- United States

- /

- Professional Services

- /

- NasdaqGS:VRSK

Verisk Analytics (VRSK) Valuation After Q3 Revenue Miss, Outlook Cut and Expanded KYND Cyber Partnership

Reviewed by Simply Wall St

Verisk Analytics (VRSK) is back in focus after missing third quarter revenue expectations and cutting its full year outlook, even as it doubled down on cyber risk capabilities through an expanded KYND partnership.

See our latest analysis for Verisk Analytics.

Those mixed signals have left Verisk’s share price at $218.23, with a sharply negative year to date share price return alongside a weak one year total shareholder return. Even though the three year total shareholder return remains solid, suggesting long term faith is intact, near term momentum has clearly faded.

If this kind of reset in expectations has you rethinking where growth and pricing power might be stronger, it could be a good moment to explore fast growing stocks with high insider ownership.

With the shares now trading about 18 percent below some intrinsic estimates and roughly 15 percent under the average analyst price target, are investors being offered mispriced compounding potential, or is the market accurately discounting Verisk’s future growth?

Most Popular Narrative: 13.2% Undervalued

Against Verisk Analytics’ last close of $218.23, the most followed narrative sees fair value materially higher, pointing to mispriced compounding rather than a value trap.

The company is committed to maintaining disciplined cost management, resulting in margin expansion and profit growth. The focus on efficiency could lead to improved net margins and increased earnings, supporting shareholder value through higher EBITDA margins.

Curious how steady but unspectacular growth, rising margins and a premium future earnings multiple can still add up to upside from here? The full narrative unpacks the specific revenue trajectory, profit expansion path and valuation math behind that higher fair value, and shows exactly which long range assumptions make the discount rate and target price hang together.

Result: Fair Value of $251.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on Verisk navigating slower organic growth and achieving successful AccuLynx integration, with AI driven investments translating into clear, profitable revenue streams.

Find out about the key risks to this Verisk Analytics narrative.

Another Angle on Valuation

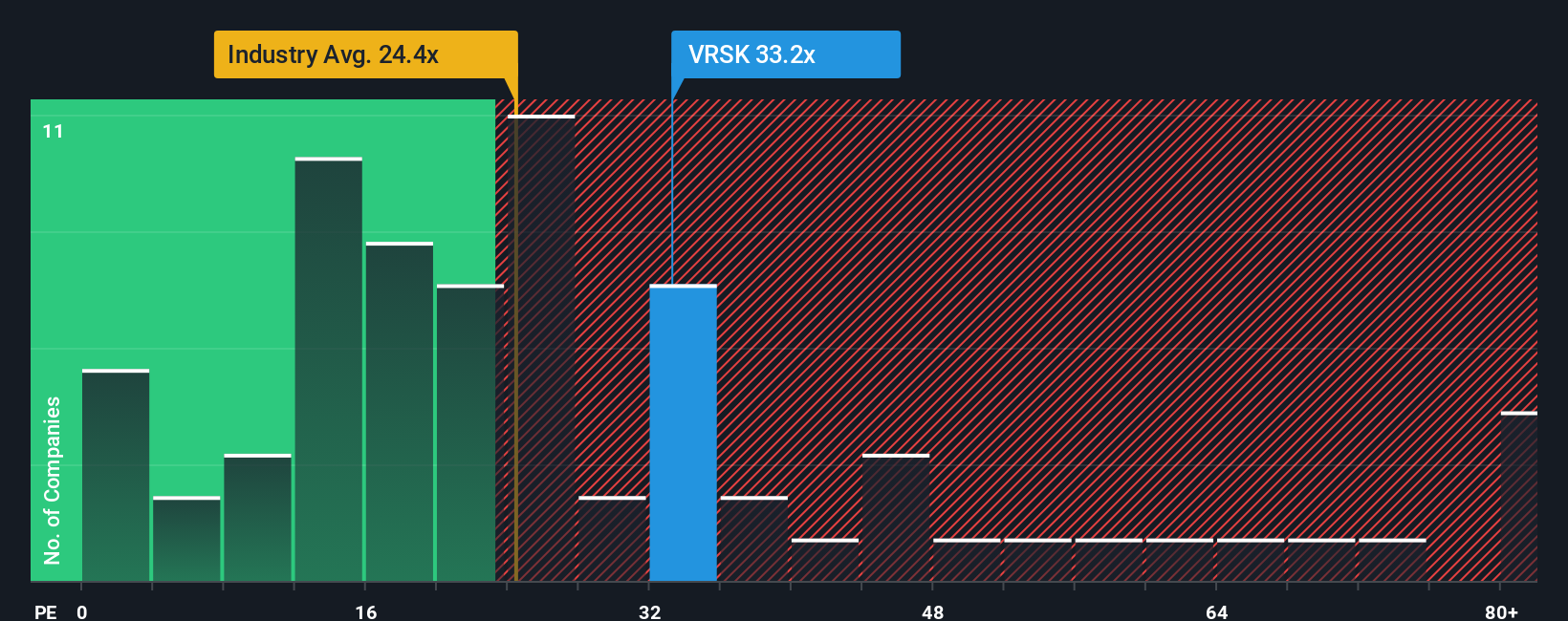

Looking at earnings multiples, Verisk trades on a price to earnings ratio of about 33 times, above its fair ratio of roughly 29 times and well ahead of the US Professional Services average near 25 times. That premium hints at execution risk if growth does not re accelerate as hoped.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verisk Analytics Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Verisk Analytics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one opportunity when the Simply Wall St Screener can surface more high conviction ideas tailored to your strategy and risk appetite.

- Capture early stage potential by reviewing these 3625 penny stocks with strong financials that already show surprisingly robust balance sheets and fundamentals.

- Position yourself at the heart of technological change with these 26 AI penny stocks that are harnessing artificial intelligence for scalable, real world revenue.

- Lock in stronger income streams by focusing on these 13 dividend stocks with yields > 3% that combine meaningful yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSK

Verisk Analytics

Engages in the provision of data analytics and technology solutions to the insurance industry in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)