- United States

- /

- Oil and Gas

- /

- NYSE:MUR

3 Outstanding Dividend Stocks Yielding Up To 6%

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, though it is up 5.7% over the past year with earnings forecasted to grow by 13% annually. In such a climate, dividend stocks yielding up to 6% can offer investors a compelling blend of income and potential growth, making them an attractive option for those seeking stability and returns in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.49% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.51% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.18% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.23% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 5.08% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.75% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.22% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.08% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.34% | ★★★★★★ |

Click here to see the full list of 170 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Shore Bancshares (NasdaqGS:SHBI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shore Bancshares, Inc., with a market cap of $411.90 million, operates as a bank holding company for Shore United Bank, N.A.

Operations: Shore Bancshares, Inc. generates revenue primarily through its Community Banking segment, which accounts for $196.96 million.

Dividend Yield: 3.8%

Shore Bancshares offers a reliable dividend with a current yield of 3.84%, although it's below the top tier in the US market. The company's dividends are well covered by earnings, with a low payout ratio of 36.4% and forecasted to improve to 28.1% in three years, suggesting sustainability. Recent executive changes include appointing Charles S. Cullum as CFO, potentially impacting future financial strategies positively given his extensive experience in finance roles at Sandy Spring Bancorp.

- Click here and access our complete dividend analysis report to understand the dynamics of Shore Bancshares.

- Insights from our recent valuation report point to the potential undervaluation of Shore Bancshares shares in the market.

ConocoPhillips (NYSE:COP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ConocoPhillips is involved in the exploration, production, transportation, and marketing of crude oil, bitumen, natural gas, LNG, and natural gas liquids with a market cap of approximately $109.17 billion.

Operations: ConocoPhillips generates revenue from several segments, including Alaska ($6.55 billion), Canada ($5.64 billion), Lower 48 ($37.03 billion), Asia Pacific ($2.94 billion), and Europe, Middle East, and North Africa ($6.37 billion).

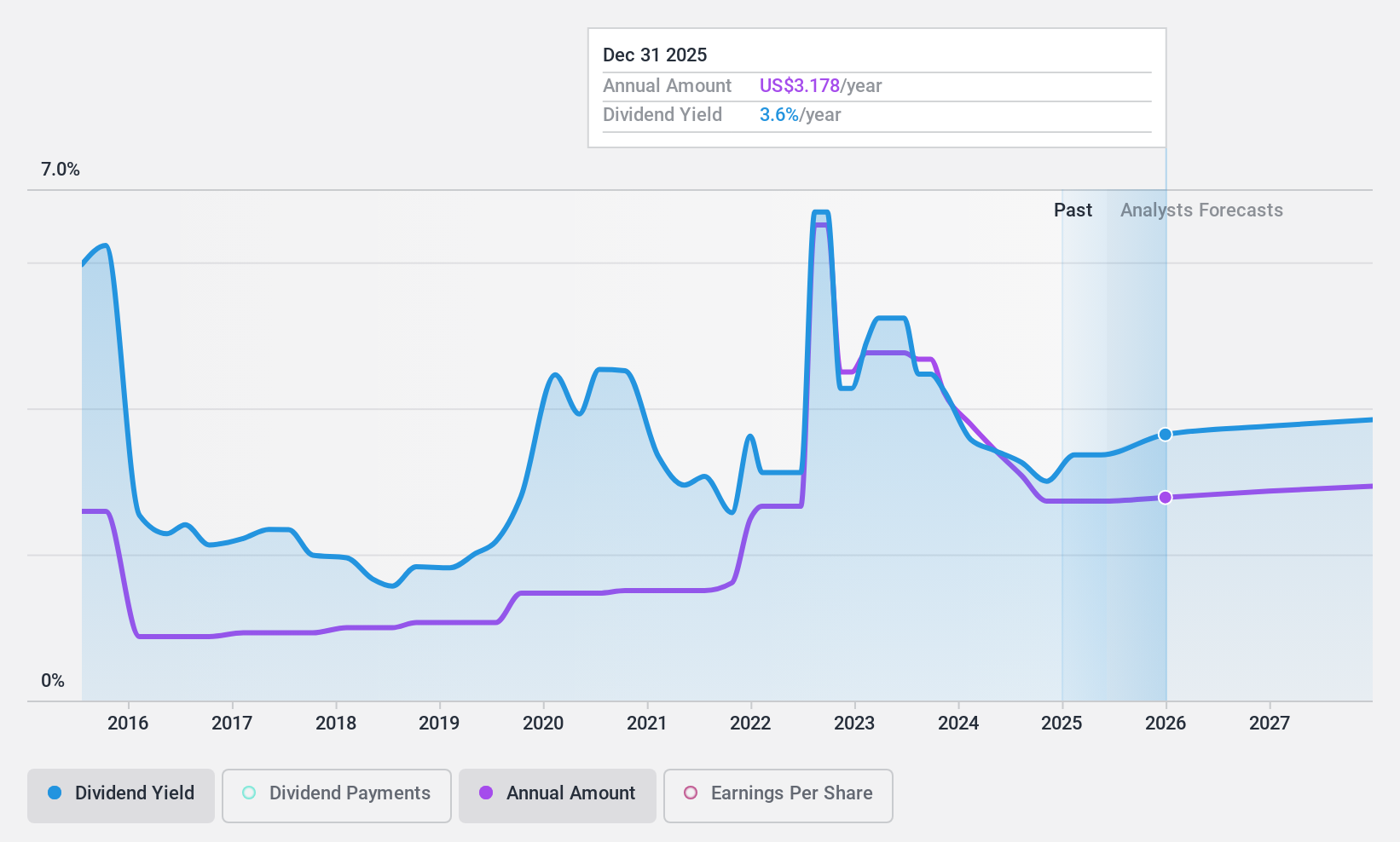

Dividend Yield: 3.5%

ConocoPhillips' dividend yield of 3.51% is lower than the top 25% of US dividend payers but remains well-covered by earnings and cash flows, with payout ratios of 39.9% and 49.3%, respectively. However, its dividend history has been volatile over the past decade despite recent increases. Recent shareholder activism challenges include proposals to remove emissions targets, which the board opposes, potentially affecting investor sentiment ahead of their May meeting.

- Unlock comprehensive insights into our analysis of ConocoPhillips stock in this dividend report.

- Our valuation report unveils the possibility ConocoPhillips' shares may be trading at a discount.

Murphy Oil (NYSE:MUR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Murphy Oil Corporation, with a market cap of approximately $2.94 billion, operates as an oil and gas exploration and production company in the United States, Canada, and internationally.

Operations: Murphy Oil Corporation generates revenue primarily from its exploration and production activities, with $2.50 billion from the United States and $508.20 million from Canada.

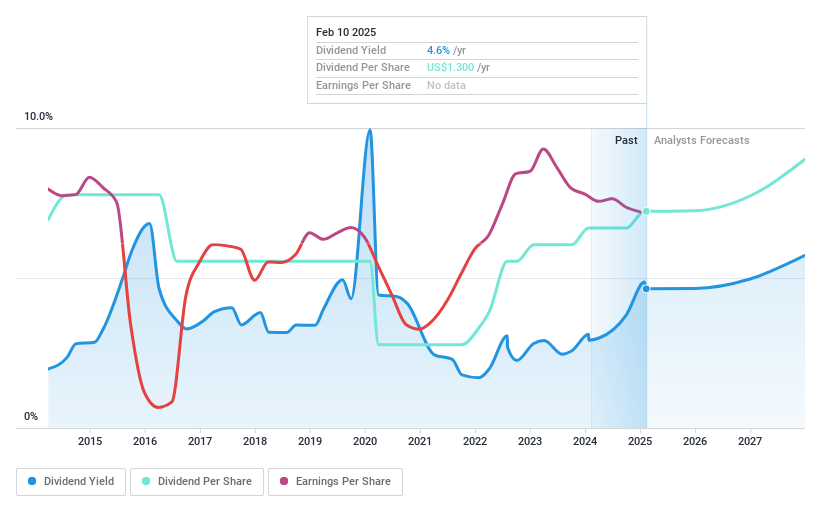

Dividend Yield: 6.1%

Murphy Oil Corporation offers a dividend yield of 6.08%, ranking it among the top 25% of US dividend payers, with dividends well-covered by earnings and cash flows at payout ratios of 43.9% and 22.6%, respectively. However, its dividend history has been unstable over the past decade, showing volatility despite recent affirmations of a quarterly cash dividend at $0.325 per share amid strategic business expansions in the Gulf of America.

- Navigate through the intricacies of Murphy Oil with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Murphy Oil is trading behind its estimated value.

Make It Happen

- Investigate our full lineup of 170 Top US Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Murphy Oil, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUR

Murphy Oil

Operates as an oil and gas exploration and production company in the United States, Canada, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives