- United States

- /

- Communications

- /

- NasdaqGM:OCC

3 US Penny Stocks With Market Caps Under $300M

Reviewed by Simply Wall St

As the U.S. stock market experiences a Santa Claus Rally, with major indices like the Nasdaq Composite and S&P 500 posting gains, investors are turning their attention to various opportunities within the market. Penny stocks, despite being an older term, remain relevant for those seeking affordable entry points into potentially high-growth companies. These smaller or newer firms can offer unique growth potential when supported by robust financials, making them intriguing options for investors looking beyond traditional blue-chip stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $99.16M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.21 | $1.91B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.8849 | $6.46M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.95 | $227.01M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $7.76M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.36 | $45.54M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.74 | $142.05M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.26 | $17.19M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.80 | $70.15M | ★★★★★☆ |

Click here to see the full list of 742 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Optical Cable (NasdaqGM:OCC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Optical Cable Corporation manufactures and sells fiber optic and copper data communications cabling and connectivity solutions for the enterprise market both in the United States and internationally, with a market cap of $27.29 million.

Operations: Optical Cable Corporation does not report specific revenue segments.

Market Cap: $27.29M

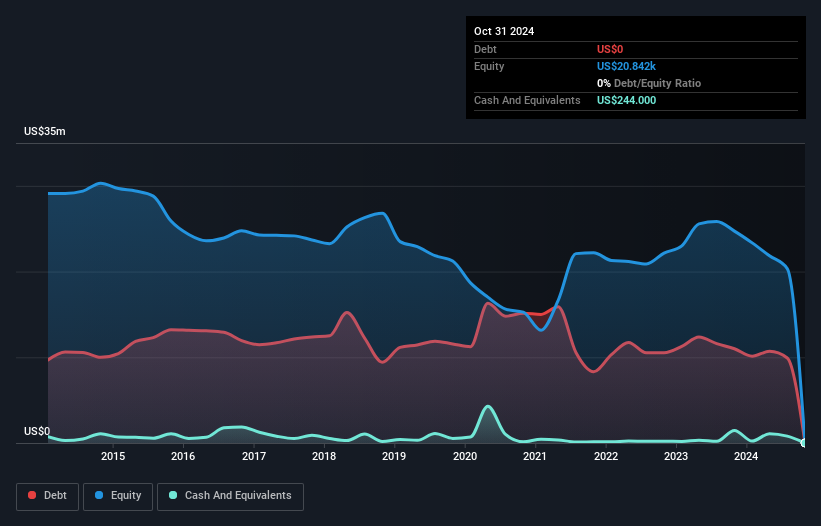

Optical Cable Corporation, with a market cap of US$27.29 million, has shown improvement in its financial performance recently. The company reported fourth-quarter sales of US$19.49 million, up from US$17.33 million the previous year, and achieved a net income of US$0.373 million compared to a net loss previously. Despite being unprofitable historically, it has no debt and more than three years of cash runway at current free cash flow levels. However, shareholder dilution has occurred over the past year and its share price remains highly volatile with negative return on equity at -20.2%.

- Click here to discover the nuances of Optical Cable with our detailed analytical financial health report.

- Evaluate Optical Cable's historical performance by accessing our past performance report.

Zentalis Pharmaceuticals (NasdaqGM:ZNTL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zentalis Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company dedicated to discovering and developing small molecule therapeutics for cancer treatment, with a market cap of $213.80 million.

Operations: Zentalis Pharmaceuticals, Inc. currently does not report any revenue segments.

Market Cap: $213.8M

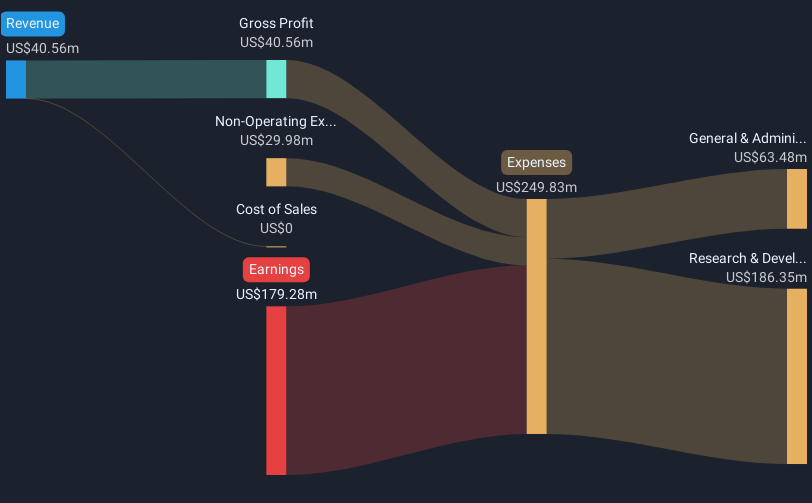

Zentalis Pharmaceuticals, Inc., with a market cap of US$213.80 million, is a pre-revenue biopharmaceutical company focused on cancer therapeutics. Despite its unprofitability and recent removal from the NASDAQ Biotechnology Index, Zentalis maintains financial stability with short-term assets of US$400.3 million exceeding both short- and long-term liabilities. The company is debt-free and has not experienced significant shareholder dilution recently. However, it faces challenges such as high share price volatility and negative return on equity (-50.61%). Leadership changes include appointing Julie Eastland as CEO to navigate upcoming registrational studies for its lead product candidate.

- Jump into the full analysis health report here for a deeper understanding of Zentalis Pharmaceuticals.

- Gain insights into Zentalis Pharmaceuticals' outlook and expected performance with our report on the company's earnings estimates.

Xtant Medical Holdings (NYSEAM:XTNT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xtant Medical Holdings, Inc. offers regenerative medicine products and medical devices for orthopedic and neurological surgeons, with a market cap of $50.04 million.

Operations: The company generates revenue of $113.86 million from the development, manufacture, and marketing of orthopedic medical products and devices.

Market Cap: $50.04M

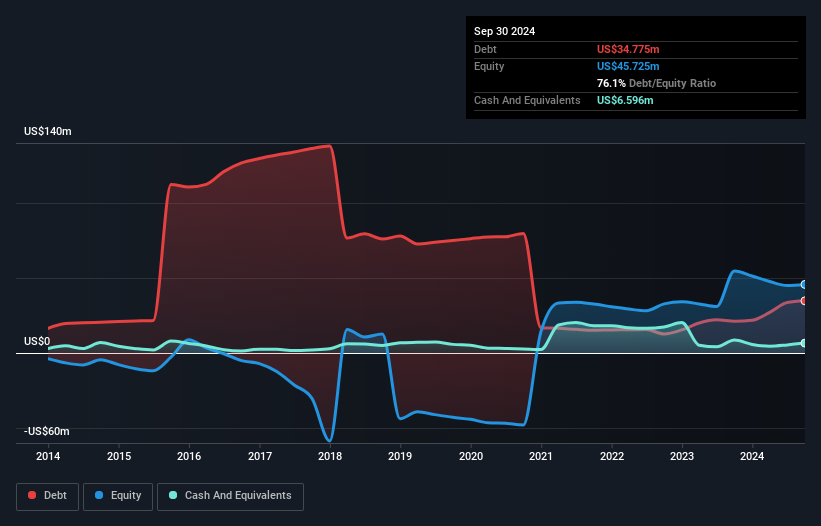

Xtant Medical Holdings, Inc., with a market cap of US$50.04 million, reported Q3 2024 sales of US$27.94 million but faced a net loss of US$5.02 million, contrasting with last year's profit. Despite revenue growth and reaffirmed guidance for 2024 between US$116 million to US$120 million, the company remains unprofitable with negative return on equity (-38.46%). While its short-term assets cover liabilities and shareholder equity has improved from five years ago, high net debt to equity (61.6%) and recent shareholder dilution pose concerns. The management team is experienced, though financial stability relies on reducing free cash flow deficits.

- Navigate through the intricacies of Xtant Medical Holdings with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Xtant Medical Holdings' future.

Make It Happen

- Get an in-depth perspective on all 742 US Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCC

Optical Cable

Manufactures and sells fiber optic and copper data communications cabling and connectivity solutions primarily for the enterprise market in the United States and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives