- United States

- /

- Professional Services

- /

- NYSE:NSP

US Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As the U.S. stock market navigates a holiday-shortened week, buoyed by gains in tech and chip stocks despite recent interest rate forecasts from the Federal Reserve, investors are keenly observing dividend stocks for their potential to provide steady income amid fluctuating market dynamics. In this environment, a good dividend stock is often characterized by its ability to maintain consistent payouts and exhibit resilience during economic shifts, making it an attractive consideration for those seeking stability and income in their investment portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.32% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.63% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.56% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.85% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.75% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.56% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.78% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.74% | ★★★★★★ |

Click here to see the full list of 158 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Carter's (NYSE:CRI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carter's, Inc. designs, sources, and markets branded childrenswear under various brands such as Carter's and OshKosh in the United States and internationally, with a market cap of approximately $20.05 billion.

Operations: Carter's, Inc. generates revenue through its U.S. Retail segment ($1.43 billion), International segment ($408.17 million), and U.S. Wholesale segment ($1 billion).

Dividend Yield: 5.8%

Carter's offers a mixed dividend profile with a yield of 5.8%, placing it in the top 25% of U.S. dividend payers, yet its track record is marked by volatility and unreliability over the past decade. Recently reaffirming its earnings guidance for 2024, Carter's maintains sustainable dividends covered by earnings (49.8%) and cash flows (41.5%). Despite being dropped from the S&P 400 and added to the S&P 600, it trades at a favorable P/E ratio of 8.8x compared to market averages.

- Get an in-depth perspective on Carter's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Carter's current price could be quite moderate.

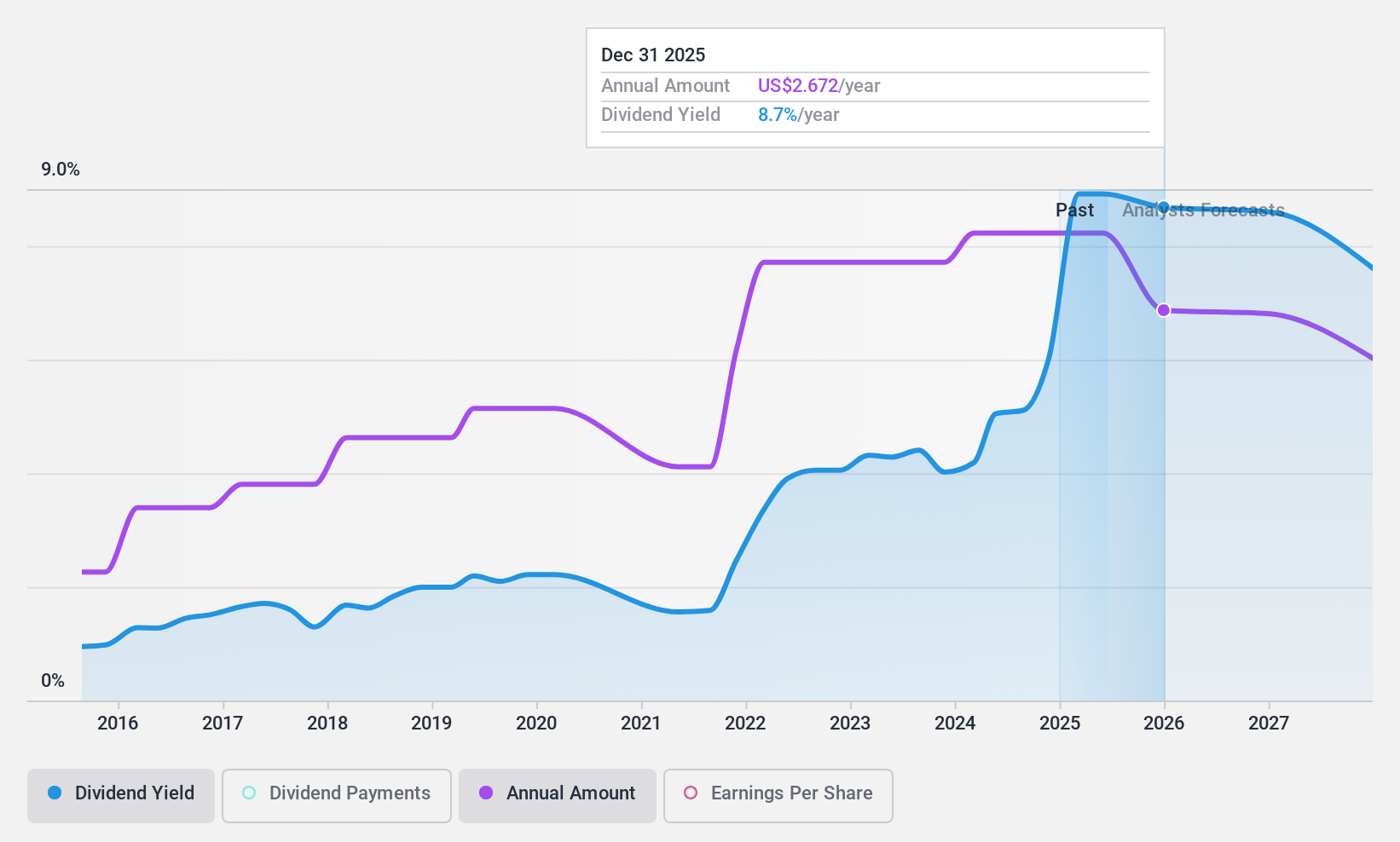

Insperity (NYSE:NSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Insperity, Inc. provides human resources and business solutions to enhance the performance of small and medium-sized businesses in the United States, with a market cap of approximately $2.85 billion.

Operations: Insperity, Inc.'s revenue from its Staffing & Outsourcing Services segment amounts to $6.55 billion.

Dividend Yield: 3.2%

Insperity's dividend, currently at 3.17%, is lower than the top quartile of U.S. dividend payers and not covered by free cash flows despite a stable 10-year history. The payout ratio of 74.1% suggests earnings coverage, but earnings are forecasted to decline slightly over the next three years. Recent insider selling and a significant drop in net income highlight potential concerns, although dividends remain consistent with recent affirmations of US$0.60 per share payments.

- Take a closer look at Insperity's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Insperity is priced lower than what may be justified by its financials.

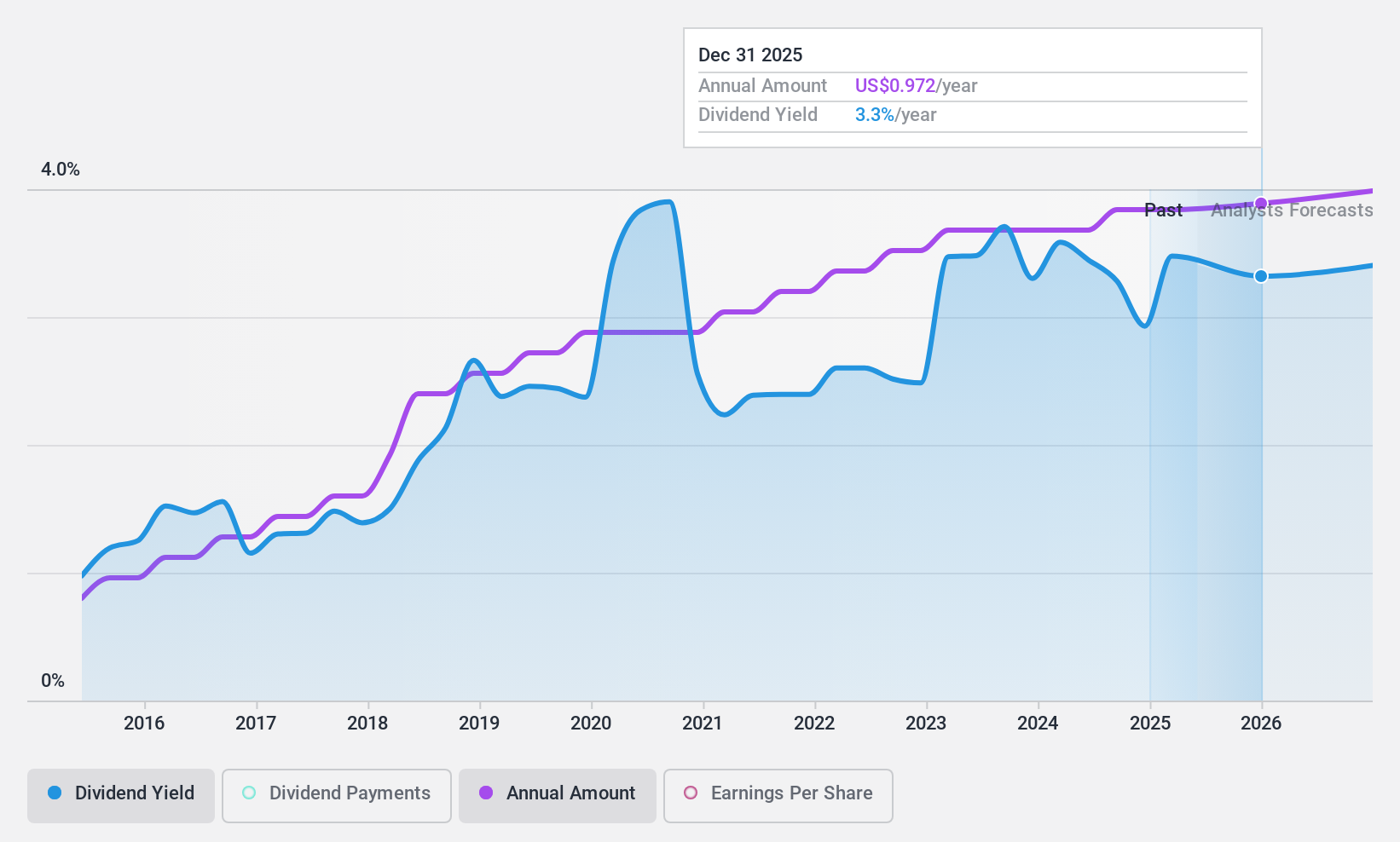

United Community Banks (NYSE:UCB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: United Community Banks, Inc. is a financial holding company for United Community Bank, offering a range of financial products and services across various sectors including commercial, retail, government, education, energy, health care, and real estate; it has a market cap of approximately $3.77 billion.

Operations: United Community Banks, Inc. generates revenue primarily through its Community Banking segment, which accounted for $827.44 million.

Dividend Yield: 3%

United Community Banks offers a stable dividend history with consistent growth over the past decade, supported by a reasonable payout ratio of 60.7%, indicating dividends are well-covered by earnings. Recent affirmations include a US$0.24 per share dividend, reflecting reliability despite its yield of 3.02% being lower than top-tier payers in the U.S. market. Earnings have shown modest growth, with net income slightly down year-over-year but maintaining strong coverage for future dividends forecasted at 39.8%.

- Dive into the specifics of United Community Banks here with our thorough dividend report.

- The valuation report we've compiled suggests that United Community Banks' current price could be inflated.

Turning Ideas Into Actions

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 155 more companies for you to explore.Click here to unveil our expertly curated list of 158 Top US Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSP

Insperity

Engages in the provision of human resources (HR) and business solutions to improve business performance for small and medium-sized businesses primarily in the United States.

Excellent balance sheet, good value and pays a dividend.