- United States

- /

- Machinery

- /

- NYSE:GBX

3 Undervalued Small Caps With Insider Action Across Regions

Reviewed by Simply Wall St

The U.S. stock market has recently faced turbulence, with major indexes posting weekly losses amid renewed U.S.-China trade tensions and economic uncertainties impacting investor sentiment. In this environment, small-cap stocks often present unique opportunities as they can be more sensitive to economic shifts and policy changes, making them a focal point for investors seeking growth potential in undervalued sectors.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Limbach Holdings | 29.9x | 1.9x | 41.96% | ★★★★★★ |

| PCB Bancorp | 9.2x | 2.8x | 37.80% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 29.96% | ★★★★★☆ |

| Farmland Partners | 6.7x | 8.1x | -38.93% | ★★★★☆☆ |

| First Northern Community Bancorp | 9.7x | 2.8x | 47.88% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.6x | 38.75% | ★★★★☆☆ |

| German American Bancorp | 16.3x | 5.0x | 47.19% | ★★★☆☆☆ |

| Arrow Financial | 14.1x | 3.1x | 23.73% | ★★★☆☆☆ |

| Citizens Community Bancorp | 12.4x | 2.7x | 20.23% | ★★★☆☆☆ |

| LifeStance Health Group | NA | 1.5x | 15.84% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Golden Entertainment (GDEN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Golden Entertainment operates a diverse portfolio of gaming properties, including taverns and casino resorts primarily in Nevada, with a market cap of approximately $1.25 billion.

Operations: Golden Entertainment's revenue primarily comes from Nevada Casino Resorts and Nevada Locals Casinos, with significant contributions from Nevada Taverns. The company has experienced fluctuations in its gross profit margin, which reached 54.18% in the most recent period. Operating expenses are a substantial part of their cost structure, with general and administrative expenses being a notable component.

PE: 36.7x

Golden Entertainment, a smaller company in the gaming and hospitality sector, recently reported second-quarter 2025 earnings with net income rising to US$4.63 million from US$0.623 million the previous year, despite slight declines in sales and revenue. Insider confidence is evident through share repurchases totaling 514,150 shares between April and June 2025 for US$14.64 million. The company also maintains a quarterly dividend of US$0.25 per share, reflecting steady shareholder returns amidst financial challenges due to reliance on external borrowing for funding.

- Click here and access our complete valuation analysis report to understand the dynamics of Golden Entertainment.

Explore historical data to track Golden Entertainment's performance over time in our Past section.

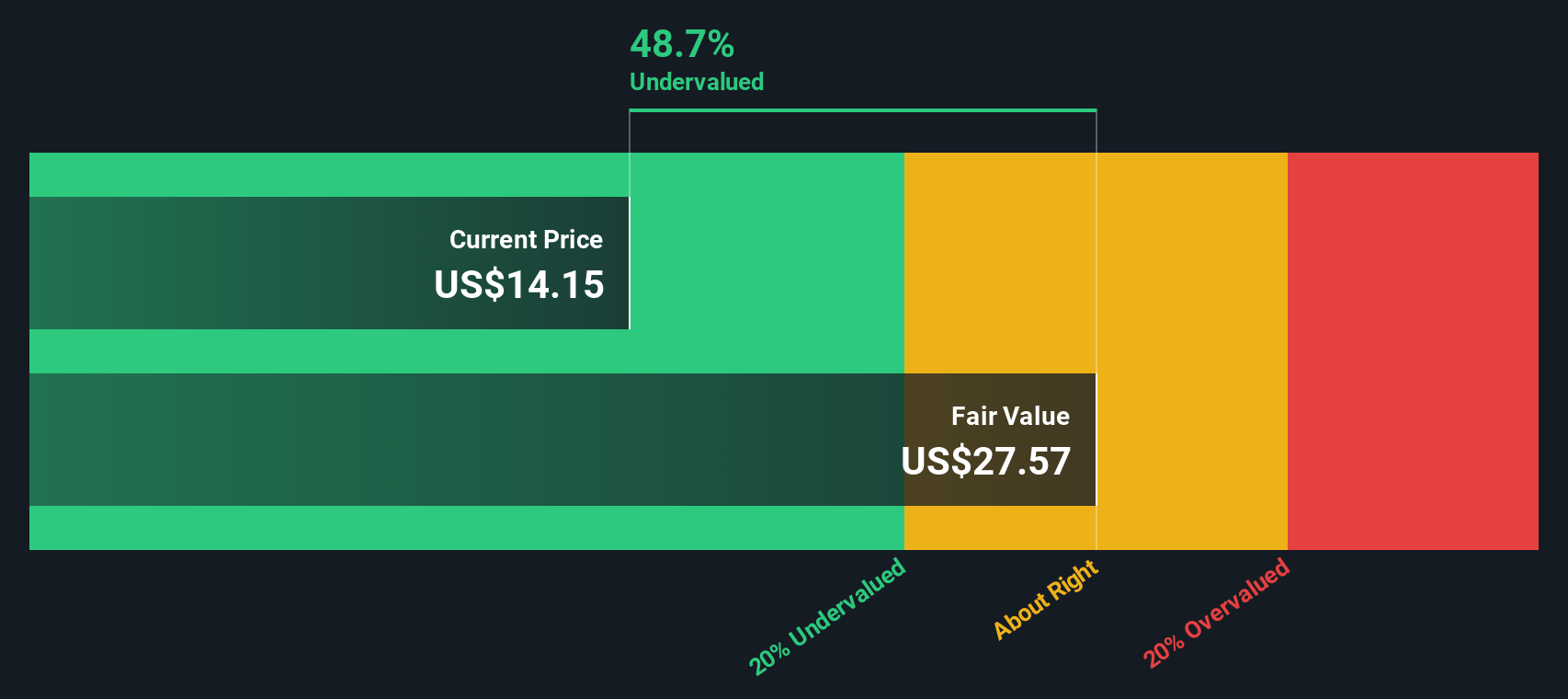

Trinity Capital (TRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Trinity Capital is a financial services company specializing in providing venture capital funding, with a market capitalization of approximately $0.54 billion.

Operations: The primary revenue stream is from venture capital activities, with the latest reported revenue at $254.89 million. Operating expenses have shown a gradual increase, reaching $63.47 million in the most recent period. Notably, the net income margin has improved over time to 0.54%, while maintaining a consistent gross profit margin of 100%.

PE: 7.3x

Trinity Capital, a smaller company in the U.S., is catching attention with its strategic moves and financial performance. Recently, they expanded their credit facility to US$690 million, indicating confidence in future growth. New leadership appointments aim to boost their Life Sciences and Equipment Finance sectors. Although earnings are set to grow by 4.97% annually, reliance on external borrowing poses risks. The recent dividend of US$0.51 per share reflects ongoing shareholder returns despite no insider buying activity reported recently.

- Click to explore a detailed breakdown of our findings in Trinity Capital's valuation report.

Assess Trinity Capital's past performance with our detailed historical performance reports.

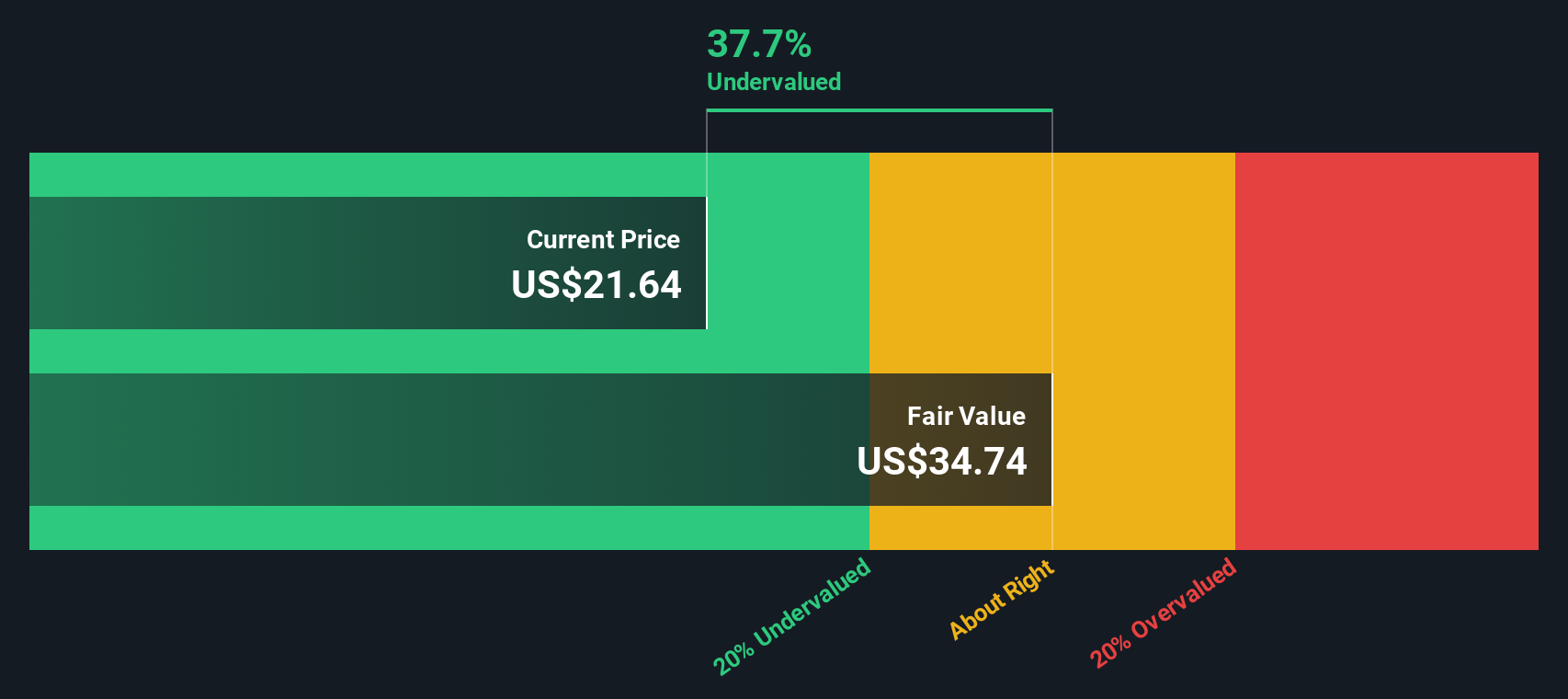

Greenbrier Companies (GBX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Greenbrier Companies is a leading manufacturer and service provider of freight railcars and marine barges, with operations that include leasing and fleet management, holding a market cap of approximately $1.09 billion.

Operations: The company derives its revenue primarily from manufacturing, with additional contributions from leasing and fleet management. Over recent periods, the net profit margin showed a notable increase, reaching 6.48% in May 2025. Operating expenses have consistently been a significant component of costs, impacting overall profitability.

PE: 5.9x

Greenbrier Companies, a player in the railcar manufacturing industry, is considered undervalued within the small cap sector. Despite a forecasted annual earnings decline of 37.4% over the next three years and reliance on external borrowing for funding, insider confidence has been evident with recent share purchases in late 2025. These actions suggest belief in long-term potential despite current financial challenges. The company's future growth hinges on navigating its debt levels while capitalizing on market opportunities.

Seize The Opportunity

- Access the full spectrum of 75 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBX

Greenbrier Companies

Designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives