- United States

- /

- Banks

- /

- NYSE:CPF

3 Dividend Stocks In US With Up To 4% Yield

Reviewed by Simply Wall St

As of mid-February 2025, the U.S. stock market has been characterized by a mix of optimism and caution, with the S&P 500 nearing an all-time high and major indexes posting weekly gains despite mixed economic signals. In this environment, dividend stocks with yields up to 4% can offer investors a blend of income and potential stability, making them an attractive option for those looking to navigate uncertain market conditions while seeking consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.25% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.88% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.34% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.27% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.86% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.75% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.82% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

Value Line (NasdaqCM:VALU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Value Line, Inc. is involved in the production and sale of investment periodicals and related publications, with a market cap of $323.59 million.

Operations: Value Line, Inc.'s revenue is primarily derived from its publishing segment, which generated $35.86 million.

Dividend Yield: 3.5%

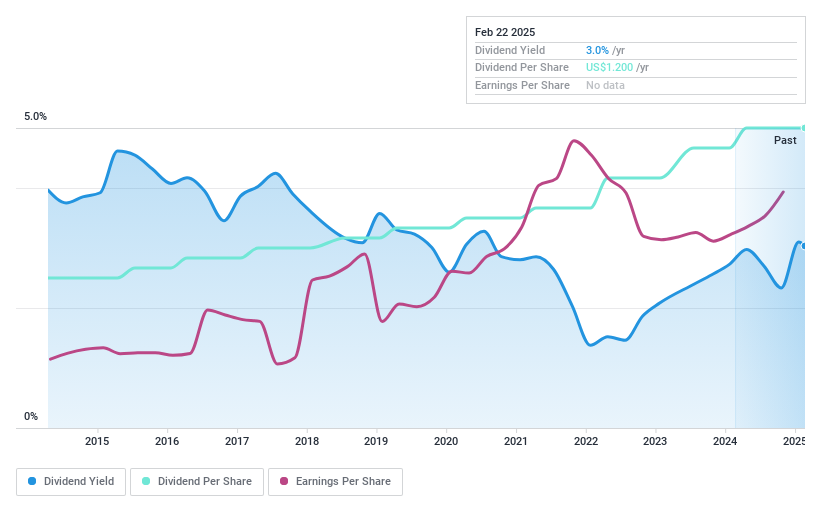

Value Line, Inc. declared a quarterly dividend of US$0.30 per share for February 2025, reflecting its stable and reliable dividend history over the past decade. Despite trading 13.2% below estimated fair value, its dividends are well-covered by earnings and cash flows with payout ratios of 50% and 56.9%, respectively. While the current yield of 3.49% is below top-tier U.S. dividend payers, consistent earnings growth supports sustainable payouts amidst recent revenue declines to US$8.84 million in Q2 2024 from US$9.61 million a year ago.

- Delve into the full analysis dividend report here for a deeper understanding of Value Line.

- In light of our recent valuation report, it seems possible that Value Line is trading behind its estimated value.

Penns Woods Bancorp (NasdaqGS:PWOD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Penns Woods Bancorp, Inc. is the bank holding company for Jersey Shore State Bank, offering commercial and retail banking services to a diverse clientele, with a market cap of $237.42 million.

Operations: Penns Woods Bancorp, Inc. generates revenue of $68.38 million from its Community Banking segment.

Dividend Yield: 4.1%

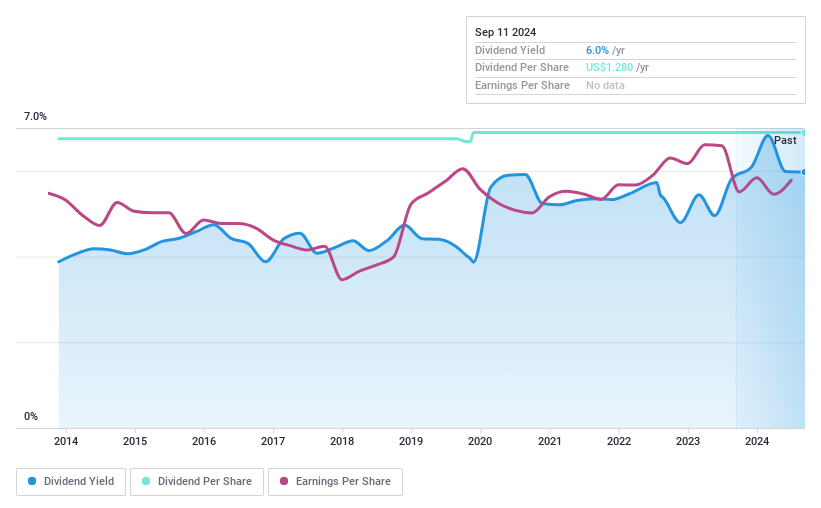

Penns Woods Bancorp declared a reliable US$0.32 per share dividend for Q4 2024, maintaining its stable payout history. Despite a lower yield of 4.07% compared to top-tier U.S. dividend payers, its dividends are well-covered by earnings with a payout ratio of 54.4%. Recent earnings show mixed results: Q4 net income fell to US$3.74 million from US$5.56 million last year, while full-year net income rose slightly to US$17.74 million amidst an impending acquisition by Northwest Bancshares valued at $260 million, expected to complete in Q3 2025.

- Unlock comprehensive insights into our analysis of Penns Woods Bancorp stock in this dividend report.

- Our expertly prepared valuation report Penns Woods Bancorp implies its share price may be too high.

Central Pacific Financial (NYSE:CPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central Pacific Financial Corp. is a bank holding company for Central Pacific Bank, offering a variety of commercial banking products and services to businesses, professionals, and individuals in the United States, with a market cap of $800.03 million.

Operations: Central Pacific Financial Corp.'s revenue from its banking segment amounts to $240.63 million.

Dividend Yield: 3.7%

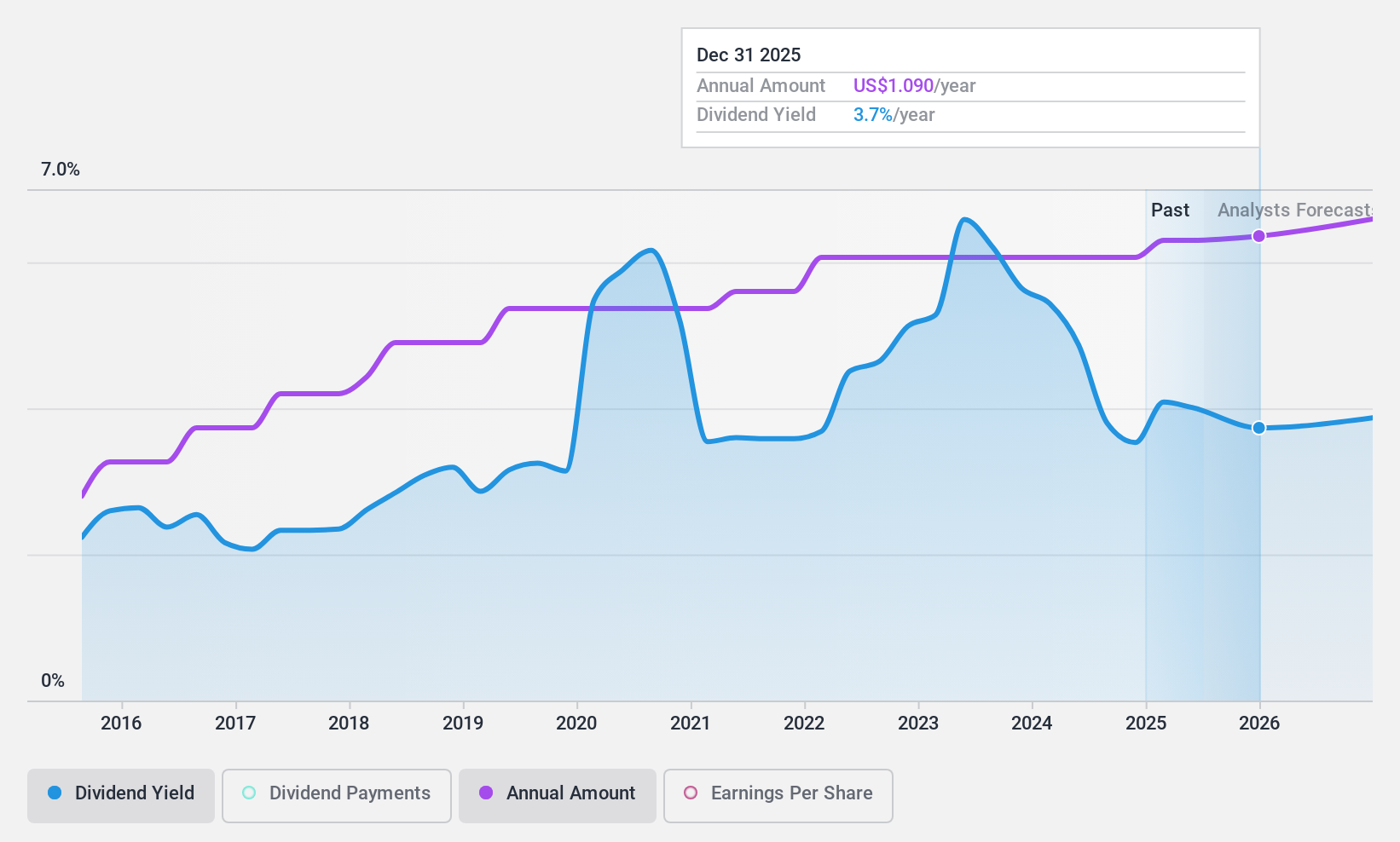

Central Pacific Financial Corp. recently increased its quarterly dividend to US$0.27 per share, reflecting a 3.8% rise, with dividends reliably growing over the past decade and a sustainable payout ratio of 52.7%. Despite earnings dipping in Q4 2024 to US$11.35 million from US$14.87 million year-over-year, the company's dividends remain well-covered by earnings and are forecasted to be secure in the coming years, supported by a new US$30 million share repurchase program for 2025.

- Click to explore a detailed breakdown of our findings in Central Pacific Financial's dividend report.

- Upon reviewing our latest valuation report, Central Pacific Financial's share price might be too pessimistic.

Seize The Opportunity

- Click this link to deep-dive into the 135 companies within our Top US Dividend Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPF

Central Pacific Financial

Operates as the bank holding company for Central Pacific Bank that provides a range of commercial banking products and services to businesses, professionals, and individuals in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives