- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

3 US Exchange Stocks That May Be Trading At A Discount

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations, with major indexes giving up early gains and closing lower amid concerns about the economy and technology sector performance, investors are on the lookout for opportunities that may be trading at a discount. Identifying undervalued stocks can be particularly advantageous during such volatile times, as these stocks have the potential to offer value despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Eastern Bankshares (NasdaqGS:EBC) | $14.81 | $29.12 | 49.1% |

| Avidbank Holdings (OTCPK:AVBH) | $18.75 | $37.03 | 49.4% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $59.04 | $117.67 | 49.8% |

| Montauk Renewables (NasdaqCM:MNTK) | $5.23 | $10.40 | 49.7% |

| American Healthcare REIT (NYSE:AHR) | $16.43 | $32.66 | 49.7% |

| Palantir Technologies (NYSE:PLTR) | $26.32 | $52.47 | 49.8% |

| USCB Financial Holdings (NasdaqGM:USCB) | $14.27 | $28.37 | 49.7% |

| Zscaler (NasdaqGS:ZS) | $166.20 | $328.95 | 49.5% |

| American Superconductor (NasdaqGS:AMSC) | $18.71 | $36.90 | 49.3% |

| Bowhead Specialty Holdings (NYSE:BOW) | $27.11 | $54.03 | 49.8% |

Let's review some notable picks from our screened stocks.

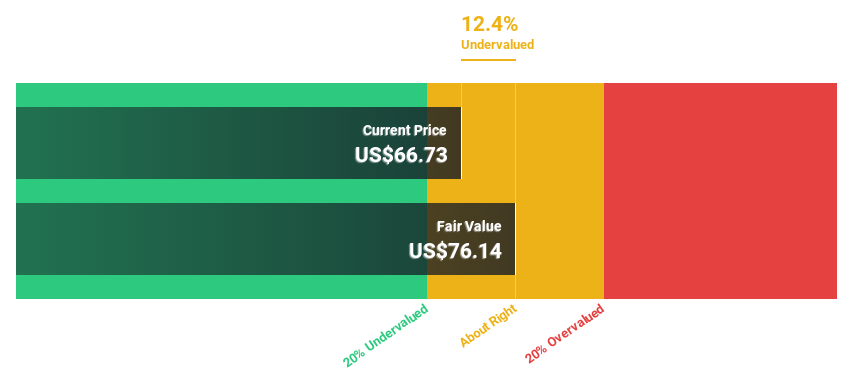

ExlService Holdings (NasdaqGS:EXLS)

Overview: ExlService Holdings, Inc. operates as a data analytics and digital operations solutions company in the United States and internationally, with a market cap of $5.49 billion.

Operations: The company's revenue segments include Analytics ($749.61 million), Insurance ($569.90 million), Healthcare ($106.48 million), and Emerging Business ($283.91 million).

Estimated Discount To Fair Value: 41.9%

ExlService Holdings is trading at US$34.04, significantly below its estimated fair value of US$58.61, indicating it may be undervalued based on cash flows. Earnings have grown 23.9% annually over the past five years and are forecast to grow 15.97% per year, outpacing the US market's growth rate of 14.9%. Recent initiatives include deploying AI applications in collaboration with NVIDIA, enhancing operational efficiencies and client-specific solutions across various industries.

- Our growth report here indicates ExlService Holdings may be poised for an improving outlook.

- Dive into the specifics of ExlService Holdings here with our thorough financial health report.

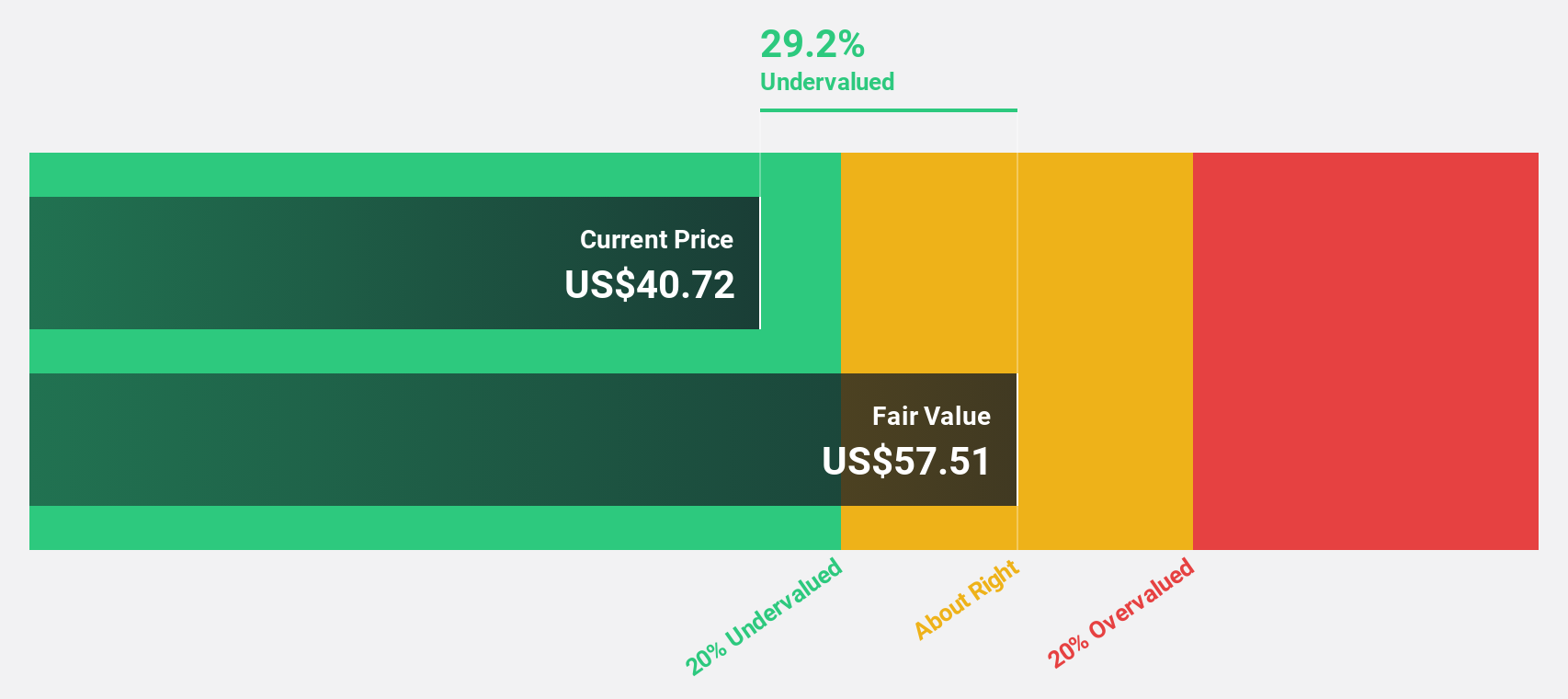

Palomar Holdings (NasdaqGS:PLMR)

Overview: Palomar Holdings, Inc., a specialty insurance company with a market cap of $2.33 billion, provides property and casualty insurance to residential and business customers in the United States.

Operations: Palomar Holdings generates revenue primarily through its Earthquake, Wind, and Flood Insurance Products, totaling $445.93 million.

Estimated Discount To Fair Value: 42.7%

Palomar Holdings appears undervalued, trading at US$94.94, which is 42.7% below its estimated fair value of US$165.67 based on discounted cash flow analysis. Recent earnings reports show strong performance with Q2 revenue rising to US$131.07 million and net income increasing to US$25.73 million year-over-year. Forecasts predict annual profit growth of 21.1%, outpacing the broader U.S market's growth rate of 14.9%, suggesting robust future prospects despite recent insider selling activity.

- Our earnings growth report unveils the potential for significant increases in Palomar Holdings' future results.

- Click here to discover the nuances of Palomar Holdings with our detailed financial health report.

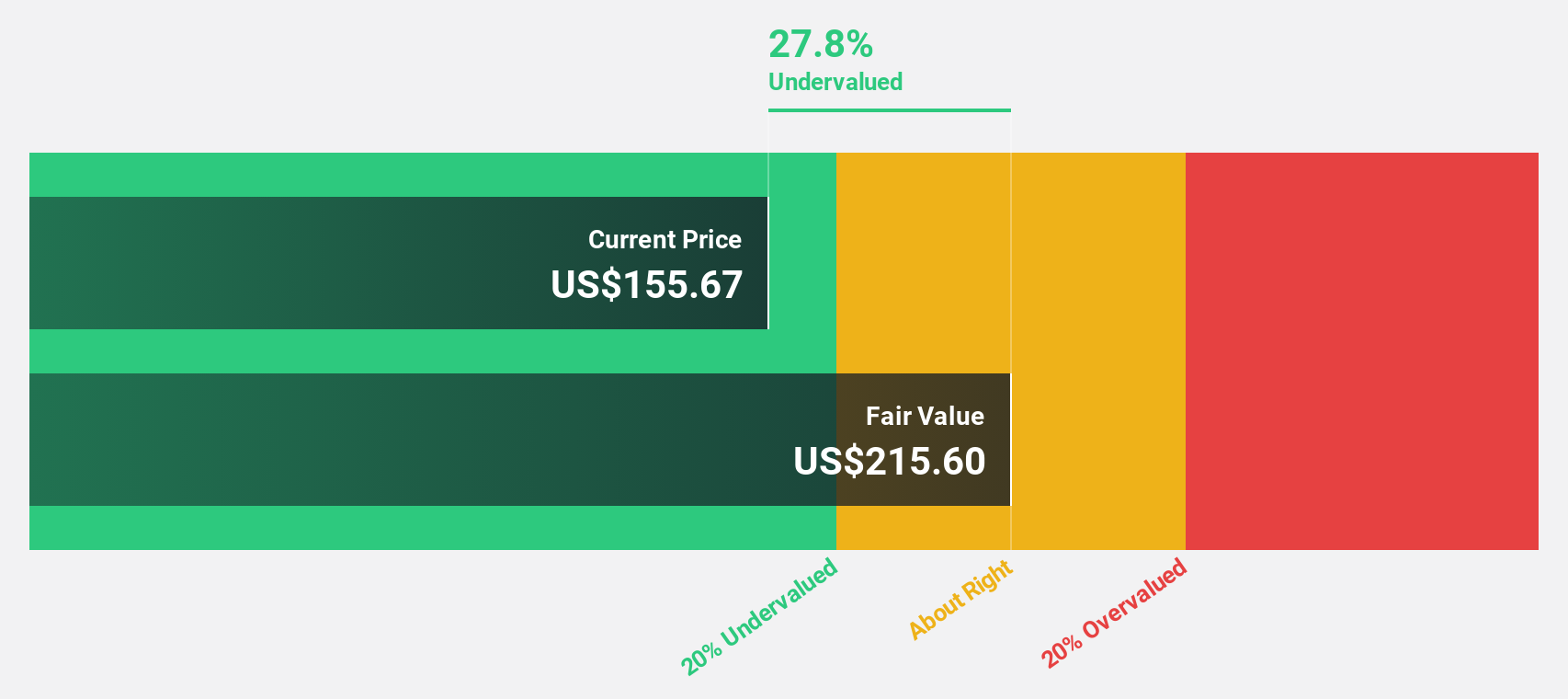

Shopify (NYSE:SHOP)

Overview: Shopify Inc. is a global commerce company that offers a platform and services for businesses across various regions including North America, Europe, the Middle East, Africa, Asia Pacific, Australia, China, and Latin America with a market cap of $69.93 billion.

Operations: Shopify generates its revenue primarily from its Internet Software & Services segment, which brought in $7.41 billion.

Estimated Discount To Fair Value: 23.1%

Shopify, trading at US$63.89, is undervalued based on a discounted cash flow analysis with an estimated fair value of US$83.07. Recent earnings show significant improvement, with Q2 revenue rising to US$2.05 billion and net income reaching US$171 million compared to a loss last year. Analysts forecast annual profit growth of 47.61% and revenue growth of 16.9% per year, outpacing the broader U.S market's growth rate of 8.5%.

- Insights from our recent growth report point to a promising forecast for Shopify's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Shopify.

Taking Advantage

- Dive into all 162 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Excellent balance sheet with reasonable growth potential.