- United States

- /

- Professional Services

- /

- NYSE:EFX

Equifax (EFX) Enhances Kount 360 With Advanced Identity Proofing To Combat Fraud

Reviewed by Simply Wall St

In September 2025, Equifax (EFX) launched its Identity Proofing feature, enhancing its Kount® 360 fraud platform, aimed at bolstering security for clients in sectors like finance and retail. Despite this development, Equifax's stock fell 2.48% over the last month, reflecting somewhat broader market trends which remained largely flat. While the company's fresh product offerings should have positively impacted investor sentiment, ongoing economic uncertainties, such as fluctuating Treasury yields and cautious consumer spending, may have played a counteracting role in EFX's share price performance during this period.

Be aware that Equifax is showing 1 weakness in our investment analysis.

The introduction of Equifax's Identity Proofing feature could bolster the company's long-term prospects by enhancing its Kount® 360 fraud platform, making it more appealing to financial and retail sectors amidst growing security demands. Over the past five years, Equifax achieved a total shareholder return of 48.05%, indicating solid long-term performance, despite a more recent 2.48% decline in its share price over the past month. This recent decline aligns with broader market trends reflecting economic uncertainties such as fluctuating Treasury yields and cautious consumer spending.

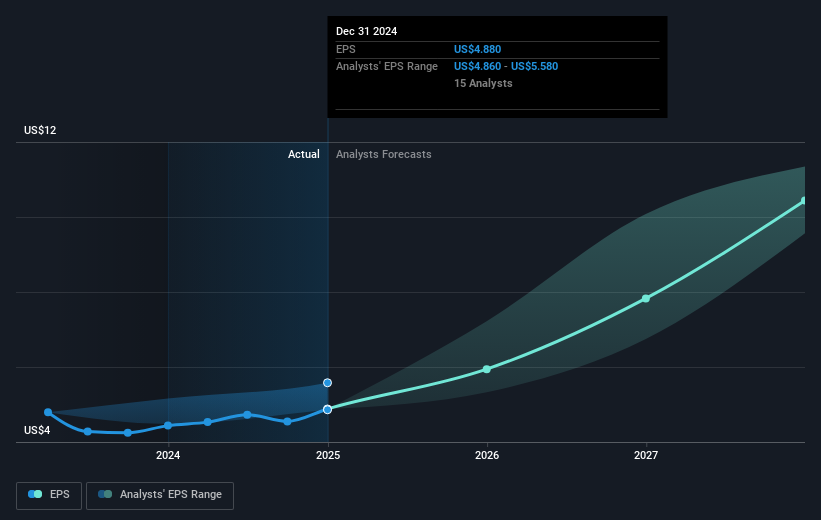

In the shorter term, Equifax's one-year performance shows underperformance against both the U.S. market and the Professional Services industry. Analysts anticipate that the company's new products, coupled with ongoing technology investments and international expansion, could drive future revenue and earnings growth, with revenue expected to increase by 9.9% annually over the next three years.

Currently trading at US$234.03, Equifax's share price remains below the consensus analyst price target of US$280.50, presenting a potential 19.86% upside. However, uncertainty around litigation, regulatory pressures, and competitive challenges may impact the realization of these forecasts. As Equifax seeks to strengthen its market position, the effective execution of its product innovations and strategic initiatives remains pivotal to enhancing investor returns and achieving the anticipated price target.

Understand Equifax's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives