- United States

- /

- Banks

- /

- NYSE:FBK

FB Financial (FBK) Margin Decline Raises Doubt on Premium Valuation Despite Strong Growth Outlook

Reviewed by Simply Wall St

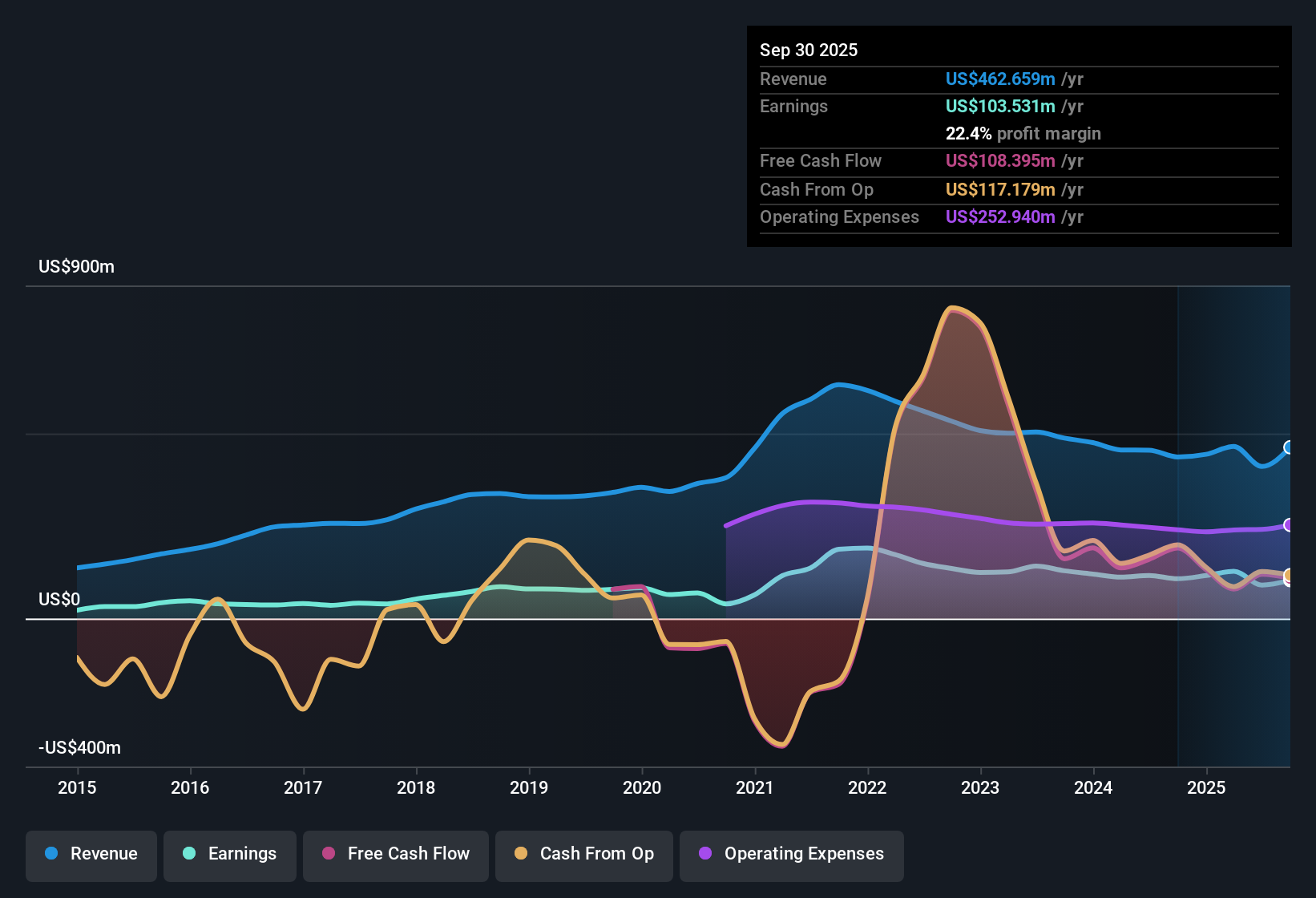

FB Financial (FBK) reported that earnings have declined at a rate of 1.4% per year over the last five years, while net profit margins narrowed to 22.4% from 24.6% a year ago. The company trades at a Price-to-Earnings Ratio of 30.5x, which is significantly above both the US banks industry average of 11.5x and the peer average of 14.2x. However, the current share price of $58.6 sits below its estimated fair value of $89.44. Looking forward, robust growth forecasts for both earnings and revenue could be a driving force for investors weighing whether FB Financial’s premium valuation is justified.

See our full analysis for FB Financial.Now, let's see how these headline results stack up against the dominant narratives and expectations surrounding FB Financial. Which storylines hold up, and which might be due for a rethink?

See what the community is saying about FB Financial

Analysts See Major EPS Upside by 2028

- Consensus estimates point to earnings jumping from $90.4 million today to $526.0 million by September 2028, with earnings per share reaching $8.92 if those numbers materialize.

- The analysts' consensus view heavily supports the bullish case for rapid future growth, with key supporting factors as follows:

- Revenue is forecast to climb 42.2% annually over the next three years, well ahead of the US market’s 15.5% rate.

- Consensus expects profit margins to nearly double from 22.0% to 44.5% in the same period, assuming smooth merger integration and continued success in new loan segments.

- It is important to sense check these optimistic projections, as analysts believe the current price already reflects a premium for growth that is not guaranteed.

Consensus sees rapid scale and lending expansion, but will higher EPS last if costs or competition revive?

📊 Read the full FB Financial Consensus Narrative.

Margin Expansion Faces Integration and Competition Risks

- The recent decline in net profit margin from 24.6% to 22.4% indicates that even with higher future growth, near-term profitability can lag if costs increase or competition intensifies.

- Bears highlight significant uncertainties in the consensus narrative and stress key risks:

- The planned Southern States Bank merger brings execution risk. Operational challenges or delayed synergies could affect margin improvement targets.

- Elevated charge-offs in the Commercial and Industrial portfolio and pressure on deposit costs may offset gains if macro conditions worsen.

Premium PE Ratio Hinges on Growth Delivering

- FB Financial’s 30.5x Price-to-Earnings multiple is more than double the US banks average (11.5x) and peer group (14.2x). The stock currently trades well below its DCF fair value of $94.99, at $56.86 per share.

- Analysts’ consensus narrative poses a challenge in justifying this valuation, as strong belief in forecasted revenue and profit expansion is required:

- If 2028 projections hold, the stock’s future PE ratio would compress to 8.8x, which suggests investors expect today’s premium to disappear as earnings increase.

- Alternatively, any missteps or slower growth could leave FB Financial appearing expensive for a longer period, with less margin for error compared to industry peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for FB Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own angle on these results? Take just a few minutes to put your view on record and guide the conversation by participating here: Do it your way.

A great starting point for your FB Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

FB Financial’s ability to deliver on ambitious growth targets is uncertain. Recent margin pressures and a lofty valuation raise the risk of disappointment.

If you want more dependable growth and less valuation risk, zero in on opportunities with proven upside and better fundamentals using our stable growth stocks screener (2096 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBK

FB Financial

Operates as a bank holding company for FirstBank that provides a suite of commercial and consumer banking services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)