- United States

- /

- Professional Services

- /

- NYSE:EFX

Equifax (EFX): Evaluating Valuation as Market Pulse Index Launch Signals Shifts in Consumer Finance and Competition

Reviewed by Kshitija Bhandaru

Equifax recently launched its Market Pulse Index, providing investors with a timely lens on consumer financial health. This development comes as the company faces shifting competition and adapts its mortgage credit scoring products as a result.

See our latest analysis for Equifax.

Despite ongoing product launches and heightened competition, Equifax’s 1-year total shareholder return slipped to -20.24%, reflecting a shift in investor sentiment as the company adapts to pricing pressures and regulatory changes. However, with a 3-year total shareholder return still positive at 46.45%, long-term momentum remains intact even as near-term share price returns have faded.

If you’re interested in expanding your search beyond household names, now is a great moment to discover fast growing stocks with high insider ownership

With shares trading nearly 21% below analyst targets and a substantial 37% intrinsic discount, is Equifax’s recent weakness a sign of undervaluation, or does the current price already reflect future growth?

Most Popular Narrative: 17.3% Undervalued

At $229.64, Equifax's recent closing price stands well below the most widely followed narrative’s fair value estimate of $277.70. With analyst and industry assumptions converging, the discussion around whether shares can catch up fuels investor debate.

Structural expansion of government verification requirements (for example, semiannual redeterminations, added work requirements, improper payment focus) and a rising TAM for eligibility verification services are set to benefit long-term revenue growth and reduce business cyclicality as Equifax's solutions become more critical to federal and state programs.

What is the engine behind this valuation? Analysts are baking in ambitious growth targets, margin upgrades, and a future profit multiple that rivals some of the most highly valued industry names. Want to see what market shifts and quantitative drivers make this fair value possible? Dive in to uncover the full set of game-changing projections behind the narrative.

Result: Fair Value of $277.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent legal costs and heightened regulatory scrutiny could compress Equifax’s margins and lead to unpredictable earnings. This may challenge even the most optimistic forecasts.

Find out about the key risks to this Equifax narrative.

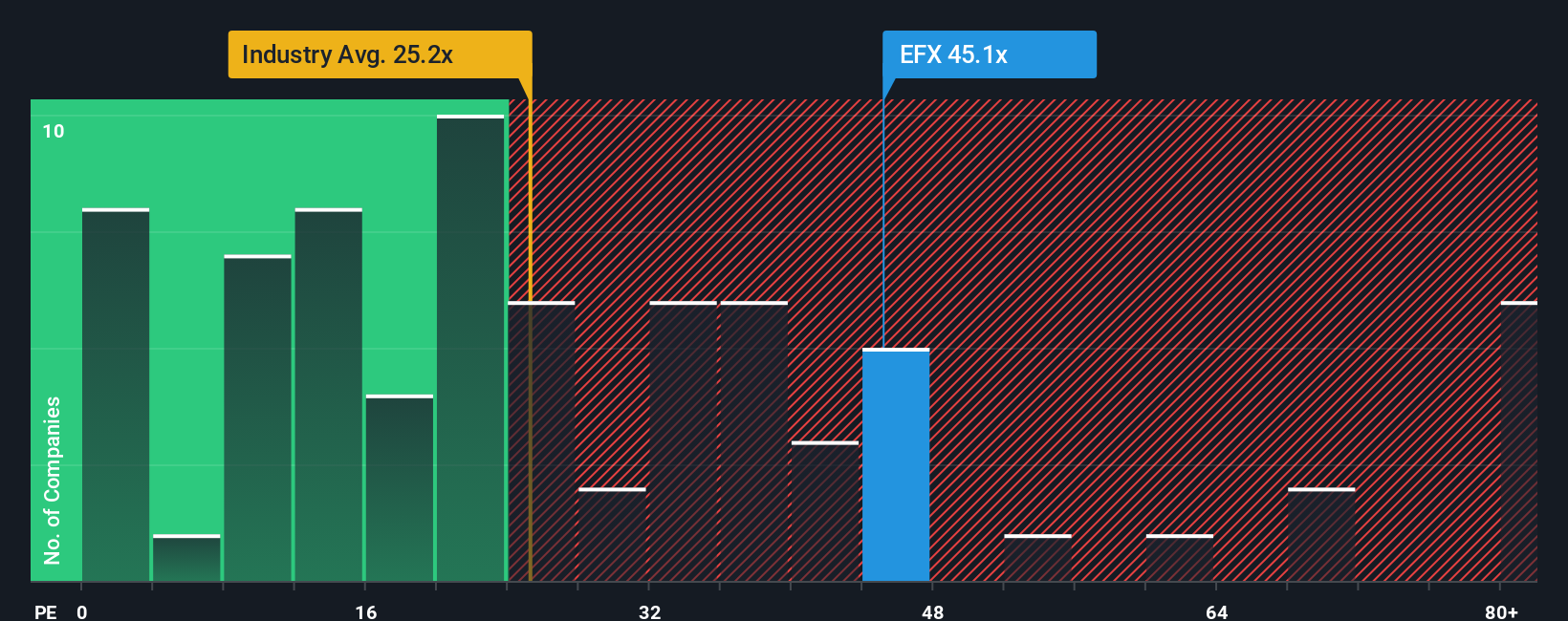

Another View: Multiples Suggest the Stock Is Expensive

Taking a look at the price-to-earnings ratio, Equifax trades at 44.4x, well above both the US Professional Services industry average of 25.7x and its peer average of 35.4x. Even compared to its fair ratio of 34.9x, the market currently prices in a premium, which raises the bar for any upside. Are investors putting too much faith in future growth, or is this premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equifax Narrative

If you have a different perspective or want to dig into the numbers yourself, you can shape your own view in just a few minutes. Do it your way

A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock fresh opportunities that others might overlook by using the right tools. If you're serious about staying ahead, these strategic screeners will give you an actionable edge.

- Capture unmatched yield potential and strengthen your portfolio with these 18 dividend stocks with yields > 3%, offering attractive income and resilient performance.

- Capitalize on promising breakthroughs in AI and get a jump start on tomorrow's leaders with these 24 AI penny stocks, featuring innovators pushing boundaries in intelligent technology.

- Spot companies the market is underestimating and position yourself for value by seizing the chance with these 870 undervalued stocks based on cash flows, which may be trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives