- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

Top US Growth Companies With Up To 31% Insider Ownership

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite continue their upward momentum, investors are increasingly looking for growth opportunities amidst a fluctuating market landscape. One key indicator of potential success is high insider ownership, which often signals confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Pangaea Logistics Solutions (NasdaqCM:PANL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pangaea Logistics Solutions, Ltd. (NasdaqCM:PANL) offers seaborne dry bulk logistics and transportation services to industrial clients globally and has a market cap of $290.32 million.

Operations: Pangaea Logistics Solutions generates $503.74 million in revenue from its Transportation - Shipping segment.

Insider Ownership: 26.4%

Pangaea Logistics Solutions shows promising growth potential with forecasted annual earnings growth of 23%, surpassing the US market average of 15%. Despite a slower revenue growth rate at 9.9% per year, it is still above the US market's 8.6%. The company trades at a significant discount to its estimated fair value and has high insider ownership, aligning management interests with shareholders. Recent earnings reports revealed improved net income and EPS, but dividend sustainability remains uncertain due to an unstable track record.

- Click to explore a detailed breakdown of our findings in Pangaea Logistics Solutions' earnings growth report.

- Upon reviewing our latest valuation report, Pangaea Logistics Solutions' share price might be too pessimistic.

LGI Homes (NasdaqGS:LGIH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LGI Homes, Inc. designs, constructs, and sells homes with a market cap of $2.47 billion.

Operations: The company's primary revenue segment is its Homebuilding Business, generating $2.22 billion.

Insider Ownership: 12.3%

LGI Homes exhibits strong growth potential with forecasted earnings and revenue increases of 20.81% and 21.6% per year, respectively, outpacing the US market. The company trades at a favorable P/E ratio of 12.6x compared to the market's 17.5x. Recent developments include new community openings in Washington, Arizona, and Florida, enhancing its portfolio with upgraded homes and amenities. However, debt coverage by operating cash flow remains a concern despite high insider ownership aligning management interests with shareholders.

- Navigate through the intricacies of LGI Homes with our comprehensive analyst estimates report here.

- Our valuation report here indicates LGI Homes may be overvalued.

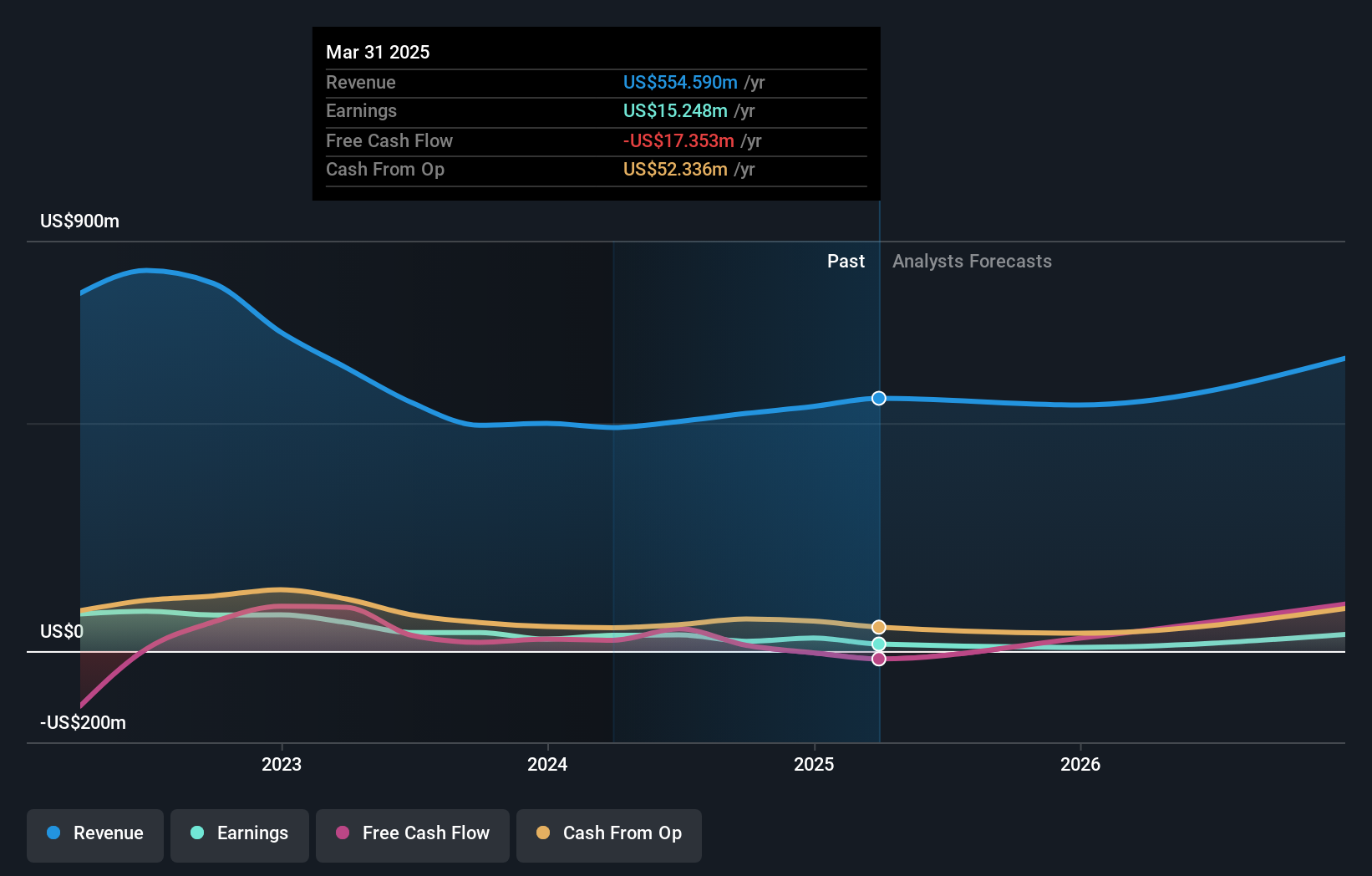

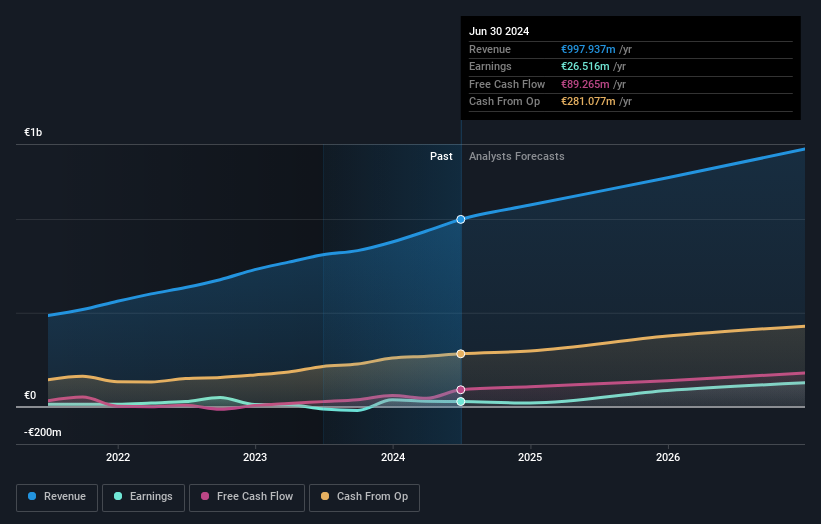

Sportradar Group (NasdaqGS:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sportradar Group AG, with a market cap of $3.52 billion, provides sports data services for the sports betting and media industries across the United Kingdom, the United States, Malta, Switzerland, and internationally.

Operations: Sportradar Group AG generates revenue through sports data services for the sports betting and media industries in various regions, including the United Kingdom, the United States, Malta, Switzerland, and other international markets.

Insider Ownership: 31.9%

Sportradar Group, a growth company with substantial insider ownership, has seen significant revenue increases, reporting €278.42 million for Q2 2024 compared to €216.43 million a year ago. Despite this growth, the company posted a net loss of €1.45 million for the quarter. Earnings are forecast to grow 42.07% annually over the next three years, outpacing the US market's expected growth rate of 15%. The stock trades at 43.7% below its estimated fair value and recently raised its full-year revenue guidance to €1.07 billion from €1.06 billion while completing an $8 million share buyback program in August 2024.

- Click here to discover the nuances of Sportradar Group with our detailed analytical future growth report.

- Our valuation report unveils the possibility Sportradar Group's shares may be trading at a premium.

Seize The Opportunity

- Investigate our full lineup of 178 Fast Growing US Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Provides sports data services for the sports betting and media industries in Switzerland, the United States, North America, Africa, the Asia Pacific, the Middle East, Europe, Latin America, and the Caribbean.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives