- United States

- /

- Banks

- /

- NYSE:GNTY

Unveiling Undiscovered Gems in the US Market August 2025

Reviewed by Simply Wall St

As the U.S. stock market hovers near record highs, investors are closely monitoring economic indicators and major earnings reports, such as Nvidia's, which could sway broader market sentiment. Amidst this backdrop, identifying promising small-cap stocks requires a keen eye for companies with solid fundamentals and growth potential that may not yet be reflected in their current valuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Northfield Bancorp (Staten Island NY) (NFBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Northfield Bancorp, Inc. (Staten Island, NY) is the bank holding company for Northfield Bank, offering various banking services to individuals and corporate clients, with a market cap of $482.91 million.

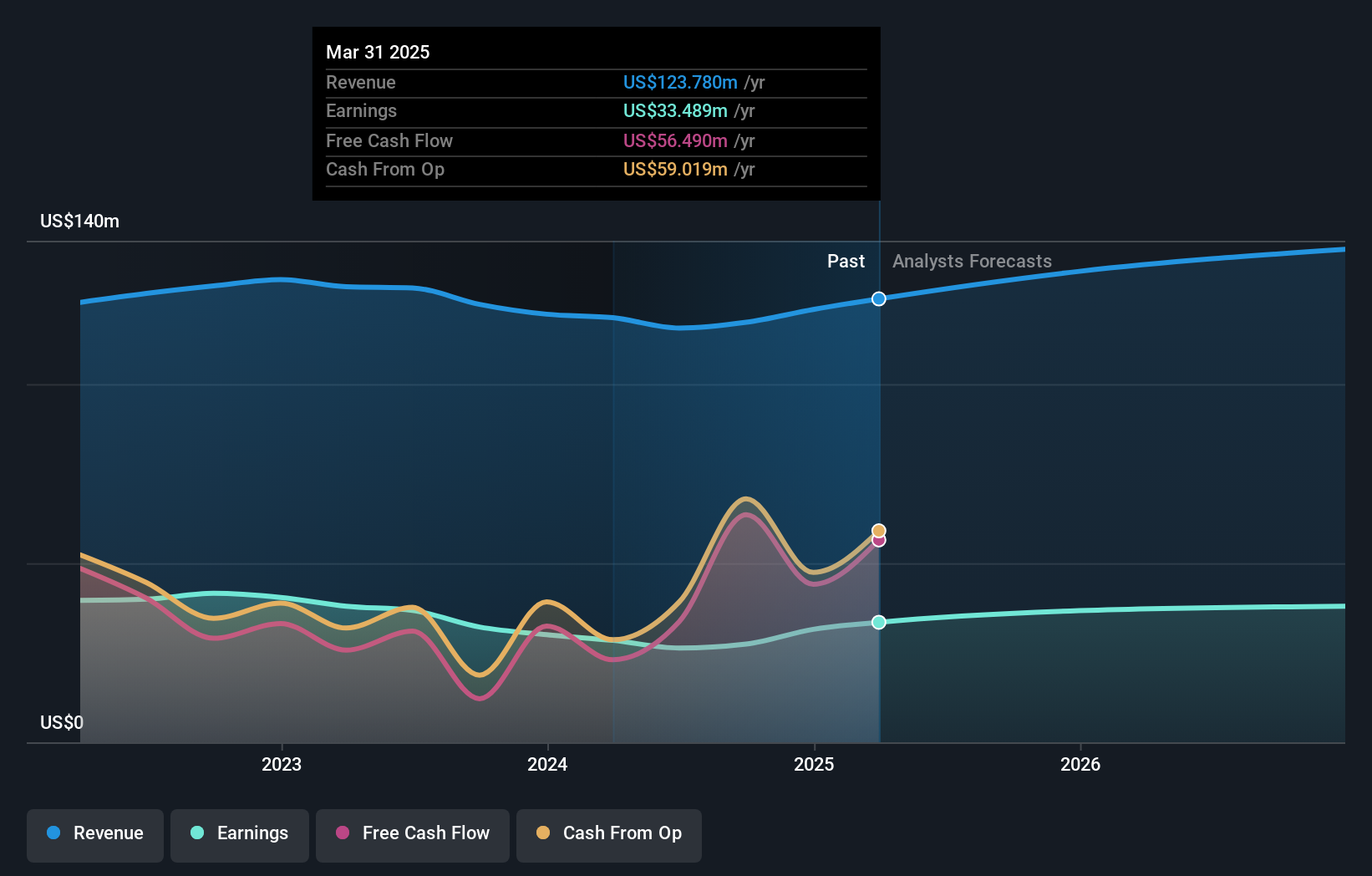

Operations: Northfield Bancorp generates revenue primarily from its banking services, amounting to $133.08 million. The company's net profit margin reflects its financial efficiency in managing costs and generating profits from its operations.

Northfield Bancorp, a dynamic player in the financial sector, showcases robust health with total assets of US$5.7 billion and equity at US$710.3 million. The company benefits from low-risk funding sources, as 80% of its liabilities are customer deposits. With a price-to-earnings ratio of 14x, it offers good value compared to the broader market's 19.2x. Its earnings growth outpaced industry norms by achieving a notable 23.3% rise over the past year while maintaining an appropriate bad loan allowance at 0.4%. Recent share buybacks saw Northfield repurchase over 862,000 shares for US$10 million, reflecting confidence in its prospects.

Sohu.com (SOHU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sohu.com Limited is an online media platform and gaming company offering online products and services on PCs and mobile devices in China, with a market cap of $482.55 million.

Operations: Sohu.com generates revenue primarily through its online advertising and gaming segments. The company's cost structure is influenced by content acquisition, marketing, and technology expenses. Its net profit margin has shown fluctuations over recent periods, reflecting changes in operational efficiency and market conditions.

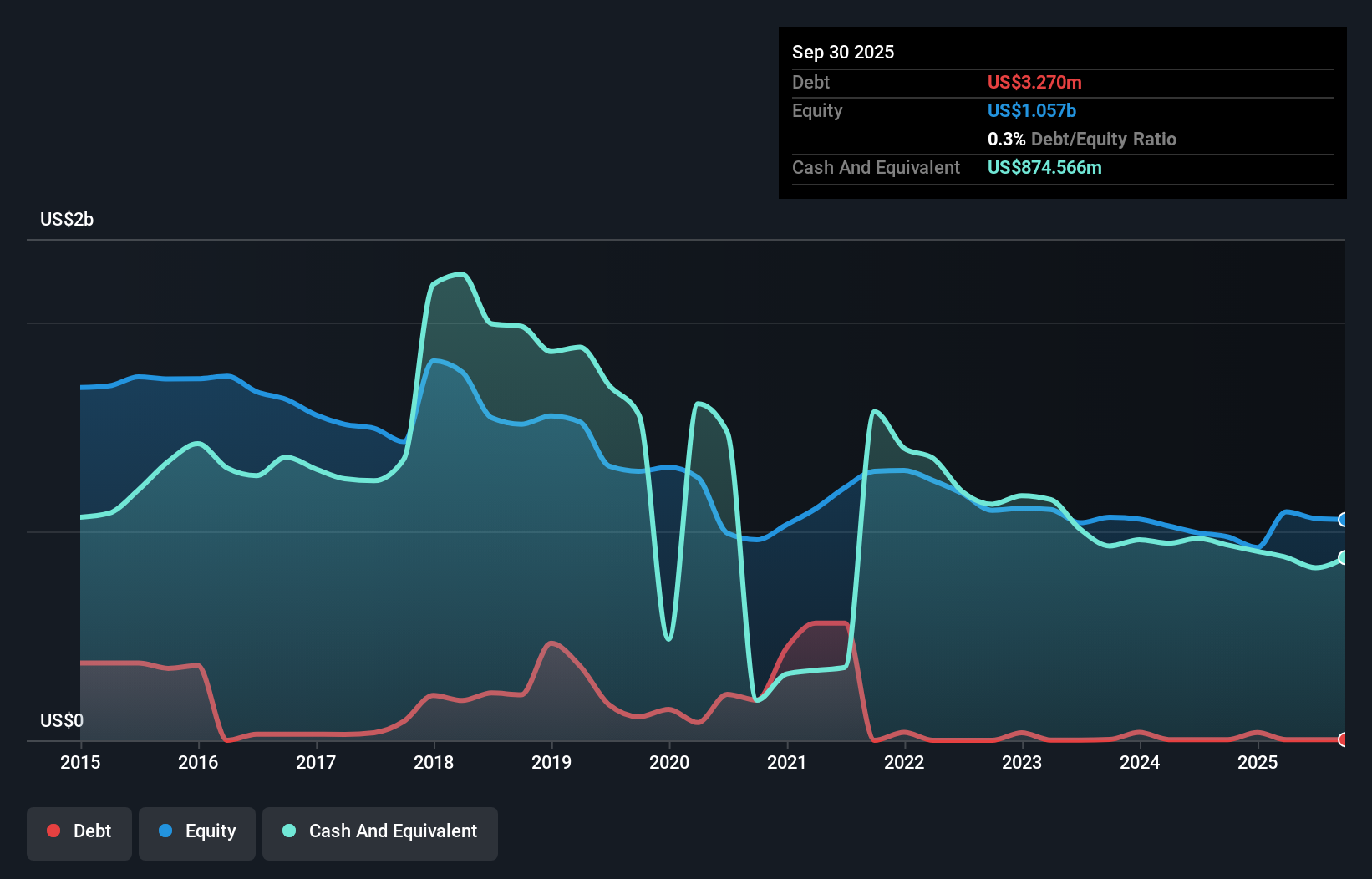

Sohu.com has shown resilience with its debt to equity ratio dropping from 22.2% to a mere 0.3% over five years, reflecting solid financial management. Despite a forecasted earnings decline of 133.3% annually for the next three years, Sohu's price-to-earnings ratio stands at an attractive 3.9x against the US market's 19.2x, suggesting potential undervaluation in this small cap space. The company repurchased nearly 21% of its shares since late 2023, indicating confidence in its value proposition despite reporting a net loss of US$20 million in Q2 2025 compared to US$37 million the previous year.

- Delve into the full analysis health report here for a deeper understanding of Sohu.com.

Gain insights into Sohu.com's past trends and performance with our Past report.

Guaranty Bancshares (GNTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Guaranty Bancshares, Inc. is a bank holding company for Guaranty Bank & Trust, N.A., with a market capitalization of $546.73 million.

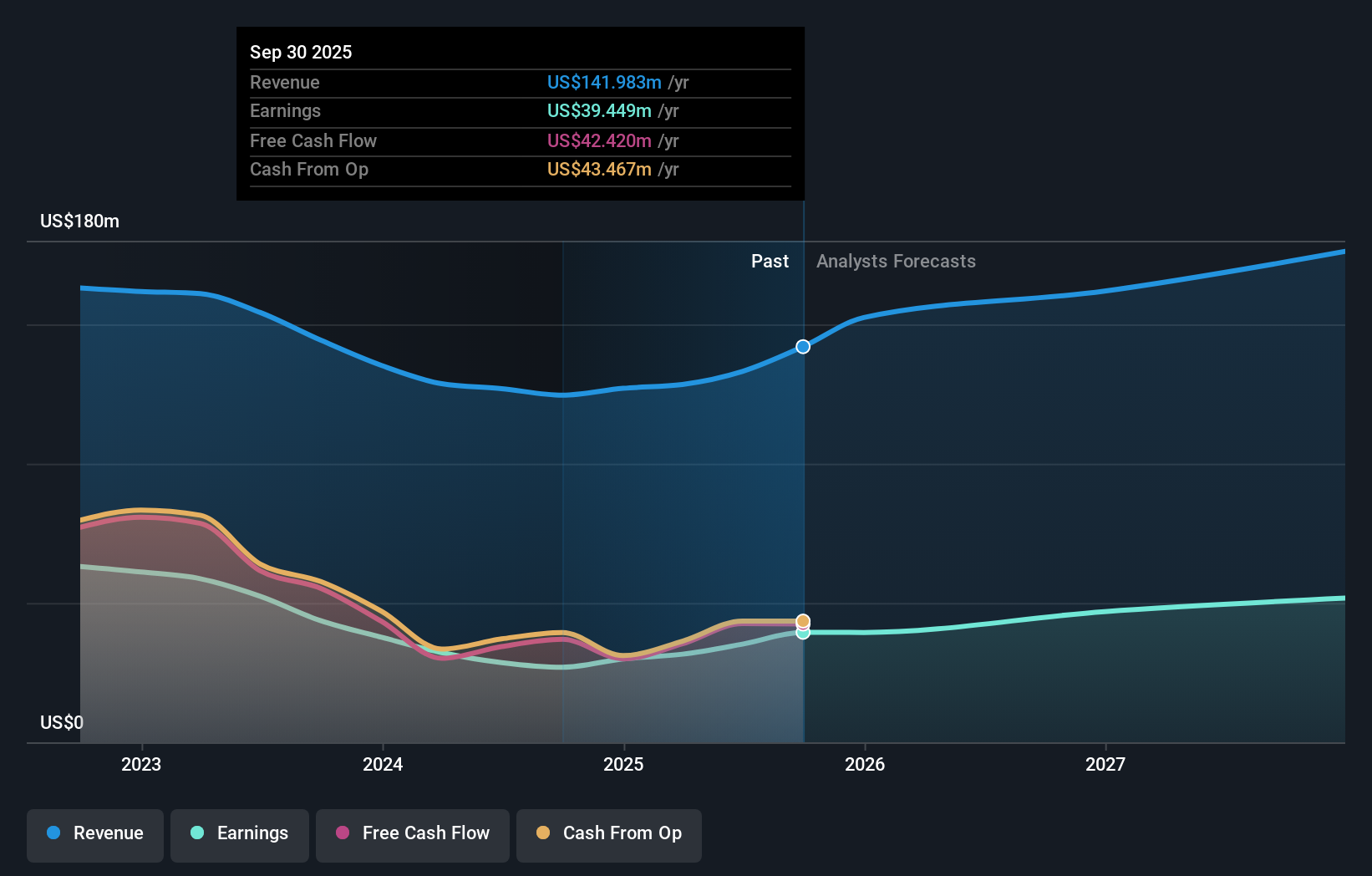

Operations: Guaranty Bancshares generates revenue primarily from its banking segment, amounting to $127.33 million. The company's financial performance is reflected in its net profit margin, which stands at 25%.

Guaranty Bancshares, with assets totaling $3.1 billion and equity of $331.8 million, stands out for its robust financial health. The bank's total deposits amount to $2.7 billion, while loans reach $2.1 billion, supported by a sufficient allowance for bad loans at 0.5% of total loans and low-risk funding sources making up 96% of liabilities. Recent earnings growth of 37% surpasses the industry average, reflecting high-quality past earnings and strong operational performance. Additionally, the company repurchased shares worth $10.69 million this year and has been added to multiple Russell Growth Indexes, enhancing its market visibility and potential investor interest.

Turning Ideas Into Actions

- Get an in-depth perspective on all 285 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNTY

Guaranty Bancshares

Operates as the bank holding company for Guaranty Bank & Trust, N.A.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)