- United States

- /

- Banks

- /

- NasdaqGS:MBWM

Exploring Three Undervalued Small Caps With Insider Activity Across Regions

Reviewed by Simply Wall St

Amidst a backdrop of declining major stock indexes and anticipation surrounding key inflation data, the U.S. market has been experiencing a period of volatility with economic indicators such as GDP growth and jobless claims showing mixed signals. In this environment, identifying small-cap stocks that exhibit strong fundamentals and insider activity can provide valuable insights for investors looking to navigate these uncertain times.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 9.7x | 2.9x | 34.43% | ★★★★★☆ |

| Limbach Holdings | 30.8x | 2.0x | 40.50% | ★★★★★☆ |

| Peoples Bancorp | 10.3x | 1.9x | 42.38% | ★★★★★☆ |

| Citizens & Northern | 11.5x | 2.8x | 40.18% | ★★★★☆☆ |

| First Northern Community Bancorp | 9.8x | 2.8x | 47.38% | ★★★★☆☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 19.25% | ★★★★☆☆ |

| Shore Bancshares | 10.5x | 2.7x | -90.81% | ★★★☆☆☆ |

| Farmland Partners | 7.1x | 8.6x | -45.39% | ★★★☆☆☆ |

| Thryv Holdings | NA | 0.7x | 33.16% | ★★★☆☆☆ |

| Helen of Troy | NA | 0.3x | -54.54% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Anterix (ATEX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Anterix is a company focused on providing wireless communications services, with a market cap of approximately $0.87 billion.

Operations: Anterix's revenue is primarily derived from wireless communications services, with recent figures showing $5.92 million in revenue. The company has experienced fluctuations in net income, with a recent positive trend resulting in a net income of $29.33 million as of June 2025. Operating expenses are significant, often exceeding $50 million per period, impacting overall profitability. The gross profit margin has consistently reached 100% over several periods due to negligible or unreported cost of goods sold (COGS).

PE: 14.1x

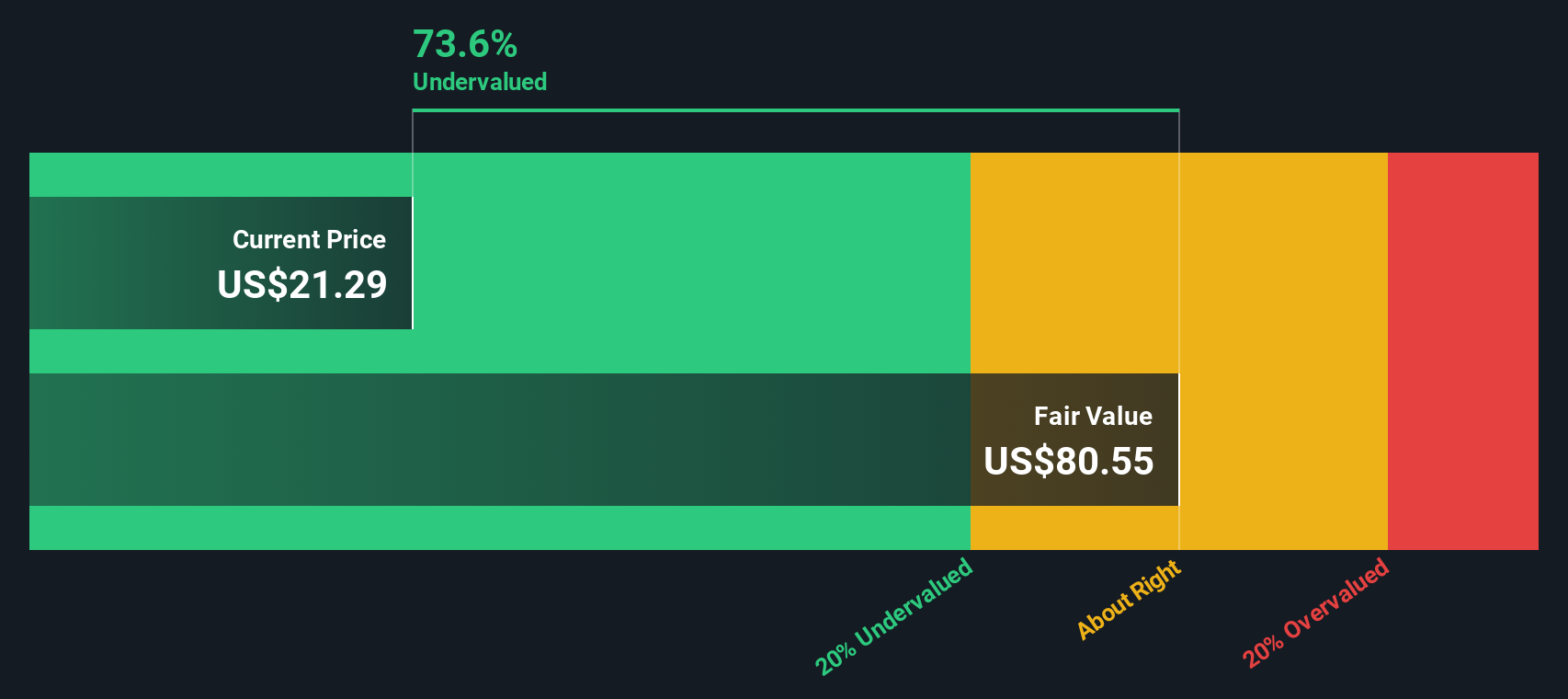

Anterix, a US-based company, is navigating its small-scale landscape with strategic leadership changes and financial shifts. Despite being dropped from several Russell indices by June 2025, the company reported a significant turnaround in Q1 2025 earnings, achieving a net income of US$25.18 million compared to a loss previously. The appointment of Elena Marquez as CFO on September 22, 2025, signals insider confidence and aims to bolster financial strategies as Anterix expands its connectivity solutions across critical infrastructure sectors.

- Click here to discover the nuances of Anterix with our detailed analytical valuation report.

Gain insights into Anterix's past trends and performance with our Past report.

Mercantile Bank (MBWM)

Simply Wall St Value Rating: ★★★★★★

Overview: Mercantile Bank operates as a provider of banking products and services, with a market capitalization of $0.41 billion.

Operations: Mercantile Bank generates revenue primarily from banking products, services, and investment securities, with recent figures reaching $228.38 million. The bank's net income margin has shown a notable trend of increasing over several periods, reaching 35.64% in the latest quarter. Operating expenses are a significant component of costs, comprising general and administrative expenses as well as sales and marketing expenses.

PE: 9.1x

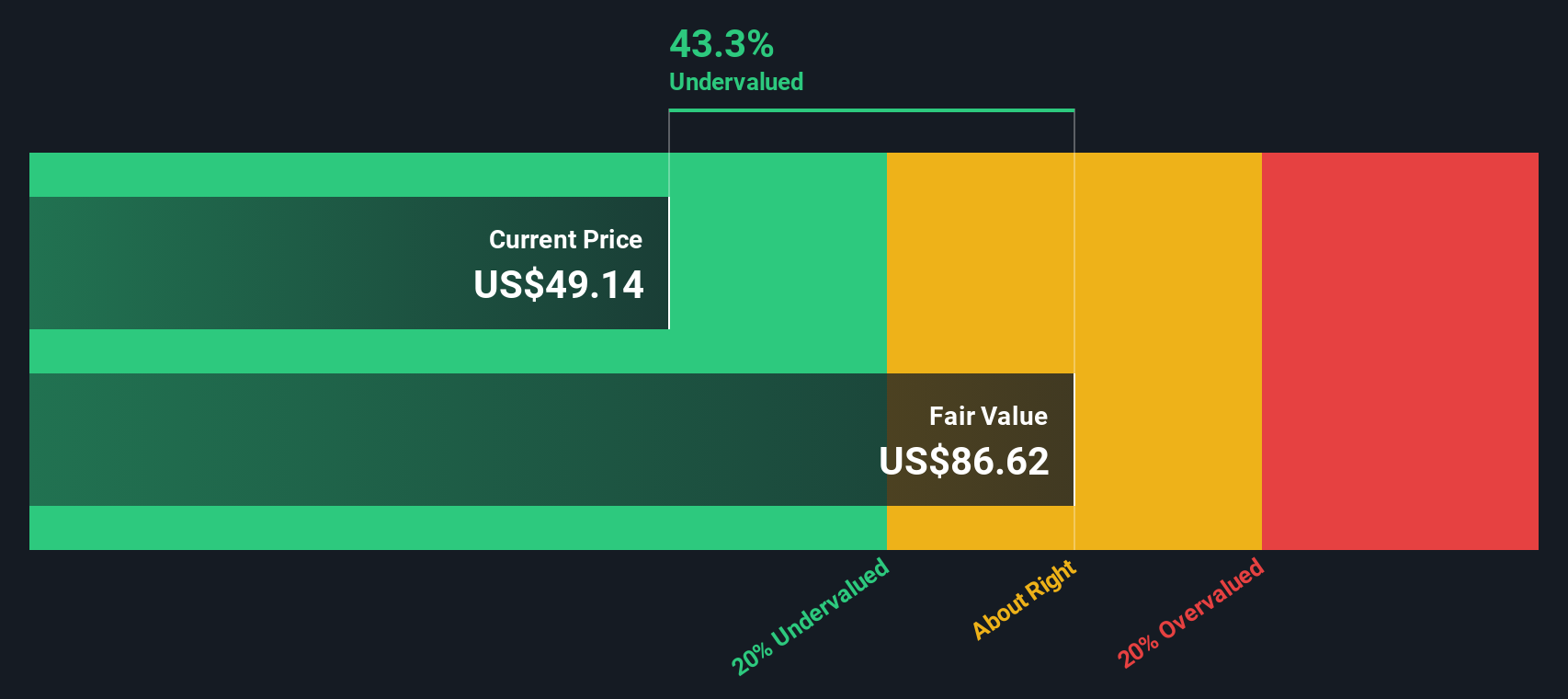

Mercantile Bank, a smaller financial institution in the U.S., demonstrates potential with its recent earnings growth. For Q2 2025, net interest income rose to US$49.48 million from US$47.07 million year-on-year, while net income increased to US$22.62 million from US$18.79 million in the same period last year. The company has completed a share buyback of 420,292 shares for US$13.18 million since May 2021, signaling insider confidence and commitment to shareholder value enhancement through strategic capital allocation decisions like dividend increases and management changes amidst steady profit forecasts of 8.54% annual growth.

- Take a closer look at Mercantile Bank's potential here in our valuation report.

Assess Mercantile Bank's past performance with our detailed historical performance reports.

Amerant Bancorp (AMTB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Amerant Bancorp operates as a bank holding company providing a range of banking services, with a market cap of $0.73 billion.

Operations: AMTB generates revenue primarily from its banking operations, with recent figures showing $305.48 million in revenue. The company has experienced fluctuations in net income margin, which reached 32.75% in late 2021 but showed a decline to -19.46% by September 2024, reflecting changes in profitability over time. Operating expenses are predominantly driven by general and administrative costs, which have been significant throughout the periods analyzed.

PE: 228.0x

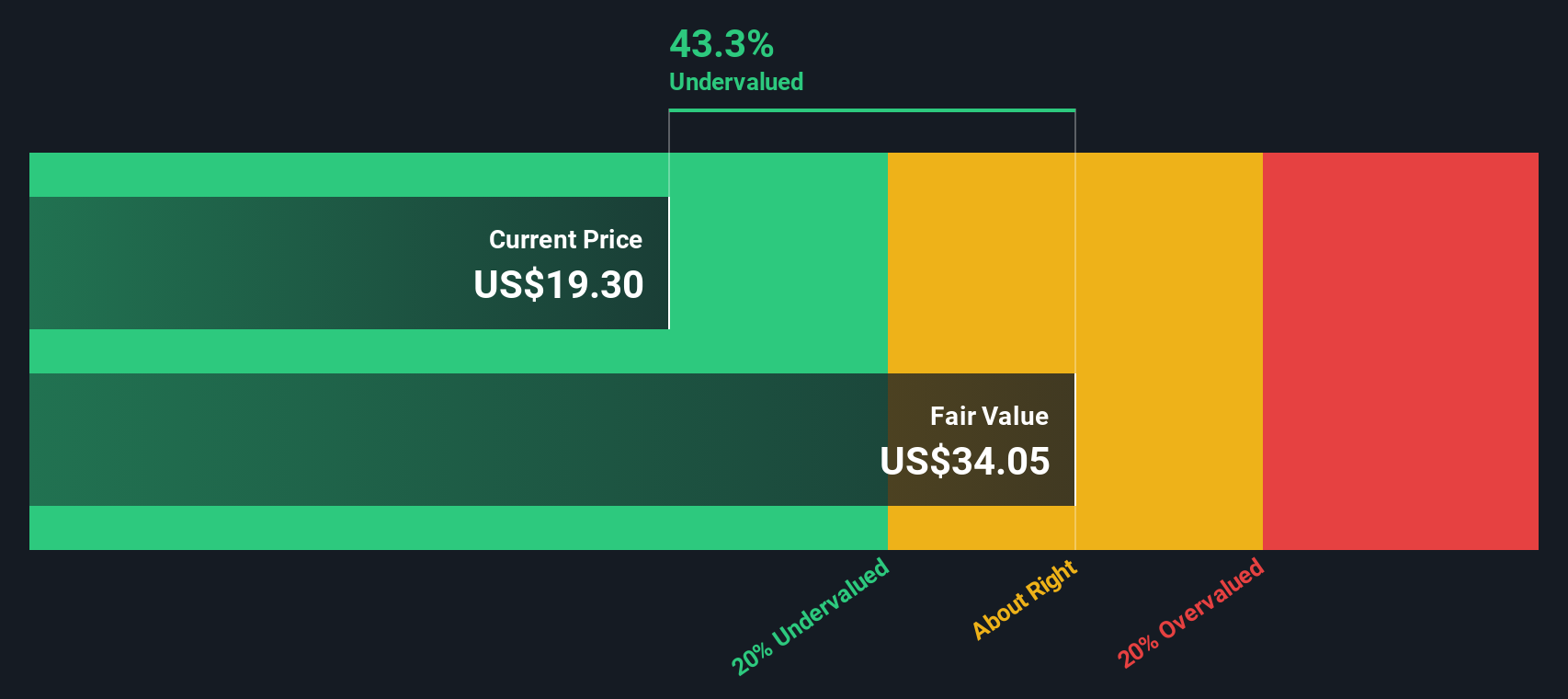

Amerant Bancorp, a small financial entity in the U.S., demonstrates potential through recent developments. The company reported significant earnings growth for Q2 2025, with net income rising to US$23 million from US$4.96 million year-on-year. Insider confidence is reflected by their share purchases over the past year, hinting at optimism about future prospects. A strategic partnership with Miami's sports scene enhances brand visibility and community ties. Despite some profit margin challenges, Amerant's inclusion in multiple Russell indices may support its growth trajectory.

- Click to explore a detailed breakdown of our findings in Amerant Bancorp's valuation report.

Evaluate Amerant Bancorp's historical performance by accessing our past performance report.

Next Steps

- Access the full spectrum of 69 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBWM

Mercantile Bank

Operates as the bank holding company for Mercantile Bank that provides commercial and retail banking services to small- to medium-sized businesses and individuals in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)