- United States

- /

- IT

- /

- NasdaqGS:BCOV

Discovering GigaMedia And 2 More US Penny Stock Opportunities

Reviewed by Simply Wall St

As the U.S. stock market faces heightened volatility, with major indices like the Dow Jones and S&P 500 experiencing declines amid concerns over interest rates and economic resilience, investors are seeking opportunities in less conventional areas. Penny stocks, while often considered a relic of past market eras, continue to offer intriguing possibilities for those looking at smaller or newer companies that may provide growth potential at lower price points. By focusing on financial strength and solid fundamentals, these stocks can present viable opportunities without many of the traditional risks associated with this segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81 | $5.88M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.25 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $102.23M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.7257 | $11.18M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.32 | $11.77M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.49 | $43.2M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.37 | $24.3M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.97 | $87.24M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.45 | $368.38M | ★★★★☆☆ |

Click here to see the full list of 728 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

GigaMedia (NasdaqCM:GIGM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GigaMedia Limited, with a market cap of $18.24 million, operates in Taiwan, Hong Kong, and Macau offering digital entertainment services through its subsidiaries.

Operations: The company generates revenue of $3.09 million from its digital entertainment business.

Market Cap: $18.24M

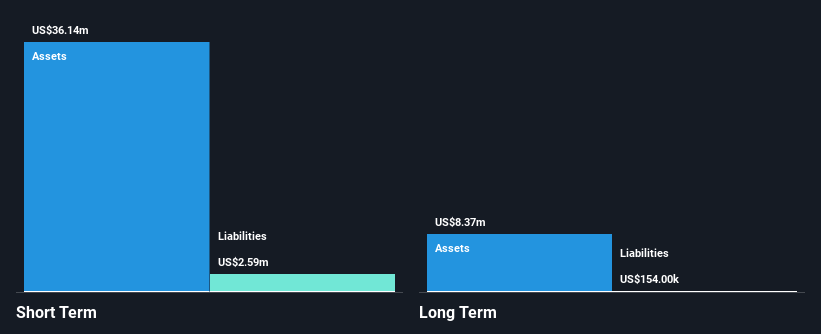

GigaMedia Limited, with a market cap of US$18.24 million, operates in the digital entertainment sector but remains unprofitable with declining earnings over the past five years at a rate of 15.8% annually. The company reported revenue of US$2.21 million for the first nine months of 2024, down from US$3.42 million the previous year, alongside increasing net losses. Despite having no debt and short-term assets exceeding liabilities, its negative return on equity and lack of meaningful revenue highlight financial challenges. Recent shelf registration filings indicate potential capital-raising activities through employee stock ownership plans (ESOPs).

- Click to explore a detailed breakdown of our findings in GigaMedia's financial health report.

- Evaluate GigaMedia's historical performance by accessing our past performance report.

MoneyHero (NasdaqGM:MNY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MoneyHero Limited operates as a personal finance company with a market cap of $47.36 million.

Operations: The company's revenue segments include contributions from Hong Kong ($31.45 million), Singapore ($37.94 million), Taiwan ($5.81 million), the Philippines ($14.75 million), and Malaysia ($0.24 million).

Market Cap: $47.36M

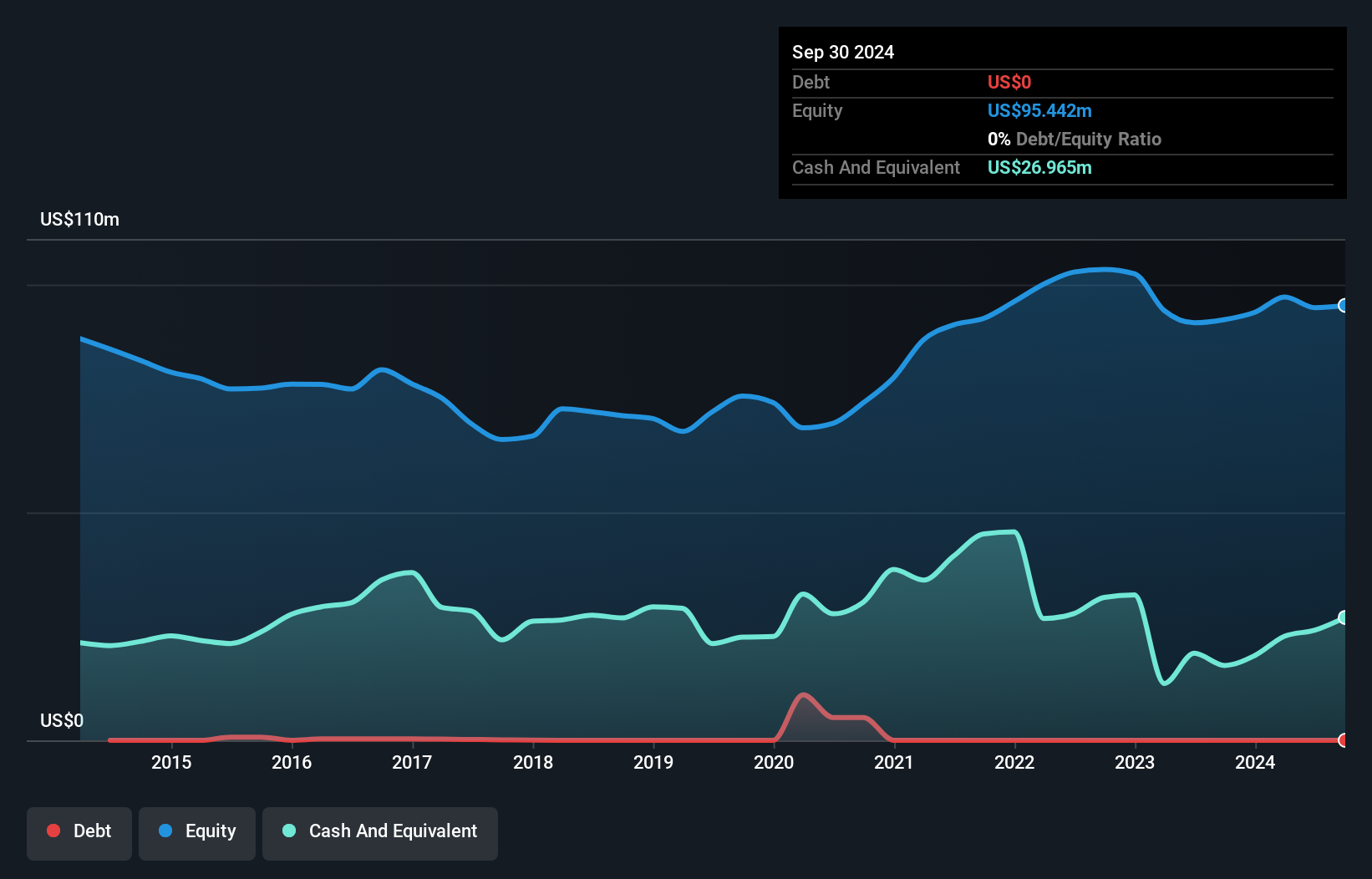

MoneyHero Limited, with a market cap of US$47.36 million, has shown significant revenue growth across its key markets in Hong Kong, Singapore, and the Philippines. Despite being unprofitable and experiencing shareholder dilution over the past year, the company reported improved earnings for Q3 2024 with a net income of US$5.72 million compared to a loss previously. It holds sufficient short-term assets to cover liabilities and remains debt-free. Recent strategic board appointments aim to enhance governance and leverage expertise in technology sectors for future growth initiatives in Greater Southeast Asia's personal finance landscape.

- Click here and access our complete financial health analysis report to understand the dynamics of MoneyHero.

- Evaluate MoneyHero's prospects by accessing our earnings growth report.

Brightcove (NasdaqGS:BCOV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Brightcove Inc. offers cloud-based streaming services across multiple regions including the Americas, Europe, Asia Pacific, Japan, India, and the Middle East with a market cap of approximately $199.83 million.

Operations: The company generates revenue of $199.83 million from its Software & Programming segment.

Market Cap: $199.83M

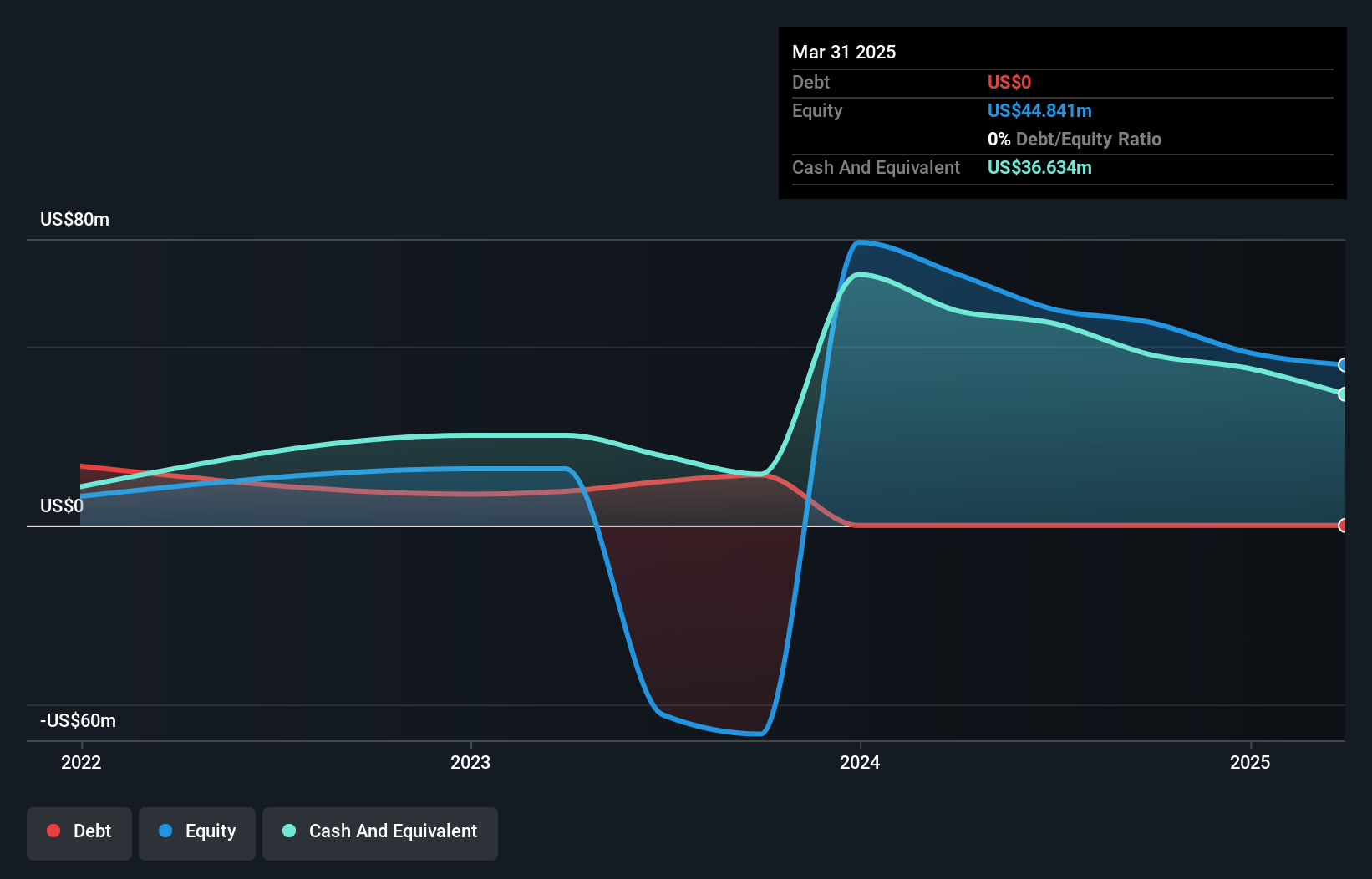

Brightcove Inc., with a market cap of US$199.83 million, is in the midst of an acquisition by Bending Spoons for US$230 million, expected to close in early 2025. Despite its unprofitability and recent shareholder dilution, Brightcove maintains a strong cash position with over three years of runway at current cash flow levels. The company has launched innovative products like Marketing Studio for Sales and Marketing Insights, enhancing video content personalization and analytics capabilities. However, it faces challenges such as high short-term liabilities exceeding assets and volatile share prices over recent months.

- Jump into the full analysis health report here for a deeper understanding of Brightcove.

- Gain insights into Brightcove's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Click through to start exploring the rest of the 725 US Penny Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brightcove might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BCOV

Brightcove

Provides cloud-based streaming services the Americas, Europe, the Asia Pacific, Japan, India, and the Middle East.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives