- United States

- /

- Oil and Gas

- /

- NYSE:MUR

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.6%, yet it remains up by 9.1% over the past year, with earnings forecasted to grow by 14% annually. In this environment, dividend stocks can offer stability and potential income, making them an attractive option for investors seeking reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.10% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.06% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.37% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.37% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.01% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.38% | ★★★★★☆ |

| Credicorp (NYSE:BAP) | 5.35% | ★★★★★☆ |

| Southside Bancshares (NYSE:SBSI) | 5.14% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 5.06% | ★★★★★☆ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.60% | ★★★★★☆ |

Click here to see the full list of 145 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Kennametal (NYSE:KMT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kennametal Inc. specializes in the development and application of tungsten carbides, ceramics, and super-hard materials for metal cutting and extreme wear applications, with a market capitalization of approximately $1.60 billion.

Operations: Kennametal Inc.'s revenue is derived from two primary segments: Metal Cutting, which generated $1.23 billion, and Infrastructure, which contributed $760.13 million.

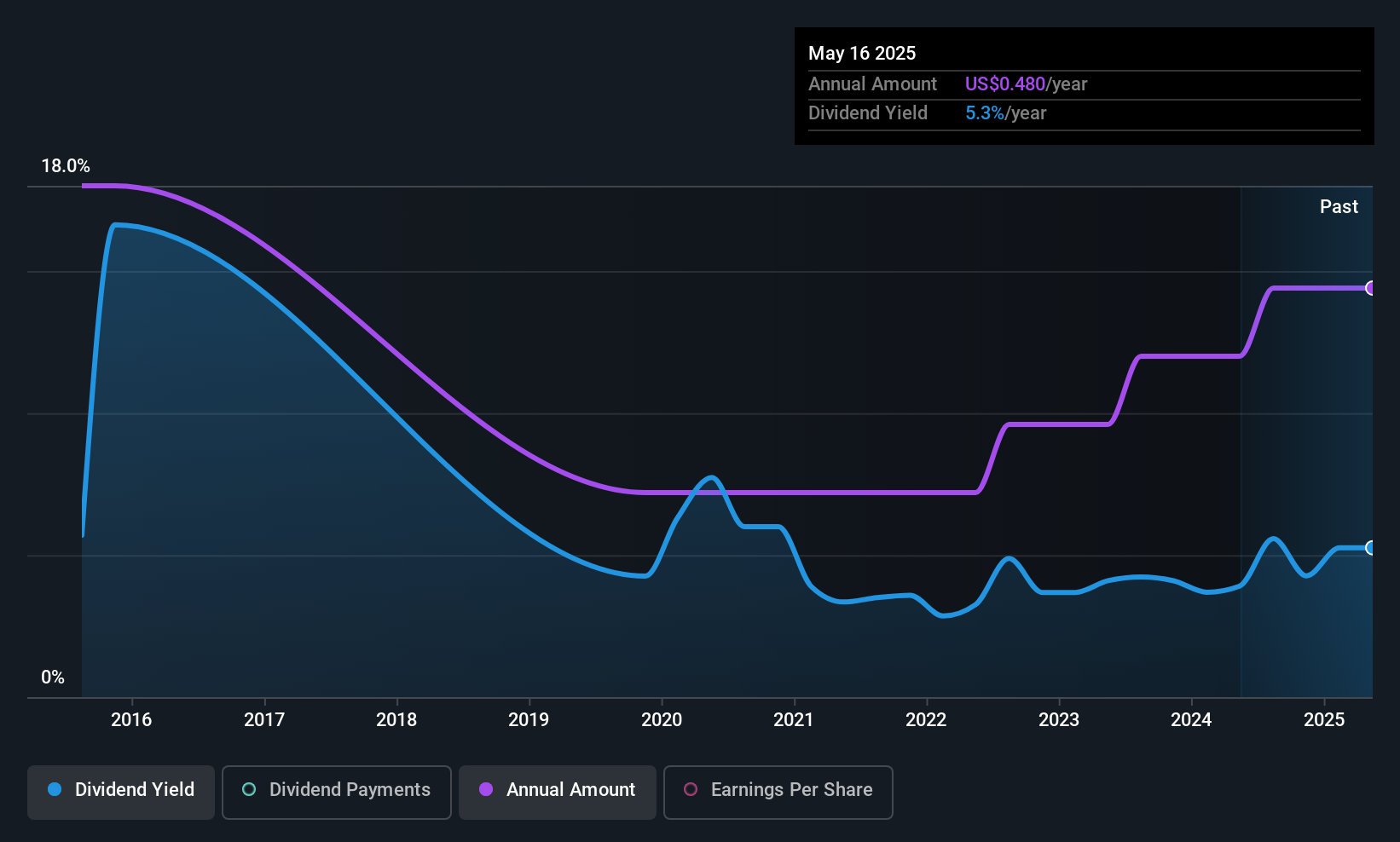

Dividend Yield: 3.8%

Kennametal provides a reliable dividend yield of 3.8%, though it is below the top quartile in the US market. The company's dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 57.3% and a cash payout ratio of 40%. Recent buybacks totaling $54.93 million reflect shareholder value initiatives, while earnings for Q3 showed improvement with net income rising to $31.48 million from $18.98 million year-over-year.

- Navigate through the intricacies of Kennametal with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Kennametal is trading behind its estimated value.

Murphy Oil (NYSE:MUR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Murphy Oil Corporation, with a market cap of $2.98 billion, operates as an oil and gas exploration and production company in the United States, Canada, and internationally.

Operations: Murphy Oil Corporation generates revenue primarily through its exploration and production activities, with $2.35 billion from the United States and $537 million from Canada.

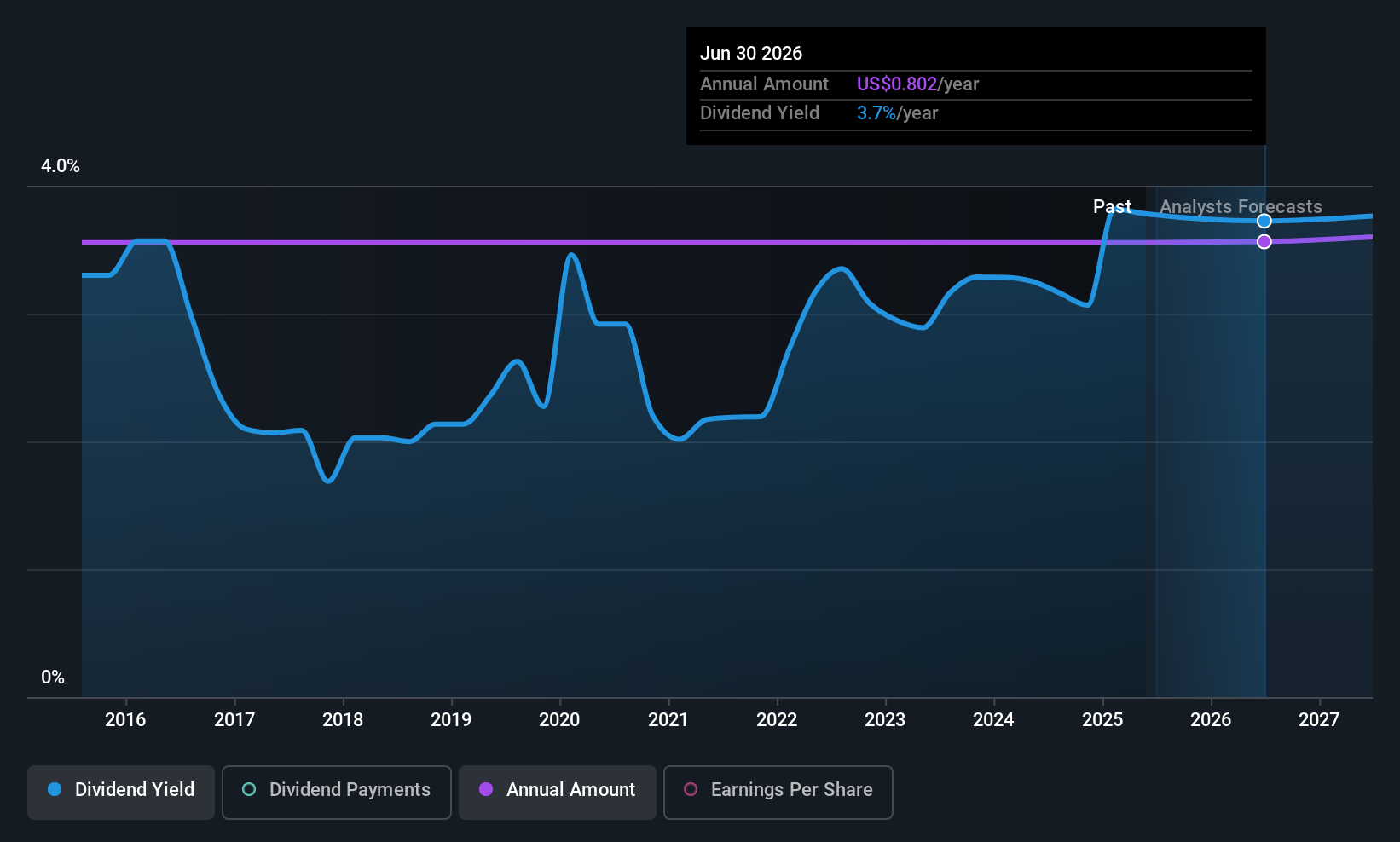

Dividend Yield: 6.2%

Murphy Oil's dividend yield of 6.22% places it among the top 25% of US dividend payers, although its dividends have been volatile and unreliable over the past decade. The company's payout ratio of 46.1% and cash payout ratio of 30.8% suggest dividends are well covered by earnings and cash flows. Recent Q1 results showed decreased revenue at $665.71 million, with net income down to $73.04 million year-over-year, while share buybacks totaled $99.98 million this quarter.

- Click here and access our complete dividend analysis report to understand the dynamics of Murphy Oil.

- Our expertly prepared valuation report Murphy Oil implies its share price may be lower than expected.

SunCoke Energy (NYSE:SXC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SunCoke Energy, Inc. is an independent producer of coke operating in the Americas and Brazil, with a market cap of approximately $711.92 million.

Operations: SunCoke Energy, Inc.'s revenue is primarily derived from its Domestic Coke segment at $1.76 billion, followed by Logistics at $107.40 million and Brazil Coke at $34.60 million.

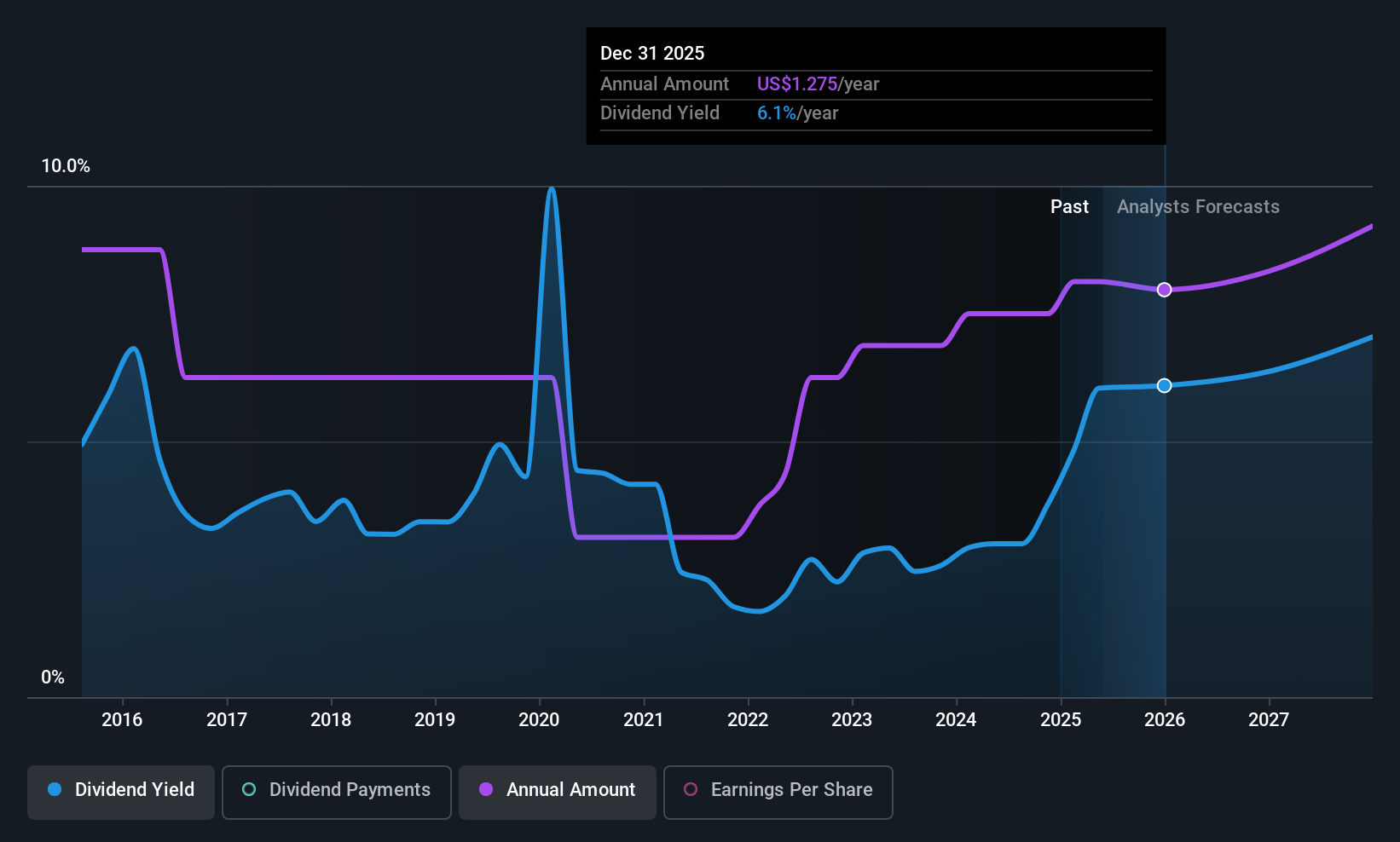

Dividend Yield: 5.7%

SunCoke Energy's dividend yield of 5.71% ranks it in the top 25% of US dividend payers, supported by a payout ratio of 42.1% and cash payout ratio of 33.2%, indicating strong coverage by earnings and cash flows. Despite a history of volatility, dividends have grown over the past decade. Recent Q1 results showed decreased sales at US$436 million and net income at US$17.3 million year-over-year, with a declared dividend of $0.12 per share payable on June 2, 2025.

- Click here to discover the nuances of SunCoke Energy with our detailed analytical dividend report.

- The valuation report we've compiled suggests that SunCoke Energy's current price could be quite moderate.

Seize The Opportunity

- Explore the 145 names from our Top US Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUR

Murphy Oil

Operates as an oil and gas exploration and production company in the United States, Canada, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives