- United States

- /

- Commercial Services

- /

- NYSE:KAR

Investing in OPENLANE (NYSE:KAR) three years ago would have delivered you a 45% gain

By buying an index fund, you can roughly match the market return with ease. But if you pick the right individual stocks, you could make more than that. For example, OPENLANE, Inc. (NYSE:KAR) shareholders have seen the share price rise 45% over three years, well in excess of the market return (34%, not including dividends).

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for OPENLANE

We don't think that OPENLANE's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last three years OPENLANE has grown its revenue at 12% annually. That's a very respectable growth rate. While the share price has done well, compounding at 13% yearly, over three years, that move doesn't seem over the top. If that's the case, then it could be well worth while to research the growth trajectory. Keep in mind that the strength of the balance sheet impacts the options open to the company.

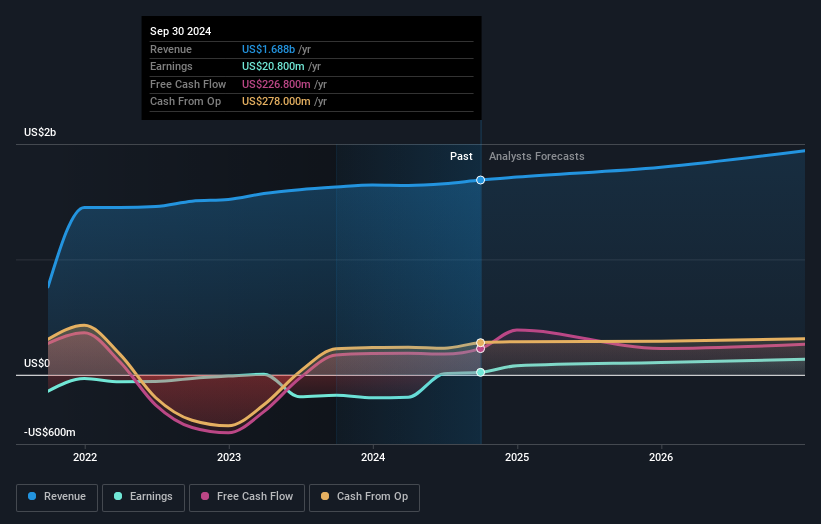

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for OPENLANE in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that OPENLANE shareholders have received a total shareholder return of 41% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.2% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand OPENLANE better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for OPENLANE you should be aware of.

OPENLANE is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KAR

OPENLANE

Operates as a digital marketplace for used vehicles, which connects sellers and buyers in North America, Europe, the Philippines, and Uruguay.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives