- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Exxon Mobil (NYSE:XOM) Achieves $8.6B Earnings, Faces Downstream Challenges and Regulatory Complexities

Reviewed by Simply Wall St

Exxon Mobil (NYSE:XOM) continues to showcase its financial prowess with an impressive $8.6 billion earnings in the third quarter, driven by enterprise-wide transformation and cost reduction initiatives. However, the company faces challenges in its downstream business and potential overvaluation concerns, despite its strategic LNG and upstream expansion efforts. This report will explore Exxon Mobil's competitive advantages, vulnerabilities, emerging market opportunities, and the regulatory and market risks that could impact its future performance.

Click here and access our complete analysis report to understand the dynamics of Exxon Mobil.

Competitive Advantages That Elevate Exxon Mobil

ExxonMobil's financial performance is underscored by its impressive earnings of $8.6 billion in the third quarter, marking one of the best quarters in the past decade, as noted by Darren Woods, Chairman and CEO. This achievement reflects the company's successful enterprise-wide transformation efforts, which have significantly enhanced earnings power. Additionally, ExxonMobil's commitment to cost reduction is evident in its Product Solutions business, where costs were reduced by $5 billion compared to 2019. Such operational efficiency has transformed its refining operations, contributing to a 24% cost reduction in turnarounds. Moreover, the company's dedication to shareholder value is demonstrated by a 4% increase in quarterly dividends, maintaining a 42-year streak of annual dividend increases, and generating a total shareholder return of 20% in the first nine months of 2024.

Vulnerabilities Impacting Exxon Mobil

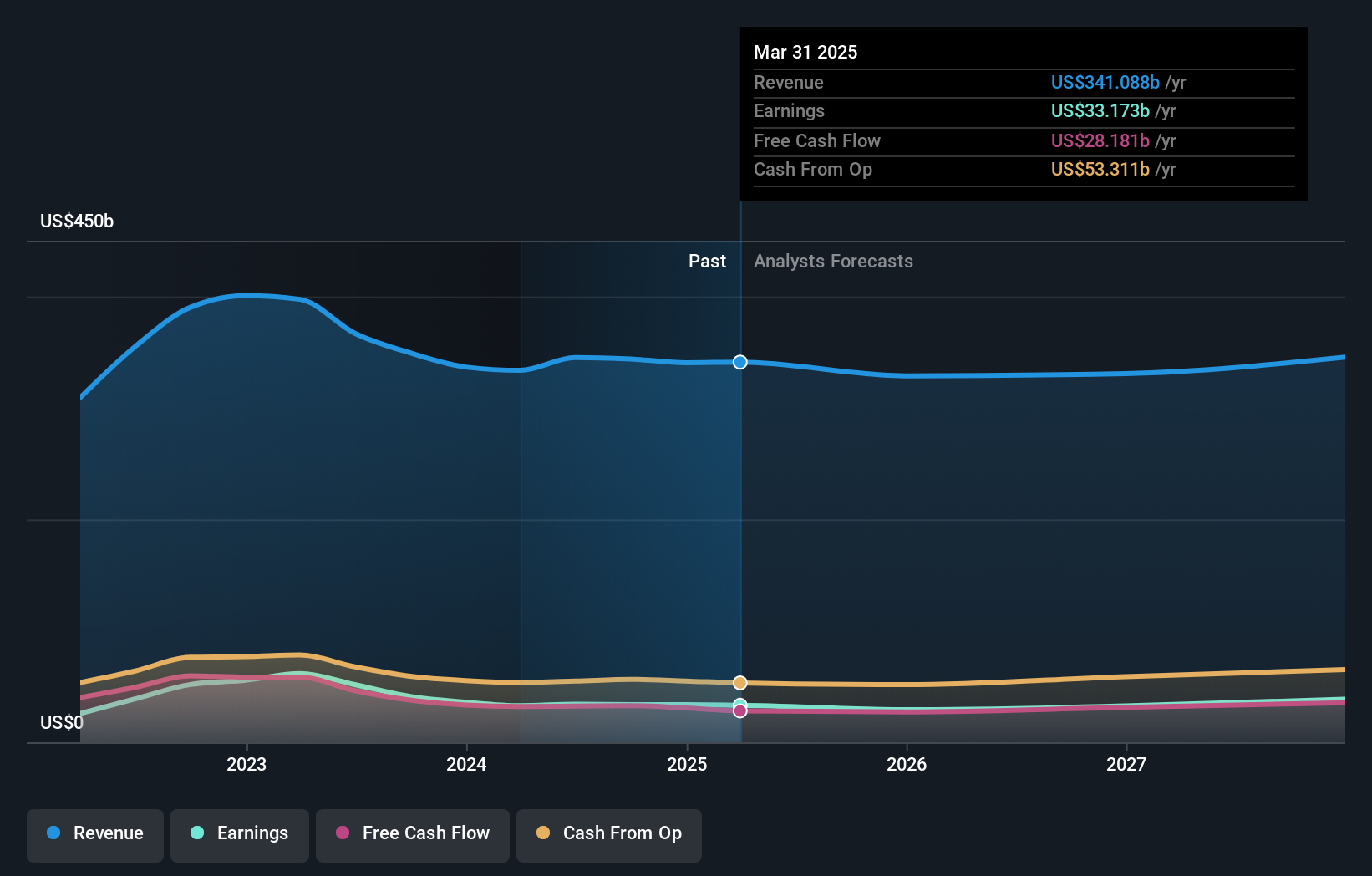

Challenges in the downstream business, highlighted by Devin McDermott of Morgan Stanley, include the Joliet impact and softening crack spreads, which pose hurdles despite strong overall results. Furthermore, ExxonMobil's Price-To-Earnings Ratio of 14.5x exceeds both peer and industry averages, suggesting potential overvaluation. This concern is compounded by a 7.3% earnings decline over the past year, with revenue expected to decrease by 2% annually over the next three years. Although the company maintains a low net debt to equity ratio of 4.9%, questions arise regarding its potential underleveraging and whether more capital could be returned to shareholders.

Emerging Markets Or Trends for Exxon Mobil

The company's LNG and upstream expansion initiatives present significant growth opportunities, as emphasized by Darren Woods. The strong market response to ExxonMobil's LNG projects signals a positive trajectory for future development. Additionally, the focus on technological innovations, such as the Proxxima thermoset resin, positions the company to capitalize on emerging trends with products that offer superior strength and corrosion resistance. These ventures not only enhance market position but also align with ExxonMobil's strategic goals of delivering attractive returns and meeting societal needs.

Competitive Pressures and Market Risks Facing Exxon Mobil

ExxonMobil faces regulatory and legislative challenges, particularly in translating technology-agnostic legislation into effective regulations for low-carbon projects. Darren Woods highlights the complexity of navigating these environments, which could impact the company's strategic initiatives. Furthermore, the acknowledgment by Kathryn Mikells, Senior Vice President and CFO, of commodity cycles and economic uncertainties underscores the external threats that could affect ExxonMobil's operations. These factors, coupled with a forecasted earnings growth rate of 4.7% that lags behind the broader US market, present ongoing challenges in maintaining competitive advantage.

Conclusion

ExxonMobil's impressive $8.6 billion earnings in the third quarter underscore its successful transformation efforts and cost reduction strategies, enhancing its financial strength and shareholder returns. However, challenges such as the Joliet impact and softening crack spreads in the downstream business, alongside a Price-To-Earnings Ratio of 14.5x that exceeds industry norms, suggest caution as the company may be perceived as expensive relative to peers. Nonetheless, ExxonMobil's strategic focus on LNG and upstream expansions, coupled with technological innovations like the Proxxima thermoset resin, positions it for future growth. Yet, navigating regulatory complexities and economic uncertainties remains crucial for sustaining its competitive edge and achieving its strategic objectives.

Make It Happen

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives