- United States

- /

- Software

- /

- NYSE:YEXT

Top 3 Undervalued Small Caps With Insider Action In US For November 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 5.7%, contributing to a substantial climb of 37% over the past year, with earnings forecasted to grow by 16% annually. In this robust market environment, identifying small-cap stocks with insider action can be an intriguing approach for investors looking to uncover potential opportunities.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Thryv Holdings | NA | 0.7x | 47.74% | ★★★★★☆ |

| HighPeak Energy | 10.8x | 1.6x | 37.99% | ★★★★★☆ |

| Solo Brands | NA | 0.2x | 32.36% | ★★★★★☆ |

| Hanover Bancorp | 10.8x | 2.3x | 43.02% | ★★★★☆☆ |

| Franklin Financial Services | 10.2x | 2.0x | 32.84% | ★★★★☆☆ |

| USCB Financial Holdings | 19.5x | 5.6x | 44.93% | ★★★☆☆☆ |

| First United | 14.0x | 3.2x | 45.68% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -228.49% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -69.24% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

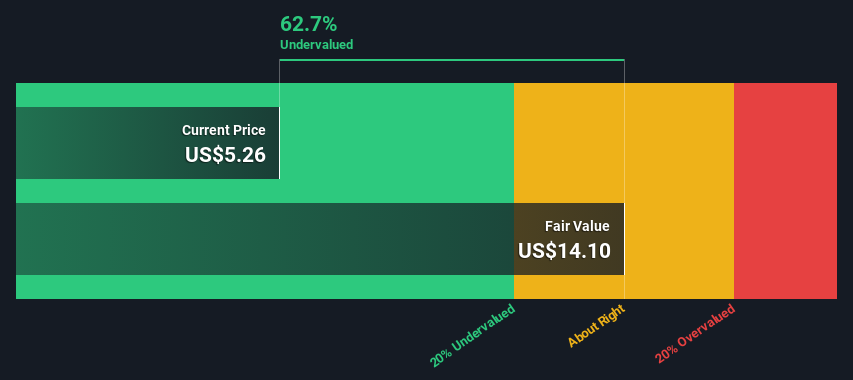

LifeMD (NasdaqGM:LFMD)

Simply Wall St Value Rating: ★★★★★★

Overview: LifeMD is a company that operates in the telehealth sector and also offers services through its Worksimpli segment, with a combined market capitalization of approximately $0.05 billion.

Operations: LifeMD generates revenue primarily from its Telehealth and Worksimpli segments, contributing $139.81 million and $53.25 million respectively. The company has seen a notable trend in its gross profit margin, reaching 89.64% as of September 2024. Operating expenses, including significant sales and marketing costs, impact the net income figures negatively despite high gross margins.

PE: -12.0x

LifeMD, a small company in the U.S., reported significant revenue growth to US$53.39 million for Q3 2024, up from US$38.61 million the previous year, despite remaining unprofitable with a net loss of US$5.13 million. Recent insider confidence is reflected in share purchases over the past year, suggesting potential value recognition by insiders. The launch of an integrated pharmacy enhances its telehealth platform and aims for annualized savings of about US$5 million, positioning LifeMD for future operational improvements and expansion opportunities within its sector.

- Navigate through the intricacies of LifeMD with our comprehensive valuation report here.

Assess LifeMD's past performance with our detailed historical performance reports.

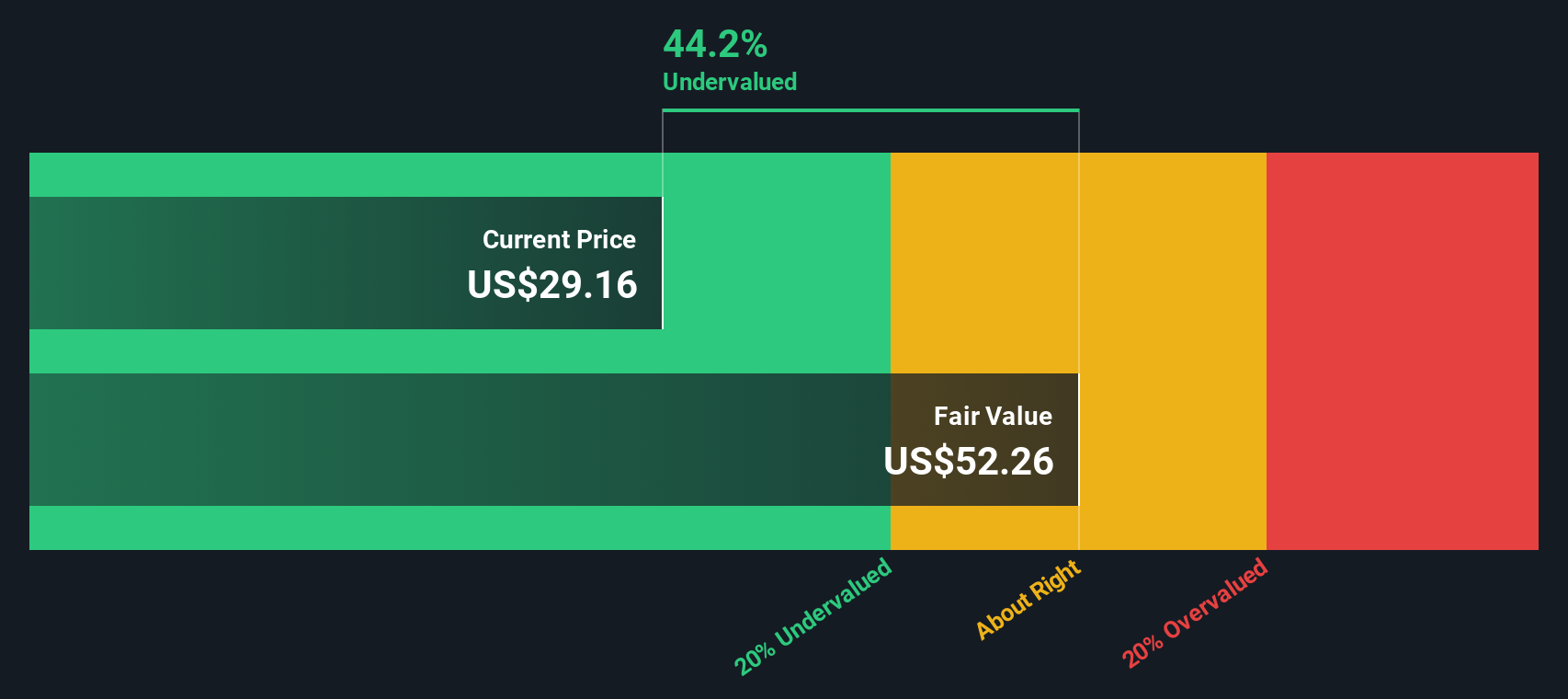

Mid Penn Bancorp (NasdaqGM:MPB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mid Penn Bancorp operates as a full-service commercial banking and trust business with a market cap of approximately $0.33 billion.

Operations: The company's revenue primarily stems from its full-service commercial banking and trust business, generating $173.42 million. Operating expenses, including general and administrative costs of $87.49 million, significantly impact the net income margin, which stands at 27.85%.

PE: 13.0x

Mid Penn Bancorp, a smaller player in the U.S. financial sector, recently completed a $70.06 million equity offering at $29.5 per share, slightly discounted by $1.48 each. Despite past shareholder dilution, their earnings for Q3 2024 showed growth with net income rising to US$12.3 million from US$9.24 million year-on-year and EPS climbing to US$0.74 from US$0.56, indicating potential for future profitability expansion at an anticipated rate of 19% annually.

- Unlock comprehensive insights into our analysis of Mid Penn Bancorp stock in this valuation report.

Examine Mid Penn Bancorp's past performance report to understand how it has performed in the past.

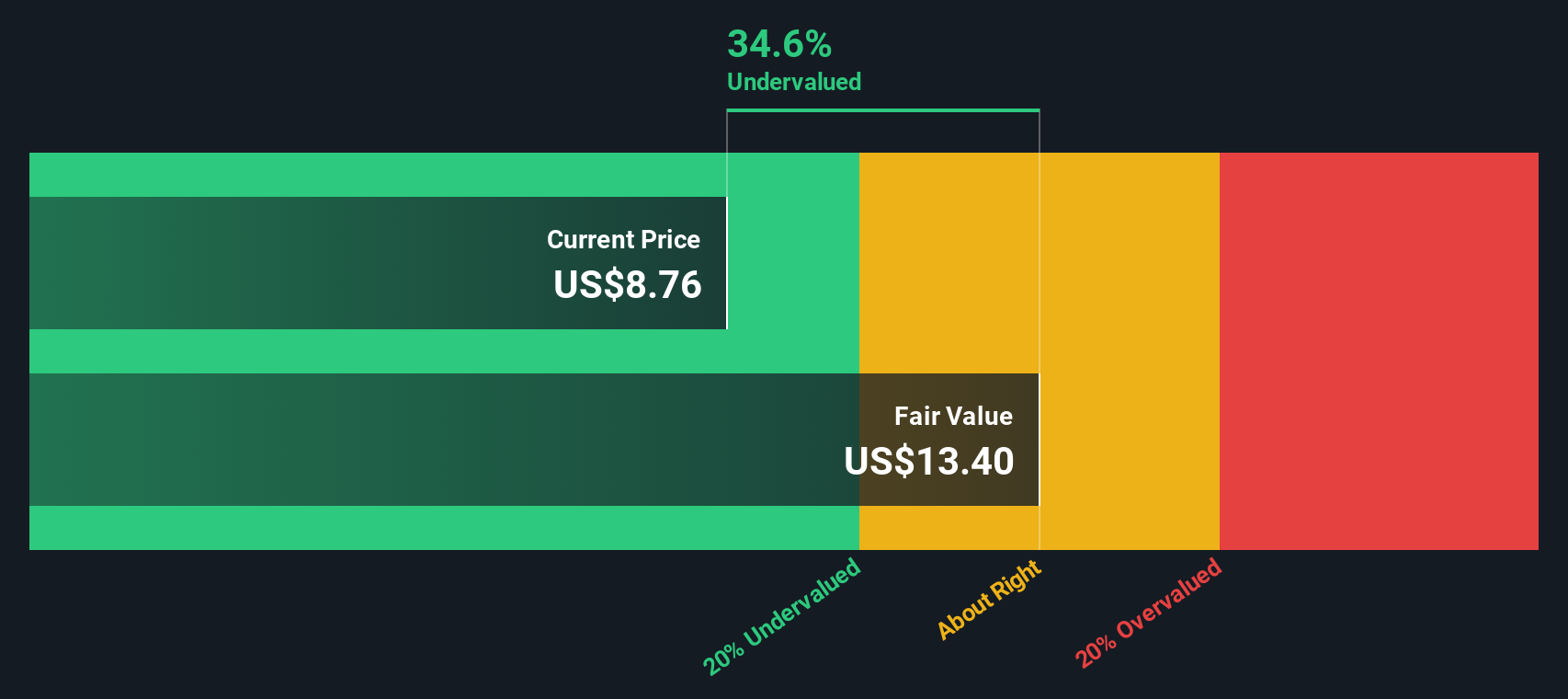

Yext (NYSE:YEXT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yext is a company that provides The Answers Platform, which helps businesses manage their digital knowledge and online presence, with a market cap of approximately $1.02 billion.

Operations: Yext's primary revenue stream comes from its Answers Platform, generating $396.15 million. The company has achieved a gross profit margin of 77.90%. Operating expenses are largely driven by sales and marketing, which constitute a significant portion of costs at $172.45 million, alongside research and development expenses totaling $72.04 million.

PE: -154.7x

Yext, a company in the AI-driven reputation management sector, recently launched an expanded AI Review Generation solution, enhancing customer engagement and brand trust. Despite reporting a net loss of US$4.06 million for Q2 2024, insider confidence is evident with Seth Waugh acquiring 32,600 shares valued at US$216,647. The company forecasts annual revenue between US$420 million and US$421 million for fiscal 2025. Yext's strategic share repurchases totalled 16.9 million shares since March 2022, reflecting commitment to shareholder value amid evolving market conditions.

- Click here and access our complete valuation analysis report to understand the dynamics of Yext.

Gain insights into Yext's historical performance by reviewing our past performance report.

Next Steps

- Discover the full array of 43 Undervalued US Small Caps With Insider Buying right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YEXT

Yext

Yext, Inc. organizes business facts to provide answers to consumer questions in North America and internationally.

Undervalued with excellent balance sheet.