🥇 Gold Breaks Records While Oil Sinks: Commodities 2025 in Contrast

Reviewed by Michael Paige, Bailey Pemberton

Quote of the week: “Tough times helped many commodities producers become lean and mean through consolidation, mergers and cost-cutting. All that excess supply has been sopped up.” Jim Rogers

It’s been a while since we checked in on commodity markets, which, like other markets, are having quite the interesting year.

In particular, gold continues its march upward, while oil remains in a slump. As for the rest, most have been up and down and ended up close to where they were a year ago.

By the end, you’ll see why gold stocks still look cheap despite these record prices — and why oil stocks, oddly enough, look expensive even as crude declines.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

✂️ Fed lowers interest rates, signals more cuts ahead ( Reuters )

- As expected, the Fed cut rates by 25 bps and signaled two more cuts this year, even with inflation still projected at 3%.

- Powell and most policymakers are prioritizing labor market cracks over sticky prices, despite dissent from new Trump appointee Stephen Miran, who pushed for deeper cuts.

- This shift toward jobs-first policy could spark more rate cuts than markets had priced in, putting downward pressure on yields and boosting rate-sensitive assets like tech and REITs. But inflation risks haven’t vanished, meaning any risk-on rally could be fragile.

- If the Fed is pivoting to prioritize employment over inflation, expect more rate cuts, and more market volatility, as they walk the tightrope.

😎 Meta unveils new smart glasses with a display and wristband controller ( TechCrunch )

- Meta is launching $799 smart glasses with a display and gesture-controlled wristband on Sept 30.

- It’s a stripped-down version of its Orion AR concept, but unlike Orion, it’s actually shipping.

- This is Meta’s clearest play yet to cut Apple and Google out of the hardware loop. While it’s not full AR, owning the device layer could give Meta control over app distribution, data, and monetization. Early traction will be key, so keep an eye out for signs of adoption, not just hype.

- Meta’s betting that being early matters more than being perfect. If consumers bite, this could be the start of a new hardware moat.

📉 Winklevoss’ Gemini Space Station Slumps to Fall Below IPO Price ( Bloomberg )

- Gemini Space Station shares soared post-IPO but are now trading 10% below debut price, undercut by a broader crypto pullback and weak risk sentiment ahead of the Fed decision.

- Coinbase and Bitcoin also dipped slightly at the time, meaning some of the weakness could be macro and industry specific rather than company-related.

- With Gemini now valued at $3B, less than half its 2021 private round, public investors are repricing crypto businesses far more harshly than VCs. Until crypto sentiment stabilizes, IPO pop-and-drops like this may be the new normal.

- As we mentioned recently in our IPO piece: Let the market come to you.

🫸 Why Beijing is freezing Nvidia’s access to the Chinese market ( CNBC )

- Nvidia is now completely frozen out of the Chinese market, with regulators blocking even its made-for-China AI chips like the H20 and RTX Pro 6000D.

- The move reflects Beijing’s growing confidence in homegrown AI chips and looks like a power play in broader U.S.-China trade talks.

- China is flexing its chip muscles to boost self-reliance and push back against U.S. export controls. Nvidia loses near-term revenue, but the bigger risk is long-term decoupling from the world’s second-largest AI market.

- For investors holding Nvidia, expect some volatility and trade-war noise. But also keep an eye on Chinese chipmakers like Huawei, that pose a risk to their market share.

🚘 China is sending its world-beating auto industry into a tailspin ( Reuters )

- According to an investigation by Reuters, China’s auto industry is drowning in overcapacity, with EVs selling at deep discounts and new cars masquerading as “used” just to move inventory.

- Automakers are prioritizing production quotas over profits, backed by local government incentives that make failing factories politically unkillable.

- This is a systemic risk with global ripples. Cheap Chinese EVs are flooding export markets, stirring trade tensions and undercutting rivals. Investors in foreign automakers should brace for margin pressure, while Chinese EV startups face an inevitable shakeout, unless government subsidies never end.

- Some investors are using this moment to reassess exposure to Chinese EV firms, and they’re watching for winners in the coming consolidation wave.

💰 Nvidia bets big on Intel with $5 billion stake and chip partnership ( Reuters )

- First $2bn from Softbank, then $5.7bn from the U.S. government, and now $5bn from Nvidia.

- Nvidia and Intel are teaming up to co-develop chips, but Nvidia is not moving its manufacturing away from TSMC (yet).

- The deal gives Intel a badly needed strategic ally and could hurt AMD, Broadcom, and any chipmakers hoping to compete in AI servers.

- Nvidia gets to expand its ecosystem without jeopardizing its current supply chain, while Intel gets relevance in AI servers, without winning a true foundry customer. The real win here is tighter integration: the deal puts Nvidia’s GPU stack directly into Intel’s x86 ecosystem, possibly pressuring AMD’s grip on both the server and PC space.

- Neither party revealed details on the financial terms of their collaboration, or when the first product would come to market, but considering they said they would make “ multiple generations ” of future products together, it’s a sign of things to come.

📈 Gold Soars, Oil Slumps, Others Drift

Last week, we said every factor that can shake up bond yields has been in play. And it’s basically been the same story with commodities.

Uncertainty in the economy, geopolitical flashpoints, and swings in other markets have all left their mark. So too, have the simple fundamentals of supply and demand.

Here’s how different commodities have performed over the last 6 and 12 months.

.jpg)

Let’s start with the shiniest of them all…

🥇 Gold Continues to Shine

The yellow metal is smashing records, and gold bugs are buzzing. It’s as if gold has been working its way through a "reasons to buy me" checklist:

- 💵 Wobbly US Dollar ✅

- 📉 Market volatility ✅

- 🌍 Global tensions ✅

- 🔥 New inflation fears ✅

- ✂️ Rate cuts are back ✅

- 🏦 Central bank stockpiling ✅

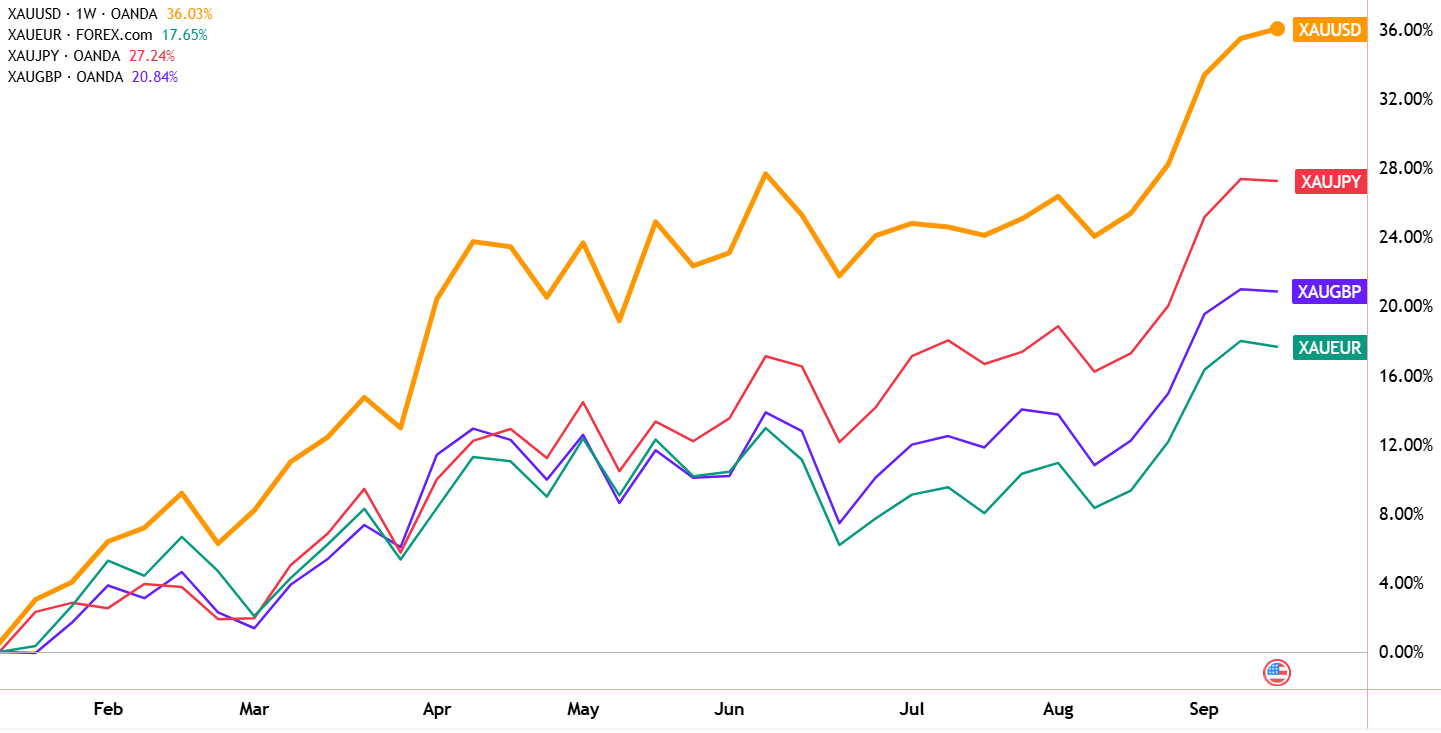

A quick look at the charts shows how much the weaker USD has helped fuel this rally. Measured in euros, pounds, or yen, the rise has been far less dramatic — but still steadily upward.

Who’s buying all the gold?

Central banks have been hoarding gold for a few years - a major driver behind the rally. That buying hasn’t stopped, but the pace has cooled over the past 12 months.

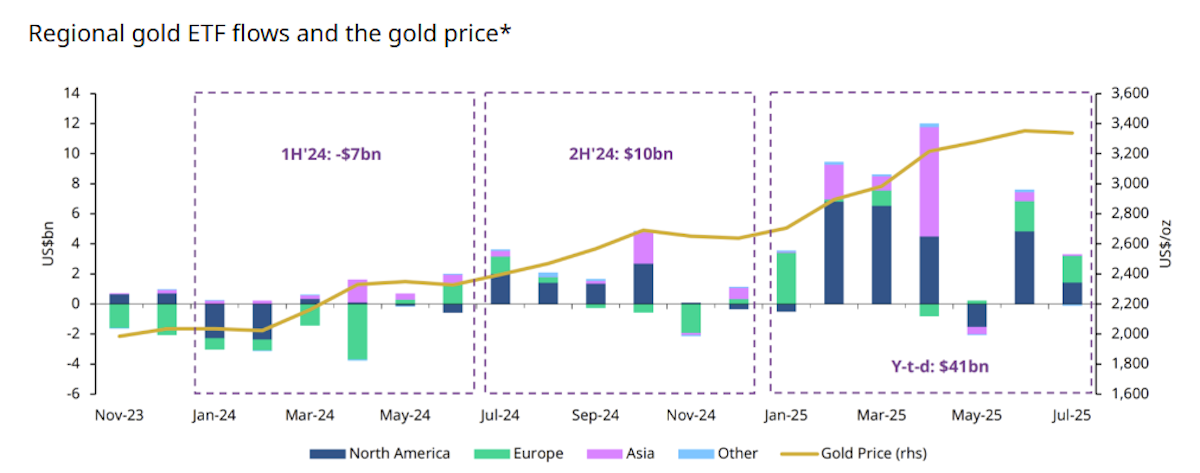

But investment demand has surged since mid-2024:

- In Q1, investors bought 552 metric tons, which is more than double the 243 tons central banks picked up.

- That’s also ahead of the 443 tons taken by the jewelry industry (traditionally the #1 source of demand).

When we say “ investment demand, ” we're talking about purchases:

- 🛒 By individuals and institutions

- 🏅 In physical form (bars, coins, etc) and via funds like ETFs

- 🎯 For investment or speculative reasons

Flows into Gold ETFs tell us more about this investment demand:

✨ We can see that the record-breaking inflows happened during the first three months of Donald Trump's current term, which brought a cocktail of a weaker dollar and tariff-fuelled chaos.

What could go wrong?

Not everyone thinks this golden run will last. Analysts at Citi are sounding a contrarian note: they see demand fading into Q4 and beyond, with prices potentially sliding to $2,500 by 2026.

Their reasoning?

- 🏦 Central banks have slowed their buying at these lofty price levels.

- 😨 Investor demand has been driven more by fear than fundamentals.

- 📈 And they believe confidence in global growth will strengthen as stimulus from the “ Big Beautiful Bill ” starts to filter through.

✨ If confidence in the global economy does improve, then their reasoning does make sense, considering gold’s narrative as a safe-haven asset. While it might seem like a big IF right now, time will tell!

You’ve likely come across plenty of bullish takes on gold (we covered some back in April ). That’s why it’s worth weighing the other side of the argument (currently Citi’s POV), because it’s the best way to make a well-informed decision.

What about the longer-term picture?

The primary catalysts for gold's continued strength are:

- ✌️ Ditching the Dollar: Around the world, central banks and investors are diversifying their holdings away from the USD.

- 🌋 Debt-ageddon!: Government balance sheets look like a horror movie. That mountain of debt is a long-term threat to the value of major currencies that continue to print money with no limit.

Last time we checked, those two catalysts are still persisting and aren’t magically fixing themselves.

⛏️ Gold Miners: Riding the Rally But Wrestling with Costs

Gold mining stocks are also on fire. The VanEck Gold Miners ETF has surged 70% over the past year, nearly double the rise in the gold price.

And funnily enough, that’s exactly what’s supposed to happen: when gold rallies, miners should outperform. But to be fair, they’ve got a lot of lost ground to make up after nearly two decades of dragging their feet.

When it comes to gold miners, the elephant in the room is costs, which often end up rising faster than the gold price.

Is it different this time?

Well, producer profit margins hit record highs in Q2. But costs are still rising. In the 12 months to March:

- Most producers saw AISC (all-in sustaining costs) jump between 5–20%.

- A few, like Alamos Gold, got hit much harder with a whopping 40% rise (here’s a narrative on it for those interested).

- A handful, like Endeavour Mining, actually reported lower costs.

Gold miners often ramp up production when prices look strong. But here’s the catch: new projects are more expensive than older ones. That means their average cost per ounce tends to creep higher, and then they get caught if or when the gold price corrects.

✨ Producers are probably more cautious than they've been in the past - but it’s crucial to keep tabs on production costs as well as the gold price.

(We covered the stark difference between investing in gold and gold miners in May last year.)

Now, onto some other well-known commodities…

🥈 Silver, Platinum, and Other Metals: Riding Gold’s Coattails

Silver and platinum are pretty much riding in gold’s slipstream right now — moving higher for the same reasons. The difference?

- Both metals have heavier industrial demand than gold.

- But neither carries quite the same “safe-haven brand value” that gold does.

🥉 Copper: From Frenzy to Fizzle

Copper had its moment in July after Trump slapped a 50% tariff on imports. Add in supply headaches at mines in Africa and South America, and the setup triggered a frenzy of buying. But that excitement has since cooled off.

🪨 Iron Ore: Slow Start, Surprise Rebound

Iron ore spent much of the year under pressure thanks to global growth worries. Then July rolled around, and China cut back on production. Prices perked up, staging a recovery from their earlier slump.

📅 Looking Ahead: A Delicate Balance

Analysts expect a mild softening in industrial metals supply/demand dynamics through 2026 due to production creeping higher while demand is expected to stay mostly flat.

At least, that’s the “base case.” But in these markets, it only takes a slight shift in demand or a supply hiccup to tilt the entire balance.

🛢️ Oil Under Pressure

2025 hasn’t been kind to oil. Prices have stayed under steady pressure as demand disappoints and supply keeps surprising to the upside.

- Demand side: Global growth has slowed, and US tariffs are muddying the outlook. Forecasts keep getting trimmed, with analysts now expecting consumption to be basically flat this year. For context, demand usually ticks up about 1% annually.

- Supply side: No slowdown here. Global production hit a record 106.9 million barrels per day (mb/d) in August. OPEC+ members are rolling back cuts faster than expected, while non-OPEC producers are adding fuel to the fire and pumping at all-time highs.

Inventories are swelling worldwide, stoking fears of a 2026 glut. Some analysts expect to see $50 a barrel in 2026.

However, reality usually turns out a little different from the forecasts.

W hile analysts kept chopping demand forecasts, actual H1 demand from OECD nations turned out stronger than expected. Why? Lower prices.

A quick reminder of how commodity markets work:

- 📉 Lower prices lead to more demand, and less supply

- 📈 Higher prices lead to less demand, and more supply

🔥 Natural Gas: The Wild Card

Unlike crude oil, which trades on a global stage, natural gas is a lot more local, and that makes it prone to some serious regional swings. The past 12 months have been a rollercoaster.

- 🇺🇸 In the US, natural gas prices spiked nearly 90% in the six months to March… only to give back about half those gains.

- 🇪🇺 In Europe, prices climbed 40% before sliding again, now sitting lower year-on-year.

Why So Volatile?

Gas markets are shaped by a tangle of moving parts:

- 🇪🇺 Europe’s supply jitters

- Uncertainty lingers, even as storage capacity expands.

- 🌍 Big-picture demand

- The long-term outlook looks bullish thanks to AI datacenters gobbling electricity and Asia’s growing energy appetite .

- 🤝 Mega deals

- The EU’s $750 billion pact with the US for LNG, oil, and nuclear fuels is a game-changer for energy flows.

- 🌦️ Weather swings

- Seasonal shifts and extreme events can send demand (and prices) lurching up or down.

💡 The Insight: Commodity Producers aren’t the Same as Other Stocks

The stocks of companies producing gold and oil are polar opposites right now.

Gold stocks are flying, while it’s hard to get too excited about oil producers.

Yet, looking at valuations, you might wonder what’s going on: Gold stocks are trading on what appears to be historically low multiples.

Here’s Newmont’s P/E ratio…

But when you look at most of the oil stocks, you’ll see them trading on much higher multiples than a few years ago. Here's Occidental’s P/E ratio…

We’ve mentioned this before, but it’s worth repeating. Commodities are as cyclical as it gets:

- 📉 When prices are low — Company profits get squeezed, making valuations look expensive because the “E” (earnings) is depressed.

- 📈 When prices are high — Margins widen, profits surge, and those multiples come down.

So if you’re sizing up a commodity stock, the trick isn’t to obsess over today’s P/E ratio. Instead:

- 👉 Look at the catalysts, both positive and negative , to build a story on what you think is most likely to unfold.

- 👉 Take a view on where the underlying commodity price is heading over the next five years and how that would impact the company's revenue and profits.

- 👉 Then work backward to figure out what you’re actually willing to pay for the stock based on those future earnings .

Those 3 elements, a story, a forecast and a fair value are the foundations for a well rounded narrative. Check out the community for more great narratives, like these ones on Cassiar Gold, Avino Silver and Gold Mines, or Chevron.

Key Events During the Next Week

Tuesday

- 🌎 S&P Global Manufacturing PMI Flash

- 📈 Forecast 49, Previous 47

- ➡️ Why it matters: A stronger reading would suggest business confidence is stabilizing.

Thursday

- 🇺🇸 US GDP Growth Rate (Final)

- 📈 Forecast 3.3%, Previous -0.5%

- ➡️ Why it matters: This is the third estimate, so forecasts are unlikely to change, but may give the market confirmation that a recession isn’t on the cards.

- 🇺🇸 US Durable Goods Orders

- 📈 Forecast -1.5%, Previous -2.8%

- ➡️ Why it matters: Manufacturing activity has been soft - an even slightly better reading would boost sentiment.

Friday

- 🇺🇸 US Core PCE Price Index YoY

- 📈 Forecast 3%, Previous 2.9%

- ➡️ Why it matters: This is the Fed’s preferred measure of inflation. As long as it’s close to consensus, the Fed’s intention to cut twice more this year should remain intact.

In the last few weeks of earnings season, we have a handful of large caps due to report:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.