- United States

- /

- Chemicals

- /

- NYSE:EMN

3 US Dividend Stocks Offering Up To 3.6% Yield

Reviewed by Simply Wall St

Amidst a fluctuating market landscape, where recent gains in major indices like the S&P 500 and Nasdaq are tempered by a stumble in the anticipated Santa Claus rally, investors are increasingly turning their attention to dividend stocks for stability and income. In this environment, identifying stocks with solid fundamentals and reliable dividend yields can offer a measure of predictability and potential income, making them an attractive option for those looking to navigate uncertain times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.22% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.66% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 4.45% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.71% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.53% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.74% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

Click here to see the full list of 153 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

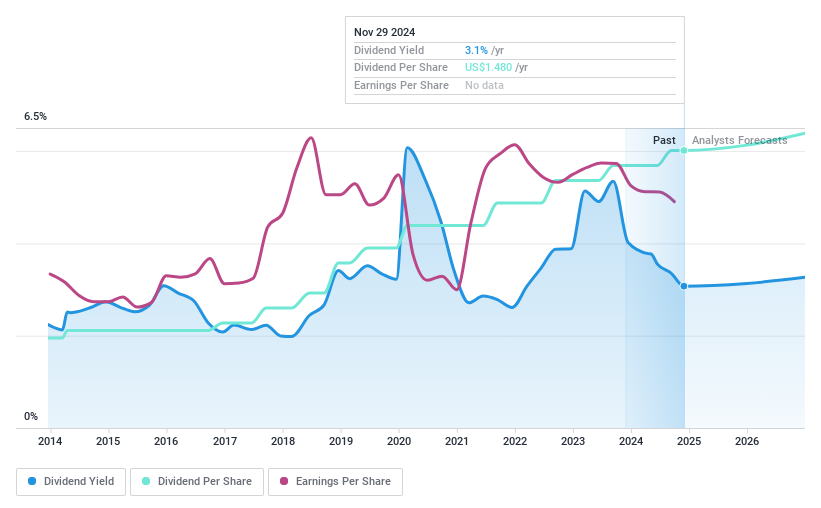

Fifth Third Bancorp (NasdaqGS:FITB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fifth Third Bancorp is a bank holding company for Fifth Third Bank, National Association, offering a variety of financial products and services in the United States, with a market cap of $28.86 billion.

Operations: Fifth Third Bancorp generates revenue through its key segments, including Commercial Banking at $3.89 billion, Wealth and Asset Management at $807 million, and Consumer and Small Business Banking at $5.19 billion.

Dividend Yield: 3.4%

Fifth Third Bancorp offers a reliable dividend, recently affirming a US$0.37 per share payout for Q4 2024. Its dividends have been stable and growing over the past decade, with a current payout ratio of 47%, indicating sustainability. Despite trading below its estimated fair value, insider selling has occurred recently. Earnings are forecasted to grow annually by 8.32%, supporting future dividend coverage with a projected payout ratio of 40% in three years.

- Unlock comprehensive insights into our analysis of Fifth Third Bancorp stock in this dividend report.

- The analysis detailed in our Fifth Third Bancorp valuation report hints at an deflated share price compared to its estimated value.

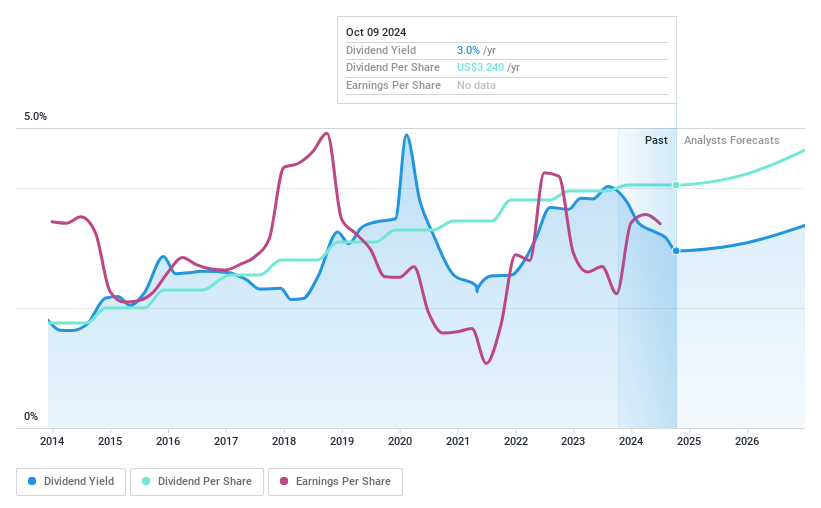

Eastman Chemical (NYSE:EMN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eastman Chemical Company is a specialty materials company operating in the United States, China, and internationally, with a market cap of approximately $10.61 billion.

Operations: Eastman Chemical Company's revenue is primarily derived from its Advanced Materials segment at $3.04 billion, Additives & Functional Products at $2.81 billion, Chemical Intermediates at $2.14 billion, and Fibers at $1.34 billion.

Dividend Yield: 3.6%

Eastman Chemical recently increased its quarterly dividend to US$0.83 per share, maintaining a reliable and stable dividend history over the past decade. The company's dividends are well covered by earnings with a payout ratio of 43% and cash flows at 64.6%. While trading below estimated fair value, it faces high debt levels. Recent buybacks support shareholder value, but its dividend yield of 3.63% is lower than top-tier payers in the US market.

- Delve into the full analysis dividend report here for a deeper understanding of Eastman Chemical.

- Upon reviewing our latest valuation report, Eastman Chemical's share price might be too pessimistic.

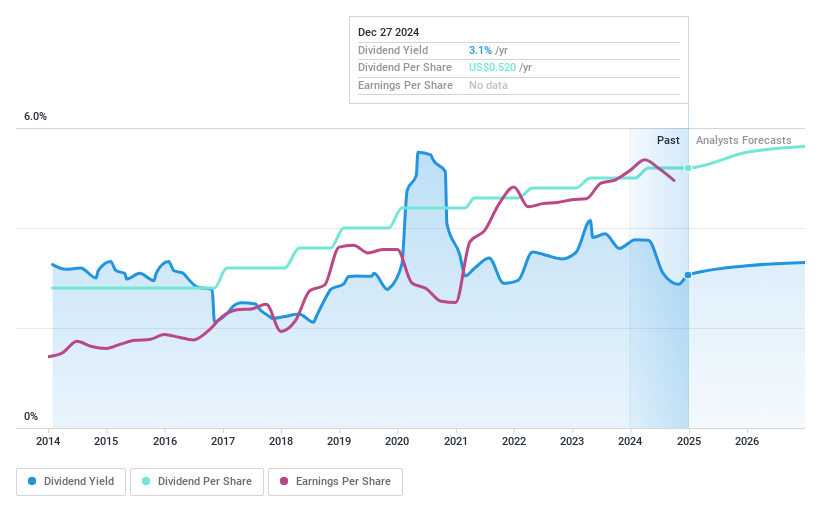

First Commonwealth Financial (NYSE:FCF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Commonwealth Financial Corporation is a financial holding company offering consumer and commercial banking services in the United States, with a market cap of $1.74 billion.

Operations: First Commonwealth Financial Corporation generates revenue primarily through its banking segment, which accounted for $456.47 million.

Dividend Yield: 3%

First Commonwealth Financial provides a stable dividend history with a 3.04% yield, lower than top-tier US payers. Dividends have grown steadily over the past decade and are well-covered by earnings, with a low payout ratio of 34.7%. The company is trading below its estimated fair value, offering potential relative value. Recent executive changes aim to enhance risk management, while recent buybacks and dividend increases reflect shareholder-friendly actions despite recent net charge-offs impacting earnings.

- Dive into the specifics of First Commonwealth Financial here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of First Commonwealth Financial shares in the market.

Taking Advantage

- Click through to start exploring the rest of the 150 Top US Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastman Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMN

Eastman Chemical

Operates as a specialty materials company in the United States, China, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives