- United States

- /

- Auto

- /

- NYSE:XPEV

3 Growth Companies With High Insider Ownership Expecting 23% Revenue Growth

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, although it has seen a 15% increase over the past year with earnings projected to grow by 15% annually in the coming years. In this context of steady growth and optimistic earnings forecasts, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations and potential for robust revenue expansion.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 36% | 88.1% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 47% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 12.9% | 44.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

Let's uncover some gems from our specialized screener.

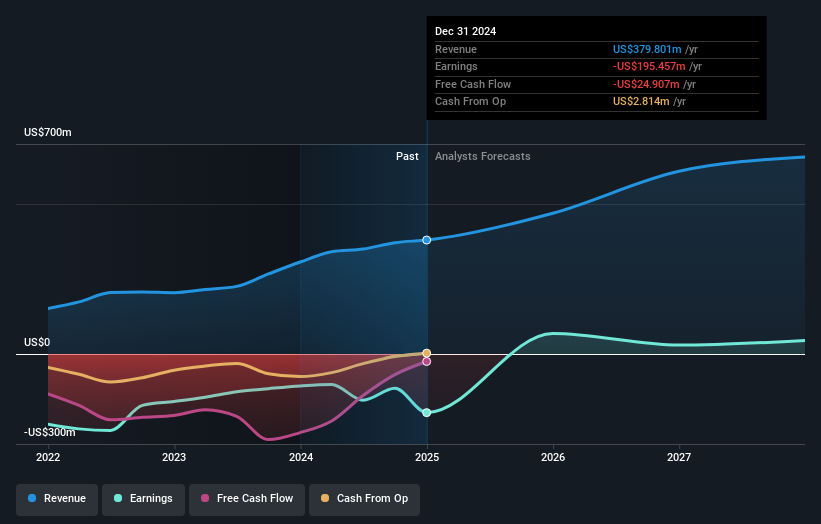

Microvast Holdings (MVST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Microvast Holdings, Inc. specializes in battery technologies for electric vehicles and energy storage solutions, with a market cap of approximately $1.09 billion.

Operations: The company generates revenue primarily through its Batteries / Battery Systems segment, which accounts for $414.94 million.

Insider Ownership: 27.7%

Revenue Growth Forecast: 15.2% p.a.

Microvast Holdings has recently been added to multiple Russell indices, indicating increased visibility in the market. The company is expected to achieve profitability within three years, with earnings projected to grow at 45.33% annually. While revenue growth is forecasted at 15.2% per year, it surpasses the broader US market's growth rate of 9%. Despite a volatile share price and limited cash runway, Microvast's innovative battery technologies and strategic expansions position it for potential long-term success.

- Click here to discover the nuances of Microvast Holdings with our detailed analytical future growth report.

- Our valuation report unveils the possibility Microvast Holdings' shares may be trading at a premium.

Toast (TOST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Toast, Inc. operates a cloud-based digital technology platform for the restaurant industry globally and has a market cap of approximately $26.88 billion.

Operations: Toast, Inc. generates revenue from its data processing segment, which amounts to $5.22 billion.

Insider Ownership: 19%

Revenue Growth Forecast: 15.1% p.a.

Toast has shown strong growth potential with expected annual earnings growth of 31%, significantly outpacing the US market's 14.7% forecast. Despite being dropped from the Russell 2500 indices, Toast remains focused on innovation, launching tools like the Menu Price Monitor and ToastIQ to enhance restaurant operations and customer engagement. Insider activity shows more substantial buying than selling recently, indicating confidence in its future prospects despite slower revenue growth compared to earnings.

- Unlock comprehensive insights into our analysis of Toast stock in this growth report.

- The analysis detailed in our Toast valuation report hints at an inflated share price compared to its estimated value.

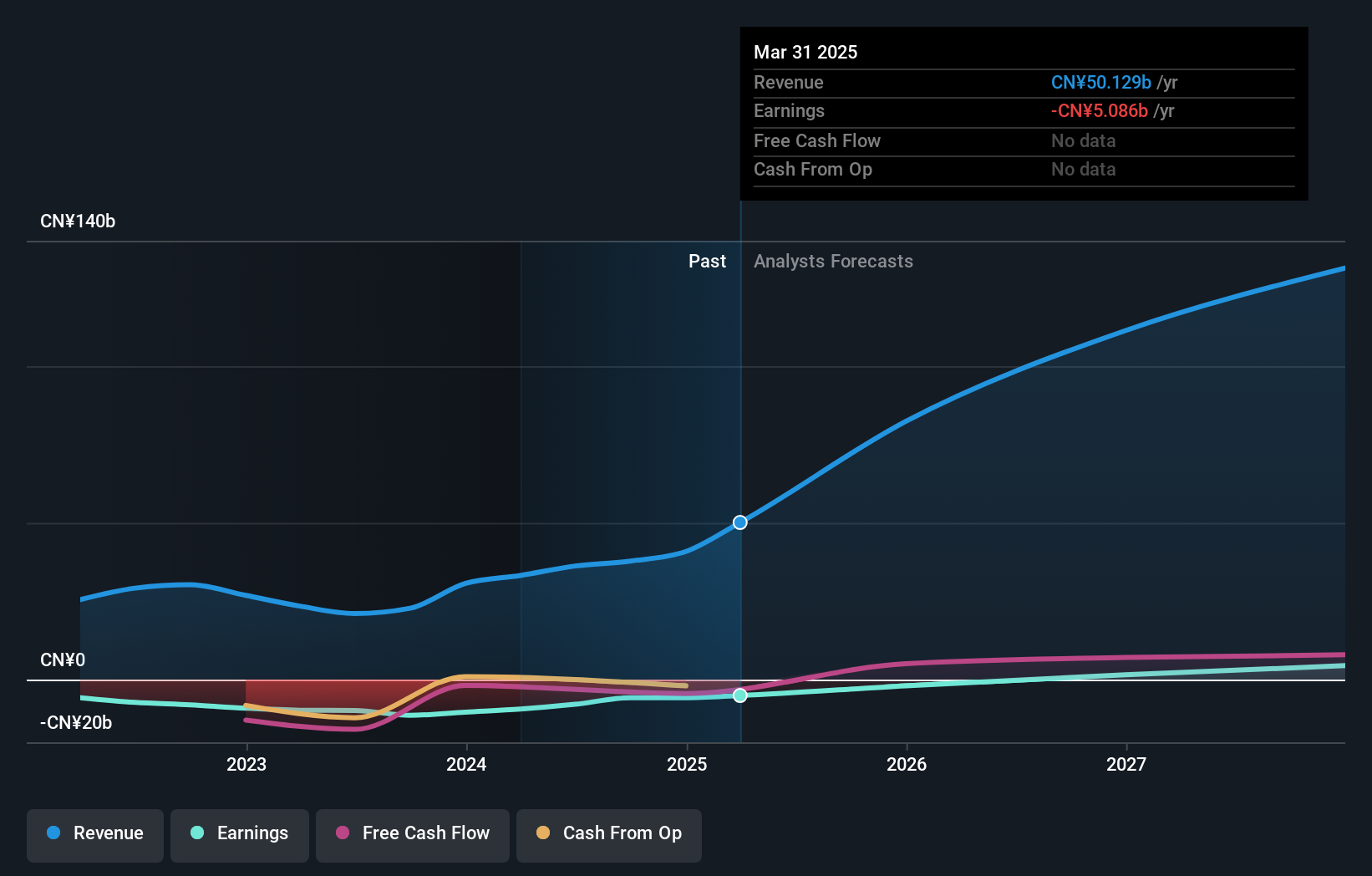

XPeng (XPEV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XPeng Inc. designs, develops, manufactures, and markets smart electric vehicles in China, with a market cap of approximately $17.43 billion.

Operations: The company's revenue primarily comes from its Auto Manufacturers segment, totaling CN¥50.13 billion.

Insider Ownership: 20.7%

Revenue Growth Forecast: 24% p.a.

XPeng is projected to achieve profitability within three years, with revenue growth expected at 24% annually, surpassing the US market's average. Recent strategic partnerships and product launches, such as the XPeng G7 with advanced features and global expansion efforts into Indonesia, underscore its commitment to innovation and market penetration. Despite a low forecasted Return on Equity of 15%, XPeng's delivery numbers have consistently set records, reflecting robust demand for its smart EVs.

- Take a closer look at XPeng's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that XPeng is priced higher than what may be justified by its financials.

Summing It All Up

- Explore the 188 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Seeking Other Investments? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives