- United States

- /

- Banks

- /

- NasdaqGS:FNLC

Uncovering 3 US Hidden Gems with Promising Potential

Reviewed by Simply Wall St

Amid a backdrop of record highs for the S&P 500 and Nasdaq, and little change in the Dow Jones during a government shutdown, investors are keenly observing how these dynamics might affect smaller companies. In this environment, identifying stocks with strong fundamentals and unique growth drivers can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

First Bancorp (FNLC)

Simply Wall St Value Rating: ★★★★★★

Overview: The First Bancorp, Inc. is a bank holding company for First National Bank, offering various banking products and services to individual and corporate clients, with a market cap of $294.39 million.

Operations: First Bancorp generates revenue primarily through its banking operations, totaling $85.45 million. The company's net profit margin reflects its financial performance and efficiency in managing expenses relative to its income.

With total assets of US$3.2 billion and equity of US$265.5 million, First Bancorp is a notable player in the financial sector. The institution's deposits stand at US$2.7 billion, while loans amount to US$2.4 billion, reflecting its robust lending operations. It maintains a net interest margin of 2.3% and has an allowance for bad loans at 0.3% of total loans, indicating prudent risk management practices. Moreover, it's trading significantly below estimated fair value by 46%. Recent earnings growth outpaced the industry with a 13.8% increase last year, showcasing strong performance amidst market challenges.

- Navigate through the intricacies of First Bancorp with our comprehensive health report here.

Understand First Bancorp's track record by examining our Past report.

Douglas Dynamics (PLOW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Douglas Dynamics, Inc. is a North American manufacturer and upfitter specializing in commercial work truck attachments and equipment, with a market cap of $720.26 million.

Operations: The company generates revenue primarily from two segments: Work Truck Solutions ($323.74 million) and Work Truck Attachments ($258.60 million).

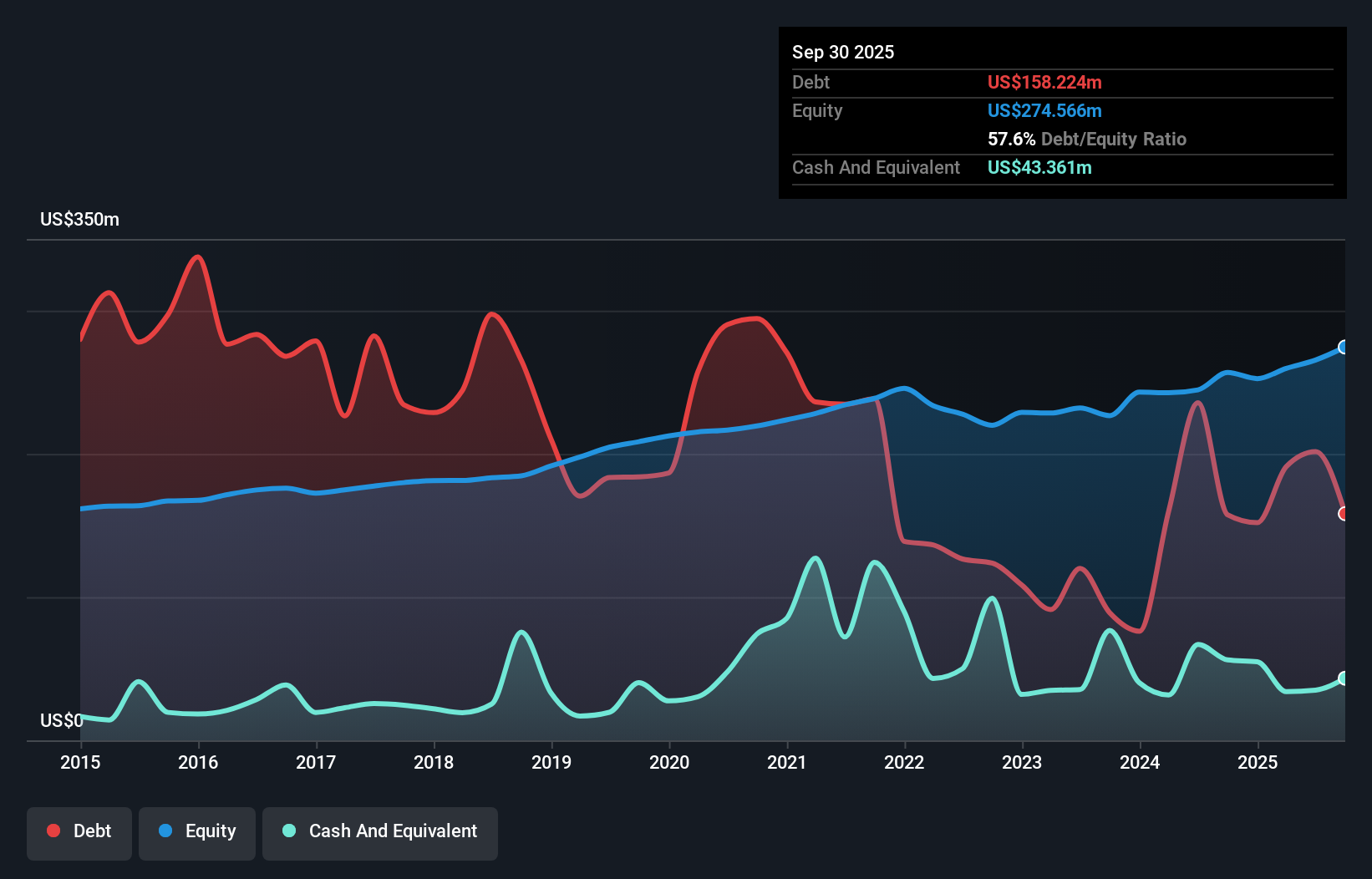

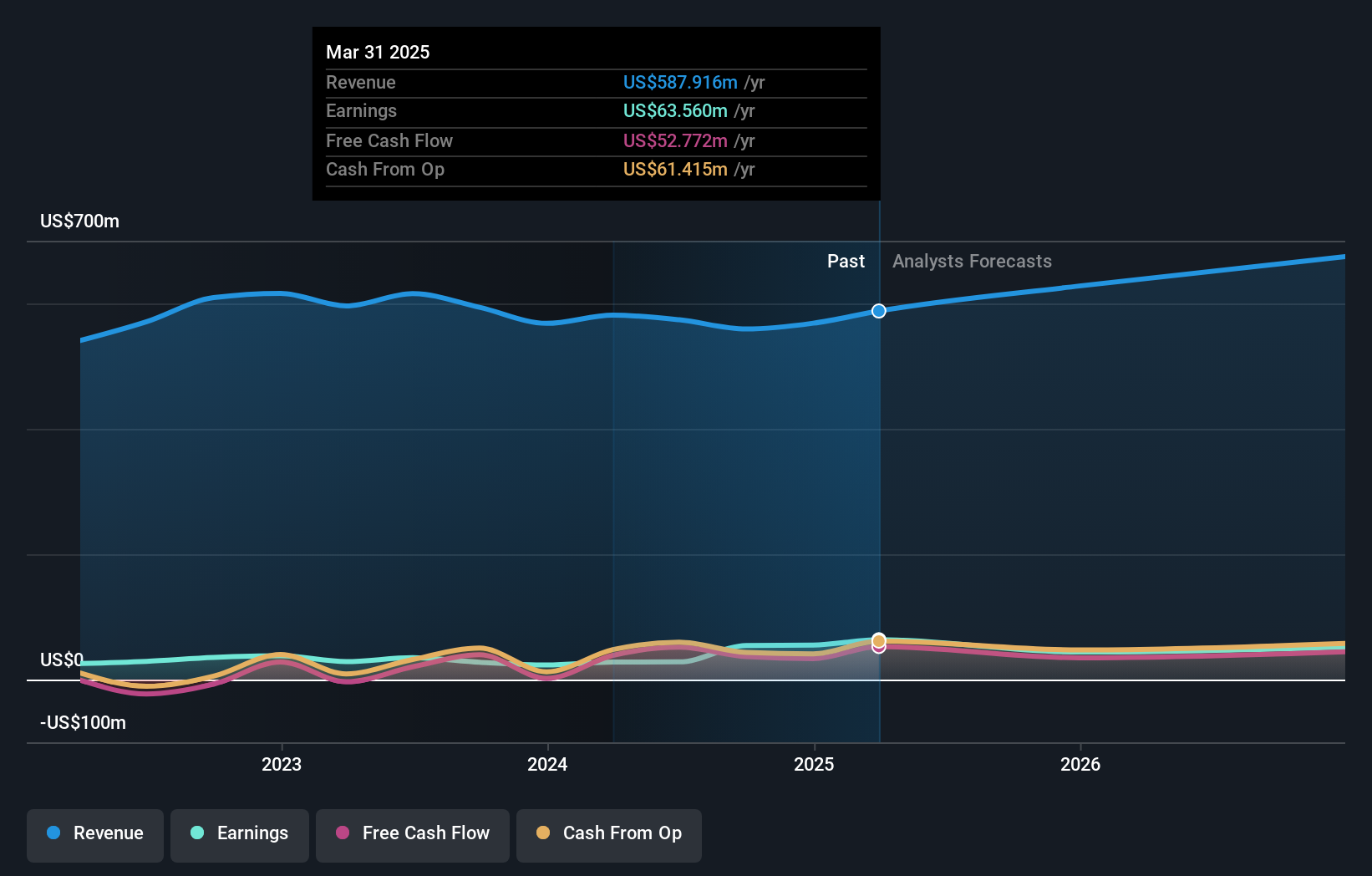

Douglas Dynamics, a key player in the commercial work truck equipment sector, has shown impressive earnings growth of 130.7% over the past year, significantly outpacing its industry peers. Despite this robust performance, a one-off gain of US$42 million has skewed recent results. The company’s debt to equity ratio has improved from 157.1% to 76.4% over five years but remains high at 73%. With revenue expected to grow by 10.33% annually and trading below fair value estimates by 7.2%, Douglas Dynamics presents an intriguing opportunity amid potential challenges related to seasonal demand fluctuations and economic pressures on customer behavior.

Valhi (VHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valhi, Inc. is a diversified company involved in chemicals, component products, and real estate management and development across Europe, North America, the Asia Pacific, and internationally with a market cap of approximately $446.61 million.

Operations: Valhi generates revenue primarily from its chemicals segment, which accounts for $1.89 billion, followed by component products at $152.6 million and real estate management and development at $48.9 million.

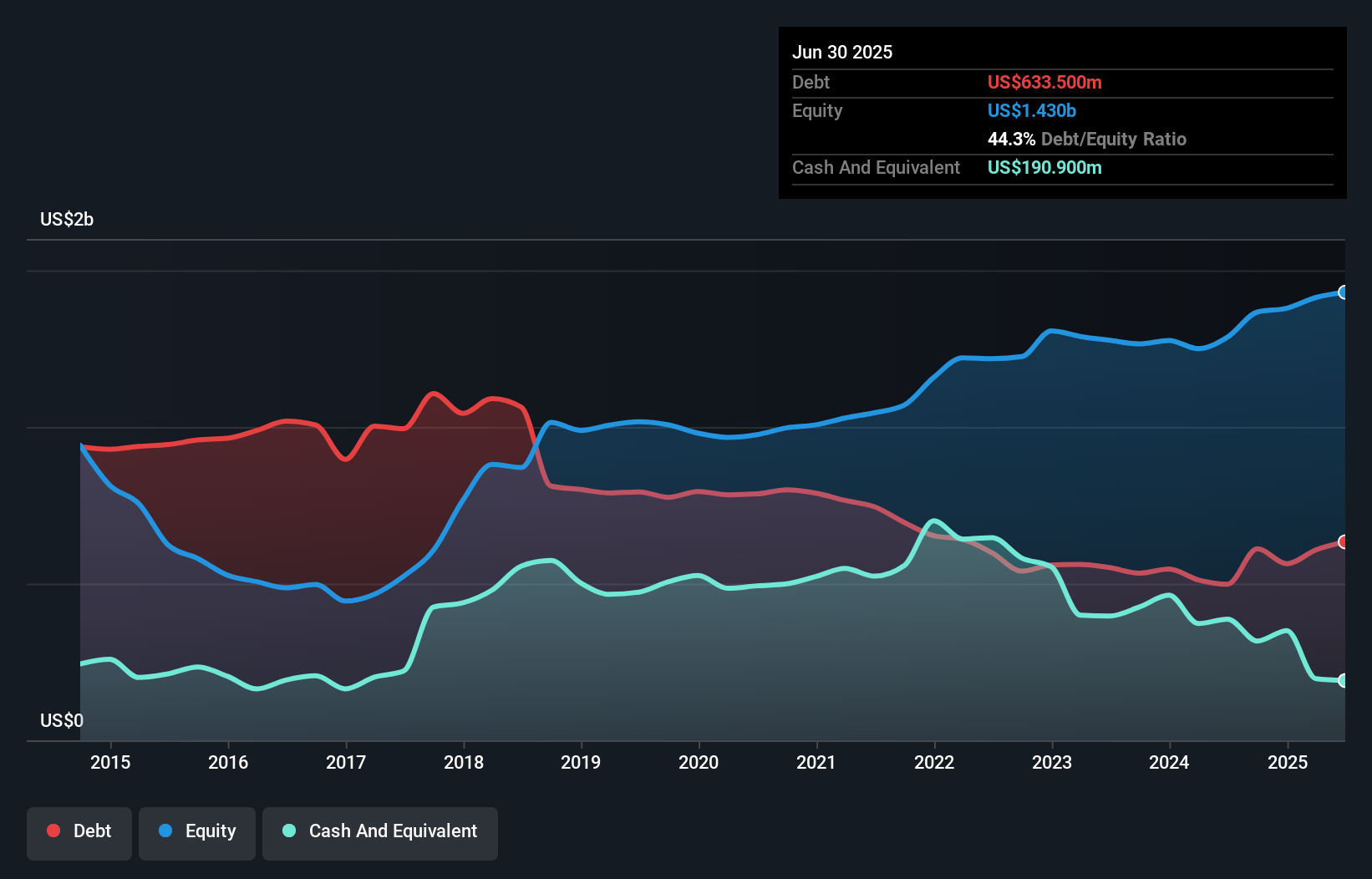

Valhi's financial landscape paints a complex picture, with its net debt to equity ratio improving from 80.6% to 44.3% over five years, indicating better leverage management. Despite a significant one-off gain of US$50.7 million boosting recent results, earnings have seen an annual decline of 1.4% over the past five years, suggesting challenges in sustaining growth momentum. The company's price-to-earnings ratio stands at an attractive 4.5x compared to the broader market's 19.1x, hinting at potential undervaluation despite recent net income dropping from US$19.9 million to US$0.9 million year-over-year for Q2 2025.

- Get an in-depth perspective on Valhi's performance by reading our health report here.

Gain insights into Valhi's historical performance by reviewing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 283 US Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FNLC

First Bancorp

Operates as the bank holding company for First National Bank that provides a range of banking products and services to individual and corporate customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)