- United States

- /

- Auto Components

- /

- NYSE:LEA

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market grapples with volatility due to tariff concerns and recession fears, investors are increasingly seeking stability in their portfolios. In such uncertain times, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an appealing choice for those looking to enhance their portfolios amidst economic turbulence.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 4.67% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.88% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.68% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.91% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.62% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.46% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.98% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.76% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.63% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.82% | ★★★★★★ |

Click here to see the full list of 158 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Hyster-Yale (NYSE:HY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hyster-Yale, Inc. operates globally through its subsidiaries by designing, engineering, manufacturing, selling, and servicing lift trucks and related products, with a market cap of approximately $787.71 million.

Operations: Hyster-Yale's revenue is primarily derived from its Lift Truck Business in the Americas ($3.22 billion), EMEA ($707.60 million), and JAPIC ($183.70 million) regions, along with contributions from Bolzoni ($379.10 million) and Nuvera ($1.40 million).

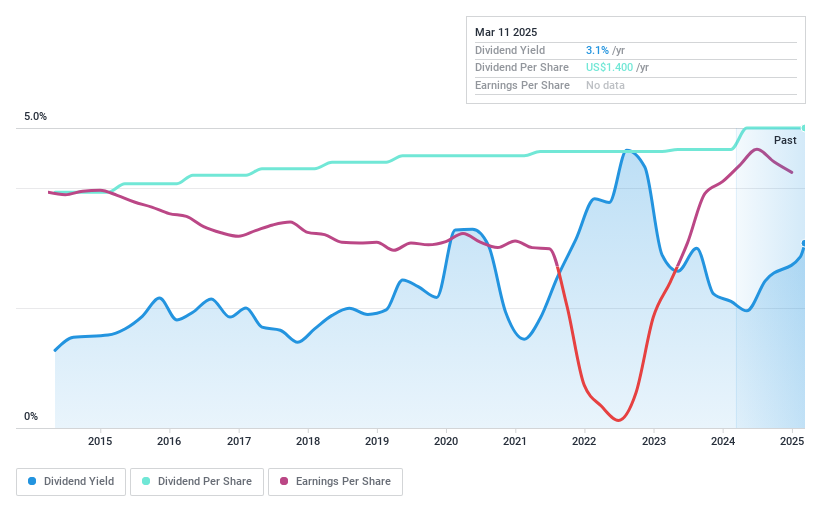

Dividend Yield: 3.1%

Hyster-Yale offers a reliable dividend yield of 3.08%, supported by a low payout ratio of 16.9%, ensuring coverage by both earnings and cash flows. Despite stable dividend growth over the past decade, its yield is lower than the top US dividend payers. The company faces challenges with anticipated revenue and profit declines in 2025 due to reduced production levels, impacting its financial position amidst high debt levels. Recent earnings showed mixed results with increased sales but decreased net income for Q4 2024.

- Navigate through the intricacies of Hyster-Yale with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Hyster-Yale shares in the market.

Lear (NYSE:LEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lear Corporation is a global company that specializes in designing, developing, engineering, manufacturing, assembling, and supplying automotive seating and electrical distribution systems for original equipment manufacturers across various continents with a market cap of approximately $5.30 billion.

Operations: Lear Corporation generates revenue through two primary segments: Seating, which accounts for $17.22 billion, and e-Systems, contributing $6.08 billion.

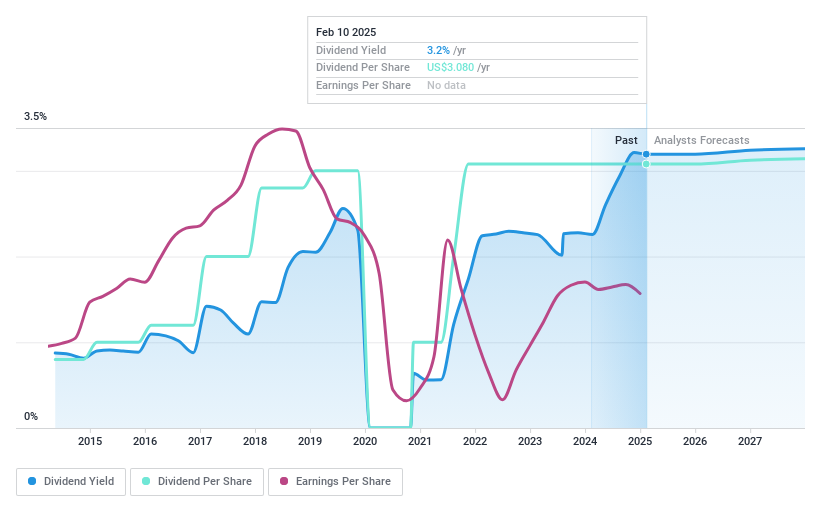

Dividend Yield: 3.1%

Lear Corporation's dividend yield of 3.1% is lower than the top US dividend payers, yet its payout is well-covered by earnings and cash flows, with a payout ratio of 34.1%. Despite past volatility in dividend payments, recent affirmations show commitment to shareholder returns with a declared $0.77 per share quarterly dividend. The company continues strategic initiatives like the ComfortMax Seat integration with General Motors, potentially enhancing future revenue streams and supporting dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Lear.

- Our expertly prepared valuation report Lear implies its share price may be lower than expected.

Murphy Oil (NYSE:MUR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Murphy Oil Corporation, along with its subsidiaries, engages in oil and gas exploration and production activities in the United States, Canada, and internationally with a market cap of approximately $3.70 billion.

Operations: Murphy Oil Corporation generates revenue through its oil and gas exploration and production activities, with $0.51 billion from Canada and $2.50 billion from the United States.

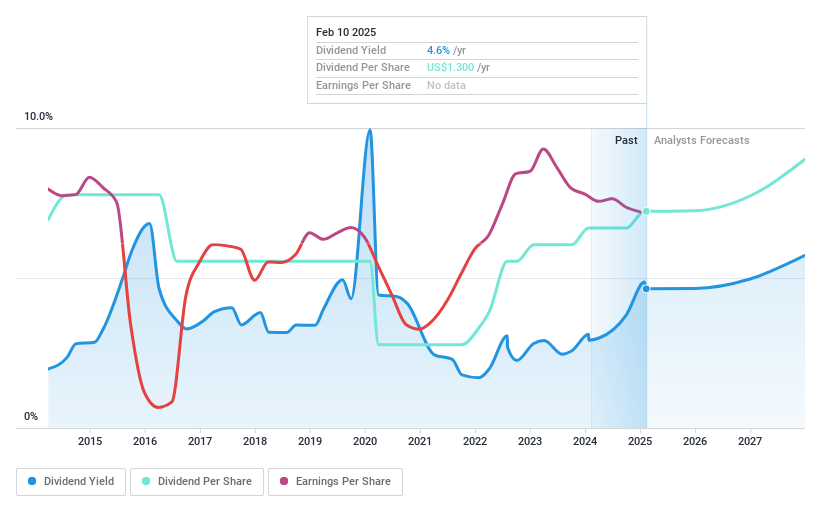

Dividend Yield: 5.1%

Murphy Oil's dividend yield of 5.07% ranks it among the top US dividend payers, supported by a payout ratio of 43.9% and a cash payout ratio of 23.1%, indicating strong coverage by earnings and cash flows. Despite past volatility in dividends, recent increases reflect an effort to stabilize shareholder returns with a declared $0.325 per share quarterly dividend. However, recent earnings declines may pose challenges if sustained over time, as seen in the latest financial results showing decreased revenue and net income for 2024 compared to the previous year.

- Get an in-depth perspective on Murphy Oil's performance by reading our dividend report here.

- According our valuation report, there's an indication that Murphy Oil's share price might be on the cheaper side.

Summing It All Up

- Gain an insight into the universe of 158 Top US Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lear, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEA

Lear

Designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives