- United States

- /

- Oil and Gas

- /

- NasdaqCM:OPAL

US Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

In the current U.S. market landscape, investors are closely watching developments around tariffs and earnings reports, with major indices showing mixed performance as they navigate these economic factors. Amidst this backdrop, growth companies with high insider ownership can present unique opportunities due to the alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 33.8% |

| Ultralife (NasdaqGM:ULBI) | 36% | 43.8% |

| Duos Technologies Group (NasdaqCM:DUOT) | 39.4% | 90.4% |

| RH (NYSE:RH) | 17% | 53.8% |

Let's dive into some prime choices out of the screener.

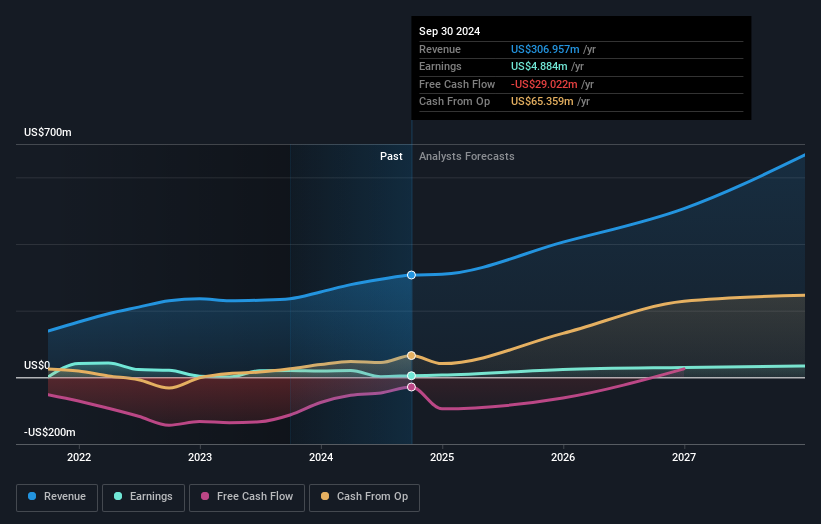

OPAL Fuels (NasdaqCM:OPAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OPAL Fuels Inc., along with its subsidiaries, focuses on producing and distributing renewable natural gas for heavy and medium-duty trucking fleets, with a market cap of approximately $527.13 million.

Operations: The company's revenue segments include RNG Fuel at $193.37 million, Renewable Power at $46.38 million, and Fuel Station Services contributing $187.59 million.

Insider Ownership: 12.3%

OPAL Fuels demonstrates significant growth potential with expected annual earnings growth of 29.3%, outpacing the US market average. Despite a revenue forecast below 20% per year, it remains above the market rate. Recent executive changes, including appointing Kazi Hasan as CFO, aim to enhance strategic execution and financial discipline. The company's expansion in renewable natural gas projects and long-term agreements bolster its position in scalable energy solutions amid insider ownership stability.

- Get an in-depth perspective on OPAL Fuels' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of OPAL Fuels shares in the market.

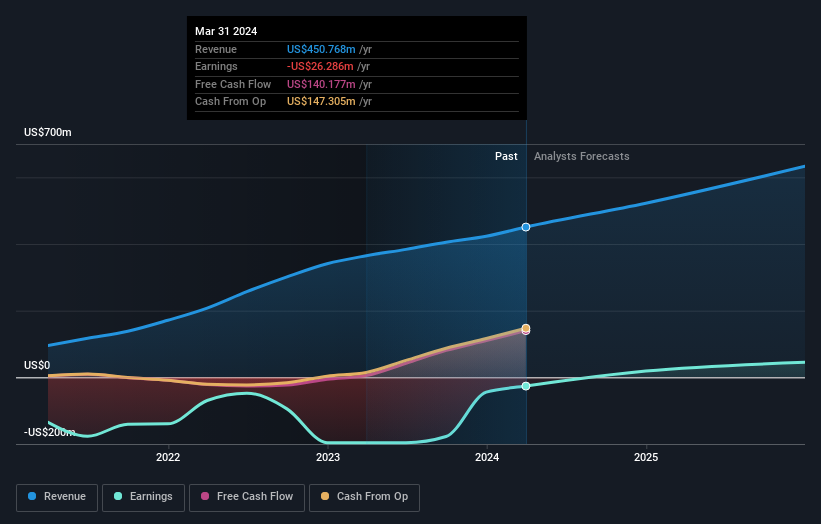

AAON (NasdaqGS:AAON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AAON, Inc., along with its subsidiaries, is involved in the engineering, manufacturing, marketing, and selling of air conditioning and heating equipment across the United States and Canada, with a market cap of approximately $9.46 billion.

Operations: The company's revenue segments include Basx at $199.96 million, AAON Oklahoma at $901.08 million, and AAON Coil Products at $154.62 million.

Insider Ownership: 17.5%

AAON is poised for growth, with earnings forecast to rise 19.3% annually, surpassing the US market average. Revenue is expected to grow at 15.8% per year, driven by strategic expansions such as a new facility in Memphis targeting data centers. Recent leadership promotions may enhance operational efficiency and product management. Insider transactions indicate more shares have been bought than sold recently, reflecting confidence in the company's future prospects amidst its robust financial performance.

- Navigate through the intricacies of AAON with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report AAON implies its share price may be too high.

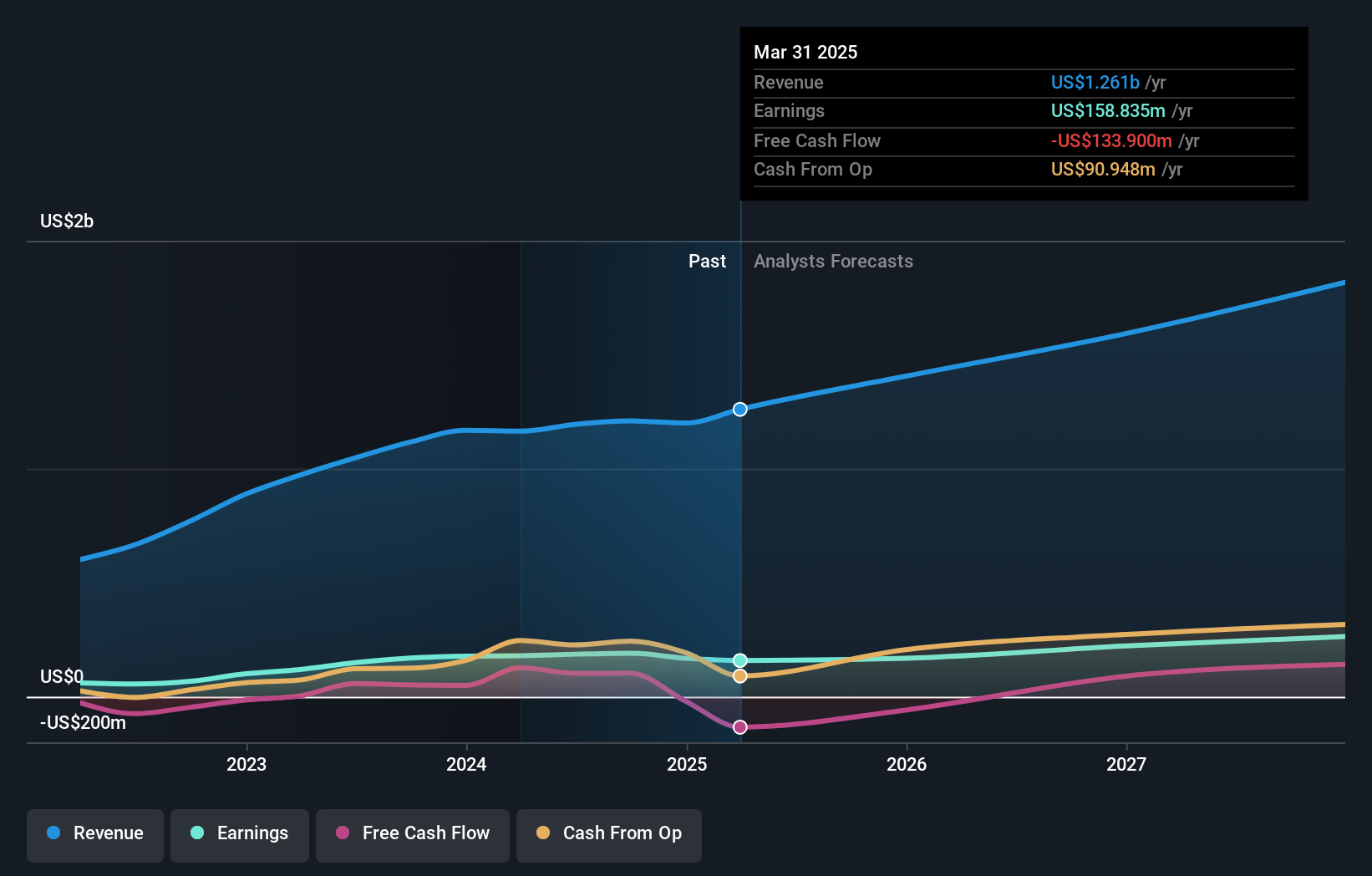

MoneyLion (NYSE:ML)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MoneyLion Inc. is a financial technology company that offers personalized financial products and content to American consumers, with a market cap of approximately $976.35 million.

Operations: The company generates revenue primarily from its data processing segment, which amounts to $500.28 million.

Insider Ownership: 20.3%

MoneyLion is experiencing significant growth, with earnings forecast to rise 92.4% annually, outpacing the US market. Revenue is also expected to grow at 21.7% per year. Despite recent volatility in its share price, substantial insider buying suggests confidence in its trajectory. The company recently reported improved financial results and revised revenue guidance upward for 2024. An acquisition by Gen Digital for US$1 billion could further impact MoneyLion's future dynamics and shareholder value.

- Unlock comprehensive insights into our analysis of MoneyLion stock in this growth report.

- Our valuation report unveils the possibility MoneyLion's shares may be trading at a premium.

Seize The Opportunity

- Delve into our full catalog of 206 Fast Growing US Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OPAL

OPAL Fuels

Engages in the production and distribution of renewable natural gas for use as a vehicle fuel for heavy and medium-duty trucking fleets throughout the United States.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives