- United States

- /

- Consumer Finance

- /

- NasdaqGS:QFIN

Qfin Holdings And 2 Other Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new all-time highs, driven by advancements in technology and strategic partnerships, investors are increasingly looking for stable returns amidst this bullish environment. In such times, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.41% | ★★★★★☆ |

| PACCAR (PCAR) | 4.45% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.74% | ★★★★★★ |

| Ennis (EBF) | 5.38% | ★★★★★★ |

| Employers Holdings (EIG) | 3.02% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.65% | ★★★★★☆ |

| Dillard's (DDS) | 4.54% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.52% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.61% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.33% | ★★★★★☆ |

Click here to see the full list of 123 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

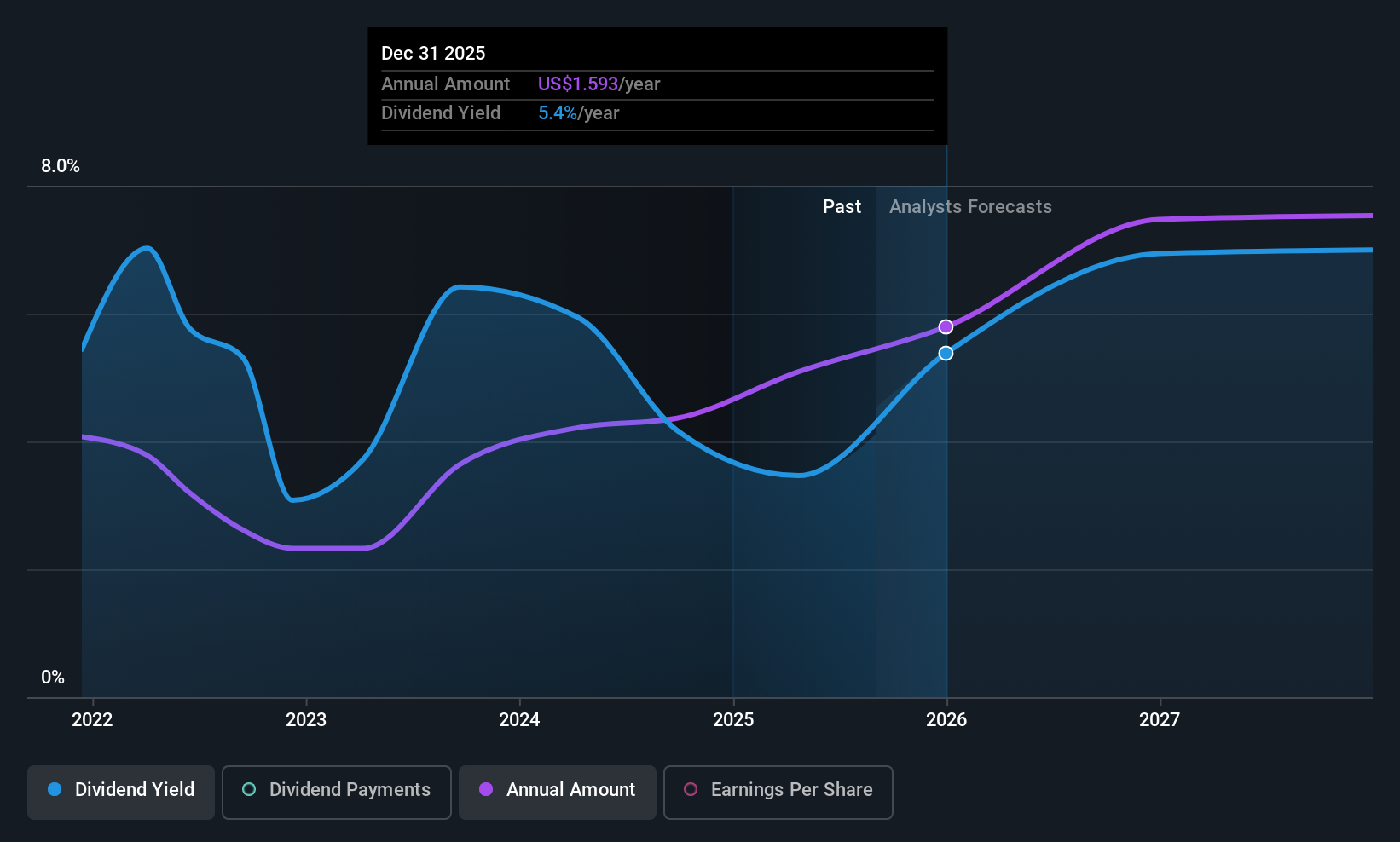

Qfin Holdings (QFIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qfin Holdings, Inc. operates an AI-driven credit-tech platform under the Qifu Jietiao brand in China and has a market cap of approximately $4.02 billion.

Operations: Qfin Holdings, Inc. generates revenue from its AI-driven credit-tech platform under the Qifu Jietiao brand in China, with unclassified services amounting to CN¥18.76 billion.

Dividend Yield: 4.9%

Qfin Holdings offers an attractive dividend yield of 4.94%, placing it among the top 25% of U.S. dividend payers. Despite a short and volatile dividend history, its payouts are well-supported by both earnings and cash flows, with low payout ratios of 20.5% and 13.4%, respectively. Recent financials show robust revenue growth, while a completed $277 million share buyback reflects strong capital management, enhancing shareholder value amidst ongoing macroeconomic uncertainties.

- Dive into the specifics of Qfin Holdings here with our thorough dividend report.

- The analysis detailed in our Qfin Holdings valuation report hints at an deflated share price compared to its estimated value.

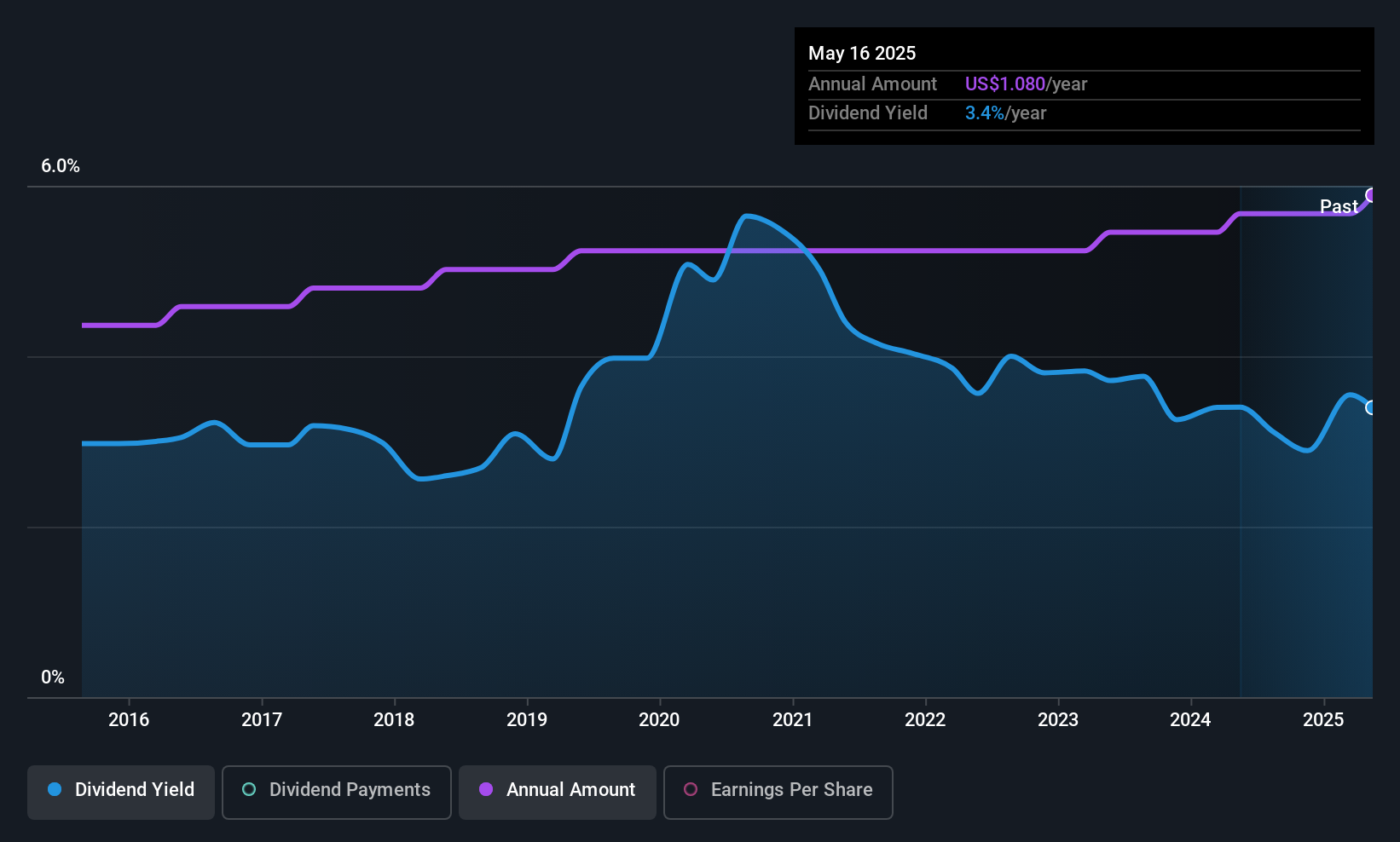

Weyco Group (WEYS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Weyco Group, Inc. designs, markets, and distributes footwear for men, women, and children across the United States, Canada, Australia, Asia, and South Africa with a market cap of $291.71 million.

Operations: Weyco Group's revenue is primarily derived from its Wholesale segment, which accounts for $221.35 million, complemented by $36.72 million from its Retail segment.

Dividend Yield: 3.5%

Weyco Group maintains a stable dividend history with consistent growth over the past decade, supported by sustainable payout ratios of 38.9% from earnings and 31.2% from cash flows. While its current yield of 3.54% is below the top quartile in the U.S., it remains reliable amidst recent leadership changes and share repurchases totaling $92.45 million since 2009, reflecting prudent capital management despite declining earnings reported for Q2 2025 compared to last year.

- Delve into the full analysis dividend report here for a deeper understanding of Weyco Group.

- In light of our recent valuation report, it seems possible that Weyco Group is trading beyond its estimated value.

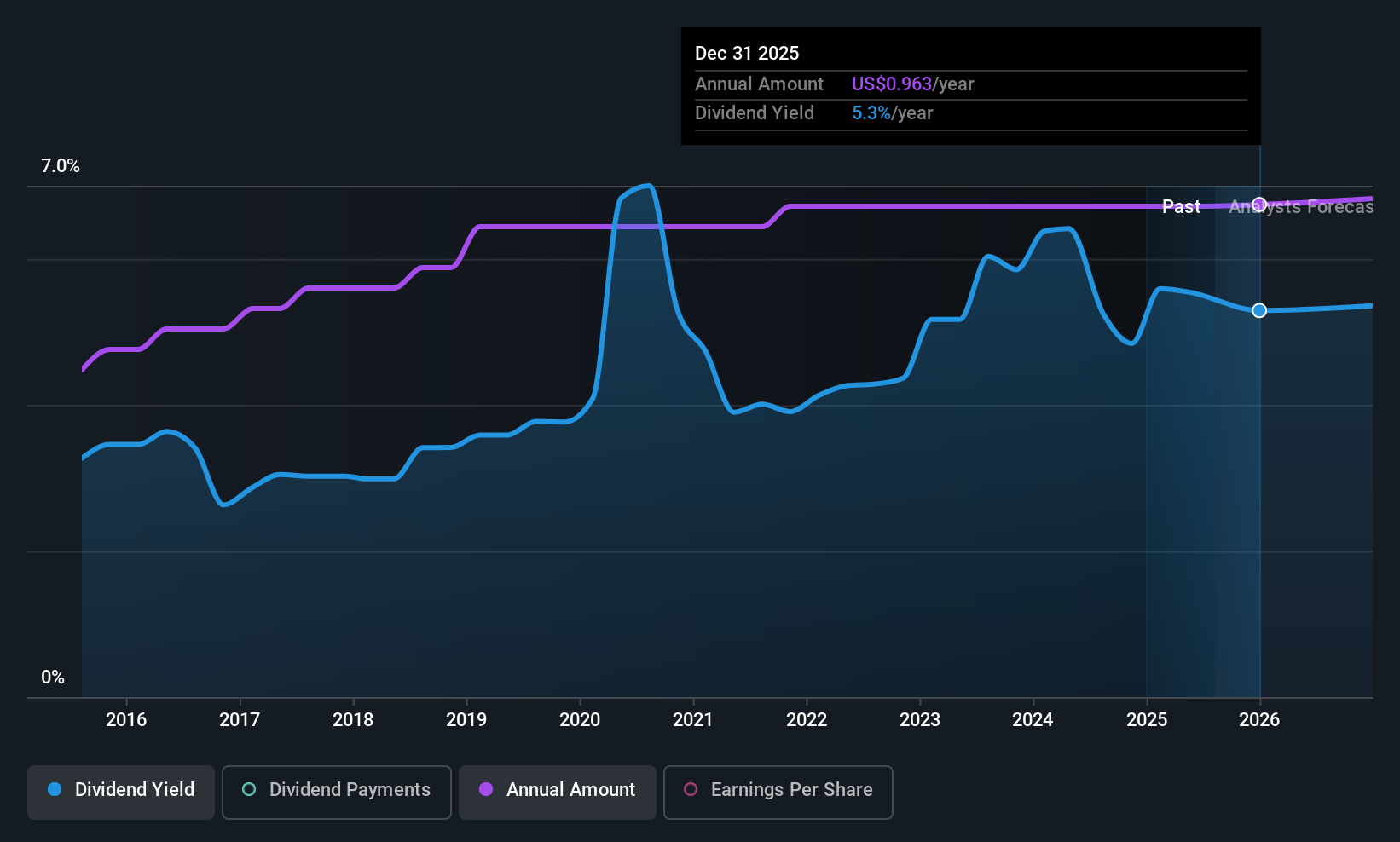

Provident Financial Services (PFS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Provident Financial Services, Inc. is the bank holding company for Provident Bank, offering a range of banking products and services to individuals, families, and businesses in the United States with a market cap of $2.60 billion.

Operations: Provident Financial Services, Inc. generates revenue primarily through its Traditional Banking and Other Financial Services segment, which accounts for $823.47 million.

Dividend Yield: 4.9%

Provident Financial Services offers a stable dividend history with a current yield of 4.86%, placing it in the top quartile of U.S. dividend payers. The company's dividends are supported by a reasonable payout ratio of 54.2%. Recent earnings improvements, with net income reaching US$71.98 million for Q2 2025, bolster its financial footing despite notable insider selling and limited data on future dividend sustainability beyond three years.

- Get an in-depth perspective on Provident Financial Services' performance by reading our dividend report here.

- Our valuation report unveils the possibility Provident Financial Services' shares may be trading at a discount.

Summing It All Up

- Take a closer look at our Top US Dividend Stocks list of 123 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qfin Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QFIN

Qfin Holdings

Qfin Holdings, Inc., together with its subsidiaries, operate AI- driven credit-tech platform under the Qifu Jietiao brand in the People’s Republic of China.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives