- United States

- /

- Banks

- /

- NasdaqGS:FISI

Top Dividend Stocks To Watch In July 2024

Reviewed by Simply Wall St

In recent market activities, U.S. stocks displayed mixed results with fluctuations influenced by the Federal Reserve's inflation data and varied earnings reports. The Nasdaq Composite and S&P 500 showed resilience in a volatile environment, while the Dow Jones Industrial Average faced slight declines. Given these conditions, investors might consider the stability offered by dividend-paying stocks, which can provide regular income streams and potential for long-term value amidst market uncertainties.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 7.24% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.07% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 5.03% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.87% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.79% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.77% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.70% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.86% | ★★★★★★ |

| Carter's (NYSE:CRI) | 5.16% | ★★★★★☆ |

| Credicorp (NYSE:BAP) | 5.66% | ★★★★★☆ |

Click here to see the full list of 207 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Flushing Financial (NasdaqGS:FFIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Flushing Financial Corporation, functioning as the bank holding company for Flushing Bank, offers banking products and services mainly to consumers, businesses, and governmental units, with a market capitalization of approximately $382.26 million.

Operations: Flushing Financial Corporation generates its revenue primarily through its Community Bank segment, which contributed $191.50 million.

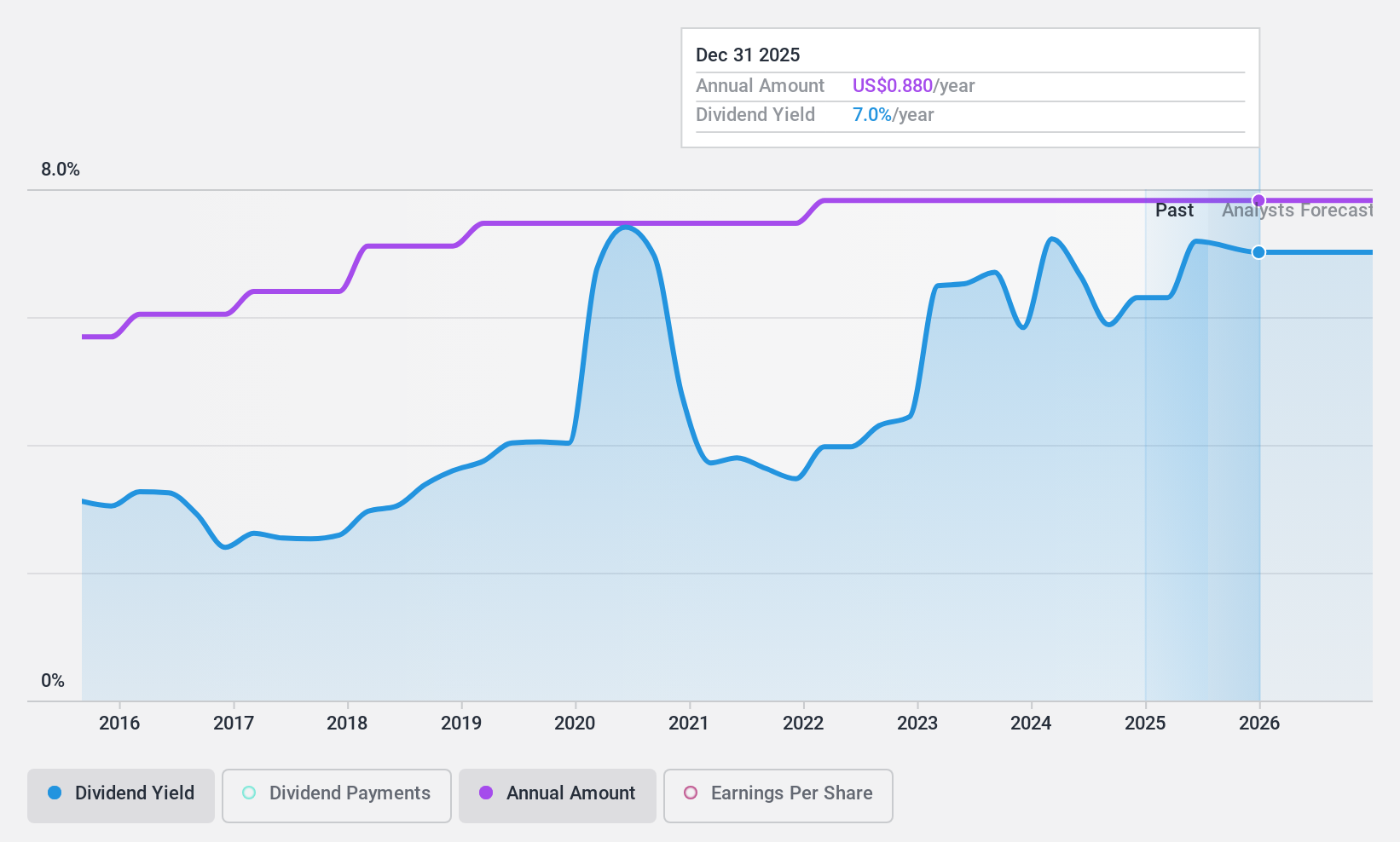

Dividend Yield: 6.7%

Flushing Financial has maintained stable dividends over the past decade, with recent affirmations of quarterly payments. However, its high payout ratio of 92.6% raises concerns about sustainability as it's not well covered by earnings. The company's profit margins have declined from 27.3% to 14.8%, and while its P/E ratio at 13.5x is below the US market average, indicating potential value, forecasted earnings growth of approximately 12.96% per year may not suffice to ensure future dividend coverage or growth without improved profitability or cash flow management.

- Dive into the specifics of Flushing Financial here with our thorough dividend report.

- Upon reviewing our latest valuation report, Flushing Financial's share price might be too optimistic.

Financial Institutions (NasdaqGS:FISI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Financial Institutions, Inc., operating through its subsidiary Five Star Bank, offers banking and financial services to individuals, municipalities, and businesses in New York, with a market capitalization of approximately $298.44 million.

Operations: Financial Institutions, Inc. generates revenue primarily through its banking segment, which recorded $196.23 million in earnings.

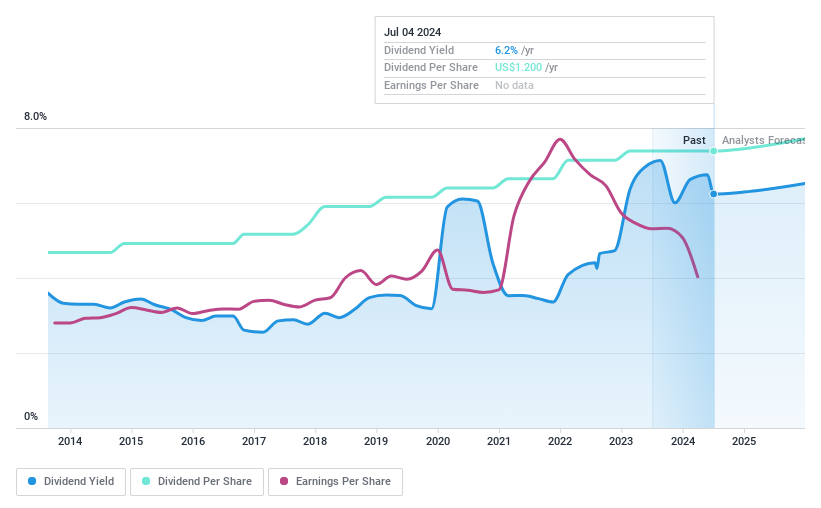

Dividend Yield: 6.2%

Financial Institutions, Inc. has demonstrated a commitment to dividends, recently affirming a quarterly cash dividend and maintaining payments on preferred stocks. With a 10-year history of stable and growing dividends supported by a payout ratio of 47.6%, the dividends appear sustainable. Despite trading at significant undervaluation, recent earnings have declined, posing potential risks to future dividend coverage without an earnings recovery. The company's consistent dividend policy amidst these challenges highlights its reliability for income-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Financial Institutions.

- Our valuation report unveils the possibility Financial Institutions' shares may be trading at a discount.

Independent Bank (NasdaqGS:IBCP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Independent Bank Corporation, serving as the bank holding company for Independent Bank, offers commercial banking services to individuals and businesses in Michigan's rural and suburban communities, with a market capitalization of approximately $564.37 million.

Operations: Independent Bank Corporation generates its revenue primarily through its subsidiary, Independent Bank, which contributed $205.98 million.

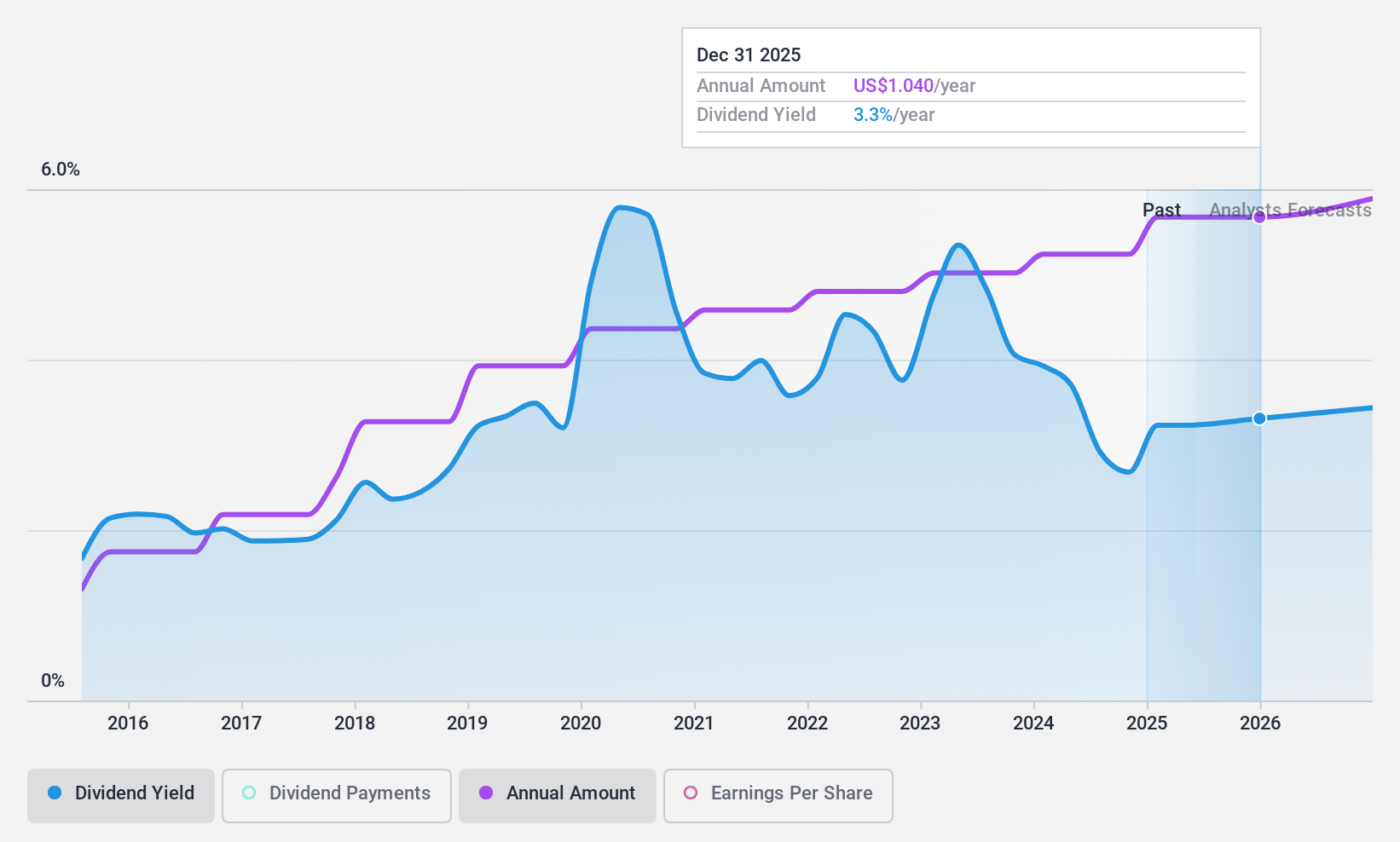

Dividend Yield: 3.6%

Independent Bank Corporation recently reported a solid increase in net interest income and net income for Q1 2024, reflecting financial growth. The company declared a quarterly cash dividend of US$0.24 per share, consistent with its history of reliable dividends over the past decade. Despite this stability, the stock trades at 62.3% below estimated fair value and faces an earnings forecast decline of 0.3% annually over the next three years, which could challenge future dividend sustainability without strategic adjustments.

- Unlock comprehensive insights into our analysis of Independent Bank stock in this dividend report.

- The valuation report we've compiled suggests that Independent Bank's current price could be quite moderate.

Summing It All Up

- Click through to start exploring the rest of the 204 Top Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Financial Institutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FISI

Financial Institutions

Through its subsidiaries, provides banking and financial services to consumer, commercial, and municipal customers in New York.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives