- United States

- /

- Insurance

- /

- NYSE:HCI

3 Growth Companies With High Insider Ownership Growing Revenues Up To 38%

Reviewed by Simply Wall St

As the U.S. markets retreat from record highs, with tech stocks facing significant pressure, investors are keenly watching for opportunities amid fluctuating economic indicators and potential Federal Reserve policy shifts. In this environment, companies with high insider ownership often attract attention as they can signal confidence in the company's growth prospects and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Prairie Operating (PROP) | 31.1% | 86.3% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hippo Holdings (HIPO) | 14.1% | 41.2% |

| Hesai Group (HSAI) | 21.3% | 41.5% |

| FTC Solar (FTCI) | 23.2% | 63% |

| Credo Technology Group Holding (CRDO) | 11.4% | 36.4% |

| Cloudflare (NET) | 10.6% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.1% |

| Astera Labs (ALAB) | 12.3% | 36.8% |

Underneath we present a selection of stocks filtered out by our screen.

Aebi Schmidt Holding (AEBI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aebi Schmidt Holding AG develops and manufactures special-purpose vehicles and attachments, with a market cap of approximately $950.06 million.

Operations: The company's revenue is primarily generated from North America, contributing $589.46 million, and Europe and the Rest of the World, adding $498.15 million.

Insider Ownership: 14.2%

Revenue Growth Forecast: 38.7% p.a.

Aebi Schmidt Holding demonstrates substantial insider ownership with recent insider buying, indicating confidence in its growth trajectory. Despite a volatile share price and interest payments not well covered by earnings, the company's revenue is forecast to grow at 38.7% annually, outpacing the US market. Aebi Schmidt's merger with The Shyft Group has led to board changes and a new dividend initiation of $0.025 per share, reflecting strategic shifts post-merger aimed at bolstering shareholder value.

- Click here and access our complete growth analysis report to understand the dynamics of Aebi Schmidt Holding.

- Our comprehensive valuation report raises the possibility that Aebi Schmidt Holding is priced higher than what may be justified by its financials.

LifeStance Health Group (LFST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LifeStance Health Group, Inc. operates through its subsidiaries to offer outpatient mental health services across various age groups in the United States, with a market cap of approximately $2.13 billion.

Operations: The company's revenue is primarily derived from mental health services, totaling $1.32 billion.

Insider Ownership: 11.5%

Revenue Growth Forecast: 13.9% p.a.

LifeStance Health Group is trading significantly below its estimated fair value and has seen substantial insider buying in the past three months, reflecting confidence in its growth potential. The company is forecast to achieve above-average market profit growth over the next three years, with revenue expected to increase by 13.9% annually. Recent board changes include appointing Sarah Personette, bringing extensive experience from leading media and technology firms, which may enhance strategic direction.

- Get an in-depth perspective on LifeStance Health Group's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, LifeStance Health Group's share price might be too pessimistic.

HCI Group (HCI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HCI Group, Inc. operates in the United States through its subsidiaries, focusing on property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses with a market cap of approximately $2.16 billion.

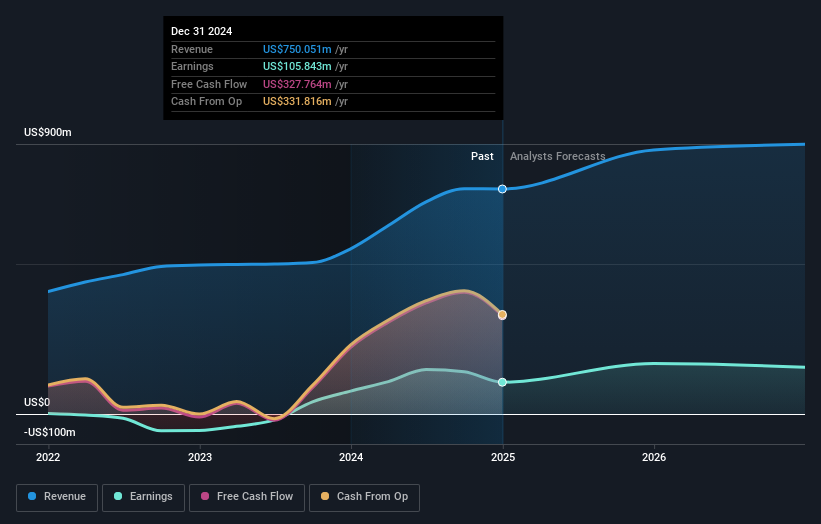

Operations: The company's revenue is primarily derived from its insurance operations at $726.94 million, followed by reciprocal exchange operations contributing $49.26 million, and real estate generating $11.12 million.

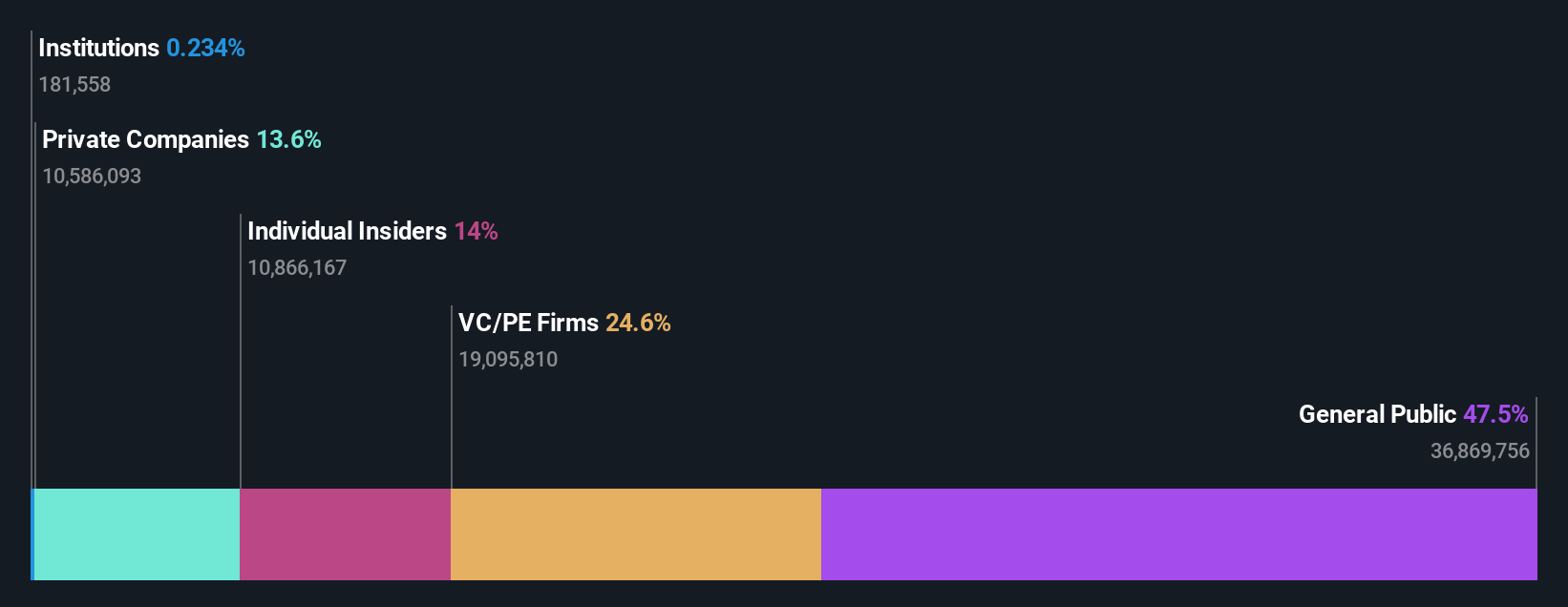

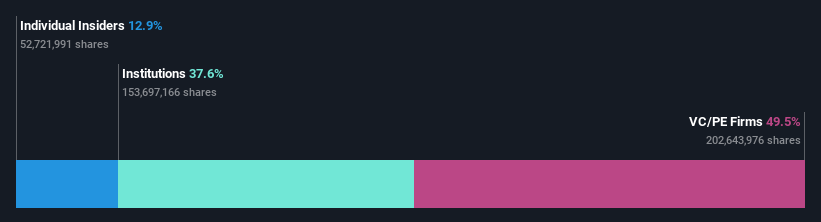

Insider Ownership: 14.3%

Revenue Growth Forecast: 11.4% p.a.

HCI Group is trading at a significant discount to its estimated fair value, with earnings forecasted to grow substantially at 25.5% annually, outpacing the US market. Revenue growth is expected at 11.4% per year, surpassing the broader market rate of 9.3%. Recent earnings reports show strong performance with net income rising to US$66.16 million for Q2 2025 from US$54.08 million a year ago, despite being removed from several Russell indices recently.

- Delve into the full analysis future growth report here for a deeper understanding of HCI Group.

- According our valuation report, there's an indication that HCI Group's share price might be on the cheaper side.

Turning Ideas Into Actions

- Discover the full array of 199 Fast Growing US Companies With High Insider Ownership right here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives