- United States

- /

- Banks

- /

- NasdaqGS:ONB

February 2025's US Stocks That May Be Trading Below Fair Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a period of record highs for major indices like the S&P 500, investors are keenly observing fluctuations in stock futures and economic indicators such as Treasury yields and Federal Reserve policies. In this context, identifying stocks that may be trading below their fair value can offer potential opportunities, especially when considering factors like earnings performance and broader market trends.

Top 5 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.48 | $36.92 | 49.9% |

| CareTrust REIT (NYSE:CTRE) | $25.86 | $50.24 | 48.5% |

| Northwest Bancshares (NasdaqGS:NWBI) | $12.76 | $24.47 | 47.9% |

| Smurfit Westrock (NYSE:SW) | $55.32 | $110.32 | 49.9% |

| Incyte (NasdaqGS:INCY) | $70.16 | $135.01 | 48% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | $33.83 | $64.44 | 47.5% |

| Expand Energy (NasdaqGS:EXE) | $107.45 | $213.31 | 49.6% |

| Nexxen International (NasdaqGM:NEXN) | $9.99 | $19.25 | 48.1% |

| Haemonetics (NYSE:HAE) | $63.66 | $122.12 | 47.9% |

| Open Lending (NasdaqGM:LPRO) | $5.53 | $10.47 | 47.2% |

| Nexxen International (NasdaqGM:NEXN) | $10.49 | $19.81 | 47.1% |

Underneath we present a selection of stocks filtered out by our screen.

Expand Energy (NasdaqGS:EXE)

Overview: Expand Energy Corporation is an independent exploration and production company in the United States with a market cap of $24.59 billion.

Operations: The company's revenue primarily comes from its exploration and production segment, which generated $3.29 billion.

Estimated Discount To Fair Value: 49.6%

Expand Energy is trading at US$107.45, significantly below its estimated fair value of US$213.31, indicating potential undervaluation based on discounted cash flow analysis. Despite substantial shareholder dilution and a dividend not well covered by earnings, the company anticipates strong revenue growth of 47.2% annually, outpacing the market average. Recent strategic financial maneuvers include refinancing debt with a US$750 million bond issuance to manage existing obligations efficiently amidst executive leadership changes enhancing marketing capabilities.

- Insights from our recent growth report point to a promising forecast for Expand Energy's business outlook.

- Dive into the specifics of Expand Energy here with our thorough financial health report.

Old National Bancorp (NasdaqGS:ONB)

Overview: Old National Bancorp is a bank holding company for Old National Bank, offering a range of financial services to individual and commercial clients in the United States, with a market cap of $7.72 billion.

Operations: Old National Bank generates revenue primarily through its Community Banking segment, which accounts for $1.76 billion.

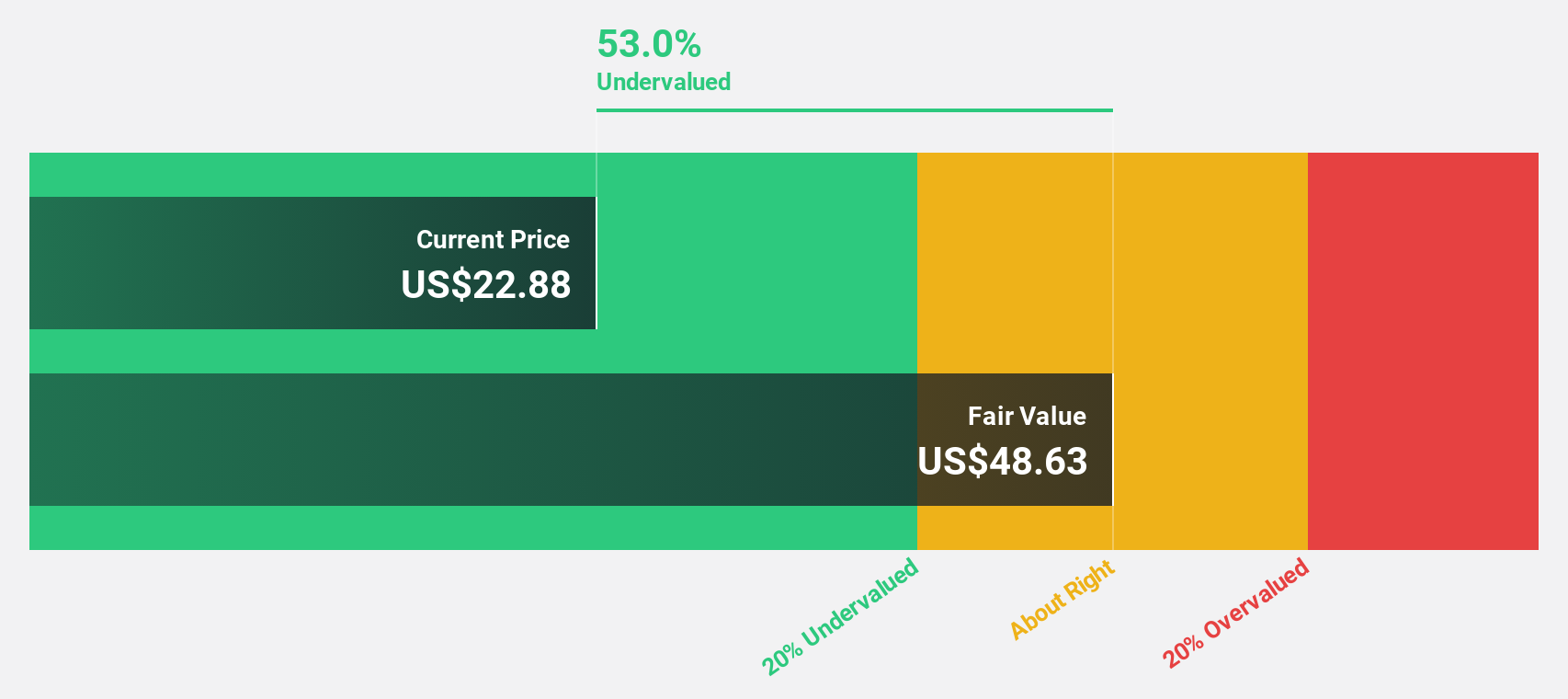

Estimated Discount To Fair Value: 46.9%

Old National Bancorp is trading at US$24.30, significantly below its estimated fair value of US$45.76, highlighting potential undervaluation based on cash flows. The company forecasts robust revenue and earnings growth of 20.8% and 33.1% annually, respectively, surpassing market averages. Despite a low return on equity forecast (12.8%), it maintains a reliable dividend yield of 2.3%. A recent US$200 million share repurchase program underscores strategic capital deployment efforts amidst ongoing acquisitions like Bremer Financial's integration.

- Our expertly prepared growth report on Old National Bancorp implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Old National Bancorp with our comprehensive financial health report here.

Repligen (NasdaqGS:RGEN)

Overview: Repligen Corporation develops and commercializes bioprocessing technologies and systems for biological drug manufacturing globally, with a market cap of approximately $8.13 billion.

Operations: The company generates revenue from its Medical Products segment, which amounted to $633.51 million.

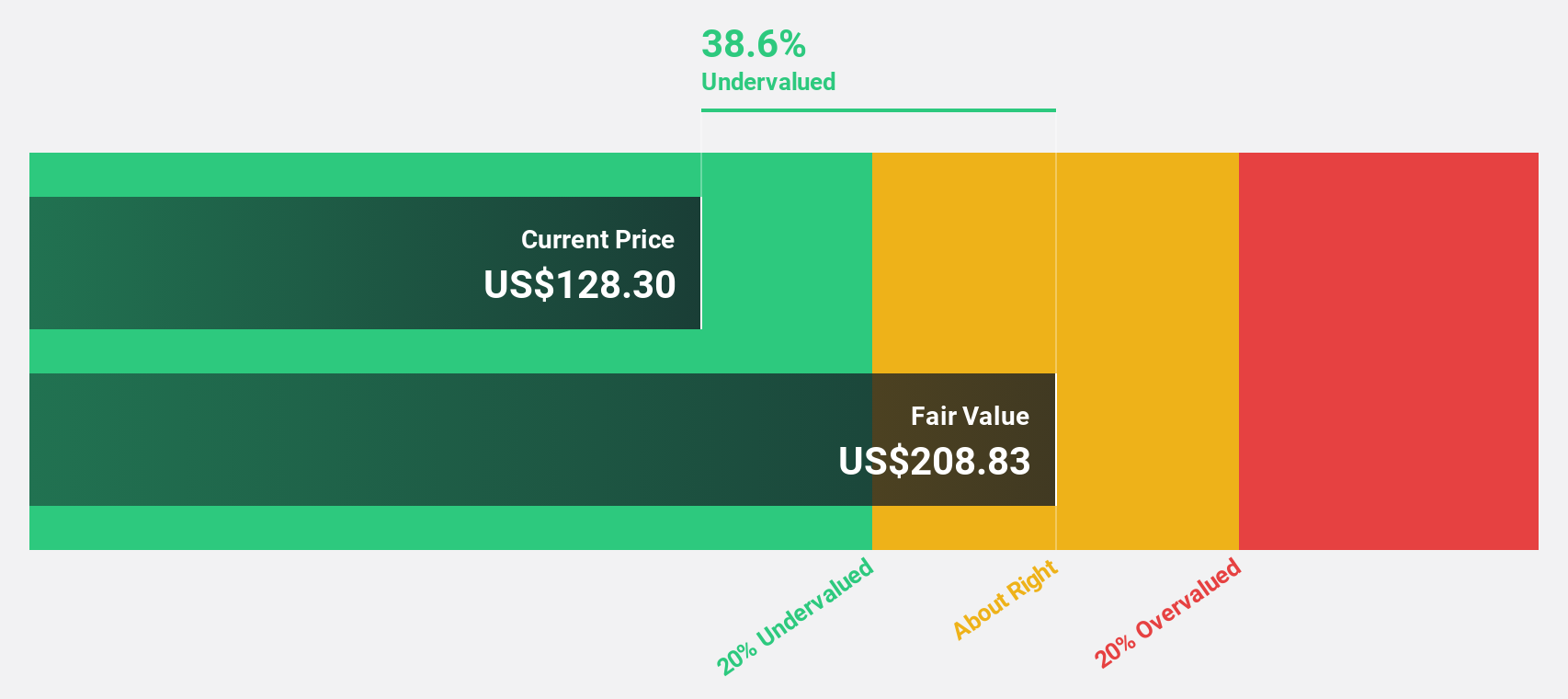

Estimated Discount To Fair Value: 42.9%

Repligen Corporation is trading at US$150.73, significantly below its estimated fair value of US$264.04, suggesting it might be undervalued based on cash flows. The company anticipates becoming profitable within three years, with earnings growth forecasted at 42.44% annually and revenue growth outpacing the U.S. market average at 13.5%. Recent innovations like the SoloVPE PLUS System and strategic acquisitions aim to enhance operational efficiency and expand market presence in biopharmaceutical manufacturing solutions.

- According our earnings growth report, there's an indication that Repligen might be ready to expand.

- Take a closer look at Repligen's balance sheet health here in our report.

Key Takeaways

- Click this link to deep-dive into the 163 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONB

Old National Bancorp

Operates as the bank holding company for Old National Bank that provides consumer and commercial banking services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives