- United States

- /

- Consumer Finance

- /

- NasdaqGS:PRAA

Exploring 3 Undervalued Small Caps With Insider Activity Across Regions

Reviewed by Simply Wall St

The United States market remained flat over the last week but has shown an 11% increase over the past year, with earnings forecasted to grow by 15% annually. In this environment, identifying small-cap stocks that exhibit promising insider activity can be a strategic approach for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | NA | 0.5x | 39.91% | ★★★★★☆ |

| Lindblad Expeditions Holdings | NA | 1.0x | 27.10% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 35.19% | ★★★★★☆ |

| Citizens & Northern | 11.5x | 2.8x | 45.23% | ★★★★☆☆ |

| Southside Bancshares | 10.5x | 3.6x | 39.02% | ★★★★☆☆ |

| S&T Bancorp | 11.3x | 3.9x | 40.27% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 31.76% | ★★★★☆☆ |

| Farmland Partners | 8.9x | 8.9x | -8.33% | ★★★☆☆☆ |

| Montrose Environmental Group | NA | 1.1x | 33.26% | ★★★☆☆☆ |

| Pebblebrook Hotel Trust | NA | 0.9x | -0.35% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Capital Southwest (CSWC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Capital Southwest is a business development company that provides capital to middle-market companies, with a market cap of approximately $0.61 billion.

Operations: The company primarily generates revenue from its investment activities, with a recent figure of $204.44 million. Over the periods analyzed, the net income margin has shown variability, reaching up to 5.52% and as low as -0.59%. Operating expenses have consistently impacted profitability, with general and administrative expenses being a significant component of these costs.

PE: 18.2x

Capital Southwest, a smaller player in the U.S. market, has shown insider confidence through share purchases over the past year. Despite a dip in net income to US$70.55 million for the year ending March 2025, revenue climbed to US$204.44 million from US$178.14 million previously, indicating potential for growth. The recent shift to monthly dividends starting July 2025 reflects a commitment to shareholder returns amidst financial challenges and reliance on higher-risk external borrowing sources for funding stability.

PRA Group (PRAA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: PRA Group is a company specializing in the purchase and collection of nonperforming loans, with a focus on accounts receivable management, and has a market cap of approximately $1.36 billion.

Operations: The primary revenue stream is from accounts receivable management, with a gross profit margin consistently at 100%. Operating expenses, which include general and administrative costs, are significant components of the cost structure. Net income margins have fluctuated over time, reflecting changes in non-operating expenses and overall financial performance.

PE: 8.8x

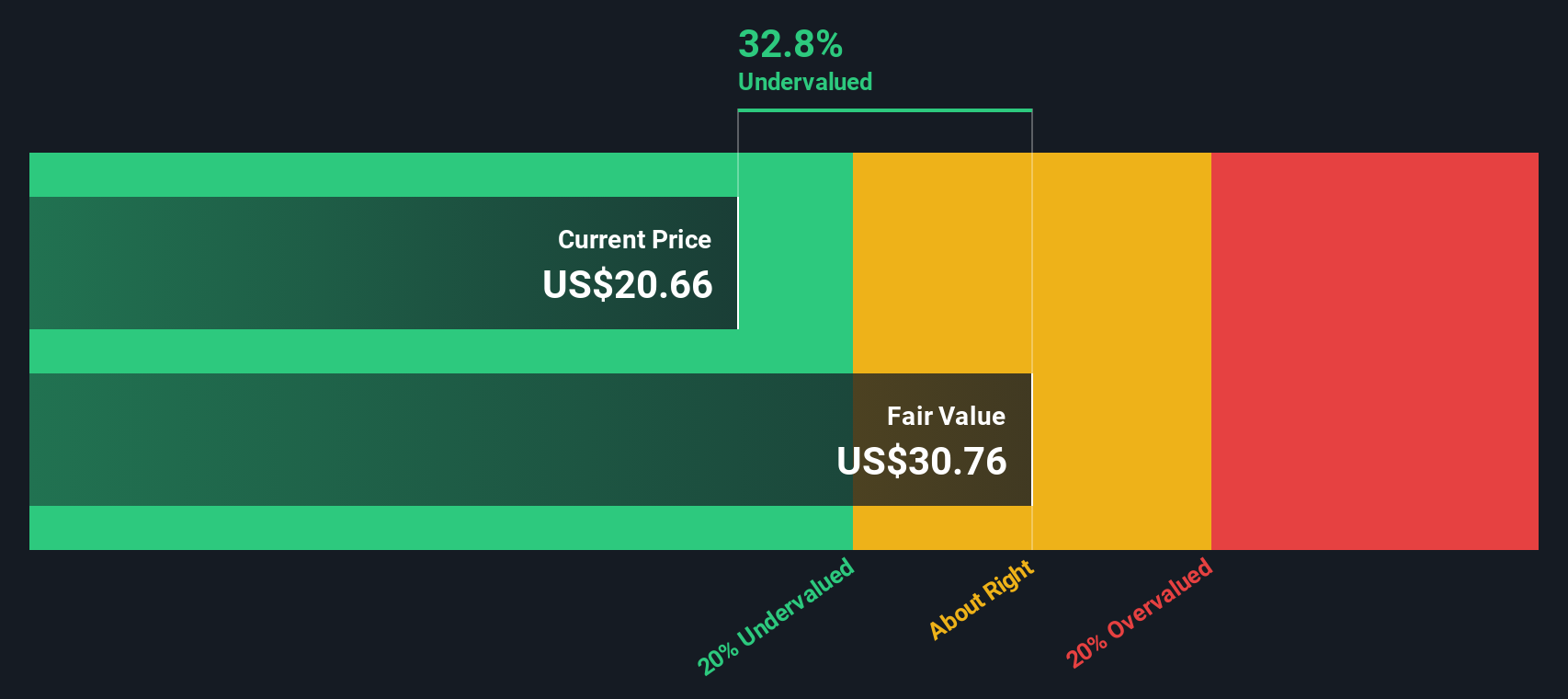

PRA Group's small-scale stature in the market belies its potential, highlighted by insider confidence as Geir Olsen acquired 18,230 shares for approximately US$247,746. Despite interest payments not being fully covered by earnings and reliance on external borrowing, the company's European segment has been a strong performer with over US$3 billion invested successfully. Recent leadership changes aim to capitalize on this momentum. Earnings rose slightly in Q1 2025 to US$269.62 million from last year's figures, showing steady growth potential.

- Take a closer look at PRA Group's potential here in our valuation report.

Assess PRA Group's past performance with our detailed historical performance reports.

Trinity Capital (TRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Trinity Capital is a venture capital firm focused on providing debt and equity solutions to growth-stage companies, with a market cap of approximately $0.77 billion.

Operations: The primary revenue stream is derived from venture capital, with recent figures showing $240.01 million. Operating expenses have been consistently increasing, reaching $60.32 million by 2025, while non-operating expenses were reported at $51.52 million during the same period. The company has achieved a gross profit margin of 100% across multiple periods, indicating that all revenue effectively contributes to gross profit without direct costs being deducted.

PE: 7.3x

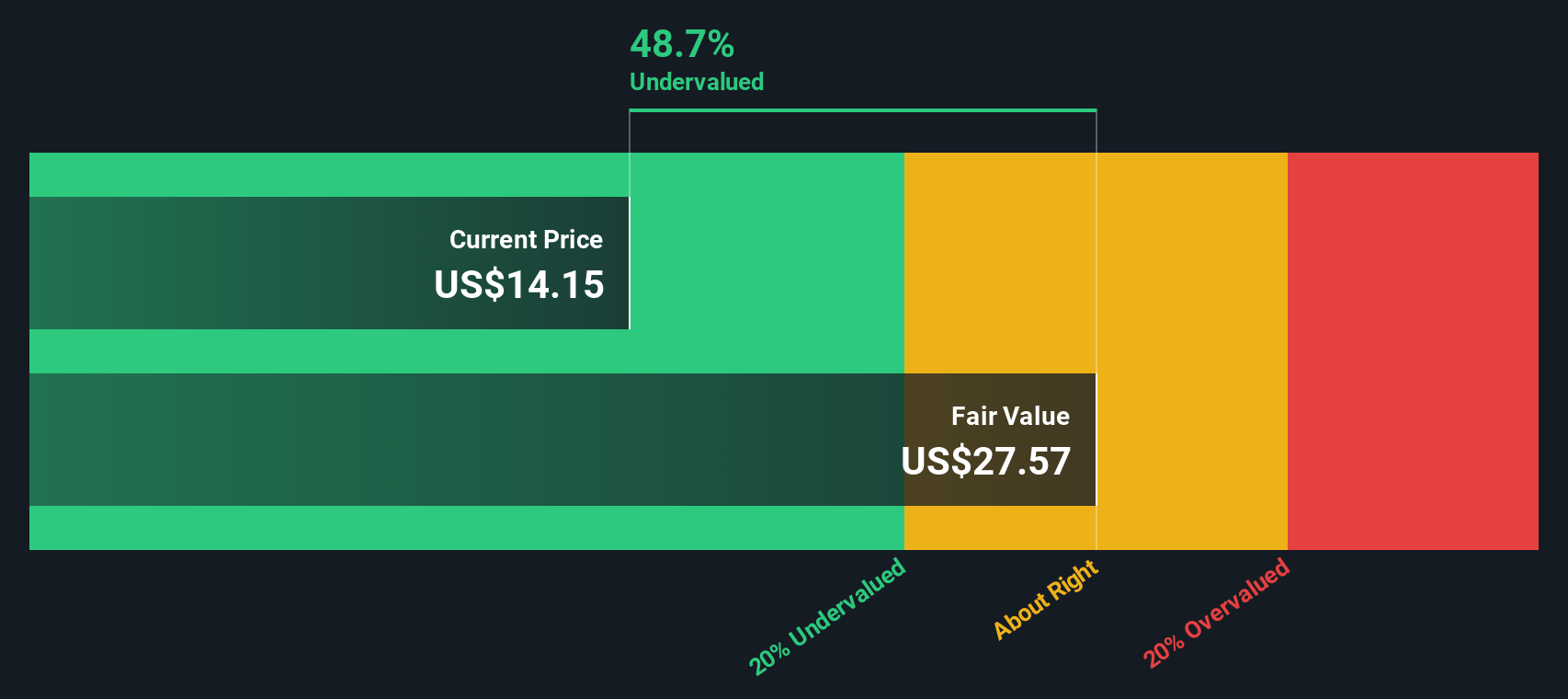

Trinity Capital, a smaller US company, is drawing attention with its recent financial maneuvers. They reported first-quarter revenue of US$65.39 million, up from US$50.45 million the previous year, and net income rose to US$27.09 million from US$14.51 million. Despite this growth, their interest payments are not well covered by earnings due to reliance on external borrowing for funding. Insider confidence was shown through share purchases earlier in the year, suggesting potential future value appreciation despite existing financial risks.

- Click here and access our complete valuation analysis report to understand the dynamics of Trinity Capital.

Explore historical data to track Trinity Capital's performance over time in our Past section.

Next Steps

- Unlock our comprehensive list of 73 Undervalued US Small Caps With Insider Buying by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAA

PRA Group

A financial services company, engages in the purchase, collection, and management of portfolios of nonperforming loans worldwide.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives