- United States

- /

- Leisure

- /

- NasdaqGS:JAKK

Top Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates through a volatile October, major indexes have shown resilience with the Nasdaq and S&P 500 closing higher despite ongoing economic uncertainties such as U.S.-China trade tensions and a prolonged government shutdown. In this environment, dividend stocks can offer stability and income potential, making them an attractive consideration for investors seeking to balance growth with steady returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 11.95% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.82% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.29% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.96% | ★★★★★★ |

| Ennis (EBF) | 5.73% | ★★★★★★ |

| Employers Holdings (EIG) | 3.08% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.82% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.51% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.73% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.47% | ★★★★★☆ |

Click here to see the full list of 134 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Civista Bancshares (CIVB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Civista Bancshares, Inc. is the financial holding company for Civista Bank, offering community banking services in the United States with a market cap of $412.14 million.

Operations: Civista Bancshares, Inc. generates revenue primarily through its banking segment, which accounts for $157.43 million.

Dividend Yield: 3.2%

Civista Bancshares offers a stable dividend yield of 3.24%, supported by a low payout ratio of 26.2%, ensuring coverage by earnings. Over the past decade, its dividends have been reliable and growing with minimal volatility. Despite trading at an estimated 41.1% below fair value, recent dilution could be a concern for shareholders. Recent executive changes and strong earnings growth—net income rose to US$11.02 million in Q2—indicate robust operational performance amidst financial adjustments like impairment charges.

- Take a closer look at Civista Bancshares' potential here in our dividend report.

- Our valuation report unveils the possibility Civista Bancshares' shares may be trading at a discount.

JAKKS Pacific (JAKK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JAKKS Pacific, Inc. is a global company involved in designing, producing, marketing, selling, and distributing toys and related products, consumer goods, children's furniture, costumes, sporting goods, and home furnishings with a market cap of approximately $211.79 million.

Operations: JAKKS Pacific's revenue is primarily derived from two segments: Toys/Consumer Products, which generated $706.62 million, and Costumes, with a contribution of -$21.93 million.

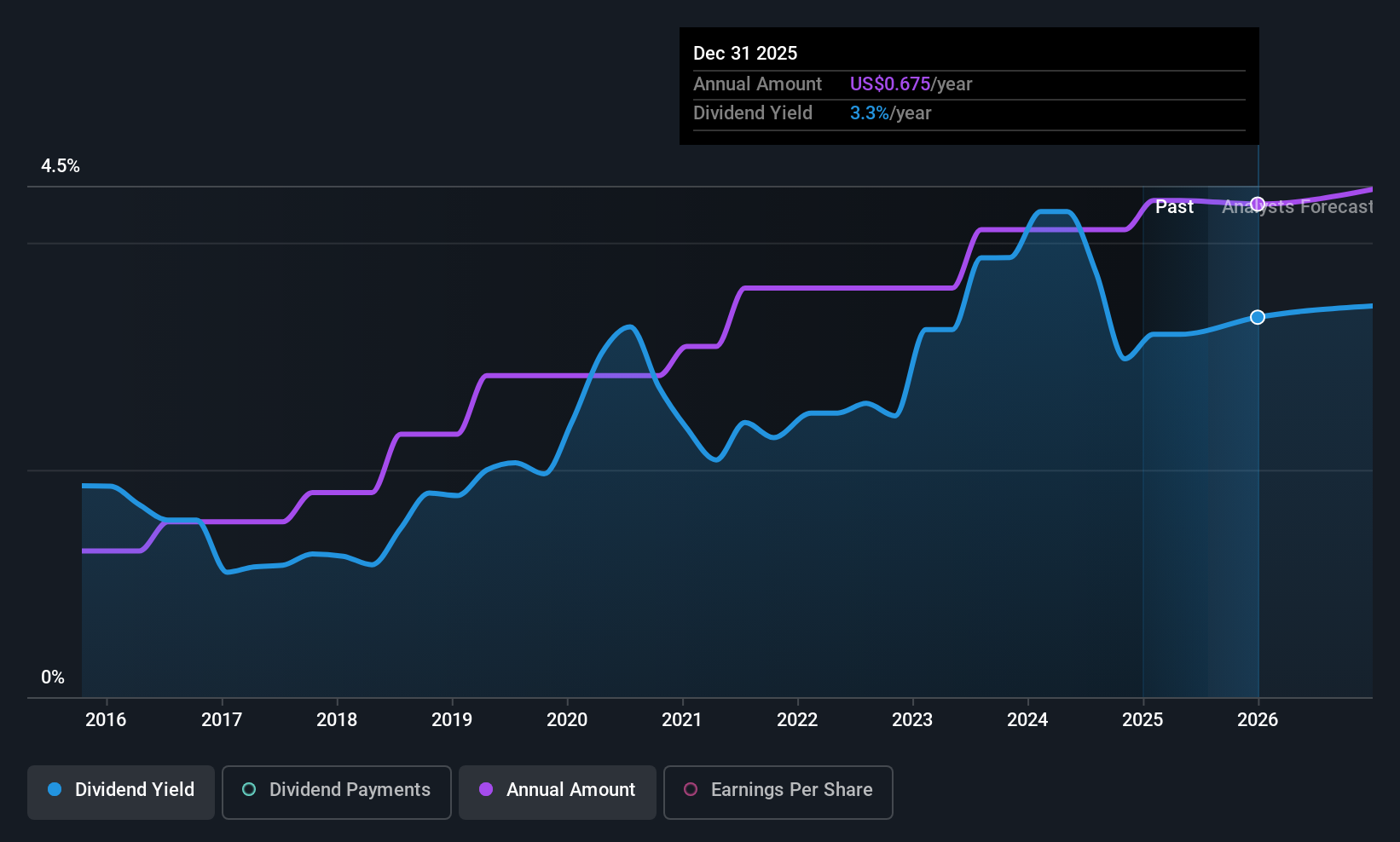

Dividend Yield: 5.1%

JAKKS Pacific's recent dividend initiation offers a yield of 5.12%, placing it among the top 25% of US dividend payers. The company's low payout ratios—14.4% from earnings and 28.2% from cash flow—suggest dividends are well-covered, though it's too early to assess reliability or growth trends. Despite a recent net loss, JAKKS maintains a favorable price-to-earnings ratio of 5.7x, indicating good value against market peers while leveraging partnerships with major brands like Warner Bros., Disney, and Nintendo for product expansion.

- Delve into the full analysis dividend report here for a deeper understanding of JAKKS Pacific.

- Our expertly prepared valuation report JAKKS Pacific implies its share price may be lower than expected.

Paychex (PAYX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paychex, Inc. offers human capital management solutions including payroll, employee benefits, HR, and insurance services for small to medium-sized businesses across the United States, Europe, and India with a market cap of approximately $46.28 billion.

Operations: Paychex, Inc.'s revenue from its Staffing & Outsourcing Services segment totals $5.79 billion.

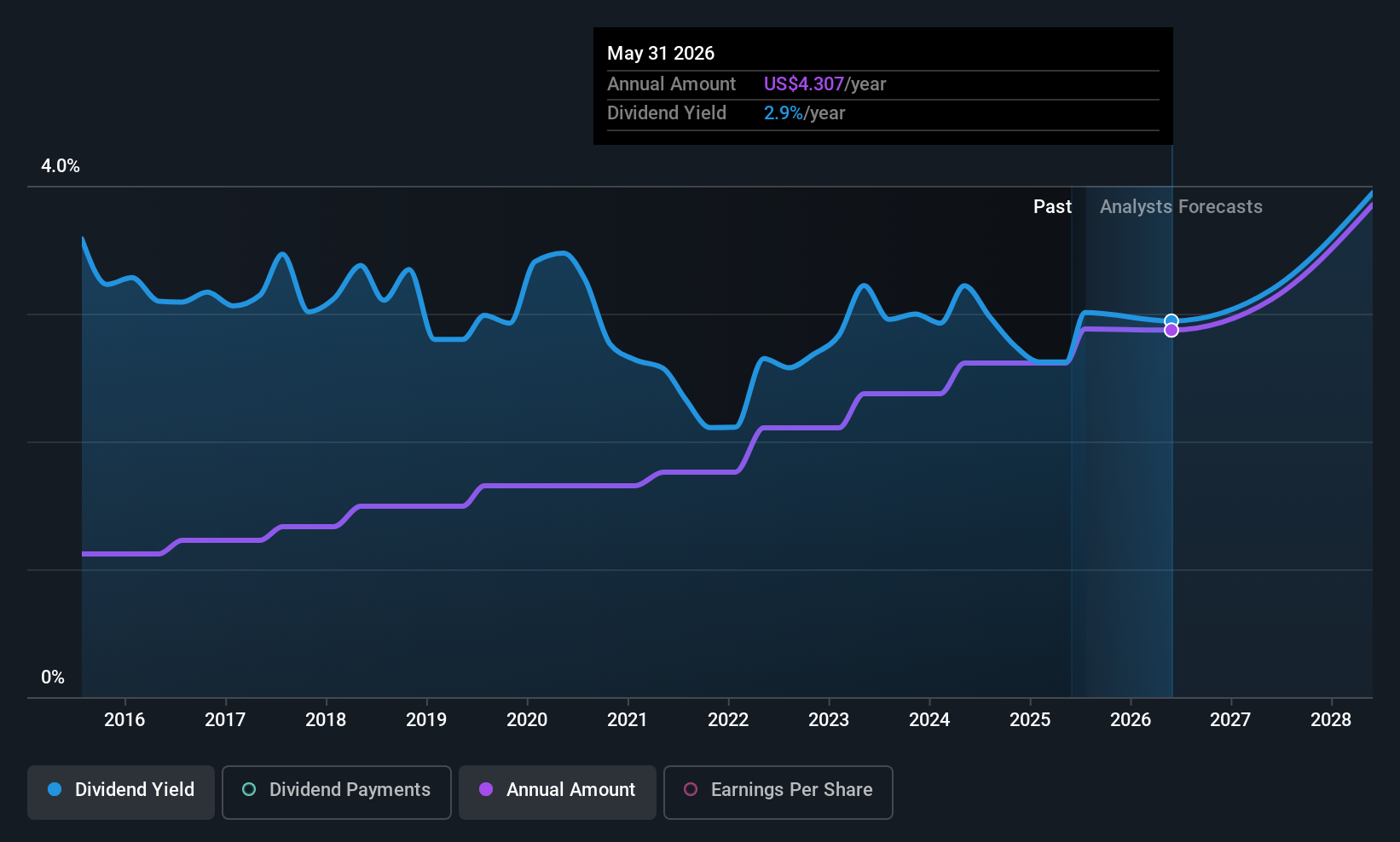

Dividend Yield: 3.4%

Paychex declared a quarterly dividend of $1.08 per share, reflecting stable payouts over the past decade despite a high payout ratio of 92%, indicating limited coverage by earnings but adequate cash flow support. The stock's dividend yield is lower than top-tier US dividends, and recent insider selling may raise concerns. Strategic partnerships, like with Nayya for enhanced benefits guidance, aim to bolster long-term growth prospects amidst ongoing revenue increases and positive fiscal outlook adjustments.

- Unlock comprehensive insights into our analysis of Paychex stock in this dividend report.

- Upon reviewing our latest valuation report, Paychex's share price might be too pessimistic.

Taking Advantage

- Discover the full array of 134 Top US Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JAKK

JAKKS Pacific

Designs, produces, markets, sells, and distributes toys and related products, consumer products, kids indoor and outdoor furniture, costumes, and sporting goods and home furnishings space products worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives