- United States

- /

- Banks

- /

- NasdaqGS:CNOB

3 US Stocks That Might Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market grapples with mixed earnings reports and ongoing geopolitical tensions, investors are closely monitoring major indices like the Dow Jones, S&P 500, and Nasdaq Composite for signs of stability. In this environment, identifying stocks that may be undervalued becomes crucial for those looking to capitalize on potential opportunities amidst broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $25.12 | $48.75 | 48.5% |

| KBR (NYSE:KBR) | $53.10 | $104.10 | 49% |

| Northwest Bancshares (NasdaqGS:NWBI) | $13.17 | $26.31 | 49.9% |

| Midland States Bancorp (NasdaqGS:MSBI) | $19.23 | $37.84 | 49.2% |

| Array Technologies (NasdaqGM:ARRY) | $7.30 | $14.40 | 49.3% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $111.41 | $217.76 | 48.8% |

| Coastal Financial (NasdaqGS:CCB) | $86.74 | $172.68 | 49.8% |

| BeiGene (NasdaqGS:ONC) | $222.91 | $441.43 | 49.5% |

| Equifax (NYSE:EFX) | $266.77 | $531.78 | 49.8% |

| Gold Royalty (NYSEAM:GROY) | $1.35 | $2.64 | 48.8% |

Let's uncover some gems from our specialized screener.

ConnectOne Bancorp (NasdaqGS:CNOB)

Overview: ConnectOne Bancorp, Inc. is a bank holding company for ConnectOne Bank, offering commercial banking products and services to small and mid-sized businesses, local professionals, and individuals in the New York Metropolitan area and South Florida market, with a market cap of approximately $964.97 million.

Operations: The company's revenue primarily comes from its community banking segment, which generated $250.27 million.

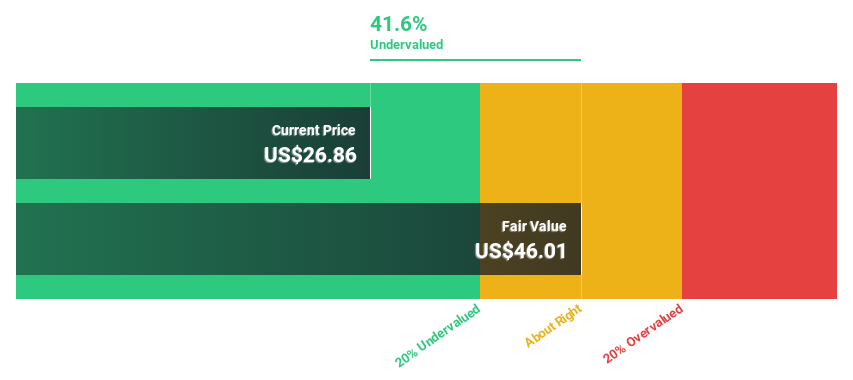

Estimated Discount To Fair Value: 46.1%

ConnectOne Bancorp is trading at US$26.27, significantly undervalued compared to its estimated fair value of US$48.76, presenting a potential opportunity based on discounted cash flow analysis. Despite a decrease in full-year net income to US$73.79 million from the previous year, the company's revenue and earnings are forecasted to grow faster than the market average, with expected annual profit growth of 48.9%. Recent earnings showed improved quarterly net interest income and reduced loan charge-offs.

- Insights from our recent growth report point to a promising forecast for ConnectOne Bancorp's business outlook.

- Get an in-depth perspective on ConnectOne Bancorp's balance sheet by reading our health report here.

CNX Resources (NYSE:CNX)

Overview: CNX Resources Corporation is an independent natural gas and midstream company focused on acquiring, exploring, developing, and producing natural gas properties in the Appalachian Basin with a market cap of approximately $4.12 billion.

Operations: CNX Resources generates its revenue primarily through the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

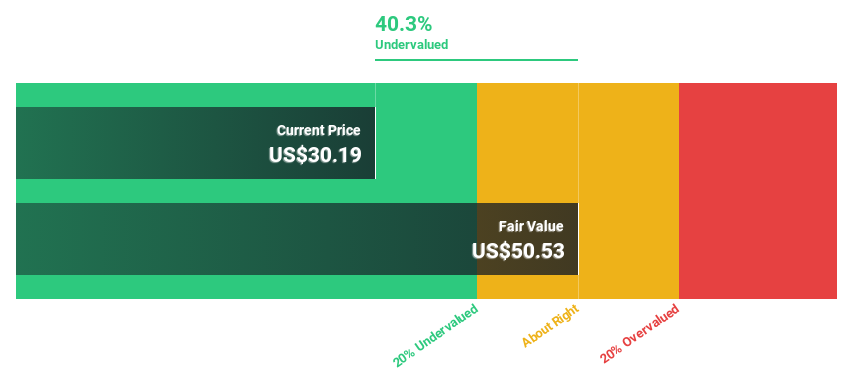

Estimated Discount To Fair Value: 45%

CNX Resources, trading at US$28.45, is undervalued relative to its fair value estimate of US$51.74 based on discounted cash flow analysis. Despite reporting a net loss of US$90.49 million for 2024, CNX's revenue is projected to grow more than 20% annually, outpacing the broader U.S. market growth rate of 8.8%. However, interest payments remain inadequately covered by earnings, and the company recently issued US$200 million in senior notes to support acquisitions and reduce debt.

- The growth report we've compiled suggests that CNX Resources' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of CNX Resources.

Genius Sports (NYSE:GENI)

Overview: Genius Sports Limited develops and sells technology-driven products and services for the sports, sports betting, and sports media industries, with a market cap of approximately $2.05 billion.

Operations: The company generates revenue from its data processing segment, amounting to $462.54 million.

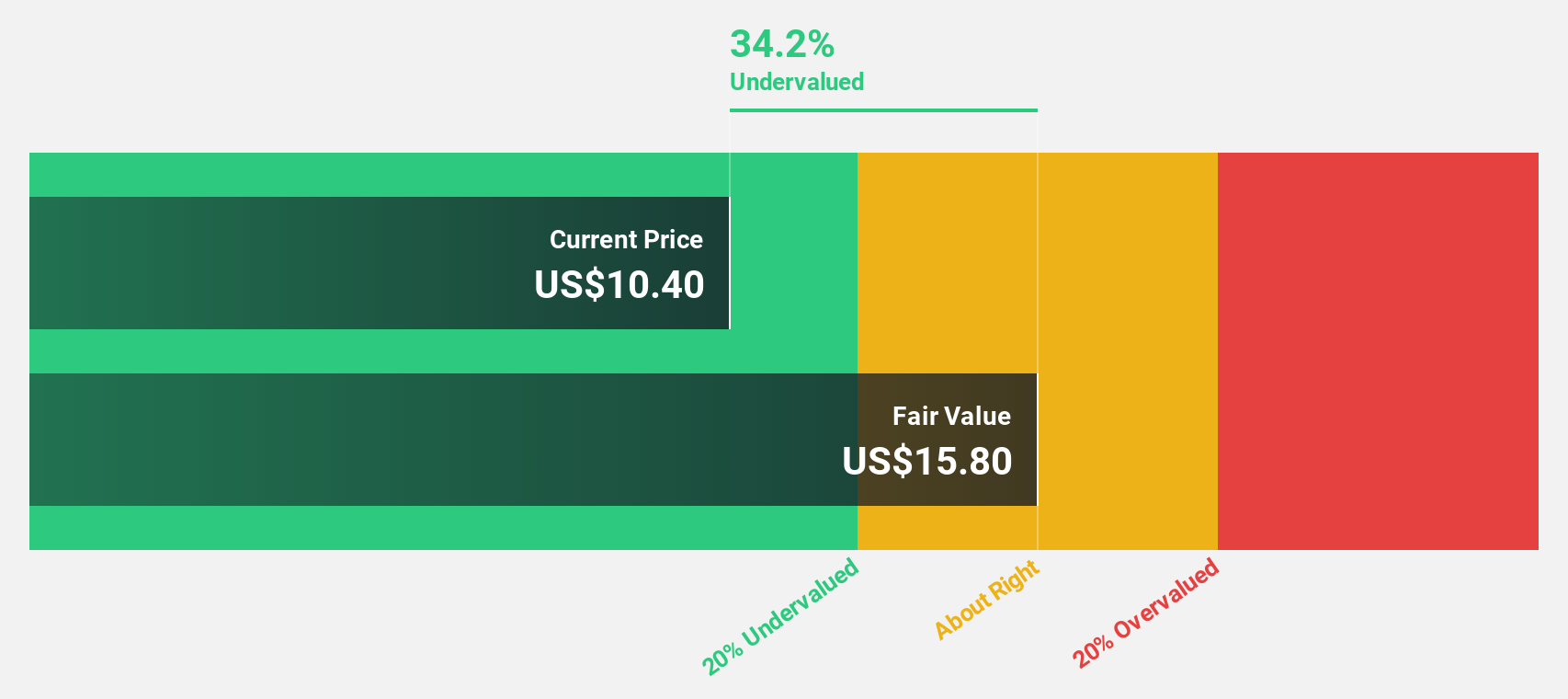

Estimated Discount To Fair Value: 18.5%

Genius Sports, priced at US$9.48, is trading 18.5% below its fair value estimate of US$11.63 based on discounted cash flow analysis. The company recently completed a follow-on equity offering worth US$150 million, which may support future growth initiatives. Despite low return on equity forecasts and slower revenue growth compared to some benchmarks, Genius Sports' earnings are expected to grow significantly and become profitable within three years, aligning with above-average market expectations.

- In light of our recent growth report, it seems possible that Genius Sports' financial performance will exceed current levels.

- Navigate through the intricacies of Genius Sports with our comprehensive financial health report here.

Seize The Opportunity

- Investigate our full lineup of 180 Undervalued US Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ConnectOne Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNOB

ConnectOne Bancorp

Operates as the bank holding company for ConnectOne Bank that provides commercial banking products and services for small and mid-sized businesses, local professionals, and individuals in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives