- United States

- /

- Oil and Gas

- /

- NasdaqGS:APA

3 Dividend Stocks Offering Yields Up To 5.2%

Reviewed by Simply Wall St

In the midst of heightened market volatility and economic uncertainty driven by new tariff announcements, investors are increasingly seeking stability through dividend stocks. In such turbulent times, stocks that offer reliable income streams can be appealing, providing a buffer against market fluctuations while offering potential yields up to 5.2%.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 4.67% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.88% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.68% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.91% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.62% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.46% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.98% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.76% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.63% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.82% | ★★★★★★ |

Click here to see the full list of 158 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

APA (NasdaqGS:APA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: APA Corporation is an independent energy company focused on the exploration, development, and production of natural gas, crude oil, and natural gas liquids with a market cap of approximately $6.86 billion.

Operations: APA Corporation generates revenue from its upstream operations primarily in the U.S. ($5.86 billion), Egypt ($2.93 billion), and the North Sea ($948 million).

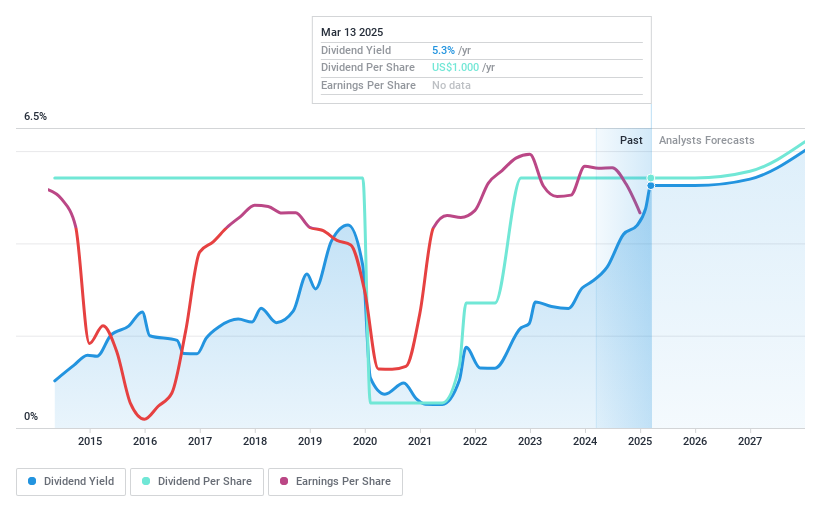

Dividend Yield: 5.3%

APA's dividend yield of 5.26% is attractive, ranking in the top 25% of US dividend payers, and is well-covered by earnings with a payout ratio of 43.9%. However, dividends have been unreliable over the past decade without growth. Recent financial results show a decline in net income to US$804 million from US$2.86 billion last year, despite increased production volumes. The company has completed significant share buybacks worth US$3 billion and maintains high debt levels but trades below estimated fair value by 66.7%.

- Take a closer look at APA's potential here in our dividend report.

- The valuation report we've compiled suggests that APA's current price could be quite moderate.

United Bankshares (NasdaqGS:UBSI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: United Bankshares, Inc. operates as a provider of commercial and retail banking products and services in the United States with a market cap of approximately $5.01 billion.

Operations: United Bankshares, Inc. generates its revenue primarily through commercial and retail banking products and services in the United States.

Dividend Yield: 4.3%

United Bankshares offers a stable dividend yield of 4.3%, though it falls short of the top 25% in the US market. The company maintains a sustainable payout ratio of 53.7%, ensuring dividends are well-covered by earnings, with forecasts suggesting continued coverage at 49.9% in three years. Dividends have been reliable and growing over the past decade, supported by recent financial performance improvements, including increased net income to US$94.41 million for Q4 2024 from US$79.39 million a year prior.

- Navigate through the intricacies of United Bankshares with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of United Bankshares shares in the market.

ConocoPhillips (NYSE:COP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ConocoPhillips is engaged in the exploration, production, transportation, and marketing of crude oil, bitumen, natural gas, LNG, and natural gas liquids with a market cap of approximately $115.32 billion.

Operations: ConocoPhillips generates revenue from several key segments, including $6.55 billion from Alaska, $5.64 billion from Canada, $37.03 billion from the Lower 48, $2.94 billion from Asia Pacific, and $6.37 billion from Europe, Middle East and North Africa.

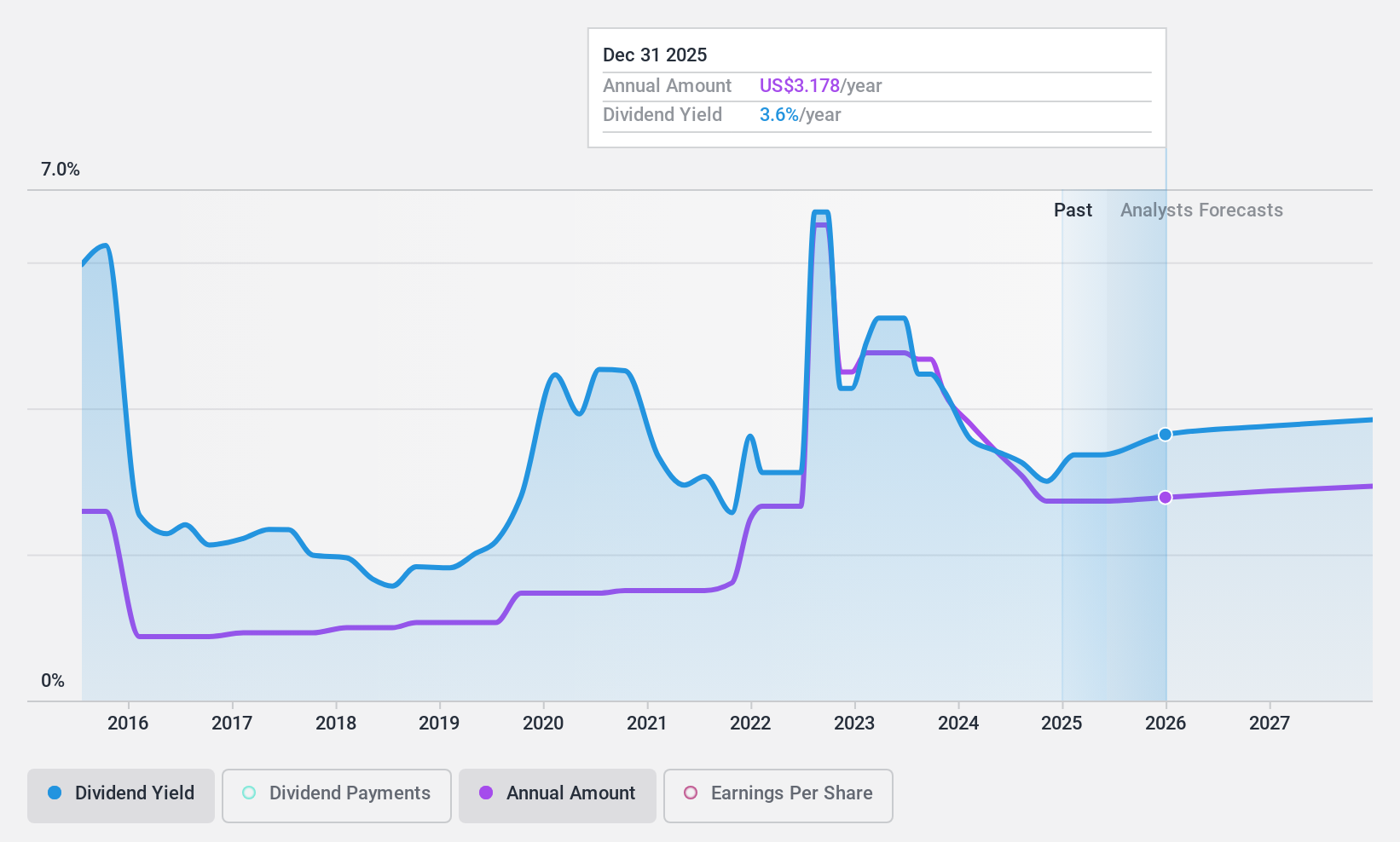

Dividend Yield: 3.4%

ConocoPhillips' dividend yield of 3.36% is below the top 25% in the US market, but its dividends are well-covered by earnings and cash flows, with payout ratios of 39.9% and 49.6%, respectively. However, dividend stability has been an issue due to volatility over the past decade. Recent financials show a decrease in net income to US$2.31 billion for Q4 2024 from US$3 billion a year ago, yet production guidance remains strong for 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of ConocoPhillips.

- Upon reviewing our latest valuation report, ConocoPhillips' share price might be too pessimistic.

Where To Now?

- Reveal the 158 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade APA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APA

APA

An independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives