- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

3 US Stocks Estimated To Be Undervalued Offering A Value Opportunity

Reviewed by Simply Wall St

As the U.S. stock market experiences a Santa Claus rally with major indices like the Nasdaq Composite and S&P 500 posting gains, investors are keenly observing opportunities that arise from these buoyant conditions. In this environment, identifying undervalued stocks can offer a strategic value opportunity for investors looking to capitalize on potential growth at attractive prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.29 | $53.16 | 48.7% |

| Argan (NYSE:AGX) | $143.57 | $279.09 | 48.6% |

| Western Alliance Bancorporation (NYSE:WAL) | $84.75 | $165.15 | 48.7% |

| Lamb Weston Holdings (NYSE:LW) | $63.69 | $125.18 | 49.1% |

| HealthEquity (NasdaqGS:HQY) | $95.68 | $189.22 | 49.4% |

| LifeMD (NasdaqGM:LFMD) | $4.91 | $9.75 | 49.6% |

| Progress Software (NasdaqGS:PRGS) | $66.26 | $129.49 | 48.8% |

| Freshpet (NasdaqGM:FRPT) | $145.17 | $283.12 | 48.7% |

| WEX (NYSE:WEX) | $171.67 | $332.99 | 48.4% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.45 | $29.97 | 48.4% |

Let's review some notable picks from our screened stocks.

Afya (NasdaqGS:AFYA)

Overview: Afya Limited is a medical education group operating in Brazil with a market capitalization of $1.41 billion.

Operations: The company generates revenue through its Undergrad segment with R$2.78 billion and Continuing Education segment with R$164.55 million, adjusted by a Segment Adjustment of R$244.29 million.

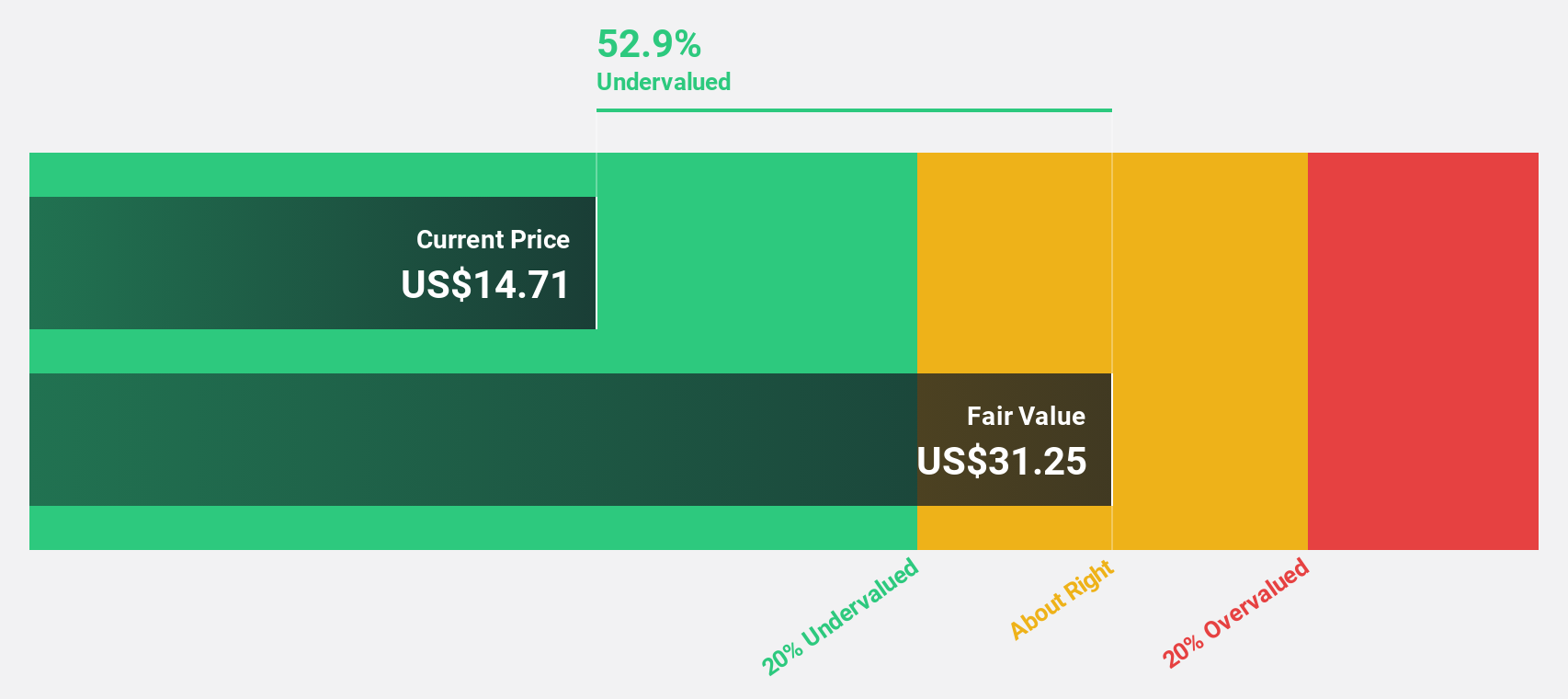

Estimated Discount To Fair Value: 46.7%

Afya is trading at a significant discount to its estimated fair value of US$29.21, currently priced at US$15.57. Its earnings, which grew by 63.3% over the past year, are expected to continue growing significantly at 21.6% annually for the next three years, outpacing the broader US market's growth rate of 15.2%. Recent quarterly results showed increased sales and net income compared to last year, reinforcing its potential as an undervalued stock based on cash flows.

- According our earnings growth report, there's an indication that Afya might be ready to expand.

- Get an in-depth perspective on Afya's balance sheet by reading our health report here.

Impinj (NasdaqGS:PI)

Overview: Impinj, Inc. operates a cloud connectivity platform across various global regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of approximately $4.21 billion.

Operations: The company's revenue primarily comes from the development and sale of its RAIN products and services, amounting to $345.17 million.

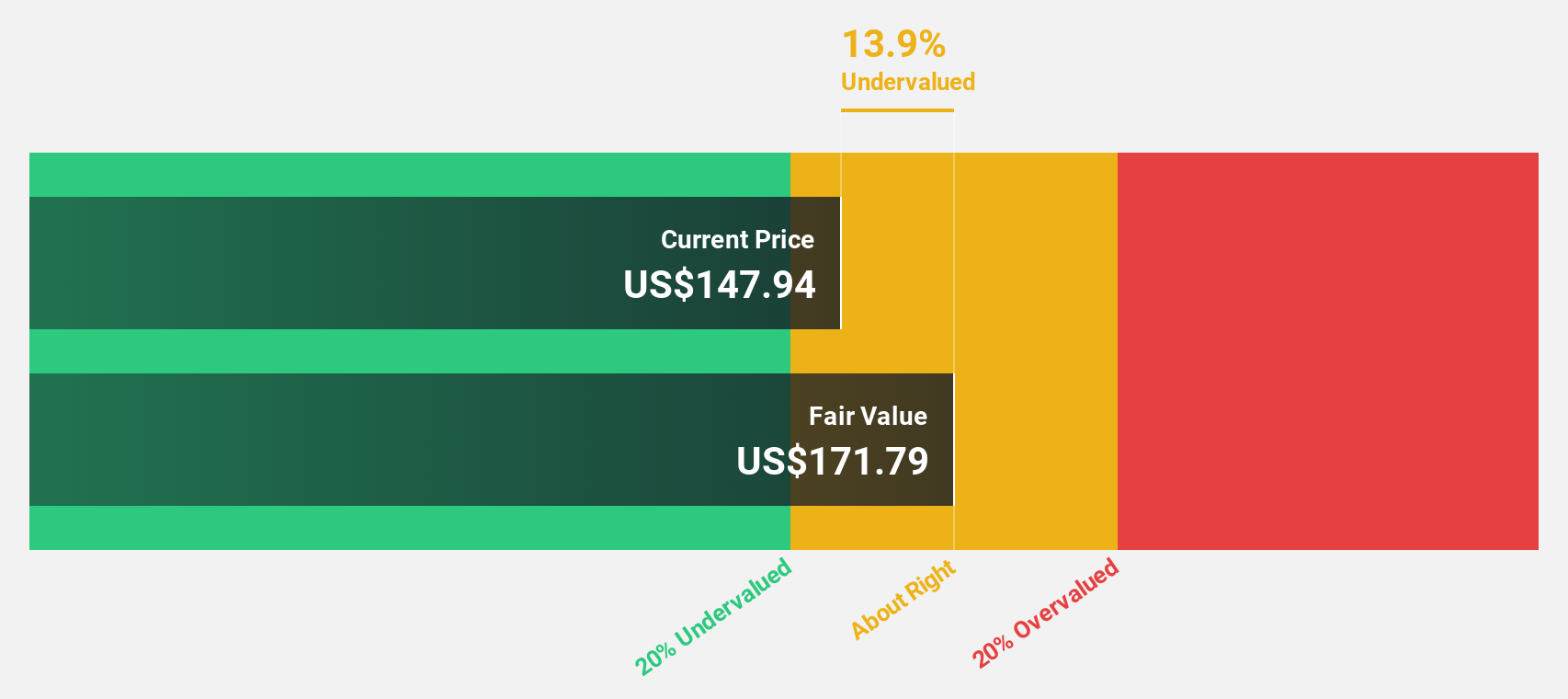

Estimated Discount To Fair Value: 36.4%

Impinj is trading at a substantial discount to its estimated fair value of US$233.88, with a current price of US$148.76. The company has recently turned profitable and forecasts suggest earnings will grow significantly at 24.94% annually, surpassing the broader US market's growth rate. Despite high debt levels and recent shareholder dilution, analysts agree that the stock price could rise by 63.8%, highlighting its potential as an undervalued opportunity based on cash flows.

- The growth report we've compiled suggests that Impinj's future prospects could be on the up.

- Navigate through the intricacies of Impinj with our comprehensive financial health report here.

KBR (NYSE:KBR)

Overview: KBR, Inc. offers scientific, technology, and engineering solutions to governments and commercial customers globally, with a market cap of approximately $7.63 billion.

Operations: The company generates revenue through its Government Solutions segment, which accounts for $5.60 billion, and its Sustainable Technology Solutions segment, contributing $1.75 billion.

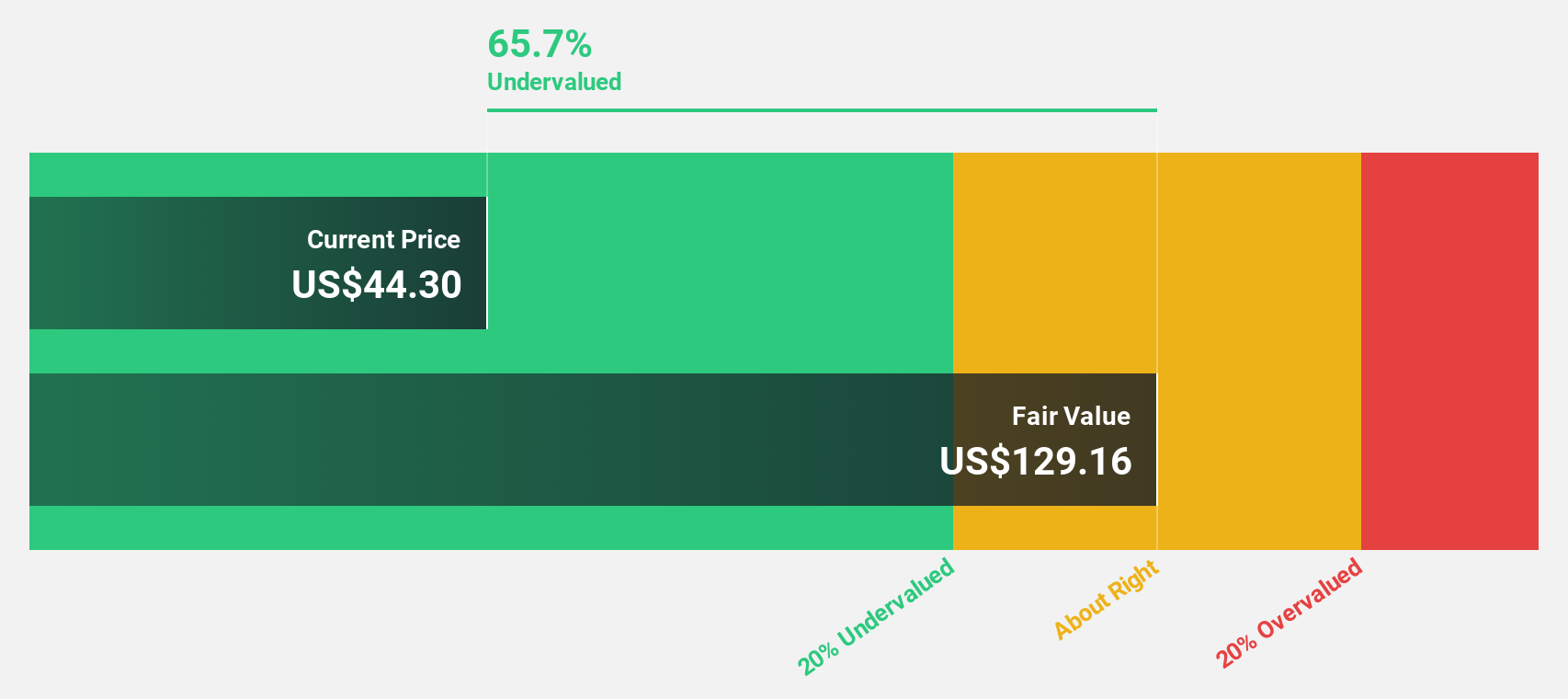

Estimated Discount To Fair Value: 38.2%

KBR is trading at a significant discount to its estimated fair value of US$92.61, with a current price of US$57.23. Expected annual earnings growth of 22.95% surpasses the broader US market's growth rate, although revenue growth forecasts are more modest at 12.7%. Recent profitable performance and strong return on equity projections bolster its undervaluation thesis, despite concerns over debt coverage by operating cash flow and activist investor pressures for strategic restructuring.

- Upon reviewing our latest growth report, KBR's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of KBR stock in this financial health report.

Make It Happen

- Discover the full array of 174 Undervalued US Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives