- United States

- /

- Retail Distributors

- /

- NasdaqGM:GCT

3 US Growth Stocks With 16% Revenue Growth And High Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market navigates a holiday-shortened week with notable gains in tech stocks like Broadcom and Nvidia, investors are keenly observing growth trends amid fluctuating interest rate forecasts from the Federal Reserve. In this environment, companies that demonstrate robust revenue growth alongside substantial insider ownership can offer unique insights into potential market resilience and investor confidence.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 34.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| CarGurus (NasdaqGS:CARG) | 17.1% | 52.6% |

Let's dive into some prime choices out of the screener.

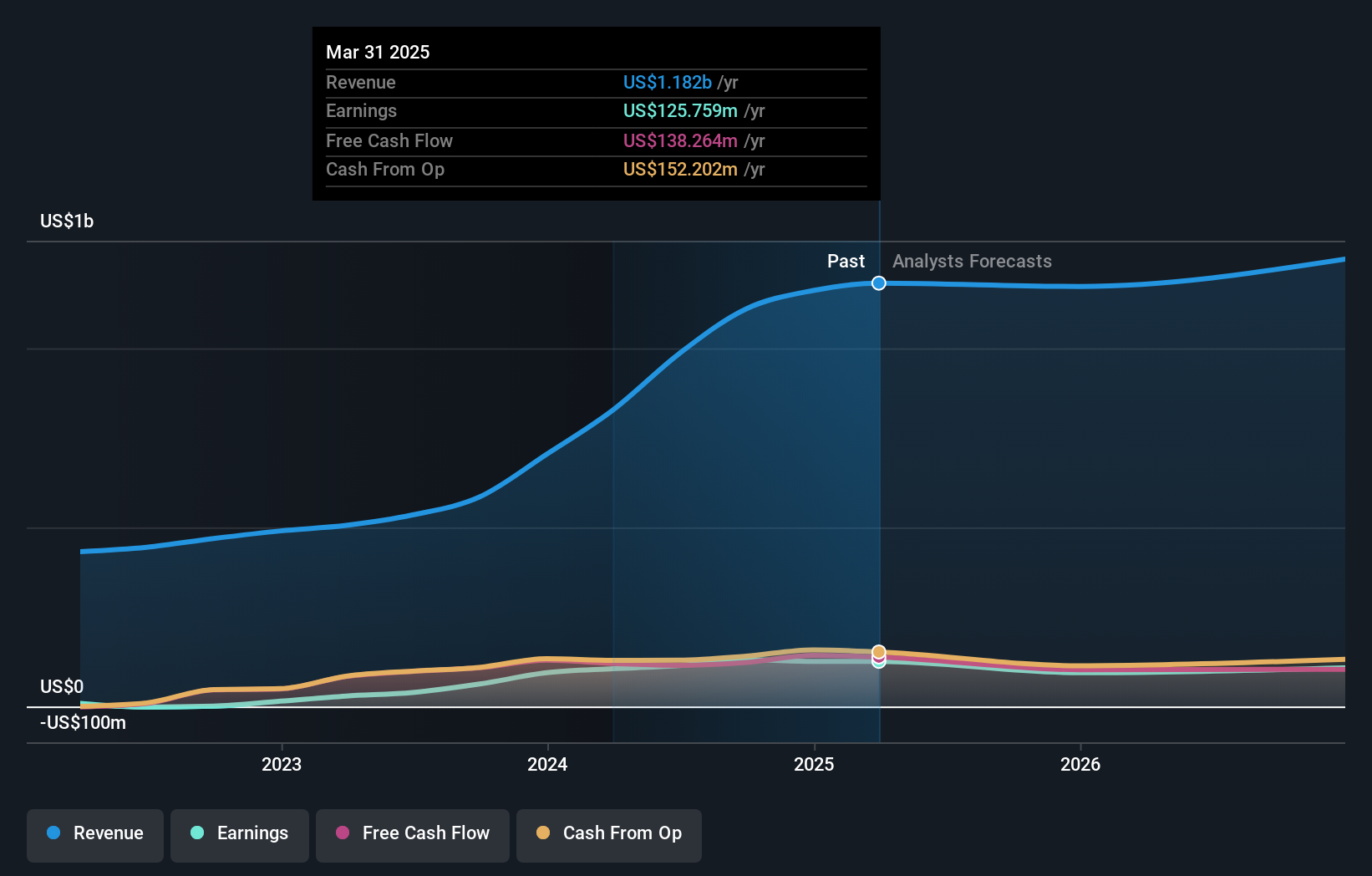

GigaCloud Technology (NasdaqGM:GCT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GigaCloud Technology Inc. offers comprehensive B2B ecommerce solutions for large parcel merchandise both in the United States and internationally, with a market cap of approximately $734.62 million.

Operations: The company's revenue is primarily derived from its online retailers segment, which generated approximately $1.11 billion.

Insider Ownership: 27.9%

Revenue Growth Forecast: 16.5% p.a.

GigaCloud Technology has demonstrated strong growth, with earnings rising by over 100% in the past year and forecasts suggesting continued outperformance against the US market. The company is trading significantly below its estimated fair value, indicating potential undervaluation. Recent board changes include appointing Marshall Bernes, enhancing leadership in their BaaS Program. Despite a volatile share price recently, GigaCloud's consistent revenue growth and strategic buybacks reflect a commitment to shareholder value.

- Unlock comprehensive insights into our analysis of GigaCloud Technology stock in this growth report.

- According our valuation report, there's an indication that GigaCloud Technology's share price might be on the cheaper side.

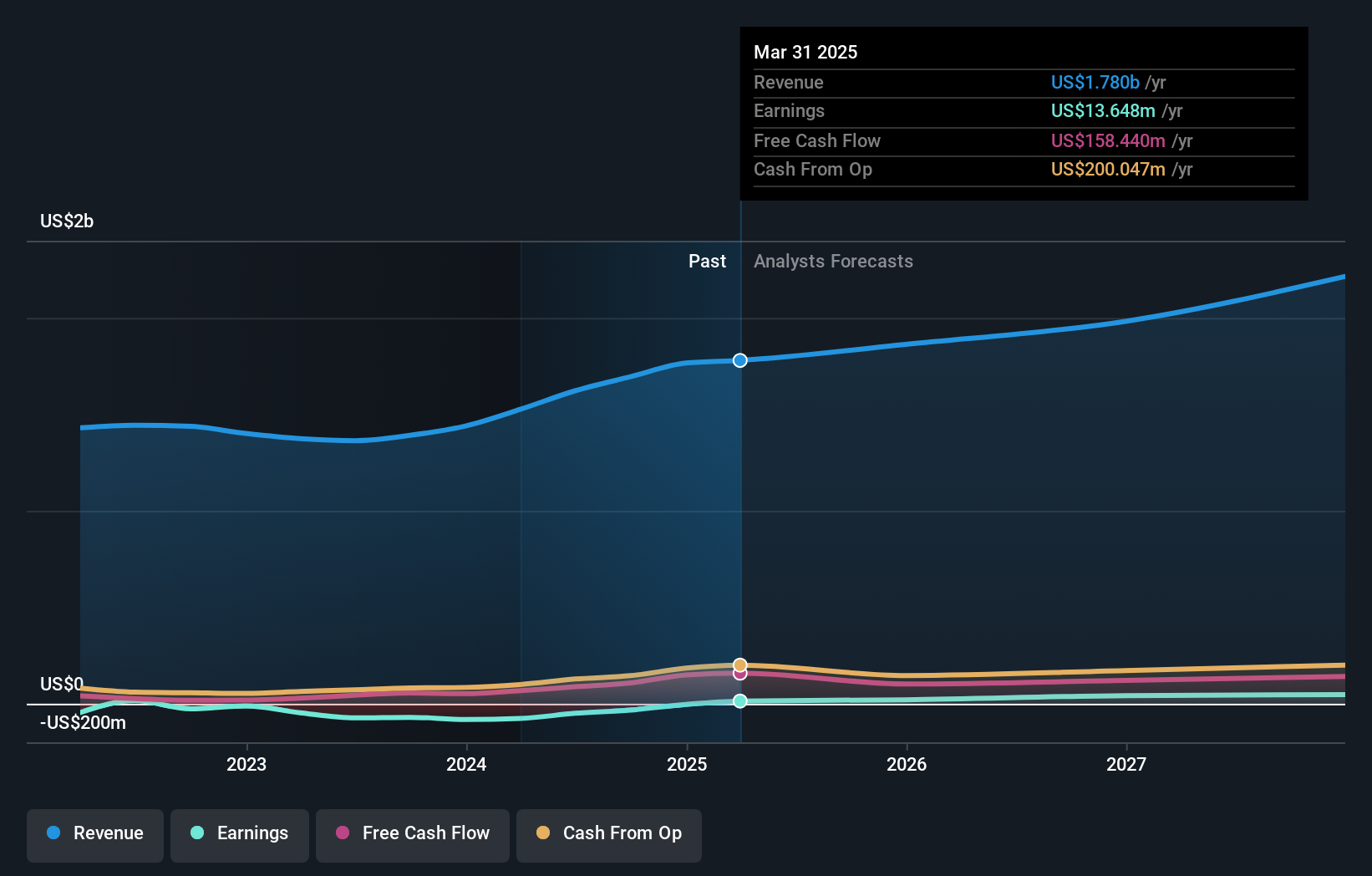

Taboola.com (NasdaqGS:TBLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries, including Israel, the United States, and the United Kingdom, with a market cap of approximately $1.29 billion.

Operations: The company generates revenue primarily from its advertising segment, which amounted to $1.69 billion.

Insider Ownership: 14.1%

Revenue Growth Forecast: 13.2% p.a.

Taboola.com has seen substantial insider buying recently, signaling confidence in its growth potential. The company is trading well below its estimated fair value and is projected to outpace the US market with a 13.2% revenue growth rate annually. Recent strategic partnerships, like those with Future and The Weather Company, highlight its focus on expanding audience engagement and revenue streams. Taboola's innovative AI technology further strengthens its position in digital advertising markets.

- Take a closer look at Taboola.com's potential here in our earnings growth report.

- Our expertly prepared valuation report Taboola.com implies its share price may be lower than expected.

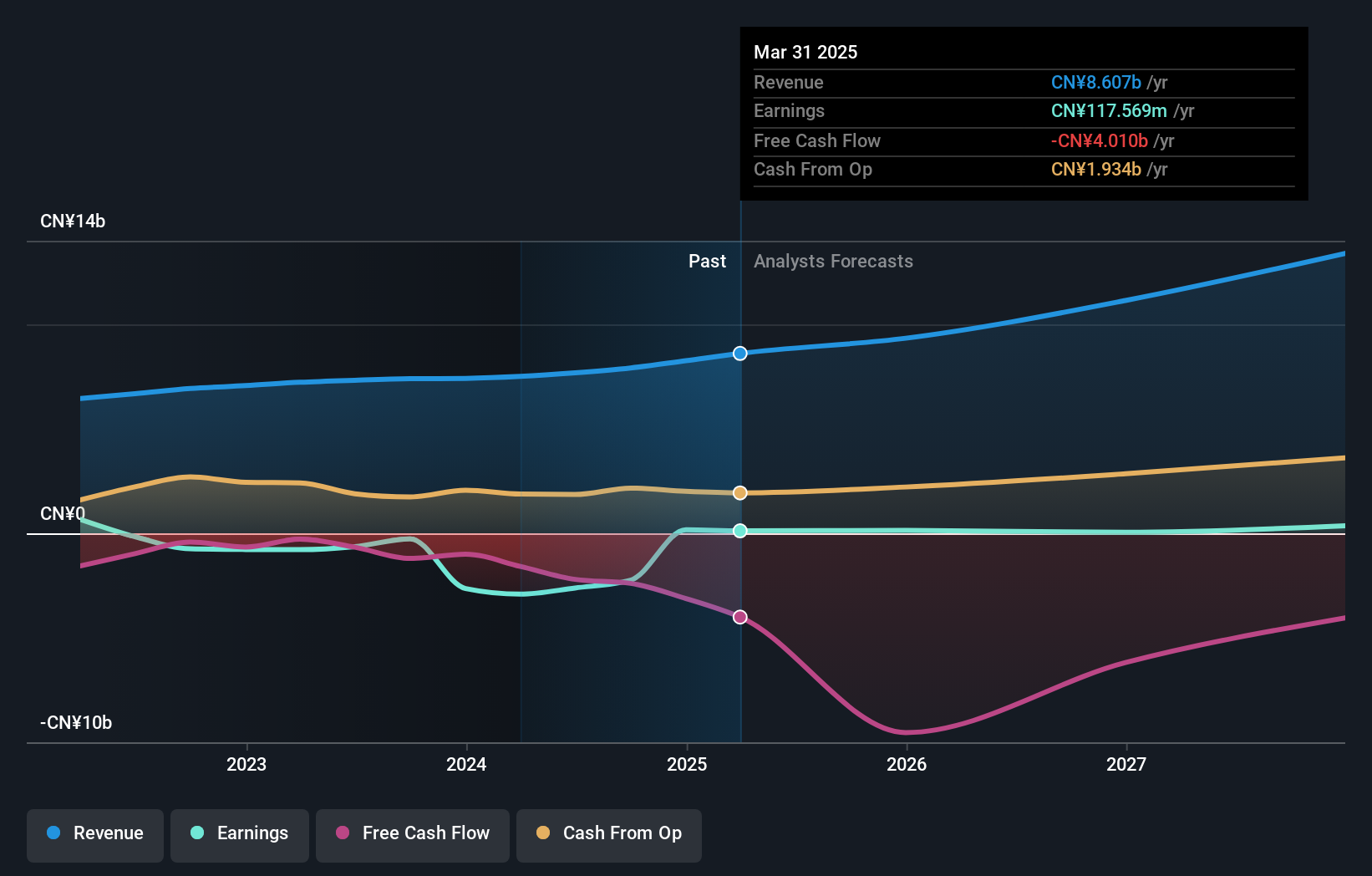

VNET Group (NasdaqGS:VNET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VNET Group, Inc. is an investment holding company that offers hosting and related services in China, with a market cap of approximately $950.40 million.

Operations: The company generates revenue of CN¥7.91 billion from its hosting and related services in China.

Insider Ownership: 10.6%

Revenue Growth Forecast: 10.3% p.a.

VNET Group is trading significantly below its estimated fair value, with revenue growth projected to surpass the US market. Despite past shareholder dilution, recent strategic alliances, such as the partnership with Dajia Investment Holding for data centers in China, bolster its growth outlook. The company reported improved financial performance in Q3 2024 and raised its revenue guidance for the year. However, it faces challenges like high volatility and a low forecasted return on equity.

- Delve into the full analysis future growth report here for a deeper understanding of VNET Group.

- Our comprehensive valuation report raises the possibility that VNET Group is priced lower than what may be justified by its financials.

Make It Happen

- Access the full spectrum of 200 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade GigaCloud Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GCT

GigaCloud Technology

Provides end-to-end B2B ecommerce solutions for large parcel merchandise in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives