- United States

- /

- Banks

- /

- NYSE:CPF

3 Leading Dividend Stocks Offering Yields From 4.7% to 5.8%

Reviewed by Sasha Jovanovic

As the United States market navigates through fluctuations, with recent focus on first-quarter GDP data and a mixed bag of corporate earnings, investors are keenly observing economic indicators and their implications on Federal Reserve policies. In this context, identifying dividend stocks that offer substantial yields becomes crucial for those looking to potentially enhance their investment portfolio's resilience against market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 7.58% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 6.89% | ★★★★★★ |

| Arrow Financial (NasdaqGS:AROW) | 4.76% | ★★★★★★ |

| Evans Bancorp (NYSEAM:EVBN) | 5.07% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.90% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.71% | ★★★★★★ |

| Bank of Marin Bancorp (NasdaqCM:BMRC) | 6.48% | ★★★★★★ |

| LCNB (NasdaqCM:LCNB) | 5.80% | ★★★★★★ |

| National Bankshares (NasdaqCM:NKSH) | 5.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.35% | ★★★★★★ |

Click here to see the full list of 210 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

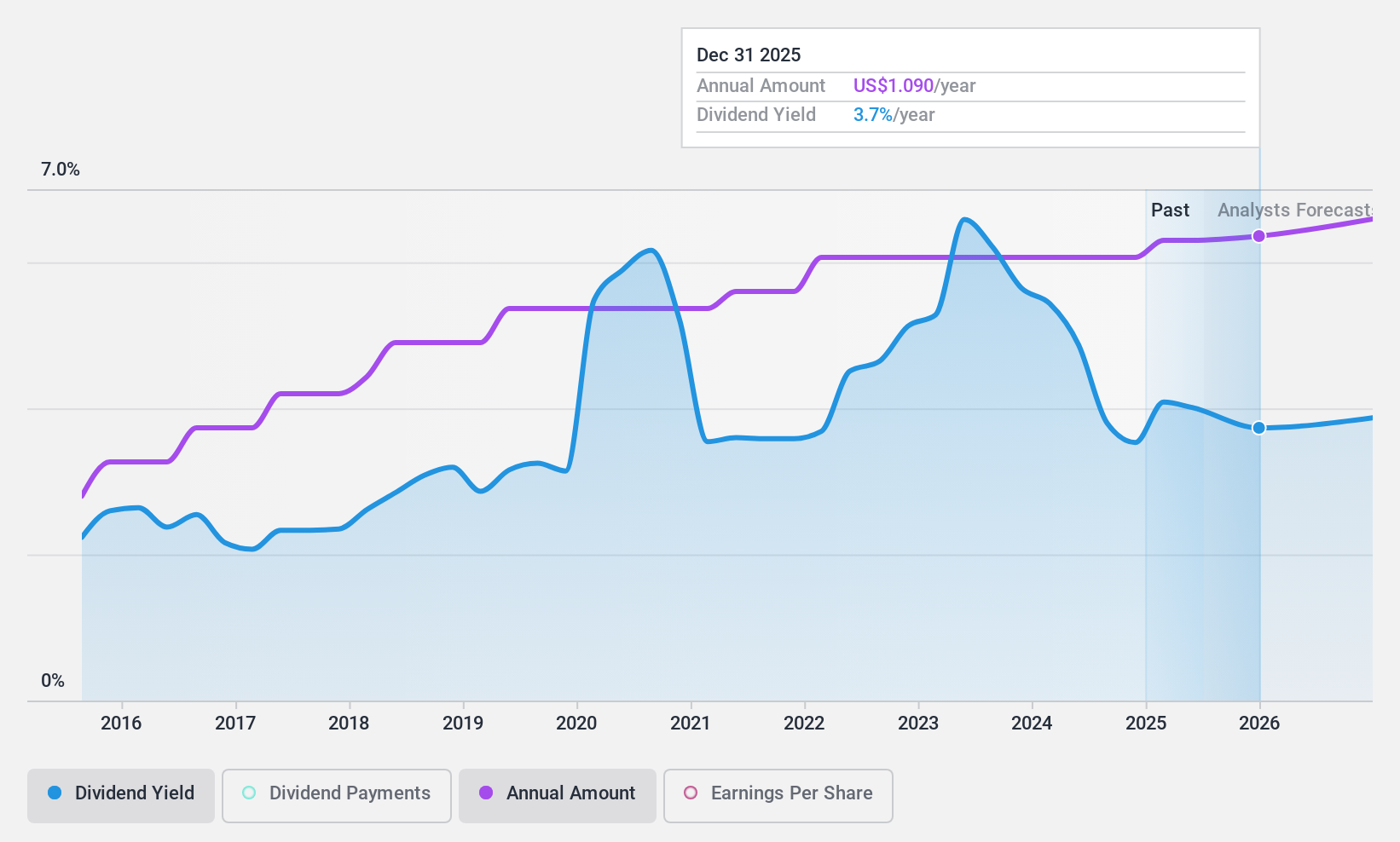

LCNB (NasdaqCM:LCNB)

Simply Wall St Dividend Rating: ★★★★★★

Overview: LCNB Corp., with a market cap of approximately $200.61 million, operates as the financial holding company for LCNB National Bank, offering banking services throughout Ohio.

Operations: LCNB Corp. generates revenue primarily through its commercial banking and insurance agency segments, totaling $69.68 million.

Dividend Yield: 5.8%

LCNB's dividend yield at 5.8% ranks in the top quartile of US dividend payers, supported by a stable payout ratio of 77.4%. Despite trading at a significant 51.1% below its estimated fair value, concerns arise from a recent net profit margin decline to 18% from last year's 29.3%, influenced by substantial one-off items. However, dividends are expected to remain sustainable with forecasted earnings coverage increasing in three years, alongside an anticipated annual earnings growth of 26.23%.

- Click to explore a detailed breakdown of our findings in LCNB's dividend report.

- Our valuation report unveils the possibility LCNB's shares may be trading at a premium.

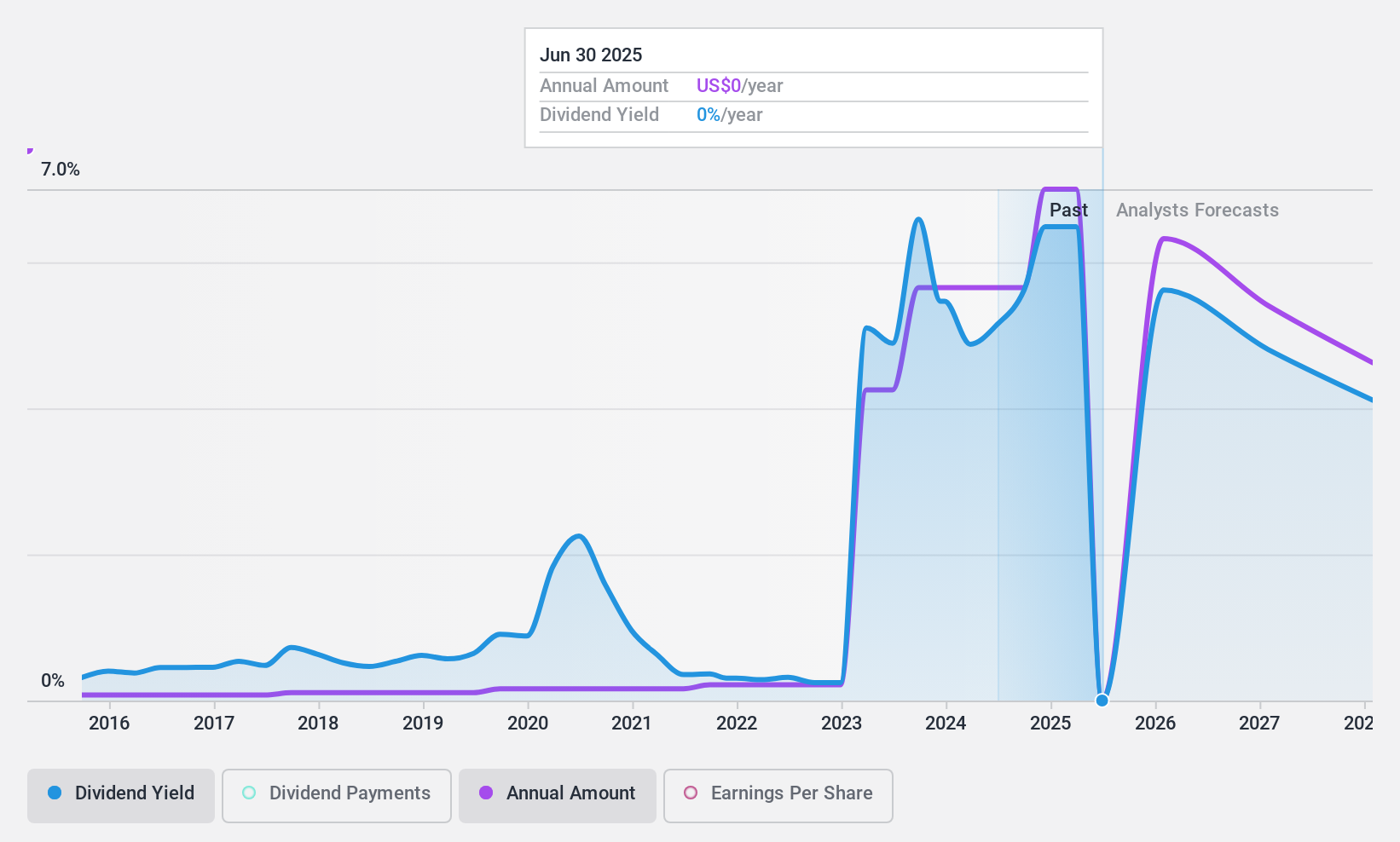

Dillard's (NYSE:DDS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Dillard's, Inc. operates retail department stores in the southeastern, southwestern, and midwestern United States, with a market capitalization of approximately $7.23 billion.

Operations: Dillard's, Inc. generates revenue primarily through its retail operations segment, which amounted to $6.48 billion.

Dividend Yield: 4.7%

Dillard's recent dividend declaration of US$0.25 per share reflects a stable payout, underpinned by a low payout ratio of 2% and cash payout ratio of 45.4%, ensuring dividends are well-covered by both earnings and cash flows. Despite this, the company faces challenges with a forecasted average earnings decline of 31.1% over the next three years. Recent collaborations in fashion lines indicate efforts to boost brand appeal and potentially sales, aligning with its strategic market positioning initiatives.

- Delve into the full analysis dividend report here for a deeper understanding of Dillard's.

- The analysis detailed in our Dillard's valuation report hints at an deflated share price compared to its estimated value.

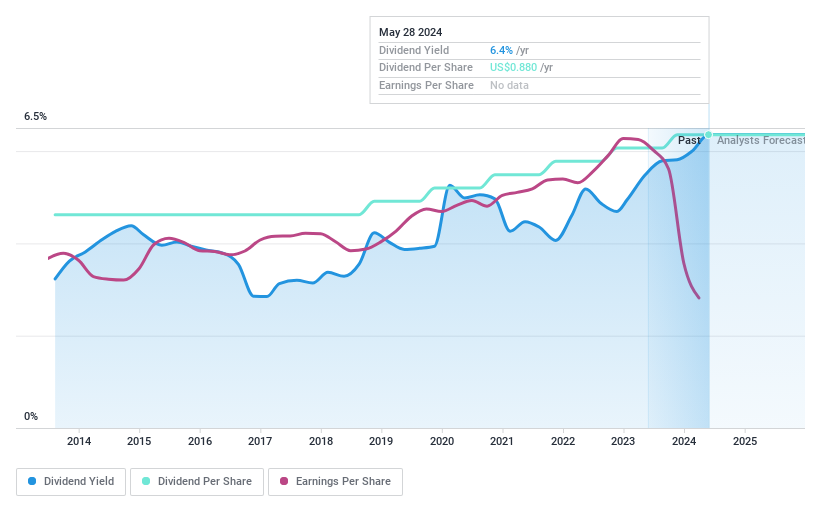

Central Pacific Financial (NYSE:CPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central Pacific Financial Corp., with a market cap of approximately $561.48 million, serves as the bank holding company for Central Pacific Bank, offering a variety of commercial banking products and services to businesses, professionals, and individuals in the United States.

Operations: Central Pacific Financial Corp. generates its revenue primarily through banking activities, totaling $235.09 million.

Dividend Yield: 5%

Central Pacific Financial Corp. reported a decrease in net interest income and net income for Q1 2024, with earnings per share dropping from US$0.6 to US$0.48 year-over-year. Despite this downturn, the company maintains a robust dividend policy, declaring a quarterly dividend of US$0.26 per share, showcasing its commitment to returning value to shareholders. The firm's dividend yield stands at 5.01%, placing it in the top tier of US dividend payers, supported by a sustainable payout ratio of 50.7%.

- Click here and access our complete dividend analysis report to understand the dynamics of Central Pacific Financial.

- According our valuation report, there's an indication that Central Pacific Financial's share price might be on the cheaper side.

Make It Happen

- Investigate our full lineup of 210 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPF

Central Pacific Financial

Operates as the bank holding company for Central Pacific Bank that provides a range of commercial banking products and services to businesses, professionals, and individuals in the United States.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives