- United States

- /

- Banks

- /

- NasdaqCM:LNKB

3 US Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market wraps up a strong year with some late volatility, major indices like the Nasdaq Composite and S&P 500 have posted impressive gains despite recent setbacks. Amidst this backdrop, investors often look for growth opportunities where insider ownership is high, as it can indicate confidence in a company's potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 79.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Travelzoo (NasdaqGS:TZOO) | 38% | 34.7% |

| Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 30.1% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 19.7% | 60.1% |

Here's a peek at a few of the choices from the screener.

LINKBANCORP (NasdaqCM:LNKB)

Simply Wall St Growth Rating: ★★★★☆☆

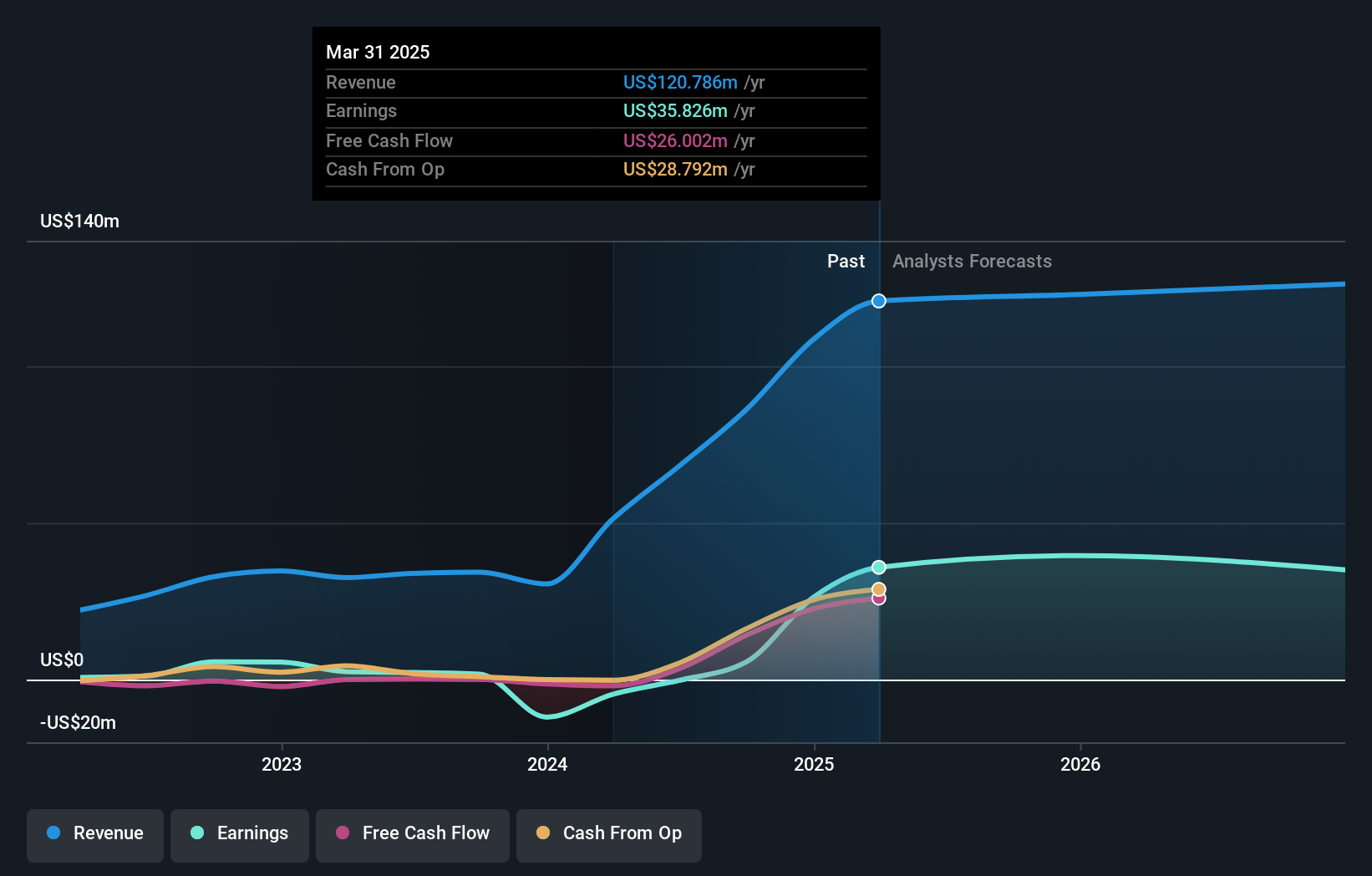

Overview: LINKBANCORP, Inc. is a bank holding company for The Gratz Bank, offering a range of banking products and services to individuals, families, nonprofits, and businesses in Pennsylvania with a market cap of $279.53 million.

Operations: The company generates revenue of $86.14 million through its banking operations, providing financial products and services to a diverse customer base in Pennsylvania.

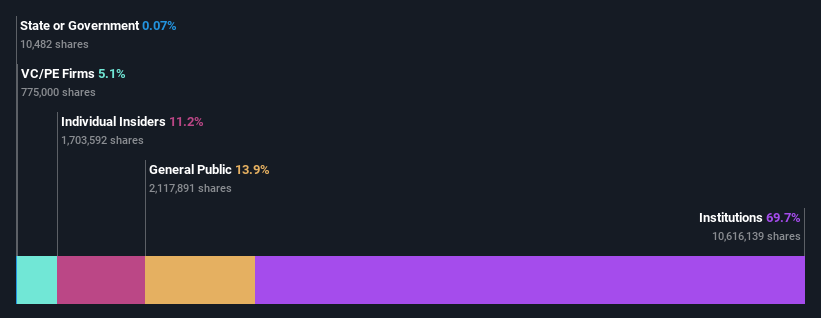

Insider Ownership: 31.9%

LINKBANCORP demonstrates strong growth potential with earnings expected to grow significantly at 38.5% annually, outpacing the US market. Despite a slower forecasted revenue growth of 13.2%, it remains above the market average. Recent financial results show substantial year-over-year improvements in net income and earnings per share, though one-off items impact quality assessments. The dividend yield of 4.01% raises sustainability concerns as it's not well covered by earnings currently or in forecasts.

- Click to explore a detailed breakdown of our findings in LINKBANCORP's earnings growth report.

- The valuation report we've compiled suggests that LINKBANCORP's current price could be inflated.

Pangaea Logistics Solutions (NasdaqCM:PANL)

Simply Wall St Growth Rating: ★★★★☆☆

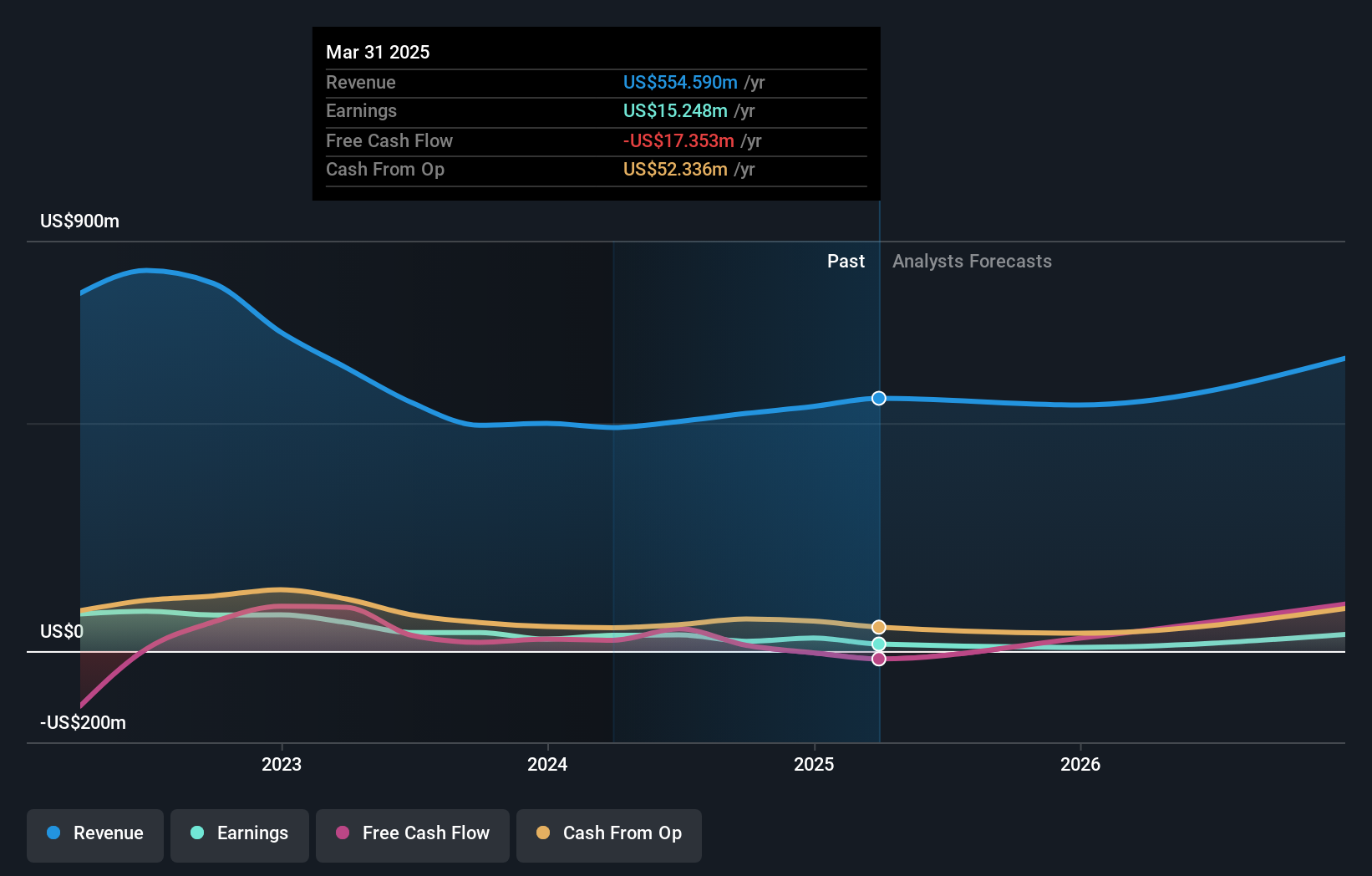

Overview: Pangaea Logistics Solutions, Ltd. and its subsidiaries offer seaborne dry bulk logistics and transportation services to industrial customers globally, with a market cap of $251.40 million.

Operations: The company generates revenue from its Transportation - Shipping segment, amounting to $521.24 million.

Insider Ownership: 26.5%

Pangaea Logistics Solutions is forecasted to achieve significant earnings growth of 29.7% annually, surpassing the US market average. Despite this, its revenue growth is slower at 9.7%. Recent financials show a decline in net income and earnings per share compared to the previous year, raising concerns about profitability sustainability. The dividend yield of 7.46% isn't well-supported by free cash flow, highlighting potential financial strain despite trading below estimated fair value by a substantial margin.

- Unlock comprehensive insights into our analysis of Pangaea Logistics Solutions stock in this growth report.

- The valuation report we've compiled suggests that Pangaea Logistics Solutions' current price could be quite moderate.

Carriage Services (NYSE:CSV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Carriage Services, Inc. operates in the United States offering funeral and cemetery services and merchandise, with a market cap of approximately $606.64 million.

Operations: The company generates revenue through its funeral segment, which accounts for $266.69 million, and its cemetery segment, contributing $138.64 million.

Insider Ownership: 11.2%

Carriage Services is experiencing significant earnings growth, forecasted at 23.8% annually, outpacing the US market. Despite slower revenue growth of 4.6%, recent financials show improved profitability with net income rising to US$9.87 million in Q3 2024 from US$4.65 million a year ago. Insider ownership remains strong without substantial selling recently, indicating confidence in its strategic objectives and leadership changes, including appointing John Enwright as CFO to drive further innovation and disciplined capital allocation strategies.

- Delve into the full analysis future growth report here for a deeper understanding of Carriage Services.

- The analysis detailed in our Carriage Services valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Click here to access our complete index of 202 Fast Growing US Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade LINKBANCORP, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LNKB

LINKBANCORP

Operates as a bank holding company for LINKBANK that provides various banking products and services in Pennsylvania.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives