- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (NYSE:WMT) Innovates in E-commerce and AI Despite High P/E Ratio and Margin Pressures

Reviewed by Simply Wall St

Walmart (NYSE:WMT) continues to solidify its market position with a strong financial performance, highlighted by a 6.1% sales growth and a 9.8% increase in profits. The latest developments include a significant 27% rise in e-commerce sales and a 28% growth in its advertising segment, showcasing Walmart's strategic shift towards digital and innovative solutions. This report will explore Walmart's unique capabilities, internal limitations, growth strategies, and potential risks impacting its future success.

Click here and access our complete analysis report to understand the dynamics of Walmart.

Unique Capabilities Enhancing Walmart's Market Position

Walmart's financial health is evident in its recent performance where sales grew by 6.1% in constant currency and profits increased by 9.8%, according to CEO Doug McMillon. This growth is complemented by a return on equity of 21.6%, which surpasses industry standards. The company's strategic focus on e-commerce has paid off, with a 27% increase in online sales, and the advertising segment growing by 28%, as highlighted by McMillon. These efforts reflect Walmart's ability to adapt and thrive in a competitive retail environment. Furthermore, the company's consistent dividend payments over the past decade, supported by a low payout ratio of 33.2%, underscore its financial stability and commitment to shareholder returns.

Internal Limitations Hindering Walmart's Growth

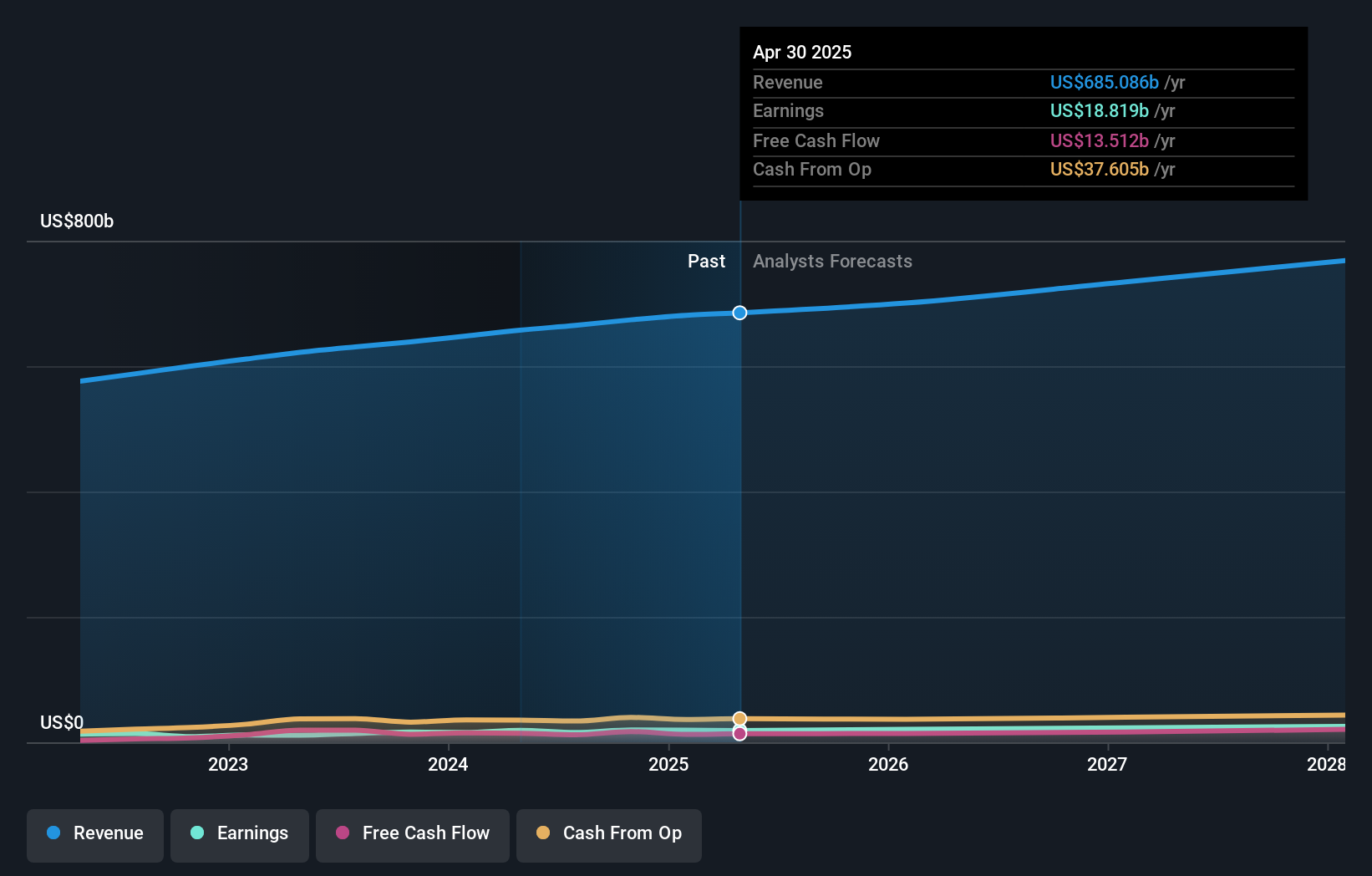

Walmart faces challenges such as slow earnings growth over the past five years, averaging just 2.1% annually. This is compounded by a revenue growth forecast of 3.6% per year, which lags behind the US market average of 9.1%. CFO John Rainey has noted margin pressures, particularly from the health and wellness sector's outsized sales growth. Additionally, Walmart's valuation, with a Price-To-Earnings Ratio of 38.5x, is higher than the peer average of 27x and the industry average of 24.7x. This could be perceived as a hurdle in attracting value-focused investors, despite trading below its estimated fair value of $101.53.

Potential Strategies for Leveraging Growth and Competitive Advantage

Walmart is actively pursuing expansion and innovation to bolster its market position. The company has enhanced its curbside pickup and delivery services, as noted by McMillon, which aligns with consumer preferences for convenience. Internationally, Walmart's operations in China and India, through Flipkart and Walmex, have shown strong performance, with sales in China being significantly digital. These initiatives not only diversify revenue streams but also position Walmart to capitalize on emerging markets and technological advancements, such as the deployment of generative AI, which McMillon mentioned is yielding early results.

Key Risks and Challenges That Could Impact Walmart's Success

Walmart must navigate several external risks, including economic fluctuations and intense competition. CFO John Rainey highlighted the impact of currency fluctuations, which negatively affected the business in Q3. Additionally, the competitive environment in the US is evolving rapidly, with new entrants challenging Walmart's market share. This dynamic requires Walmart to continuously innovate and adapt to maintain its leadership position. Furthermore, significant insider selling over the past three months may suggest concerns about long-term growth prospects, potentially affecting investor confidence.

Conclusion

Walmart's strong financial performance, highlighted by a 6.1% sales growth and a 9.8% increase in profits, showcases its ability to adapt and thrive, particularly through its strategic focus on e-commerce and advertising. However, the company faces internal challenges, including slow earnings growth and margin pressures, which could hinder its future expansion. Walmart's high Price-To-Earnings Ratio of 38.5x, compared to the peer average of 27x, suggests that it may struggle to attract value-focused investors, even though it trades below its estimated fair value of $101.53. To sustain its market position, Walmart must continue to innovate and leverage its strong international presence, while addressing external risks such as economic fluctuations and intense competition to maintain investor confidence and drive long-term growth.

Seize The Opportunity

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives