- United States

- /

- Banks

- /

- NasdaqGS:CCB

3 US Growth Companies With High Insider Ownership Growing Earnings At 46%

Reviewed by Simply Wall St

As the U.S. stock market experiences a pullback from record highs, with technology stocks showing mixed performance, investors are closely monitoring economic indicators that could influence future Federal Reserve interest rate decisions. In such an environment, growth companies with high insider ownership and strong earnings growth can offer compelling opportunities for those seeking to navigate market fluctuations effectively.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.7% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.6% | 65.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| MoneyLion (NYSE:ML) | 18.9% | 89.9% |

Here's a peek at a few of the choices from the screener.

Coastal Financial (NasdaqGS:CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation, with a market cap of $1.01 billion, operates as the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Operations: The company's revenue is derived from three main segments: CCBX ($192.73 million), Community Bank ($78.94 million), and Treasury & Administration ($12.45 million).

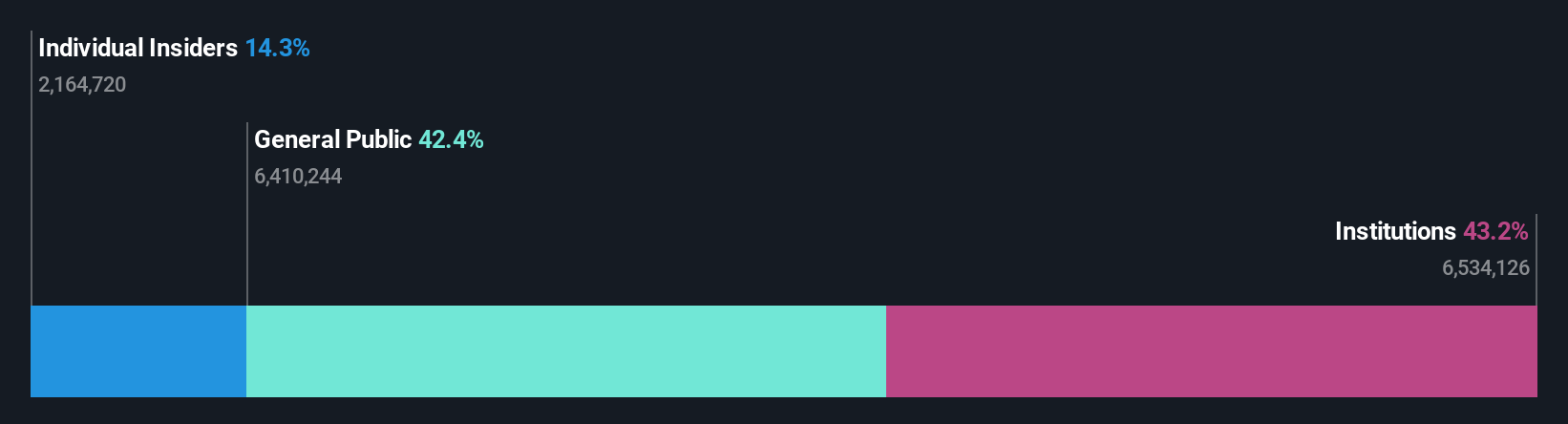

Insider Ownership: 17.8%

Earnings Growth Forecast: 46.5% p.a.

Coastal Financial, trading significantly below its fair value, shows promising growth potential with earnings and revenue forecasted to grow substantially faster than the US market. Despite recent insider selling, more shares have been bought than sold over three months. The company recently completed an $85.2 million equity offering and reported strong Q3 earnings growth. Leadership changes include appointing Brian Hamilton as president of the CCBX division, enhancing its FinTech capabilities.

- Click here and access our complete growth analysis report to understand the dynamics of Coastal Financial.

- In light of our recent valuation report, it seems possible that Coastal Financial is trading beyond its estimated value.

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions across various regions, including the United States, Europe, and Asia Pacific, with a market cap of approximately $994.66 million.

Operations: The company's revenue primarily comes from its online financial information providers segment, generating $241.08 million.

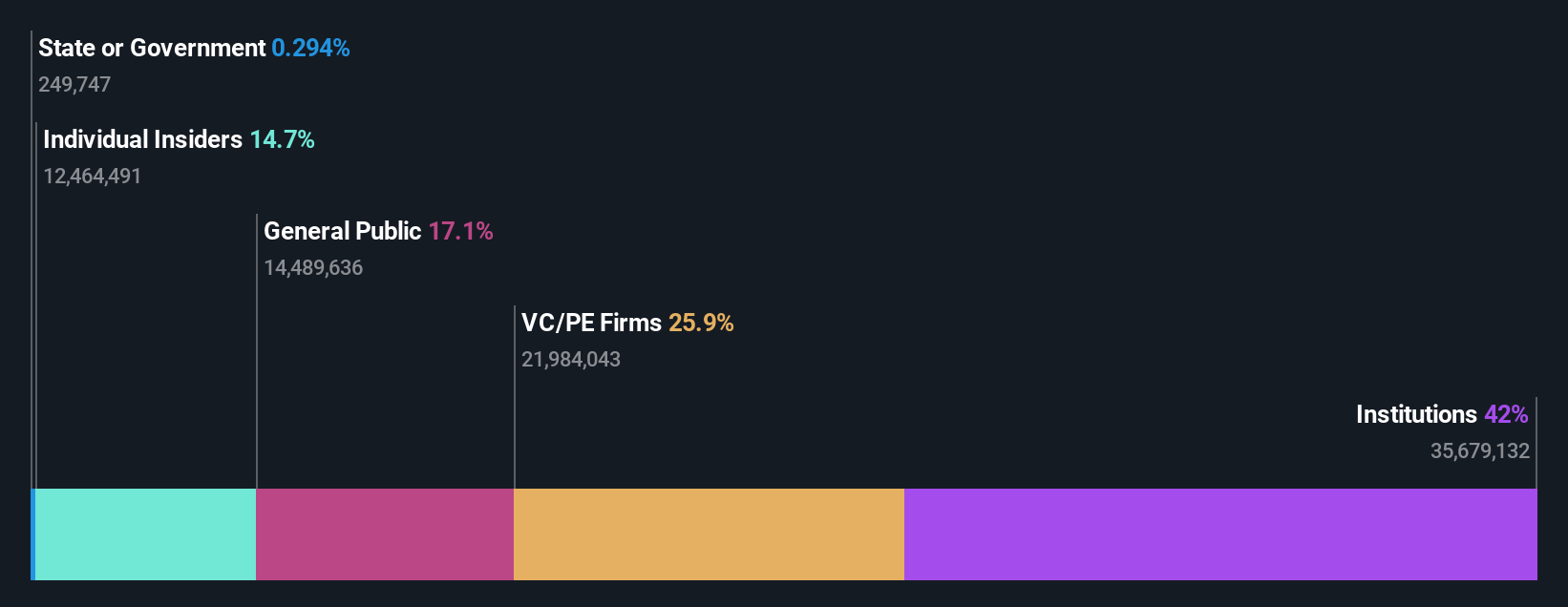

Insider Ownership: 25.4%

Earnings Growth Forecast: 126.3% p.a.

Similarweb, trading below its estimated fair value, has demonstrated revenue growth with third-quarter sales reaching US$64.71 million, up from US$54.83 million a year ago. Despite past shareholder dilution and no recent insider trading activity, the company forecasts becoming profitable in three years with high return on equity expectations. Recent earnings guidance suggests continued growth, supported by a recent US$27.48 million follow-on equity offering to bolster financial flexibility amidst ongoing expansion efforts.

- Unlock comprehensive insights into our analysis of Similarweb stock in this growth report.

- Our valuation report unveils the possibility Similarweb's shares may be trading at a discount.

Tutor Perini (NYSE:TPC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tutor Perini Corporation is a construction company offering general contracting, construction management, and design-build services to private and public clients both in the United States and internationally, with a market cap of approximately $1.38 billion.

Operations: The company's revenue segments include $615.19 million from Specialty Contractors, $2.14 billion from Civil (Including Management Services), and $1.70 billion from Building (Including Management Services).

Insider Ownership: 16.3%

Earnings Growth Forecast: 120.5% p.a.

Tutor Perini, trading at a significant discount to its estimated fair value, is poised for above-market revenue growth with annual expectations of 13%. The company has recently secured major contracts, including a US$1.18 billion project in New Jersey and a US$1.66 billion contract in Honolulu, boosting its backlog significantly. Despite recent net losses, Tutor Perini is actively deleveraging by paying down US$150 million of debt and anticipates profitability within three years.

- Click to explore a detailed breakdown of our findings in Tutor Perini's earnings growth report.

- Our comprehensive valuation report raises the possibility that Tutor Perini is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Gain an insight into the universe of 201 Fast Growing US Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCB

Coastal Financial

Operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Flawless balance sheet with high growth potential.