- United States

- /

- Software

- /

- NasdaqGS:PEGA

3 US Stocks That May Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance amid anticipation of key economic data, investors are closely watching for signs that could influence interest rate decisions. With major indices showing slight fluctuations and economic indicators highlighting ongoing strength, identifying stocks that may be trading below their estimated fair value becomes increasingly relevant. In such an environment, a good stock might be one that demonstrates solid fundamentals and potential resilience against macroeconomic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.16 | $53.27 | 49% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $31.31 | $61.52 | 49.1% |

| Afya (NasdaqGS:AFYA) | $15.08 | $29.41 | 48.7% |

| Ally Financial (NYSE:ALLY) | $35.61 | $69.71 | 48.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | $93.54 | $186.41 | 49.8% |

| Constellium (NYSE:CSTM) | $10.77 | $20.78 | 48.2% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $39.04 | $75.33 | 48.2% |

| Bilibili (NasdaqGS:BILI) | $16.78 | $32.78 | 48.8% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.78 | $30.71 | 48.6% |

| Coeur Mining (NYSE:CDE) | $6.44 | $12.59 | 48.8% |

Let's dive into some prime choices out of the screener.

Pegasystems (NasdaqGS:PEGA)

Overview: Pegasystems Inc. is a company that develops, markets, licenses, hosts, and supports enterprise software across various regions including the Americas, Europe, the Middle East, Africa, and Asia-Pacific with a market capitalization of approximately $8.06 billion.

Operations: The company's revenue segment for Software & Programming is $1.48 billion.

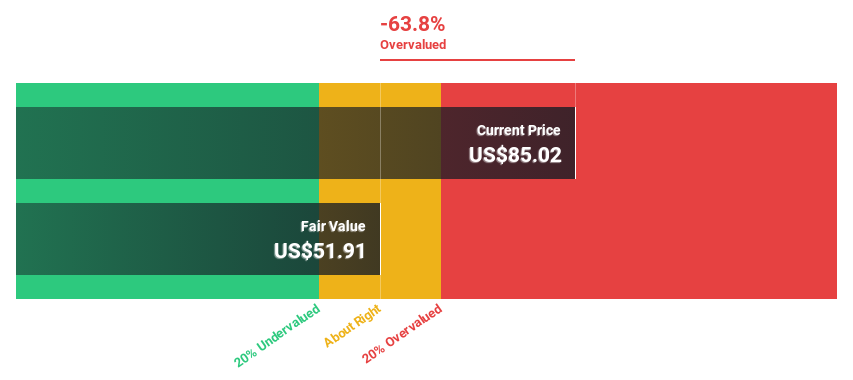

Estimated Discount To Fair Value: 30%

Pegasystems is trading at US$96.09, below its estimated fair value of US$137.29, suggesting it may be undervalued based on cash flows. Despite recent shareholder dilution, earnings are expected to grow significantly at 20.54% annually over the next three years, outpacing the broader U.S. market's growth expectations. However, revenue growth is forecasted to lag behind the market average. Recent product enhancements with AI capabilities could support future profitability improvements and operational efficiencies.

- Our growth report here indicates Pegasystems may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Pegasystems.

Levi Strauss (NYSE:LEVI)

Overview: Levi Strauss & Co. designs, markets, and sells apparel and related accessories for men, women, and children worldwide, with a market cap of approximately $7.01 billion.

Operations: The company's revenue is primarily generated from its operations in the Americas ($3.09 billion), Europe ($1.56 billion), and Asia ($1.06 billion).

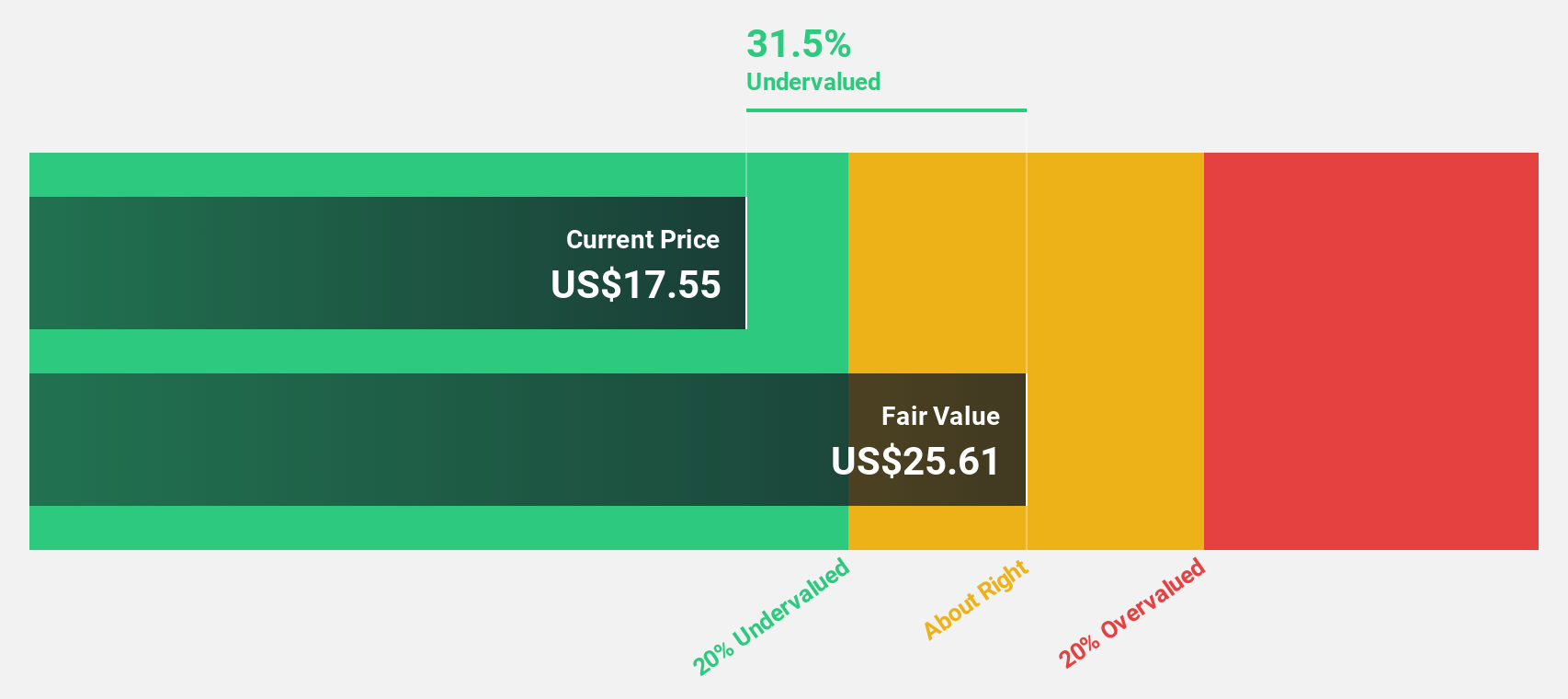

Estimated Discount To Fair Value: 28.6%

Levi Strauss, trading at US$17.86, is valued 28.6% below its estimated fair value of US$25.02, highlighting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 45.4% annually over the next three years, surpassing the U.S. market's growth rate of 15%. However, revenue growth is expected to be slower than the market average and profit margins have decreased from last year. Recent leadership changes aim to drive sustainable growth in Latin America.

- The growth report we've compiled suggests that Levi Strauss' future prospects could be on the up.

- Get an in-depth perspective on Levi Strauss' balance sheet by reading our health report here.

BBB Foods (NYSE:TBBB)

Overview: BBB Foods Inc. operates a chain of grocery retail stores in Mexico through its subsidiaries, with a market cap of $3.34 billion.

Operations: The company's revenue segment is focused on the sale, acquisition, and distribution of all types of products and consumer goods, generating MX$53.41 billion.

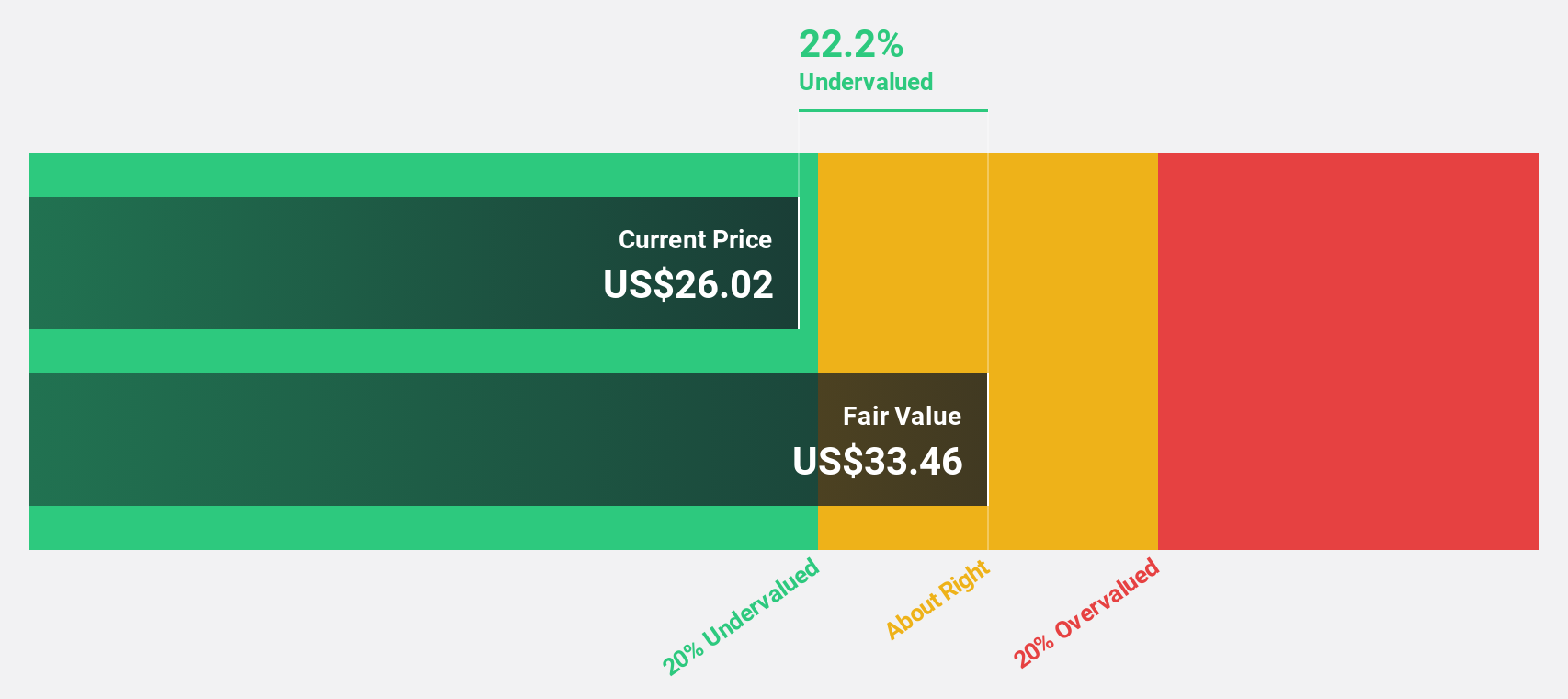

Estimated Discount To Fair Value: 20.2%

BBB Foods, with a trading price of MXN 30.1, is valued at 20.2% below its estimated fair value of MXN 37.73, suggesting undervaluation based on cash flows. The company has transitioned to profitability this year and forecasts indicate robust earnings growth at 40.7% annually over the next three years, outpacing the U.S. market's rate of 15.1%. Recent earnings reports show improved financial performance with significant revenue and net income increases compared to last year.

- Our comprehensive growth report raises the possibility that BBB Foods is poised for substantial financial growth.

- Click here to discover the nuances of BBB Foods with our detailed financial health report.

Next Steps

- Navigate through the entire inventory of 169 Undervalued US Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pegasystems, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEGA

Pegasystems

Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives