- United States

- /

- Banks

- /

- NasdaqCM:OBT

Discovering US Hidden Gems With Strong Market Potential

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge following the Federal Reserve's decision to cut interest rates, small-cap stocks, represented by indices like the Russell 2000, are gaining attention for their potential to thrive in this environment. Amidst this backdrop of economic adjustments and shifting investor sentiment, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

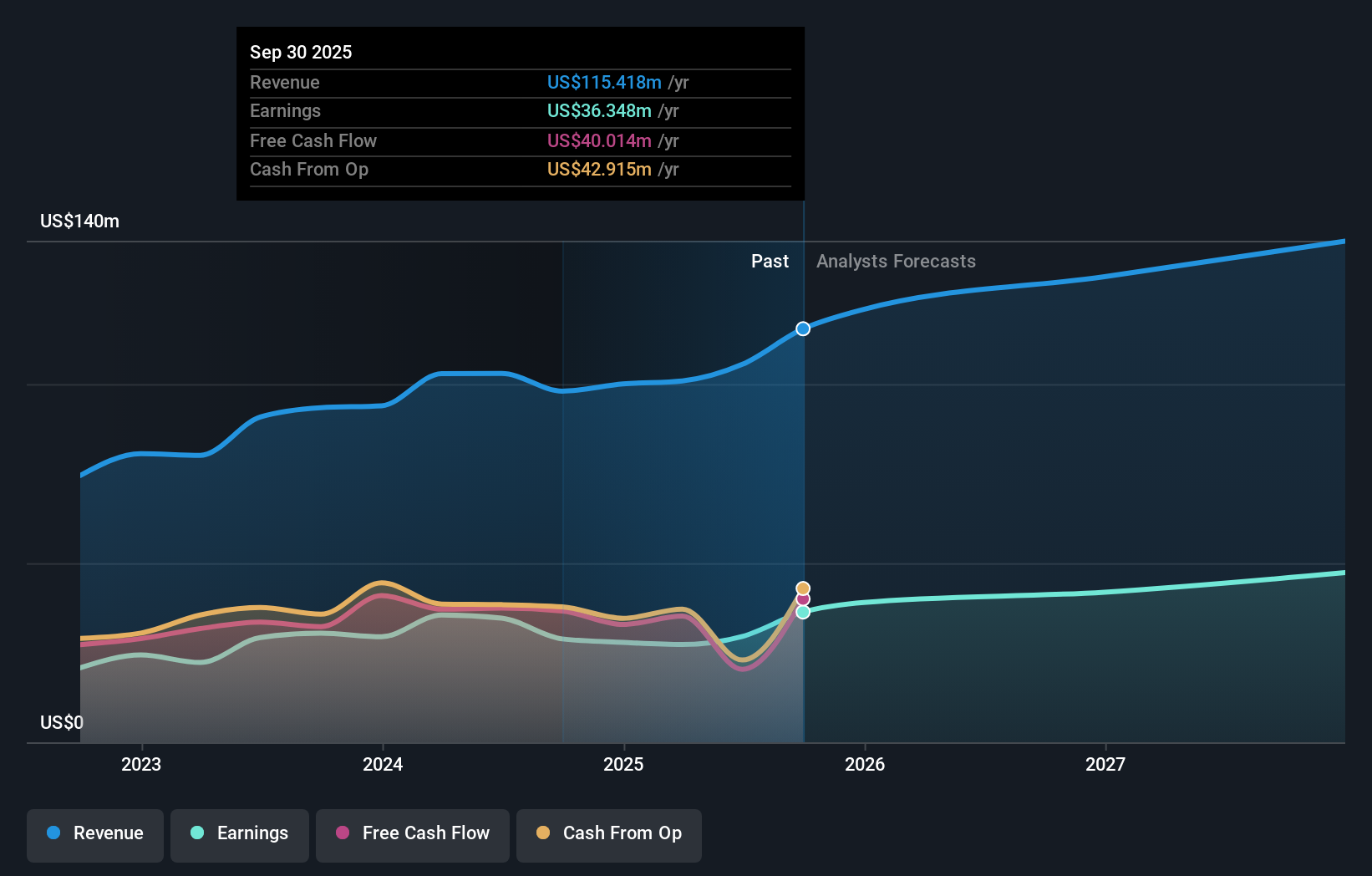

Orange County Bancorp (OBT)

Simply Wall St Value Rating: ★★★★★★

Overview: Orange County Bancorp, Inc. operates through its subsidiaries to offer a range of commercial and consumer banking products and services, with a market capitalization of approximately $385.90 million.

Operations: Orange County Bancorp generates revenue primarily from its banking segment, which accounts for $101.76 million, while its wealth management services contribute $13.66 million.

Orange County Bancorp, with assets totaling US$2.6 billion and equity of US$270.1 million, stands out for its robust financial health. Total deposits are US$2.3 billion against loans of US$1.9 billion, showcasing a solid deposit base with primarily low-risk funding sources accounting for 96% of liabilities. The company has an allowance for bad loans at 0.6%, which is well-managed within industry standards, and earnings growth over the past year hit 26%, surpassing the bank industry's average of 18%. Recently, it announced a dividend increase to $0.18 per share and issued $25 million in subordinated notes to bolster its Tier 2 capital position under Federal Reserve guidelines.

- Navigate through the intricacies of Orange County Bancorp with our comprehensive health report here.

Understand Orange County Bancorp's track record by examining our Past report.

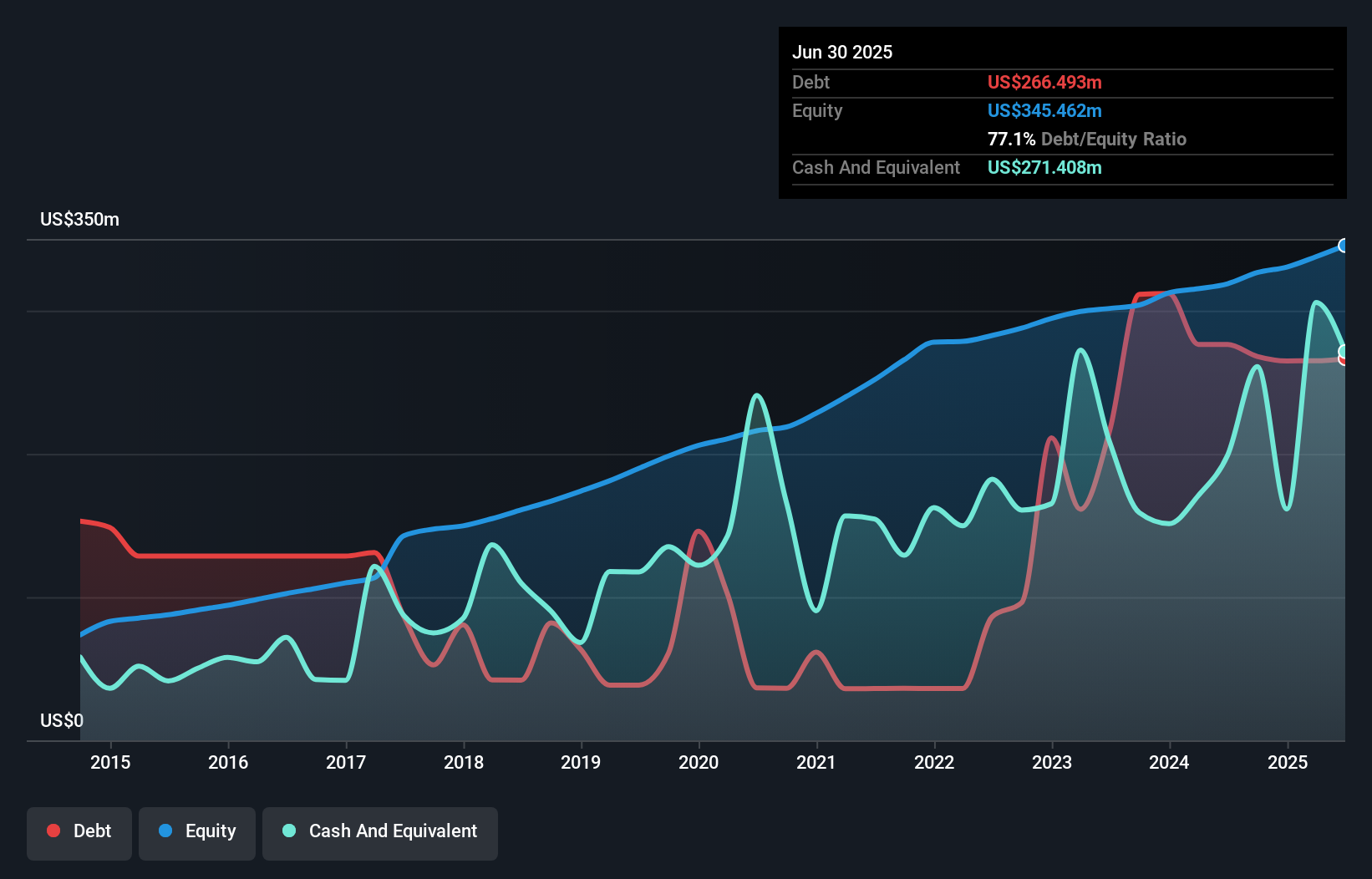

Southern First Bancshares (SFST)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern First Bancshares, Inc. is the bank holding company for Southern First Bank, offering commercial, consumer, and mortgage loans across South Carolina, North Carolina, and Georgia with a market cap of $447.78 million.

Operations: Southern First Bancshares generates revenue primarily through its banking operations, amounting to $109.39 million. The company's financial performance is reflected in its net profit margin, which stands at 25%.

Southern First Bancshares, with assets totaling US$4.4 billion and equity of US$356.3 million, is a noteworthy player in the banking sector. The company boasts total deposits and loans both at US$3.7 billion, highlighting its balanced financial structure. It maintains a net interest margin of 2.1% and has set aside an allowance for bad loans at 0.3% of total loans, reflecting prudent risk management practices with a significant buffer against potential defaults (365%). Its price-to-earnings ratio stands at 17.1x, which is below the broader US market average of 18.8x, suggesting it could be undervalued relative to peers.

- Click here to discover the nuances of Southern First Bancshares with our detailed analytical health report.

Gain insights into Southern First Bancshares' past trends and performance with our Past report.

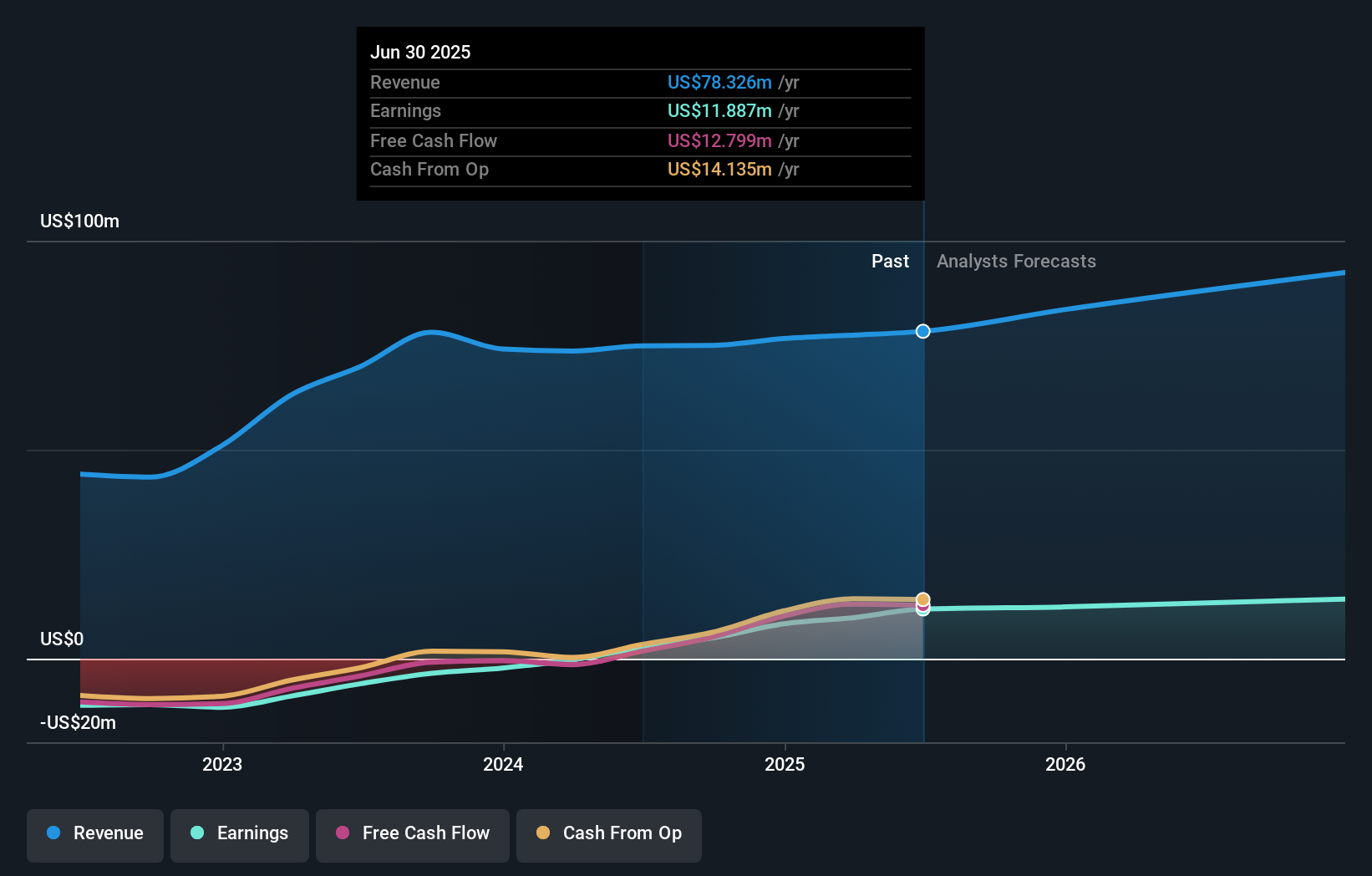

BK Technologies (BKTI)

Simply Wall St Value Rating: ★★★★★★

Overview: BK Technologies Corporation, with a market cap of $261.26 million, designs, manufactures, and markets wireless communications products both in the United States and internationally through its subsidiary BK Technologies, Inc.

Operations: BK Technologies generates revenue primarily from its Land Mobile Radio (LMR) Products and Solutions segment, which accounts for $82.56 million. The company's financial performance is reflected in its net profit margin, which provides insight into profitability trends over time.

BK Technologies, a nimble player in the communications space, is making waves with its strong financial footing and strategic pivots. The firm boasts high-quality earnings and impressive growth, with a 159.7% rise in earnings over the past year outpacing industry averages. Trading at 86% below estimated fair value, it presents an attractive proposition for investors seeking value plays. BK's debt-free status enhances its appeal, while its focus on higher-margin products could bolster profitability further. Recent quarterly results showed net income climbing to US$3.44 million from US$2.36 million last year, reflecting robust operational performance amidst evolving market dynamics.

Where To Now?

- Click here to access our complete index of 296 US Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OBT

Orange County Bancorp

Through its subsidiaries, provides commercial and consumer banking products and services.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion