- United States

- /

- Banks

- /

- NasdaqCM:LNKB

Discovering Hidden US Stocks: 3 Undiscovered Gems

Reviewed by Simply Wall St

As the U.S. market navigates through a landscape marked by fluctuating indices and economic uncertainties, investors are keeping a keen eye on small-cap stocks, which often hold potential for growth amidst broader market volatility. In this dynamic environment, identifying promising yet under-the-radar stocks can be crucial for those looking to capitalize on unique opportunities that might not be immediately apparent in more prominent sectors or companies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tri-County Financial Group | 82.51% | 3.15% | -17.04% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| FRMO | 0.10% | 41.35% | 45.95% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

LINKBANCORP (LNKB)

Simply Wall St Value Rating: ★★★★★★

Overview: LINKBANCORP, Inc. is a bank holding company for LINKBANK, offering a range of banking products and services in Pennsylvania with a market cap of $269.26 million.

Operations: The primary revenue stream for LINKBANCORP comes from its banking segment, generating $121.98 million. The company's market capitalization stands at $269.26 million.

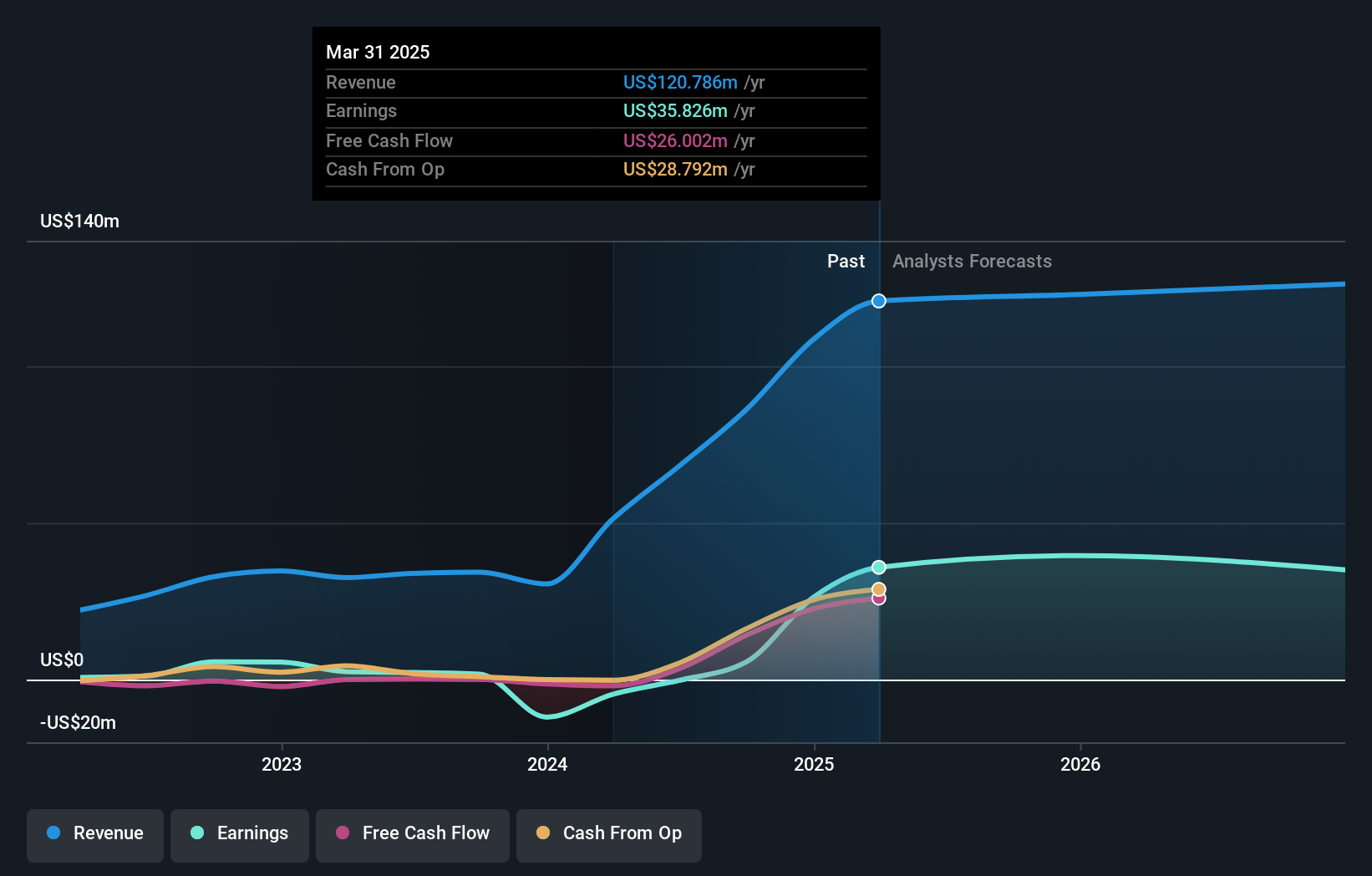

With total assets of US$2.9 billion and equity standing at US$298 million, LINKBANCORP showcases a solid financial foundation. Total deposits reach US$2.5 billion, while loans amount to US$2.3 billion, supported by a net interest margin of 3.9%. The company maintains a sufficient allowance for bad loans at 0.9% of total loans, reflecting prudent risk management. Trading at an attractive price-to-earnings ratio of 6.9x, it offers good value compared to the broader market average of 18.8x. Recently added to the S&P Global BMI Index, LINKBANCORP's inclusion signals growing recognition in the financial sector.

Greenfire Resources (GFR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Greenfire Resources Ltd. is involved in the exploration, development, and operation of oil and gas properties in Alberta's Athabasca oil sands region, with a market cap of CA$323.87 million.

Operations: Greenfire generates revenue primarily from its oil sands operations, amounting to CA$704.17 million.

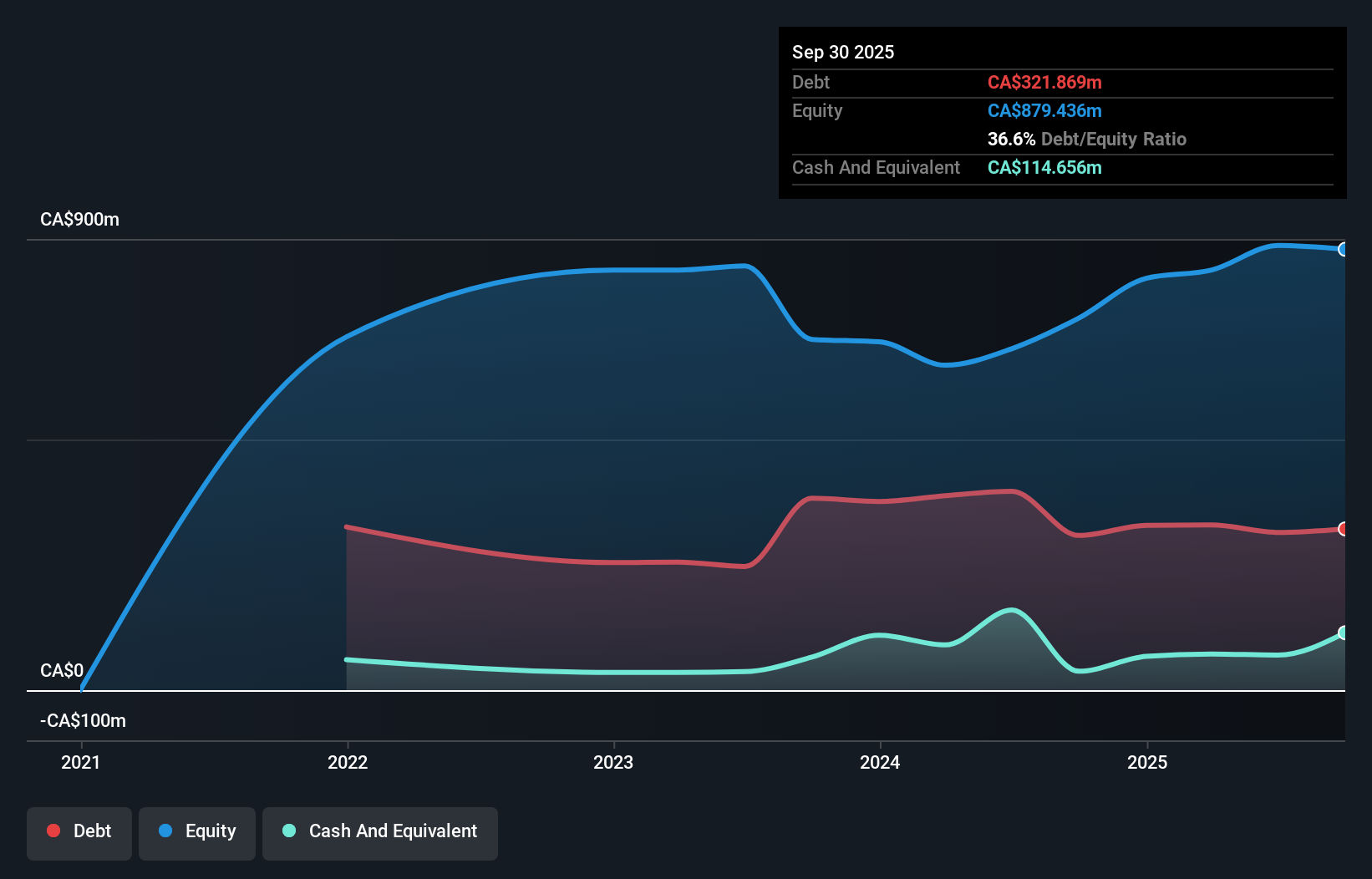

Greenfire Resources, a small player in the oil and gas sector, recently turned profitable, contrasting with the industry's 17.4% earnings dip. Despite a 25.8% annual earnings drop over five years, its net debt to equity ratio of 27.6% is satisfactory, and interest payments are well covered by EBIT at 3.2x. Trading at 97.5% below estimated fair value, it shows potential for value seekers. The company reported a net income of CAD 48.73 million in Q2 2025, up from CAD 30.85 million the previous year, with basic earnings per share rising to CAD 0.69 from CAD 0.45.

- Navigate through the intricacies of Greenfire Resources with our comprehensive health report here.

Understand Greenfire Resources' track record by examining our Past report.

NL Industries (NL)

Simply Wall St Value Rating: ★★★★★☆

Overview: NL Industries, Inc. operates in the component products industry across Europe, North America, the Asia Pacific, and internationally with a market capitalization of approximately $297.57 million.

Operations: NL Industries generates revenue primarily from its component products segment, which reported $152.60 million. The company's financial performance is influenced by its cost structure and operational efficiencies.

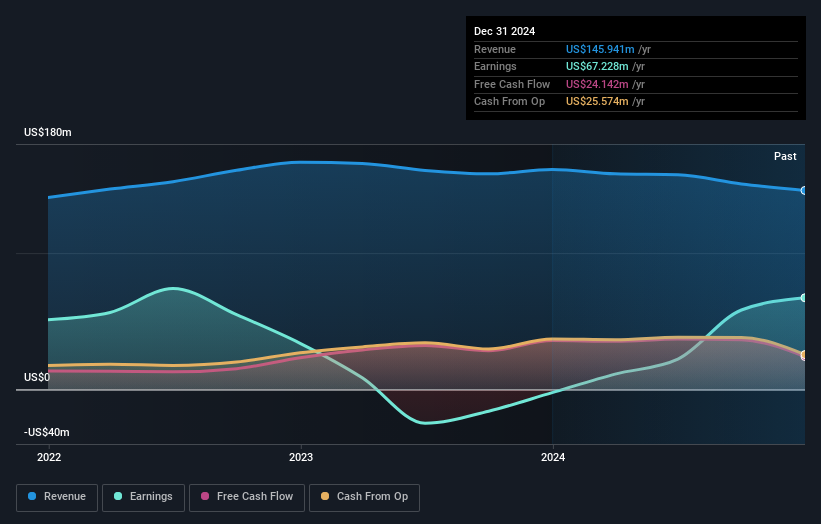

NL Industries has made notable strides, with earnings surging by 141.4% over the past year, outpacing the Commercial Services industry growth of 4.5%. Despite a reduction in net income from US$7.84 million to US$0.355 million in the second quarter, the company remains profitable and not burdened by debt concerns, as its debt-to-equity ratio improved from 0.2% to 0.1% over five years. Trading at 37.6% below its estimated fair value, NL seems undervalued. Recent announcements include a quarterly dividend of US$0.09 and a special dividend of US$0.21 per share, reflecting strong cash flows.

- Take a closer look at NL Industries' potential here in our health report.

Gain insights into NL Industries' past trends and performance with our Past report.

Key Takeaways

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 290 more companies for you to explore.Click here to unveil our expertly curated list of 293 US Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LNKB

LINKBANCORP

Operates as a bank holding company for LINKBANK that provides various banking products and services in Pennsylvania.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)