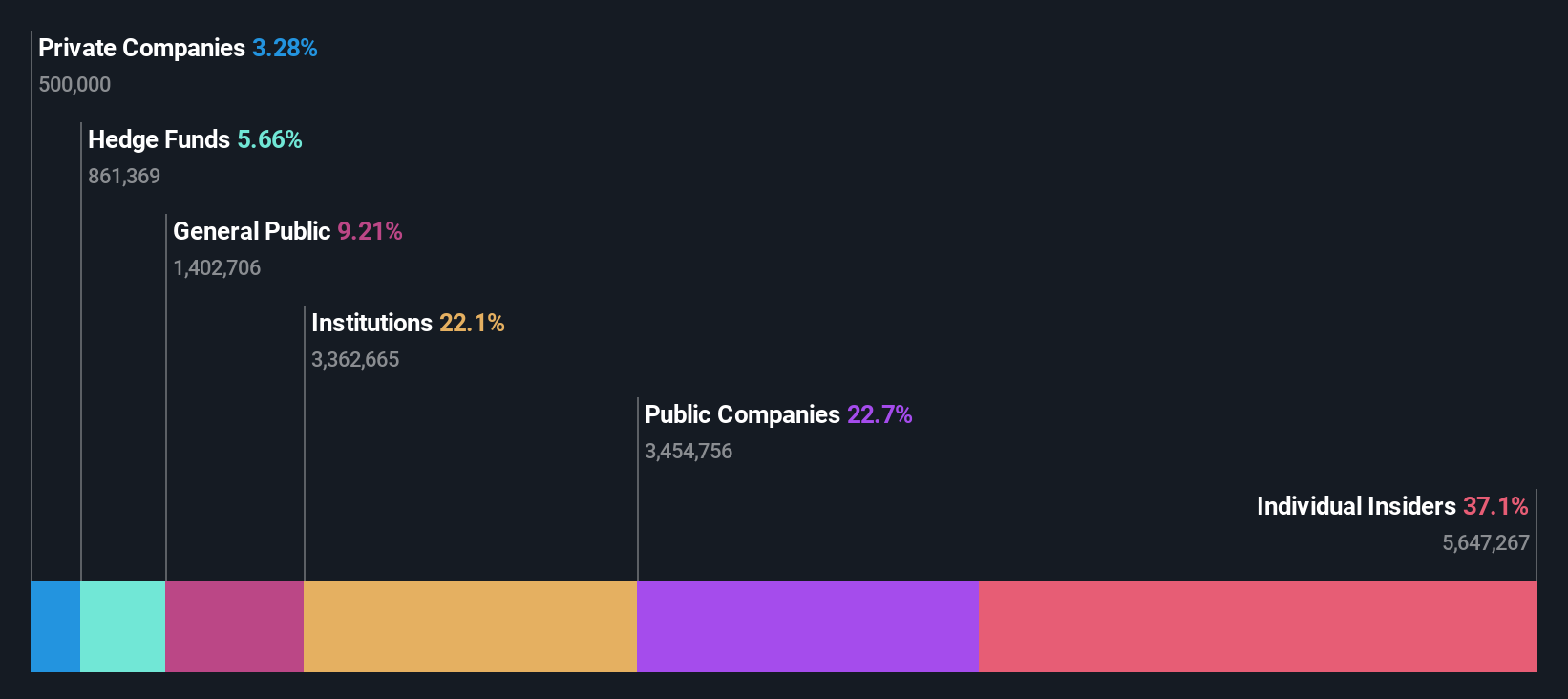

Insider Ownership: 39.8%

Earnings Growth Forecast: 27.6% p.a.

Lifeway Foods, with substantial insider ownership, is positioned for growth despite recent insider selling. Its earnings are forecast to grow significantly at 27.6% annually, outpacing the US market. The company recently expanded its product distribution by introducing Farmer Cheese to 1,400 Albertsons stores and launched a new Probiotic Smoothie + Collagen line. Lifeway rejected Danone's acquisition offer as undervaluing the company, emphasizing its commitment to realizing full shareholder value through independent growth strategies.

- Navigate through the intricacies of Lifeway Foods with our comprehensive analyst estimates report here.

- The analysis detailed in our Lifeway Foods valuation report hints at an deflated share price compared to its estimated value.

TaskUs (NasdaqGS:TASK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TaskUs, Inc. is a company that offers digital outsourcing services across the Philippines, United States, India, and internationally with a market cap of approximately $1.42 billion.

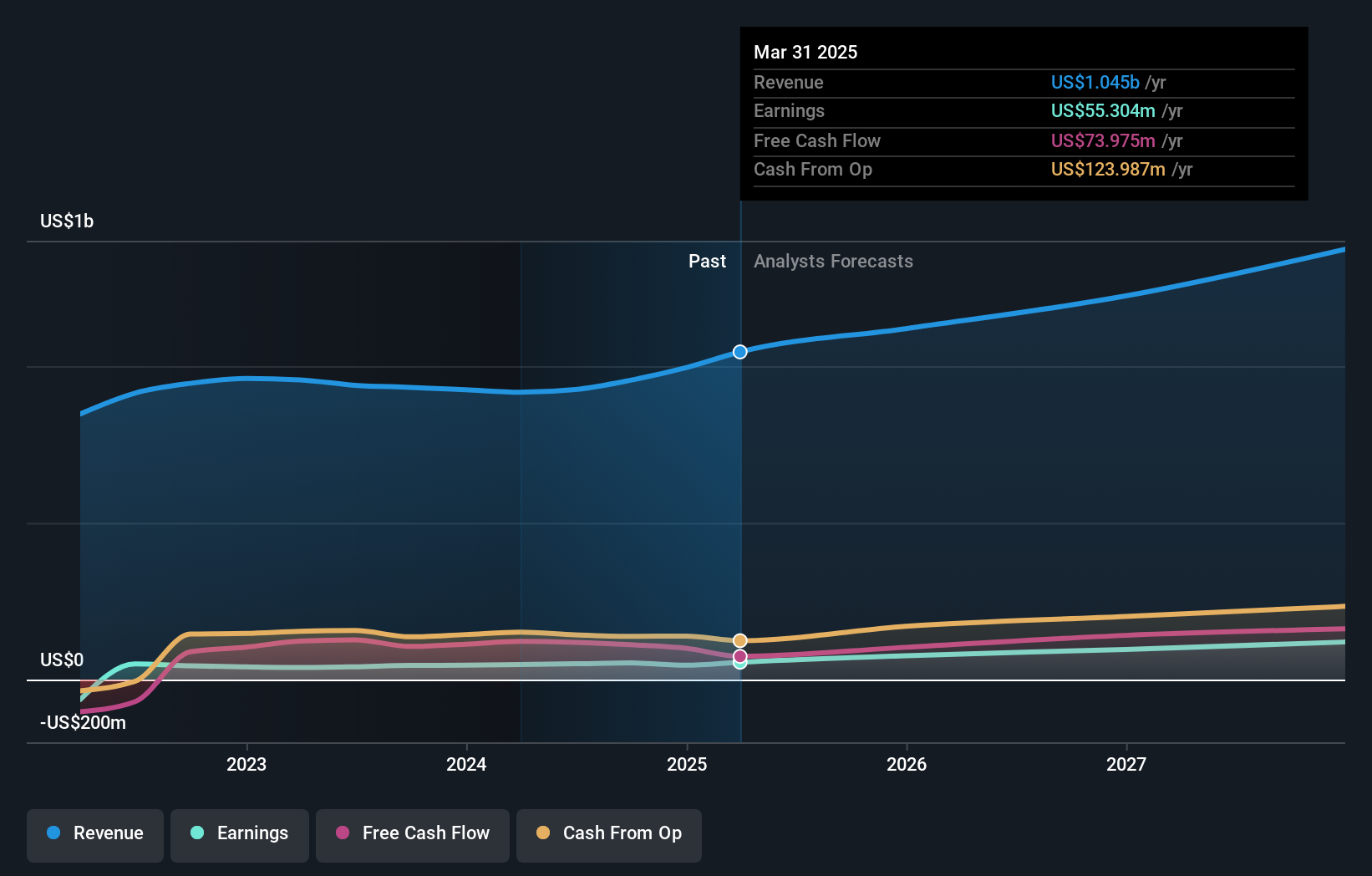

Operations: The company generates revenue primarily from its Direct Marketing segment, which accounts for $955.01 million.

Insider Ownership: 27%

Earnings Growth Forecast: 23.5% p.a.

TaskUs demonstrates strong growth potential with earnings forecasted to grow significantly at 23.5% annually, surpassing the US market. Despite trading below its estimated fair value, insider ownership remains a key factor for investors. Recent strategic alliances, such as the partnership with Red Points, enhance its digital protection offerings and brand safety services. This collaboration aims to mitigate risks associated with digital fraud and intellectual property violations, potentially safeguarding substantial revenue streams for clients.

- Dive into the specifics of TaskUs here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of TaskUs shares in the market.

Atlas Energy Solutions (NYSE:AESI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Atlas Energy Solutions Inc. operates in the production, processing, and sale of mesh and sand used as proppants for well completions in the Permian Basin, with a market cap of $2.66 billion.

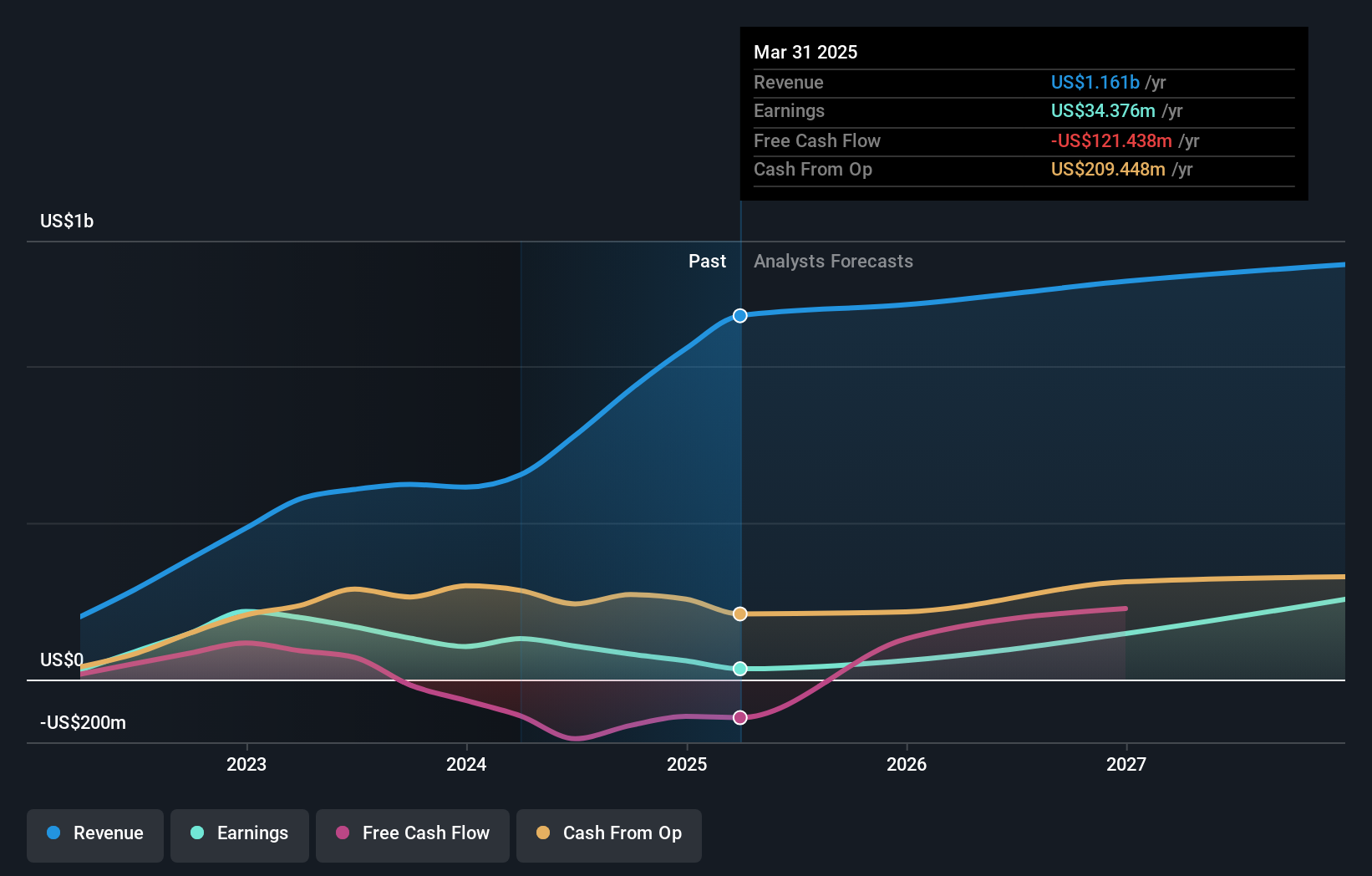

Operations: The company's revenue primarily stems from its Oil Well Equipment & Services segment, which generated $925.76 million.

Insider Ownership: 26.2%

Earnings Growth Forecast: 53.9% p.a.

Atlas Energy Solutions shows promising growth prospects with earnings expected to grow significantly at 53.9% annually, outpacing the US market. Despite a recent $264.5 million equity offering and notable insider selling, the company continues to innovate with its Dune Express conveyor system and driverless RoboTrucks in the Permian Basin. However, profit margins have decreased from last year, and dividends are not well covered by earnings or free cash flows, indicating potential financial challenges ahead.

- Click here to discover the nuances of Atlas Energy Solutions with our detailed analytical future growth report.

- Our expertly prepared valuation report Atlas Energy Solutions implies its share price may be too high.

Summing It All Up

- Access the full spectrum of 196 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LWAY

Lifeway Foods

Produces and markets probiotic-based products in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives