- United States

- /

- Software

- /

- NasdaqGS:WDAY

Discover 3 Stocks That Might Be Trading Below Their Estimated Fair Value

Reviewed by Simply Wall St

As U.S. stock indexes reach new highs, with the S&P 500 and Nasdaq posting their third consecutive week of gains, investors are increasingly focused on identifying opportunities that might be trading below their estimated fair value. In this buoyant market environment, a good stock is often characterized by strong fundamentals and potential for growth that isn't fully reflected in its current price.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $13.29 | $26.50 | 49.8% |

| Royal Gold (RGLD) | $191.67 | $383.08 | 50% |

| Pinnacle Financial Partners (PNFP) | $96.02 | $186.59 | 48.5% |

| Phibro Animal Health (PAHC) | $39.86 | $77.67 | 48.7% |

| Peapack-Gladstone Financial (PGC) | $29.06 | $56.54 | 48.6% |

| McGraw Hill (MH) | $13.54 | $26.49 | 48.9% |

| Investar Holding (ISTR) | $23.01 | $44.74 | 48.6% |

| Alnylam Pharmaceuticals (ALNY) | $453.56 | $902.17 | 49.7% |

| Advanced Flower Capital (AFCG) | $4.43 | $8.76 | 49.4% |

| AbbVie (ABBV) | $222.47 | $441.60 | 49.6% |

Let's uncover some gems from our specialized screener.

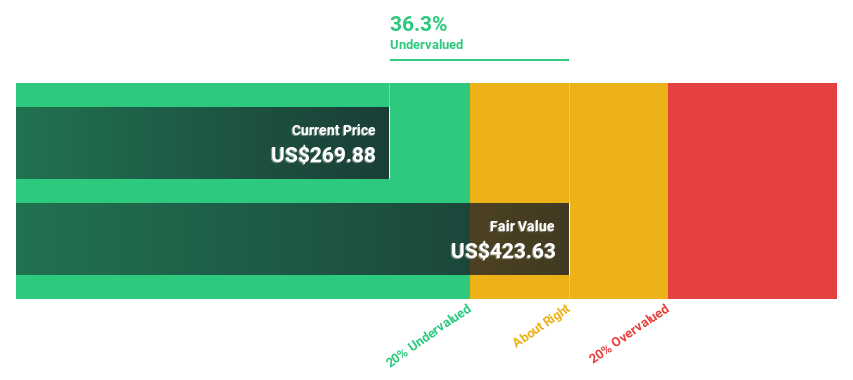

Workday (WDAY)

Overview: Workday, Inc. offers enterprise cloud applications globally and has a market cap of $62.38 billion.

Operations: The company's revenue primarily comes from its cloud applications segment, which generated $8.96 billion.

Estimated Discount To Fair Value: 28.0%

Workday is trading at US$233.62, significantly below its estimated fair value of US$324.35, suggesting potential undervaluation based on cash flows. Recent announcements include a $4 billion share repurchase program and ongoing strategic acquisitions to bolster growth. Despite a dip in profit margins from last year, Workday's earnings are projected to grow substantially over the next three years, supported by innovative product developments like Workday Data Cloud and partnerships enhancing AI capabilities.

- Our comprehensive growth report raises the possibility that Workday is poised for substantial financial growth.

- Navigate through the intricacies of Workday with our comprehensive financial health report here.

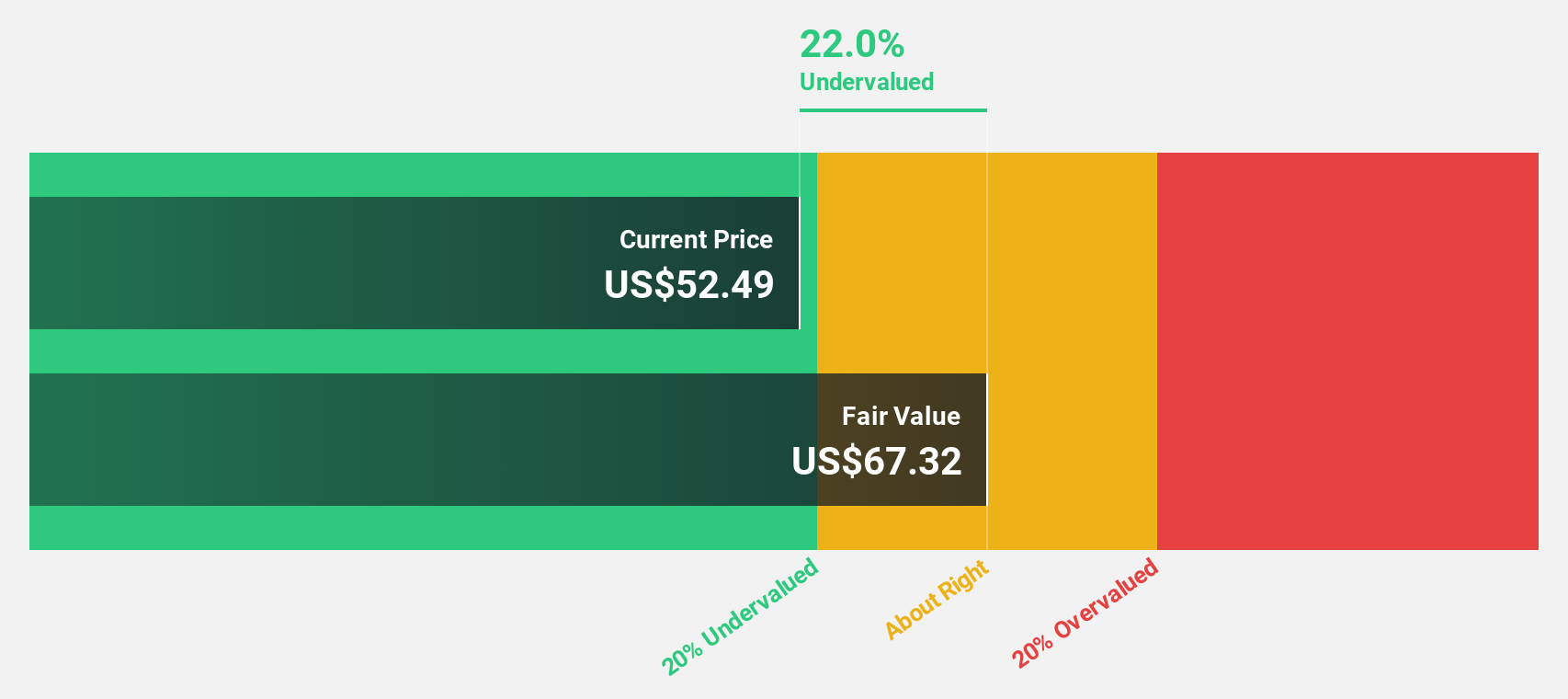

On Holding (ONON)

Overview: On Holding AG develops and distributes sports products globally, with a market cap of approximately $14.77 billion.

Operations: The company generates revenue from its athletic footwear segment, which amounts to CHF 2.72 billion.

Estimated Discount To Fair Value: 17%

On Holding is trading at US$45.23, below its estimated fair value of US$54.48, indicating it may be undervalued based on cash flows. The company forecasts robust revenue growth of 17.6% annually, outpacing the broader market, with earnings expected to rise significantly over the next three years. Despite a recent decline in profit margins and net income for the first half of 2025, On Holding has raised its full-year earnings guidance amid strong sales performance and index inclusions enhancing visibility.

- Our expertly prepared growth report on On Holding implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on On Holding's balance sheet by reading our health report here.

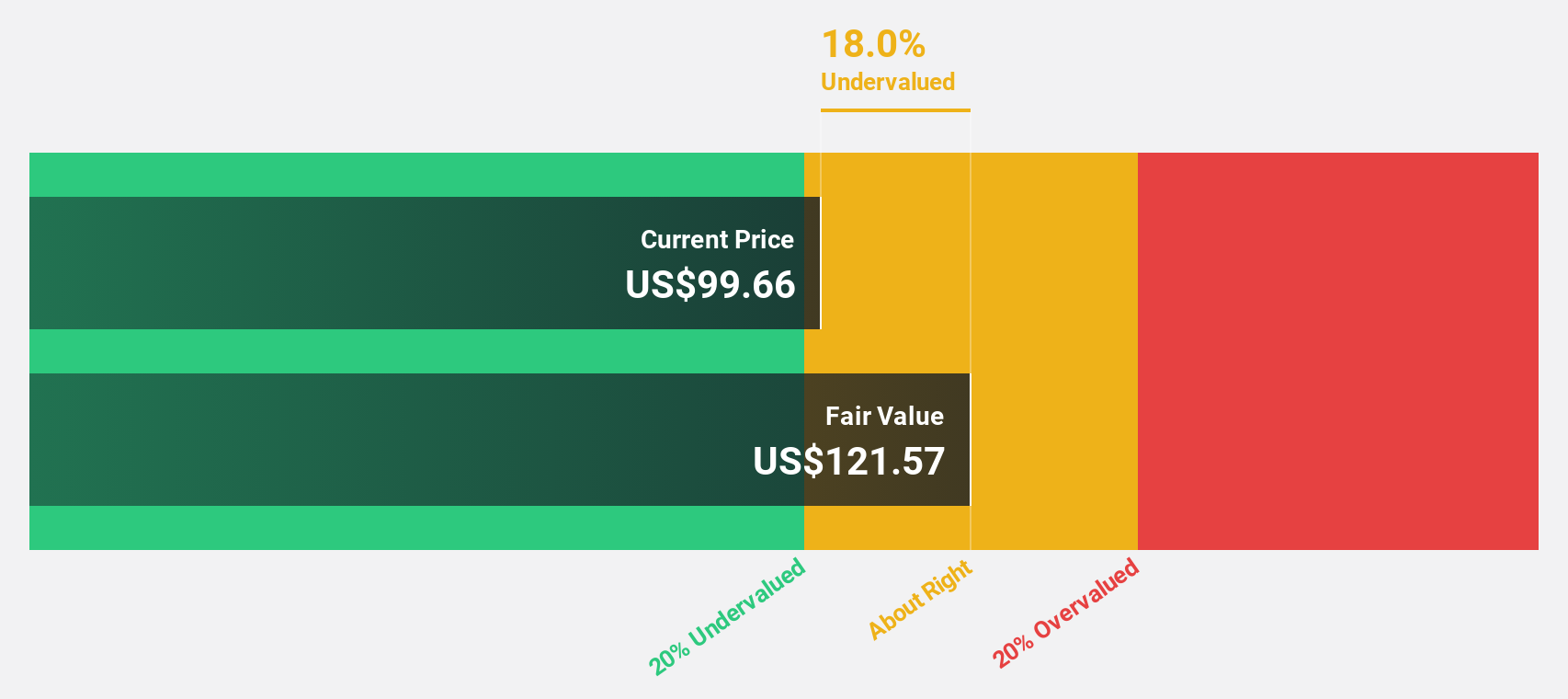

Tapestry (TPR)

Overview: Tapestry, Inc. is a company that offers accessories and lifestyle brand products across North America, Greater China, the rest of Asia, and internationally with a market cap of $23.77 billion.

Operations: Tapestry's revenue is derived from its three main segments: Coach at $5.60 billion, Kate Spade at $1.20 billion, and Stuart Weitzman at $215.10 million.

Estimated Discount To Fair Value: 12.3%

Tapestry is trading at US$114.19, below its estimated fair value of US$130.20, suggesting potential undervaluation based on cash flows. Despite a recent decline in profit margins and net income, the company forecasts significant earnings growth of 25.3% annually over the next three years, outpacing the broader market's growth rate. A newly authorized US$3 billion share repurchase program underscores confidence in robust free cash flow generation despite slower revenue growth projections compared to market averages.

- The growth report we've compiled suggests that Tapestry's future prospects could be on the up.

- Dive into the specifics of Tapestry here with our thorough financial health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 191 Undervalued US Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)