- United States

- /

- Wireless Telecom

- /

- NasdaqGM:UCL

December 2024 US Exchange: Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As the United States stock market experiences a mixed performance with the S&P 500 snapping its three-week winning streak, investors are keenly watching for opportunities amid fluctuating indices. Penny stocks, though often considered a niche area of investment, still hold potential for growth by offering access to smaller or newer companies at lower price points. In this article, we explore several penny stocks that combine strong balance sheets and solid fundamentals, presenting underappreciated opportunities in today’s market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.63 | $2.03B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8695 | $6.32M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.96 | $89.78M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.224099 | $8.25M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.48 | $48.84M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.755 | $13.39M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8405 | $75.59M | ★★★★★☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

CVD Equipment (NasdaqCM:CVV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CVD Equipment Corporation, along with its subsidiaries, designs, develops, manufactures, and sells equipment for material and coating development and manufacturing both in the United States and internationally, with a market cap of $29.32 million.

Operations: The company's revenue is primarily derived from three segments: CVD Equipment Corporation (excluding CVD Materials) at $15.30 million, Stainless Design Concepts (SDC) at $7.71 million, and CVD Materials at $0.86 million.

Market Cap: $29.32M

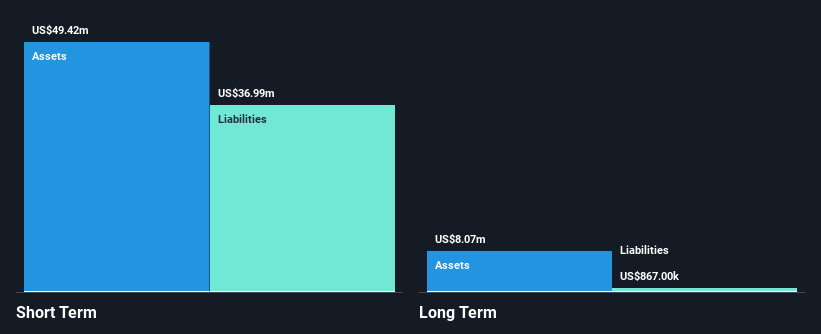

CVD Equipment Corporation, with a market cap of US$29.32 million, reported third-quarter 2024 sales of US$8.19 million, up from US$6.23 million the previous year, and achieved a net income of US$0.203 million compared to a net loss last year. Despite being unprofitable overall with a negative return on equity (-17.23%), the company has reduced losses over five years by 11.7% annually and maintains more cash than debt while covering both short- and long-term liabilities with its assets. The management team is experienced, although the board is relatively new in tenure terms.

- Unlock comprehensive insights into our analysis of CVD Equipment stock in this financial health report.

- Evaluate CVD Equipment's historical performance by accessing our past performance report.

uCloudlink Group (NasdaqGM:UCL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: uCloudlink Group Inc. operates as a mobile data traffic sharing marketplace in the telecommunications industry with a market cap of $50.24 million.

Operations: The company generates revenue from its Wireless Communications Services segment, which amounted to $87.41 million.

Market Cap: $50.24M

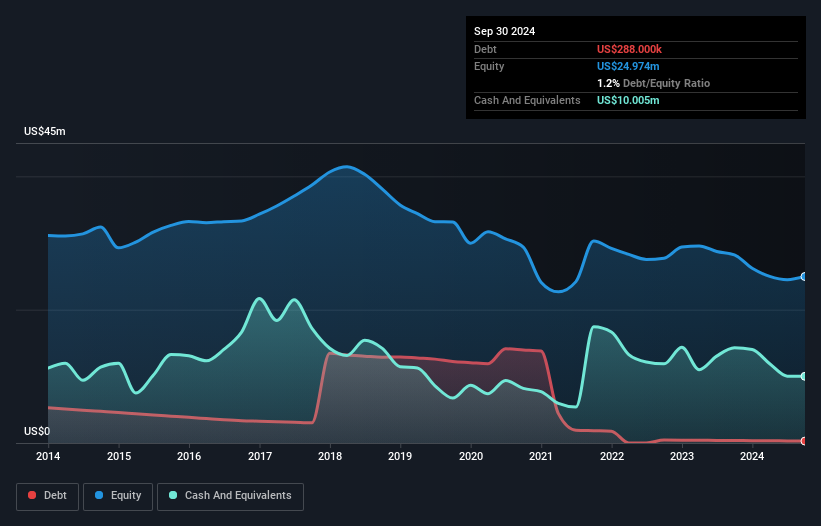

uCloudlink Group Inc. has demonstrated financial stability with a market cap of US$50.24 million and revenues of US$87.41 million from its Wireless Communications Services segment. Recent earnings guidance indicates expected revenue growth, with fourth-quarter projections between US$25 million and US$30 million, reflecting an increase from the previous year. The company's debt is well-covered by operating cash flow, and it holds more cash than total debt, ensuring short- and long-term liabilities are covered by assets. Despite a one-off loss impacting recent results, uCloudlink's profitability has grown over five years at 28.8% annually without significant shareholder dilution recently.

- Jump into the full analysis health report here for a deeper understanding of uCloudlink Group.

- Explore uCloudlink Group's analyst forecasts in our growth report.

PHX Minerals (NYSE:PHX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PHX Minerals Inc. is a natural gas and oil mineral company operating in the United States with a market cap of approximately $150.30 million.

Operations: The company generates revenue of $31.94 million from exploring, developing, producing, and selling oil, NGL, and natural gas.

Market Cap: $150.3M

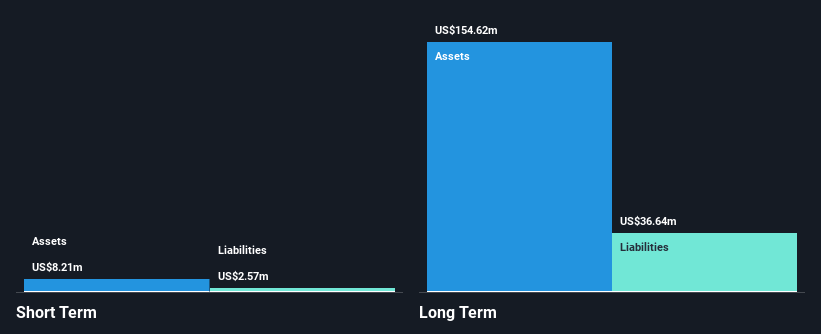

PHX Minerals Inc., with a market cap of approximately US$150.30 million, faces challenges as its earnings growth has been negative over the past year, and profit margins have decreased from 34.1% to 14.8%. Despite these issues, the company has not experienced significant shareholder dilution recently and maintains satisfactory debt levels with net debt to equity at 20.3%. However, its dividend yield of 3.99% is not well-covered by current earnings. Recent strategic moves include exploring potential mergers or sales to enhance shareholder value, guided by RBC Capital Markets as financial advisors amidst ongoing investor activism discussions led by Edenbrook Capital LLC.

- Dive into the specifics of PHX Minerals here with our thorough balance sheet health report.

- Examine PHX Minerals' earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Explore the 720 names from our US Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if uCloudlink Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:UCL

uCloudlink Group

Operates as a mobile data traffic sharing marketplace in the telecommunications industry.

Excellent balance sheet with acceptable track record.