- United States

- /

- Banks

- /

- NasdaqGS:RBCA.A

3 Undiscovered Gems In The US Market To Enhance Your Portfolio

Reviewed by Simply Wall St

In the current U.S. market landscape, major indices like the Dow Jones Industrial Average have experienced fluctuations, with tech stocks under pressure due to AI bubble concerns. Despite these challenges, opportunities remain in identifying lesser-known stocks that can add value to a diversified portfolio. A good stock in this context is one that demonstrates resilience and potential for growth even amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Village Farms International (VFF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Village Farms International, Inc. operates in North America as a producer, marketer, and distributor of greenhouse-grown tomatoes, bell peppers, cucumbers, and mini-cukes with a market capitalization of $471.31 million.

Operations: Village Farms International derives its revenue primarily from its Produce segment, contributing $167.85 million, and the Cannabis - Canada segment, adding $160.14 million. The company also generates revenue from the U.S. Cannabis market at $15.70 million and Clean Energy at $1.74 million.

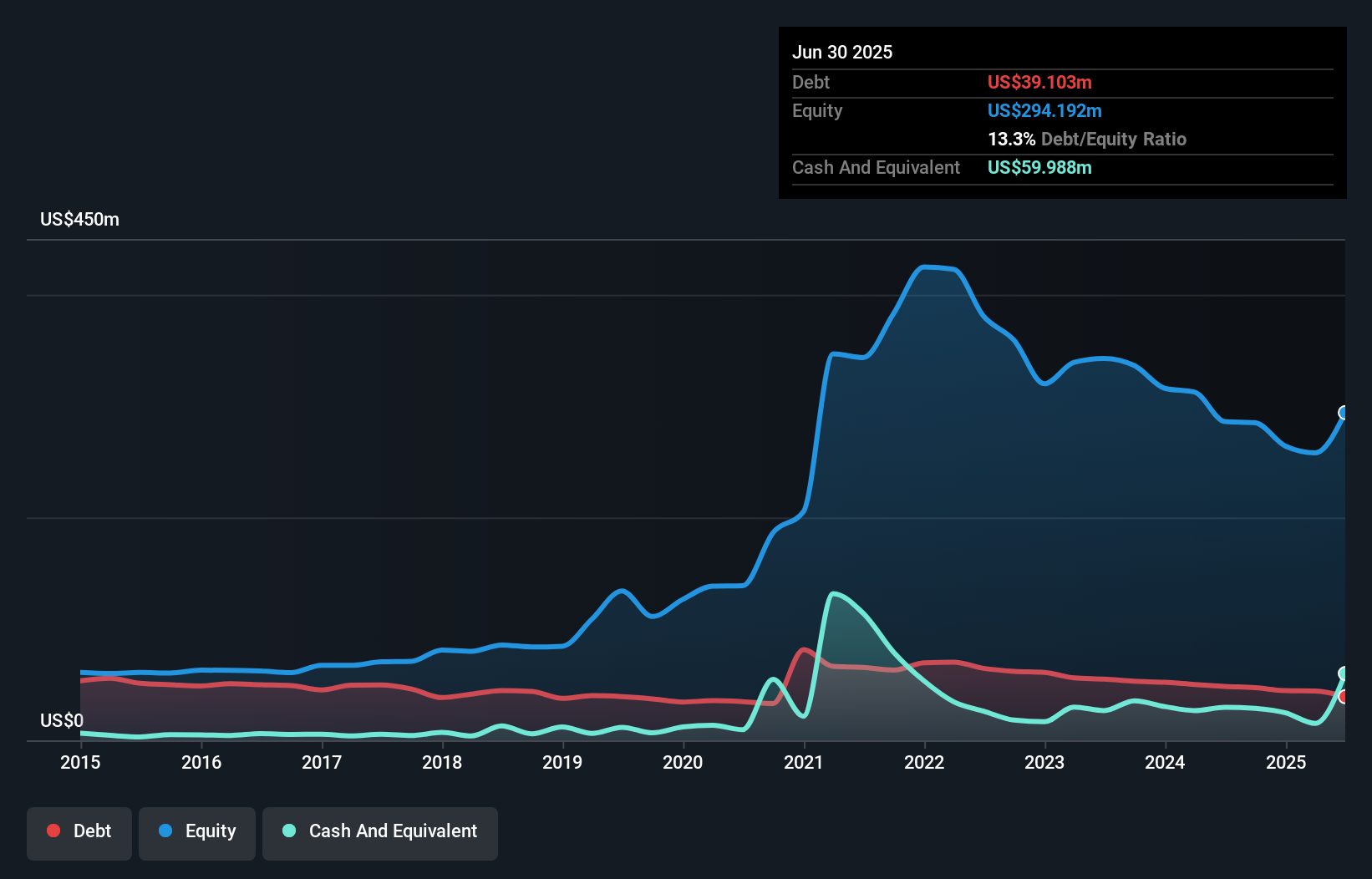

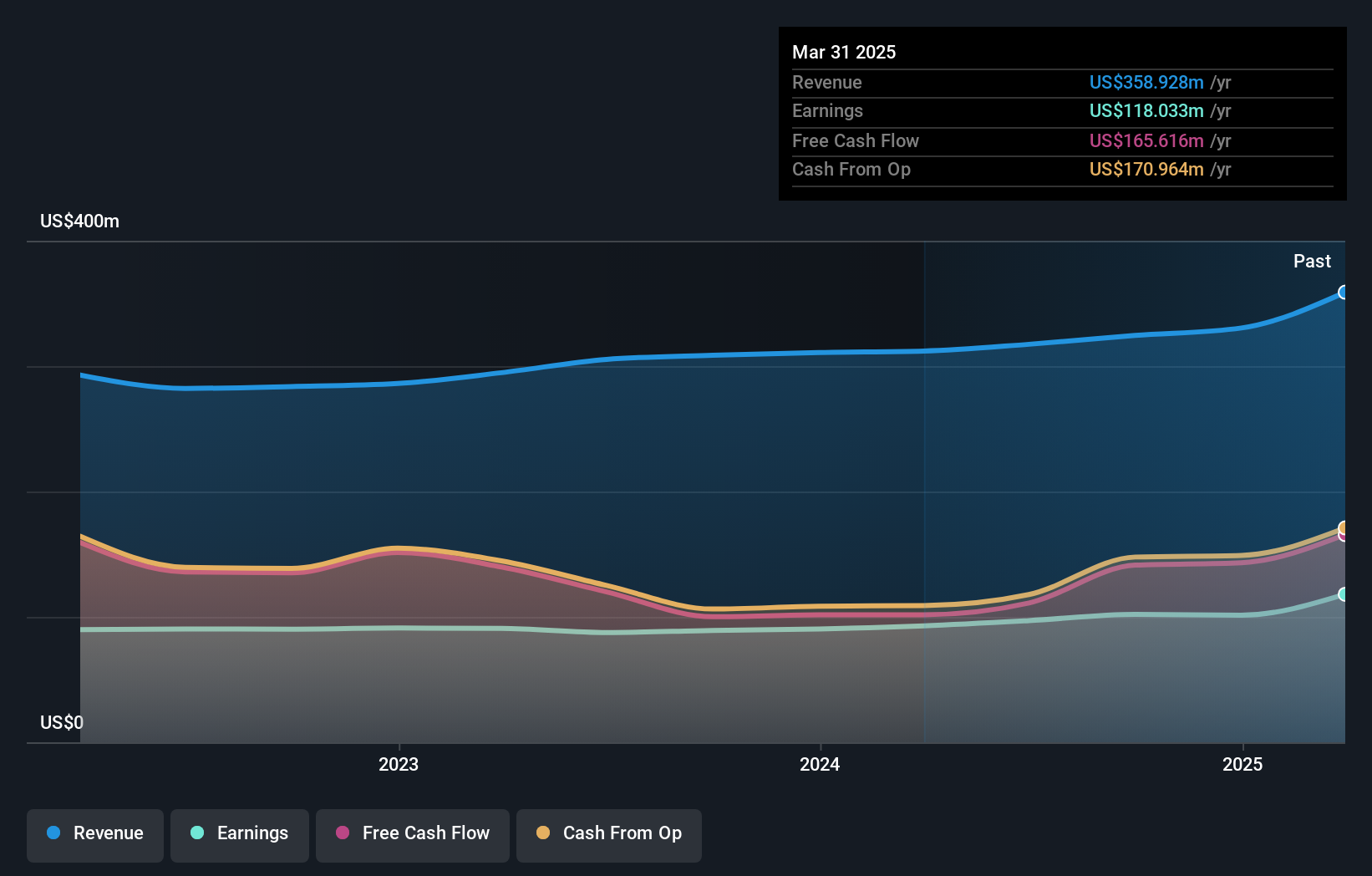

Village Farms International is carving a niche in the cannabis sector with its recent launch of Promenade's Matin vape, tapping into Quebec's regulated market. The company reported a notable turnaround with third-quarter sales of US$66.74 million and net income of US$10.22 million, compared to a loss last year. Despite its high volatility and significant insider selling recently, VFF has more cash than debt and boasts an improved debt-to-equity ratio from 17.7% to 11.3% over five years. Earnings are forecasted to grow nearly 55% annually, though interest coverage remains tight at 2.9 times EBIT.

Republic Bancorp (RBCA.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Republic Bancorp, Inc. is a bank holding company for Republic Bank & Trust Company, offering a range of banking products and services in the United States with a market cap of $1.45 billion.

Operations: The company's revenue streams include Core Banking with Warehouse Lending and Traditional Banking contributing $14.15 million and $267.14 million, respectively, while the Republic Processing Group (RPG) adds revenue through Tax Refund Solutions at $32.66 million, Republic Credit Solutions at $47.90 million, and Republic Payment Solutions at $16.43 million.

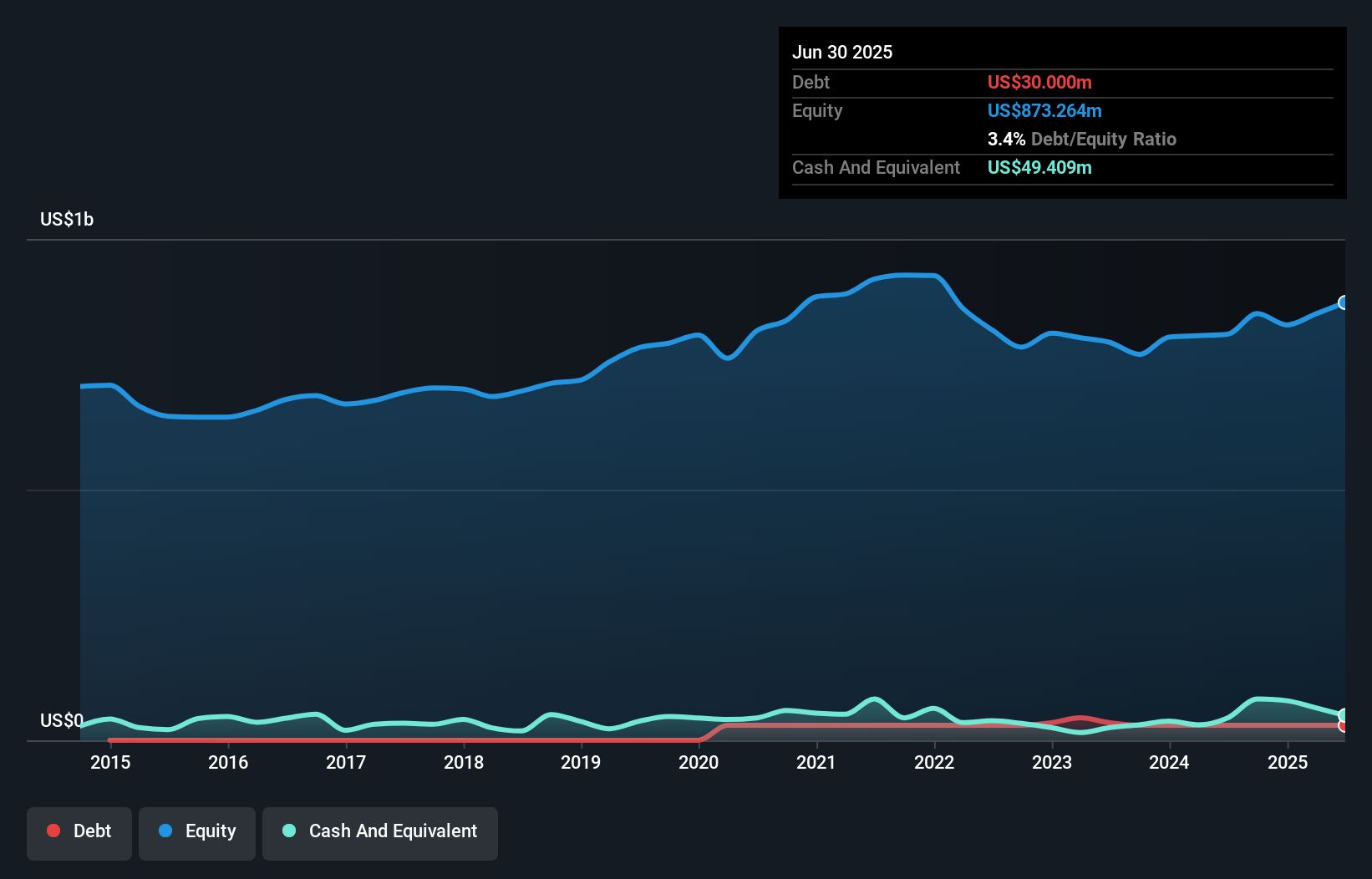

Republic Bancorp, with total assets of US$7 billion and equity of US$1.1 billion, shows strong fundamentals. The company boasts a net interest margin of 4.9% and maintains an appropriate level of bad loans at 0.4%, supported by a sufficient allowance for bad loans at 368%. Deposits stand at US$5.3 billion against loans totaling US$5.2 billion, indicating robust financial health with primarily low-risk funding sources comprising 90% customer deposits. Despite earnings growth outpacing the industry last year by reaching 25%, future earnings are expected to decline annually by an average of 3.3% over the next three years, suggesting cautious optimism moving forward.

- Click to explore a detailed breakdown of our findings in Republic Bancorp's health report.

Evaluate Republic Bancorp's historical performance by accessing our past performance report.

Safety Insurance Group (SAFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Safety Insurance Group, Inc. operates in the United States offering private passenger and commercial automobile insurance as well as homeowner insurance, with a market cap of approximately $1.17 billion.

Operations: Revenue is primarily generated from property and casualty insurance operations, totaling $1.23 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Safety Insurance Group, with its nimble market presence, has shown a solid performance recently. Net income for the third quarter reached US$28.31 million, up from US$25.89 million last year, while revenue climbed to US$326.62 million from US$295.28 million in the same period last year. The debt-to-equity ratio improved slightly over five years from 3.6 to 3.3, and earnings growth of 16.5% outpaced the insurance industry average of 11.6%. With a price-to-earnings ratio at 13.5x below the broader market's 19.1x and robust interest coverage of over 100 times by EBIT, Safety Insurance seems well-positioned financially.

- Unlock comprehensive insights into our analysis of Safety Insurance Group stock in this health report.

Learn about Safety Insurance Group's historical performance.

Where To Now?

- Embark on your investment journey to our 300 US Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RBCA.A

Republic Bancorp

Operates as a bank holding company for Republic Bank & Trust Company that provides various banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)