- United States

- /

- Banks

- /

- NasdaqGS:PEBO

OceanFirst Financial And 2 Other Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 4.5%, contributing to an impressive 11% climb over the past year, with earnings expected to grow by 14% annually. In this promising environment, dividend stocks like OceanFirst Financial and others stand out as attractive options for investors seeking a combination of income and potential growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.73% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.79% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.33% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.11% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.81% | ★★★★★★ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.80% | ★★★★★☆ |

| Douglas Dynamics (NYSE:PLOW) | 4.03% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 3.85% | ★★★★★☆ |

| Southside Bancshares (NYSE:SBSI) | 4.82% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 8.82% | ★★★★★☆ |

Click here to see the full list of 141 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

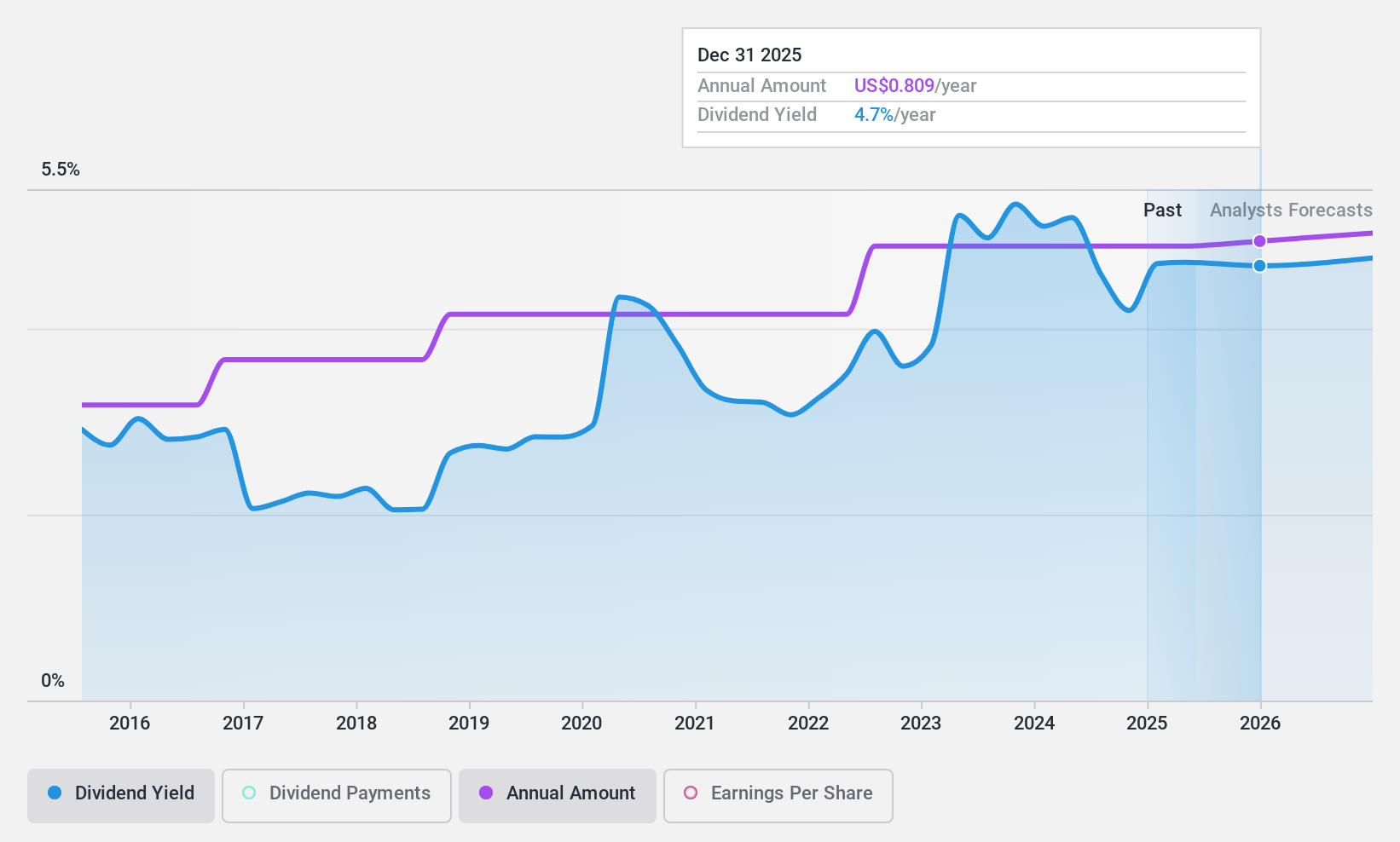

OceanFirst Financial (NasdaqGS:OCFC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OceanFirst Financial Corp., with a market cap of $1.03 billion, operates as the bank holding company for OceanFirst Bank N.A.

Operations: OceanFirst Financial Corp. generates revenue primarily through its Community Banking Operations, which amounted to $369.88 million.

Dividend Yield: 4.5%

OceanFirst Financial's dividend payments have been stable and growing over the past decade, with a current yield of 4.51%, slightly below the top 25% in the US market. The company declared its 113th consecutive quarterly cash dividend of $0.20 per share, reflecting consistency in payouts. Despite a decrease in net income to $21.51 million for Q1 2025, dividends appear covered by earnings given a payout ratio of 52.3%. Recent buybacks indicate shareholder value focus.

- Click here to discover the nuances of OceanFirst Financial with our detailed analytical dividend report.

- Our expertly prepared valuation report OceanFirst Financial implies its share price may be lower than expected.

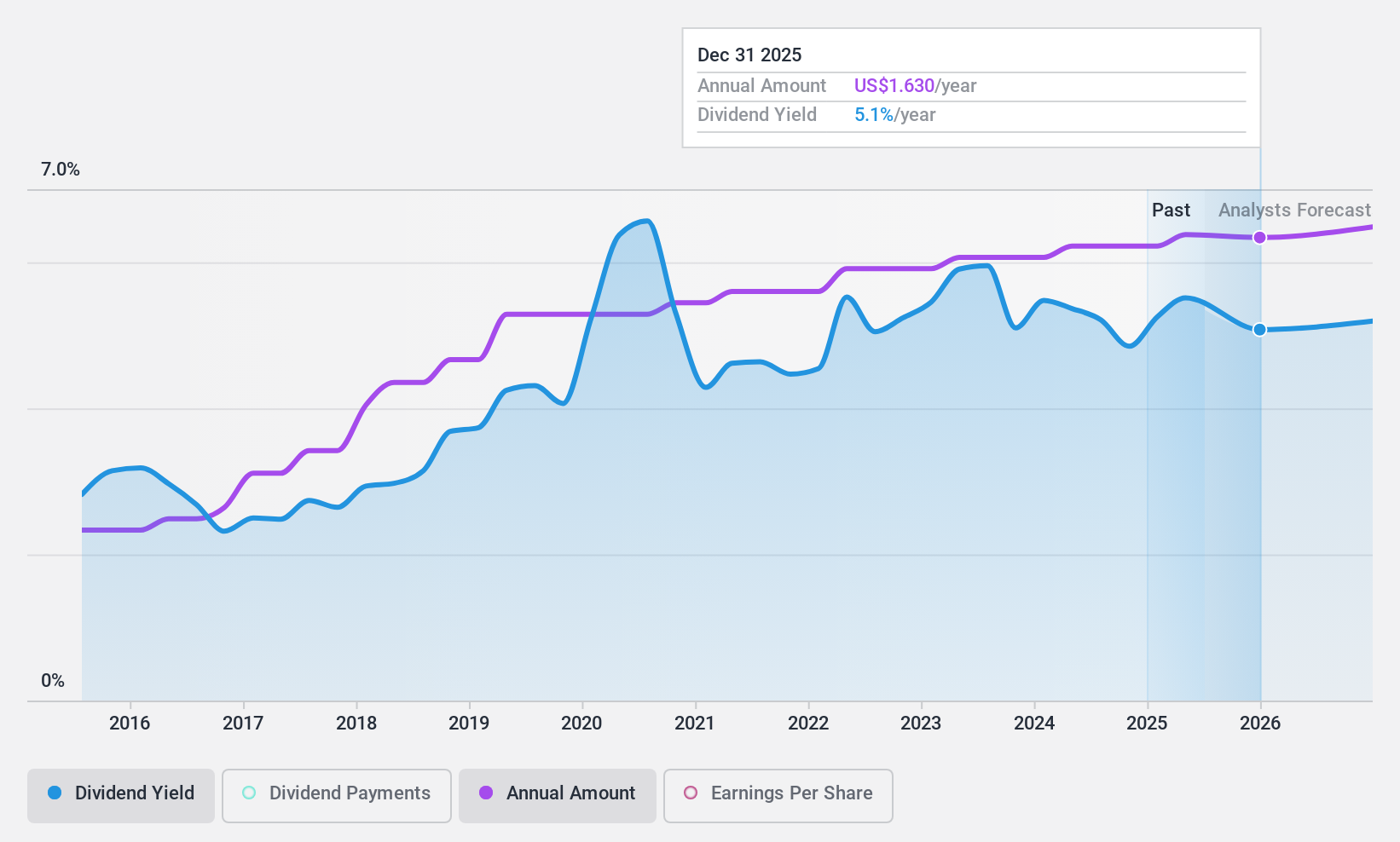

Peoples Bancorp (NasdaqGS:PEBO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Peoples Bancorp Inc. is a financial holding company for Peoples Bank, offering commercial and consumer banking products and services, with a market cap of approximately $1.07 billion.

Operations: Peoples Bancorp Inc.'s revenue is primarily derived from its Community Banking segment, which generated $561.24 million.

Dividend Yield: 5.3%

Peoples Bancorp offers a high dividend yield of 5.29%, ranking in the top 25% of U.S. dividend payers, with stable and increasing dividends over the past decade. The recent quarterly cash dividend is set at $0.41 per share, supported by a reasonable payout ratio of 50.5%. However, Q1 2025 saw net income decline to US$24.34 million from US$29.58 million year-on-year, potentially impacting future payouts despite past reliability and good relative value compared to peers.

- Unlock comprehensive insights into our analysis of Peoples Bancorp stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Peoples Bancorp shares in the market.

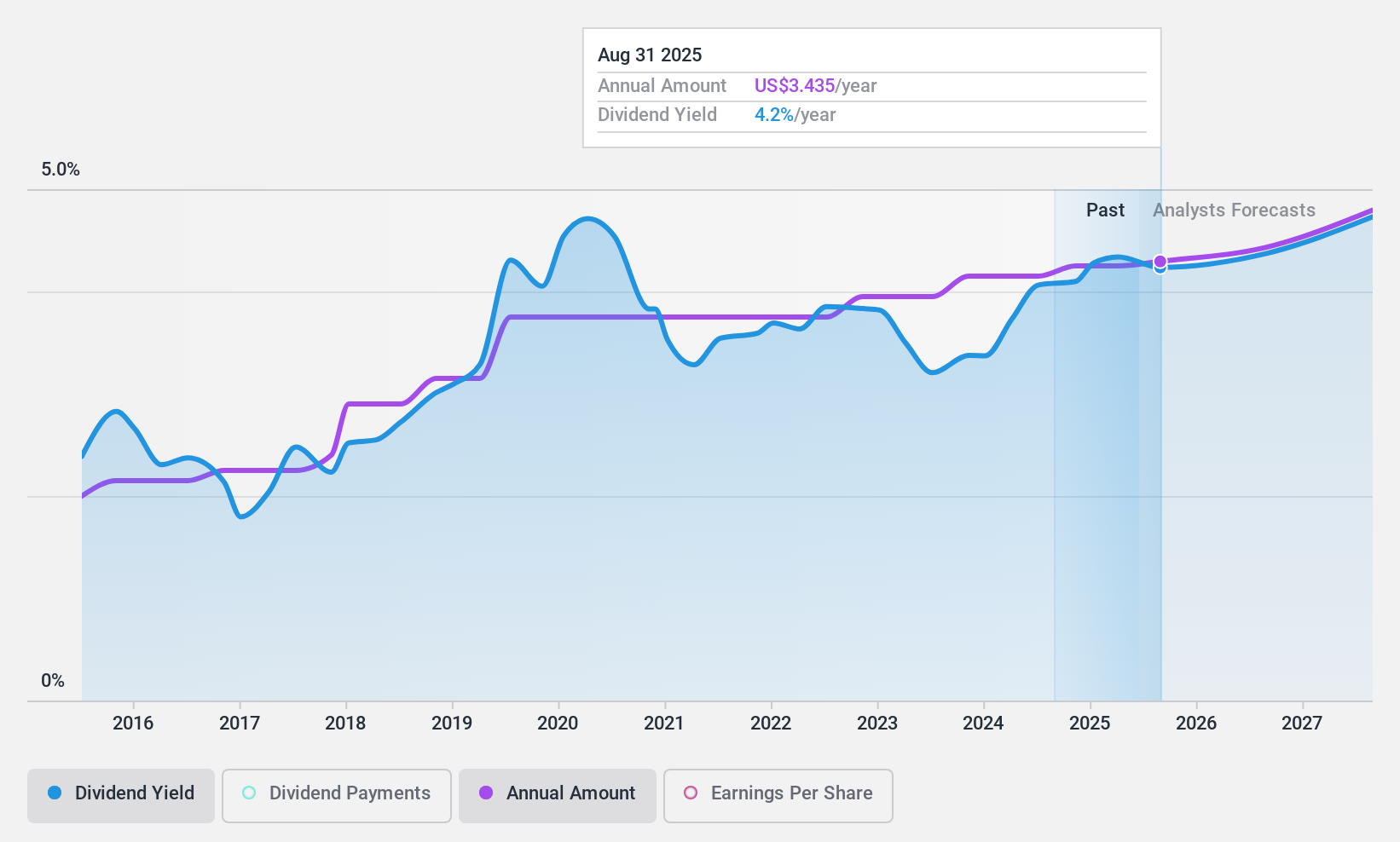

MSC Industrial Direct (NYSE:MSM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MSC Industrial Direct Co., Inc. is a distributor of metalworking and MRO products and services operating in the U.S., Canada, Mexico, the UK, and internationally, with a market cap of approximately $4.41 billion.

Operations: The company's revenue segment primarily consists of its distribution of metalworking, MRO, Class C consumables, and OEM products and services, generating approximately $3.75 billion.

Dividend Yield: 4.3%

MSC Industrial Direct has maintained stable and growing dividends over the past decade, with a recent dividend of $0.85 per share. Despite a high payout ratio of 88.7%, dividends are covered by earnings and cash flows, with a cash payout ratio of 62.8%. The company is actively pursuing bolt-on acquisitions to enhance growth while having completed significant share buybacks worth $315.52 million since 2021, reflecting its commitment to returning capital to shareholders amidst declining earnings in Q2 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of MSC Industrial Direct.

- The analysis detailed in our MSC Industrial Direct valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Dive into all 141 of the Top US Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEBO

Peoples Bancorp

Operates as the financial holding company for Peoples Bank that provides commercial and consumer banking products and services.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives